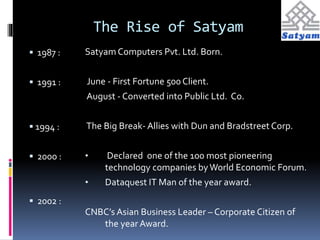

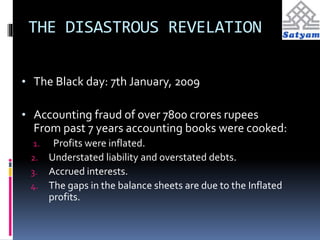

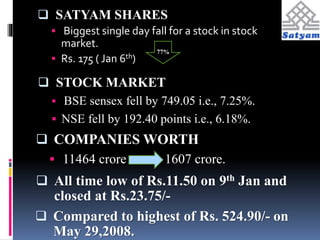

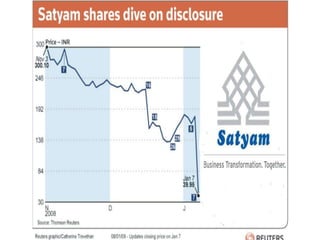

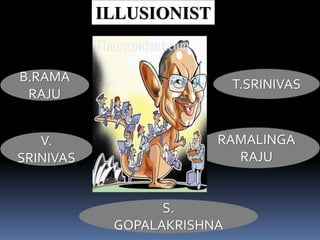

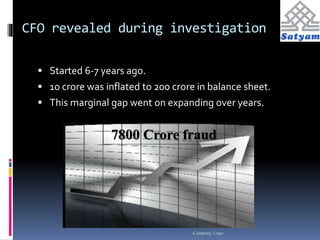

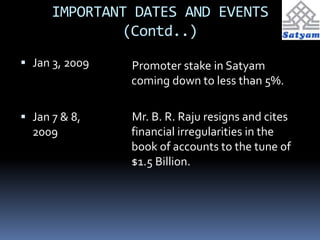

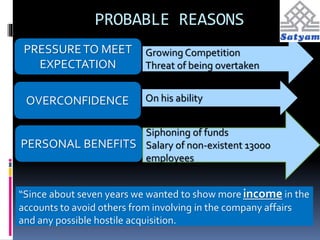

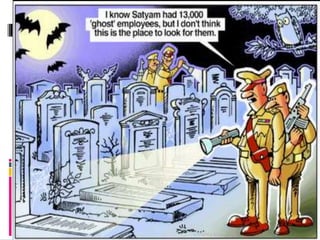

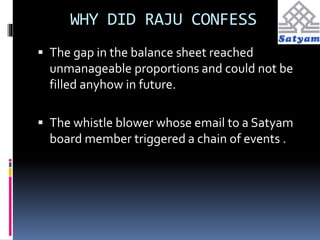

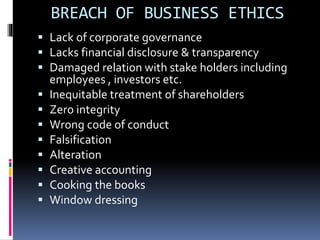

Satyam Computer Services was one of India's largest IT companies, founded in 1987. In January 2009, its chairman Ramalinga Raju confessed to a $1 billion accounting fraud, in what became India's biggest corporate scandal. Raju had inflated profits and faked accounts for years to mislead shareholders and regulators. When the gap in finances became too large to cover up, Raju confessed and resigned. The fraud damaged India's reputation in global IT business and impacted the livelihoods of thousands of employees. Investigations were launched and new leadership appointed to rebuild the company.