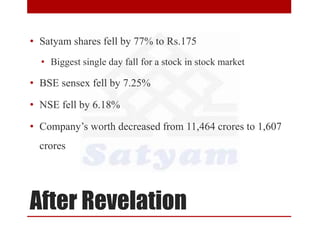

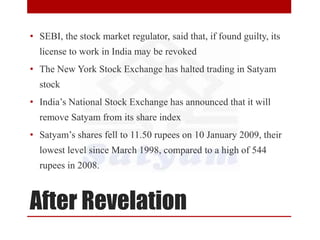

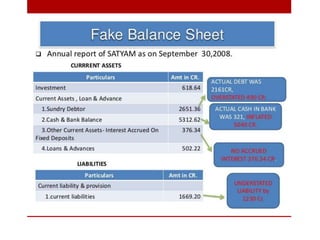

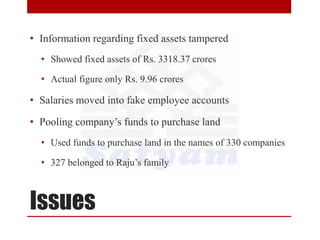

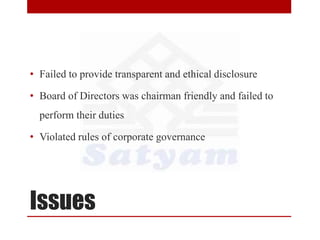

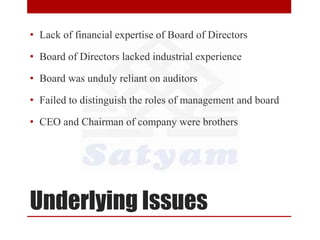

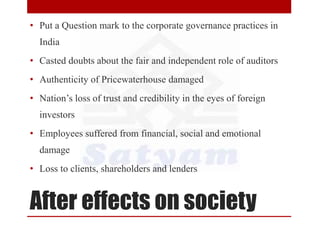

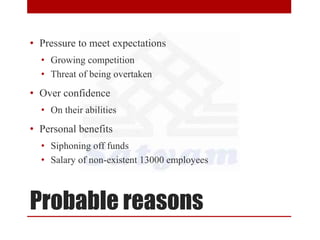

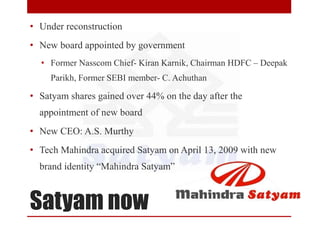

The document summarizes the Satyam corporate accounting fraud scandal in India, one of the largest in history. It describes how Satyam Computer Services founder Ramalinga Raju inflated profits and falsified financial records over 8 years, misrepresenting over $1 billion in assets. In January 2009, Raju confessed to the fraud in a letter, causing Satyam's stock to plummet 77% in one day. An investigation found many issues, including tampered financials and assets, and funds siphoned to Raju's family. After effects included loss of trust in corporate governance and auditors in India. Raju and others were later sentenced to 7 years in prison for their roles in the fraud.