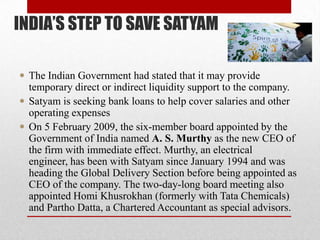

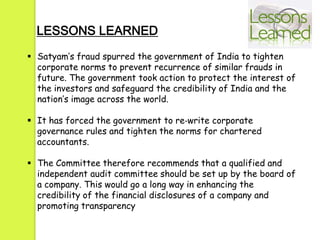

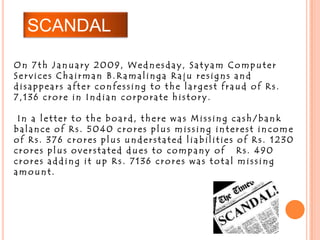

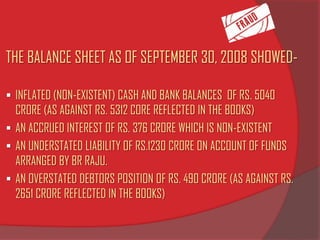

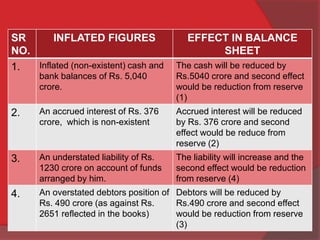

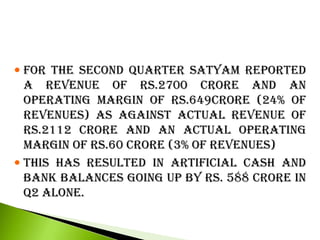

This document provides a summary of the Satyam scandal that occurred in 2009. It describes Satyam as a large Indian IT company with over 50,000 employees that was found to have falsified its accounts through inflated cash balances, revenues, and profits. The scandal came to light when Satyam's Chairman, B. Ramalinga Raju, confessed to the board that the company's accounts had been falsified, with a total discrepancy of over 7,000 crore (71.36 billion) rupees. This led to a huge fall in Satyam's share price and damage to investor confidence. The Indian government took steps to rescue Satyam and tighten corporate governance rules to prevent such frauds in the future.

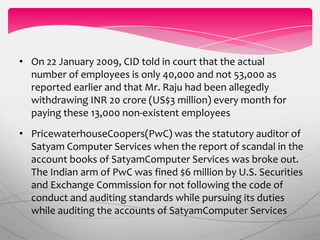

![ Satyam's shares fell to 11.50 rupees on 10

January 2009, their lowest level since March

1998, compared to a high of 544 rupees in

2008.[14] In New York Stock Exchange Satyam

shares peaked in 2008 at US$ 29.10; by March

2009 they were trading around US $1.80.

The benchmark Sensex slipped over to 7% on 7

January 2009.

Satyam stock is being removed from its S&P

CNX Nifty 50-share index.

Satyam’s largest shareholder, Aberdeen AMC,

dumped the tainted software entity’s shares.](https://image.slidesharecdn.com/satyamscam2-130818093151-phpapp01/85/Satyam-Scam-15-320.jpg)