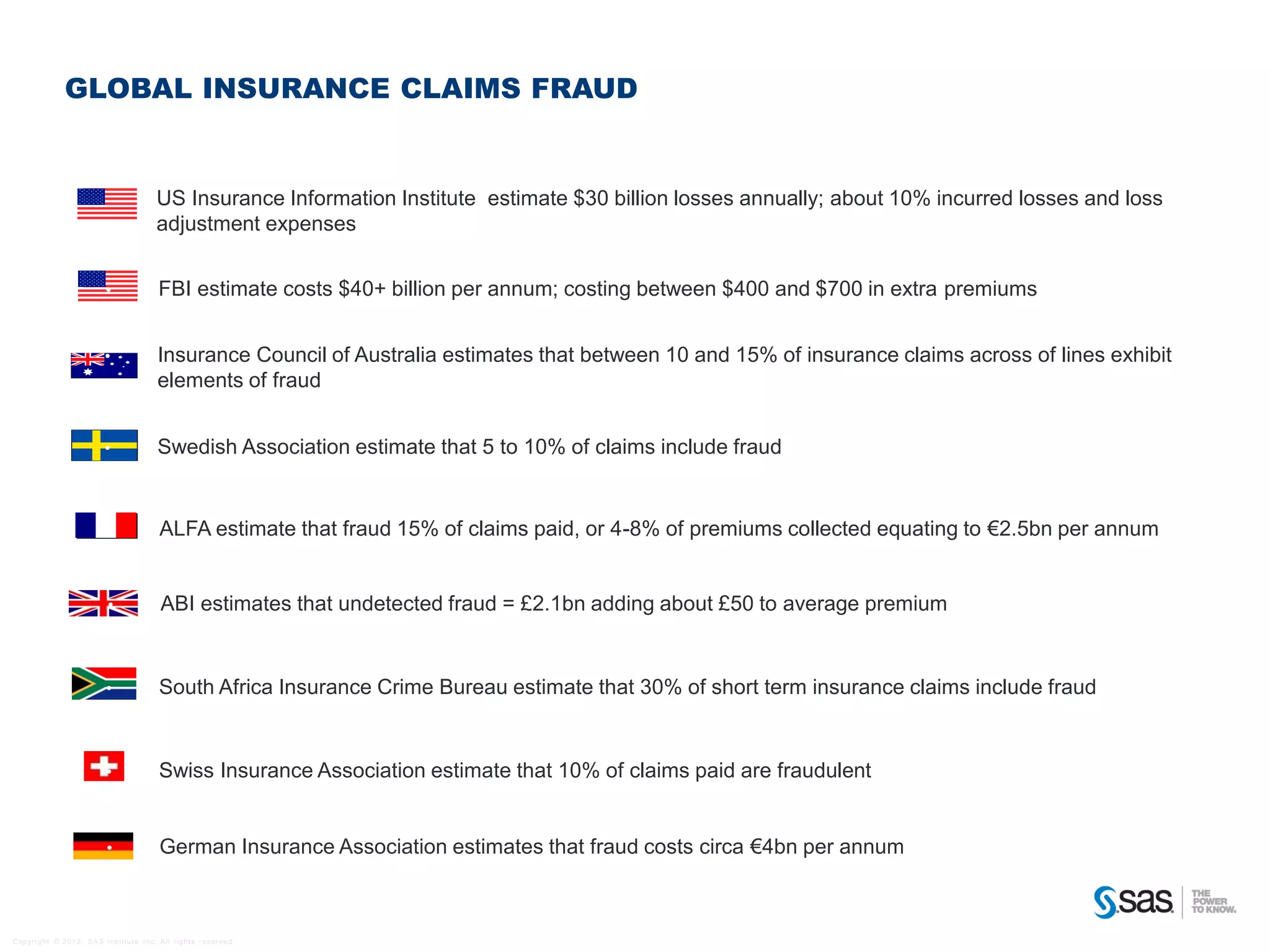

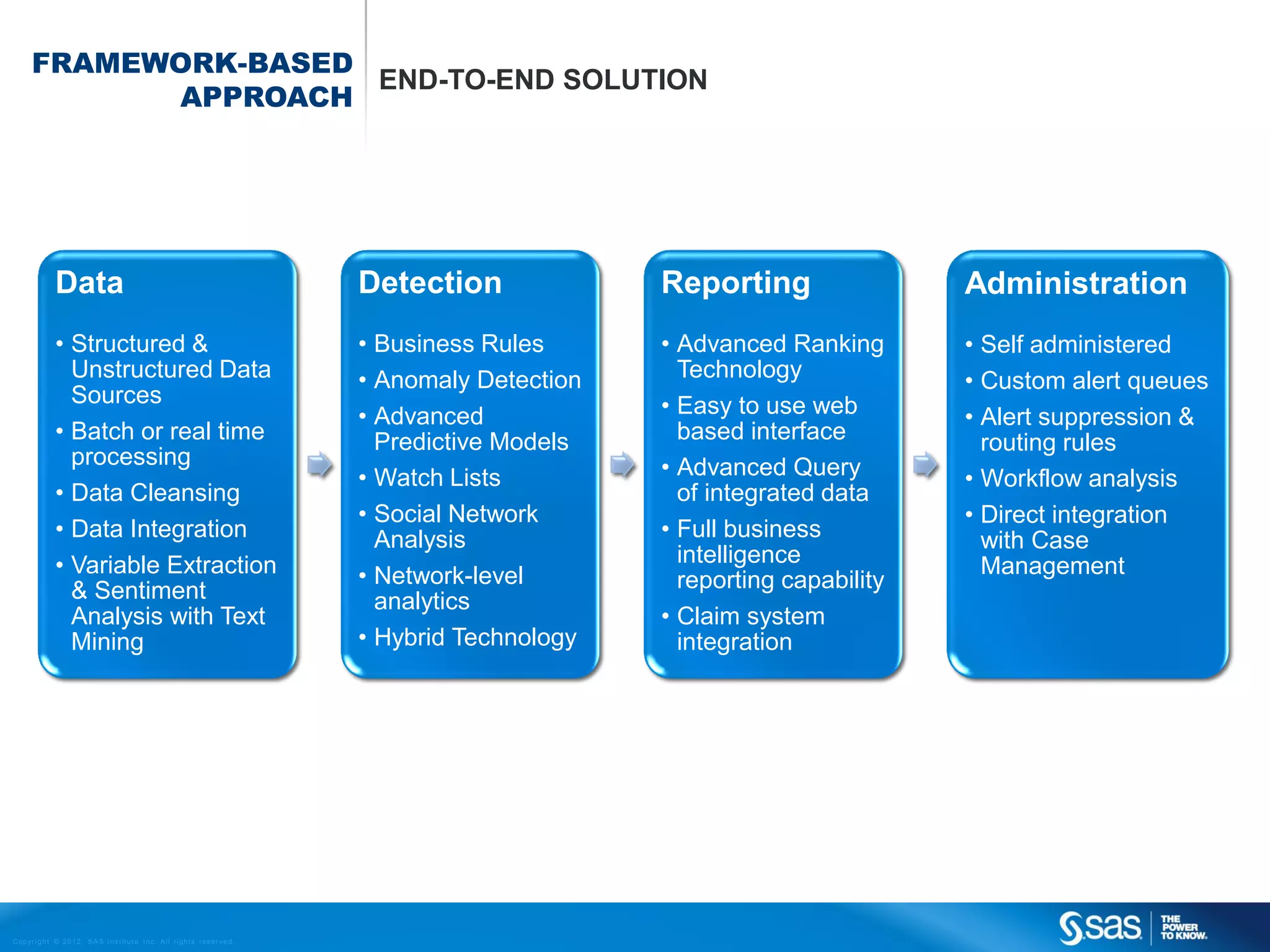

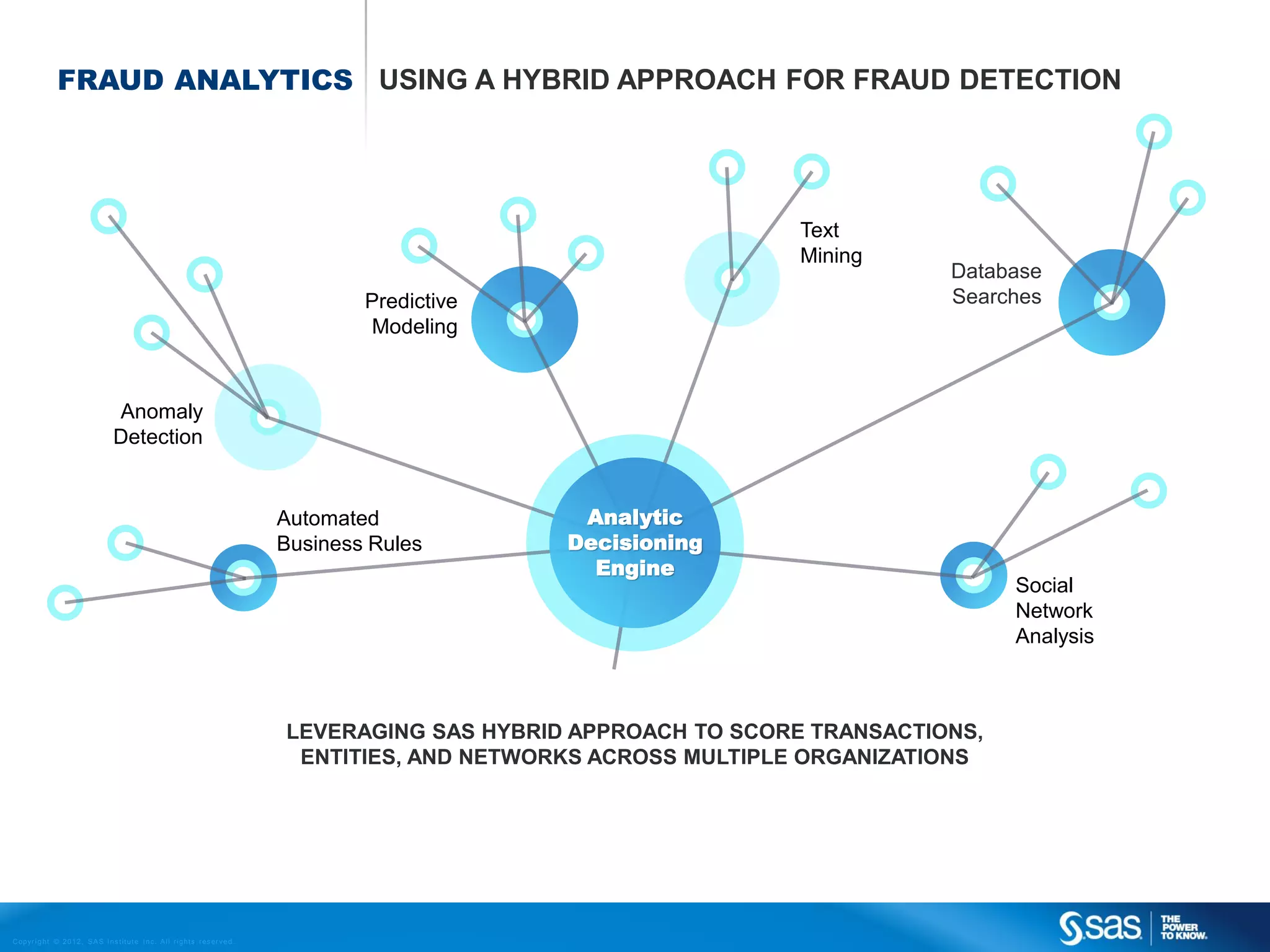

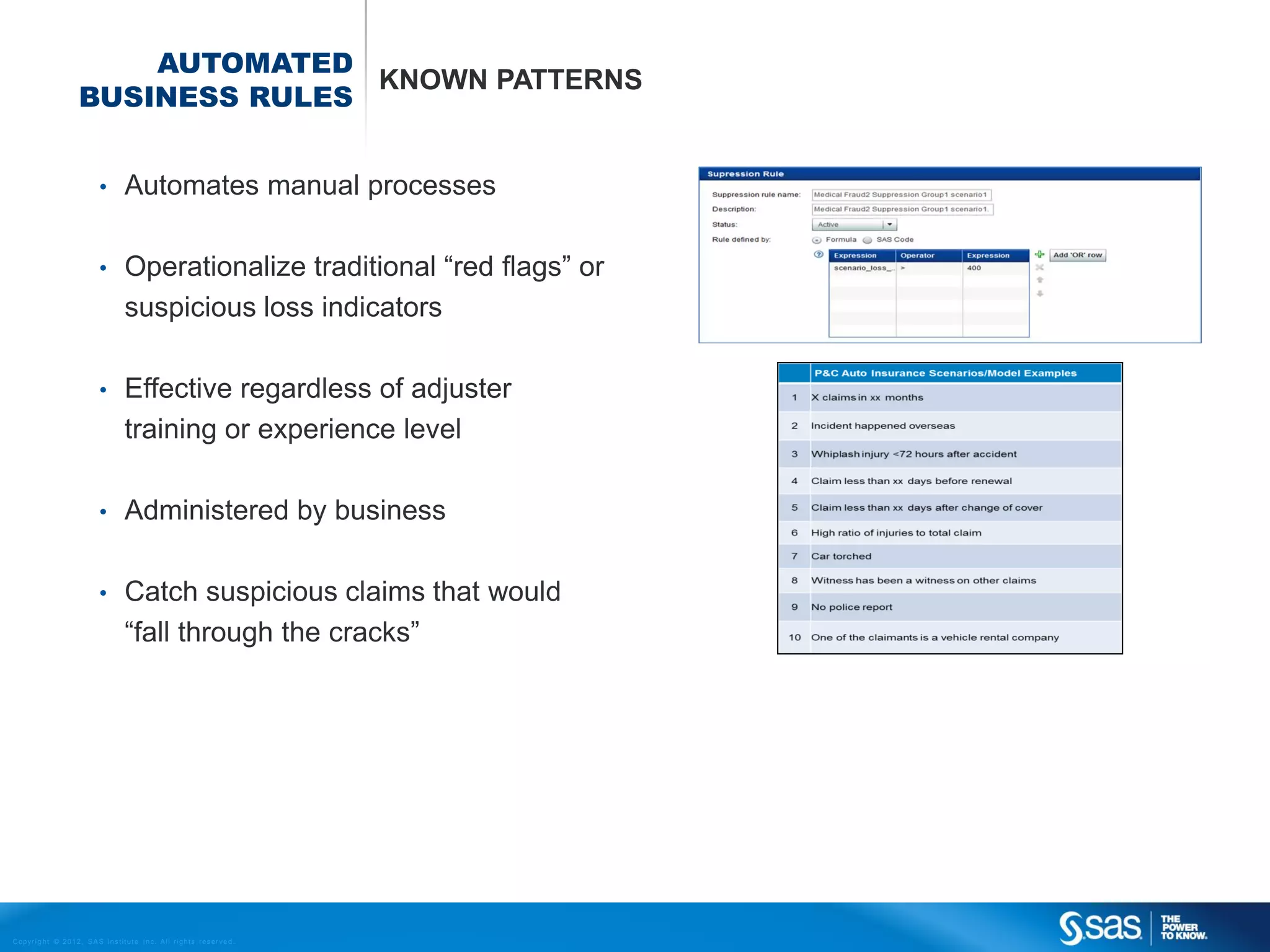

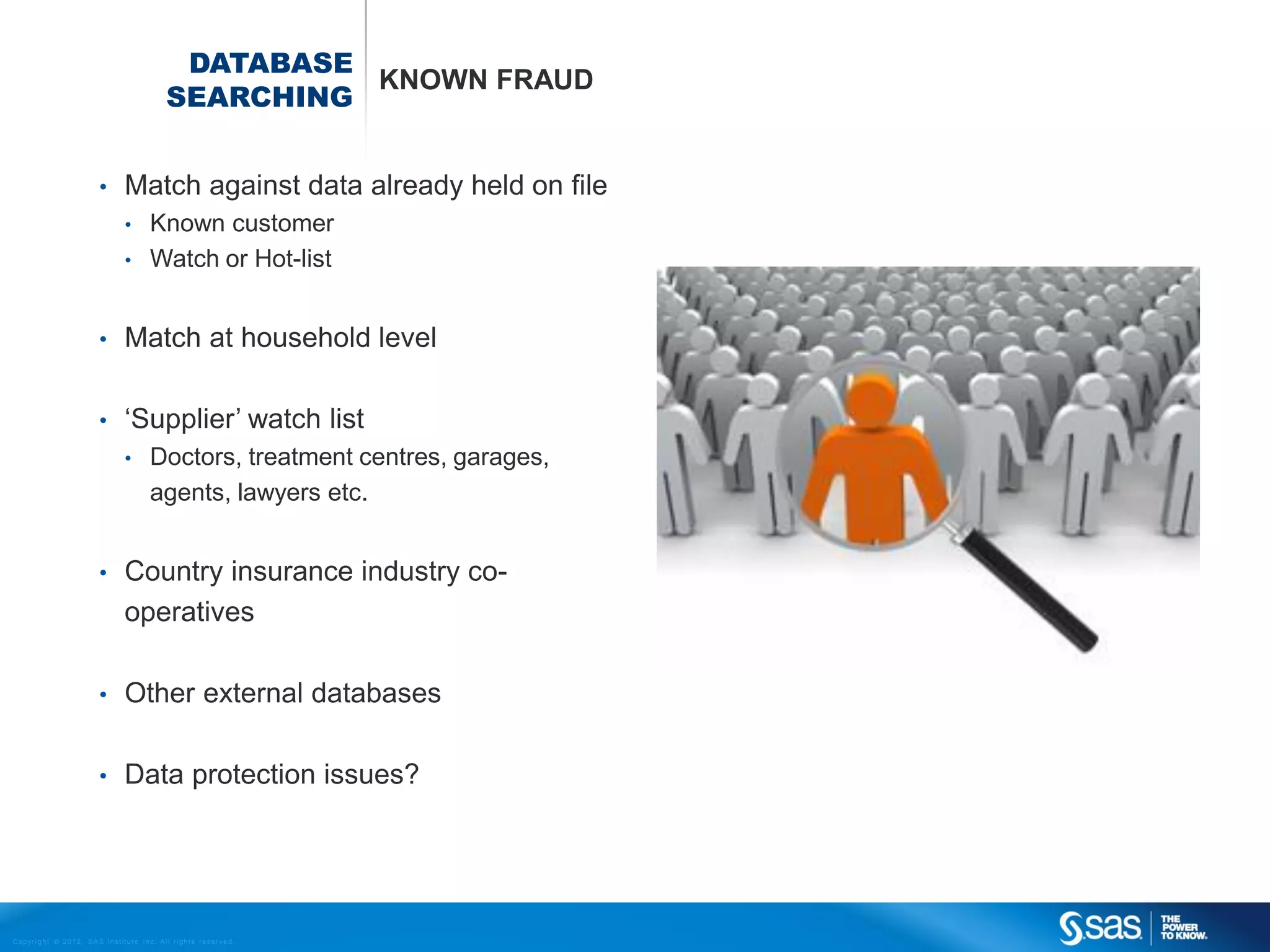

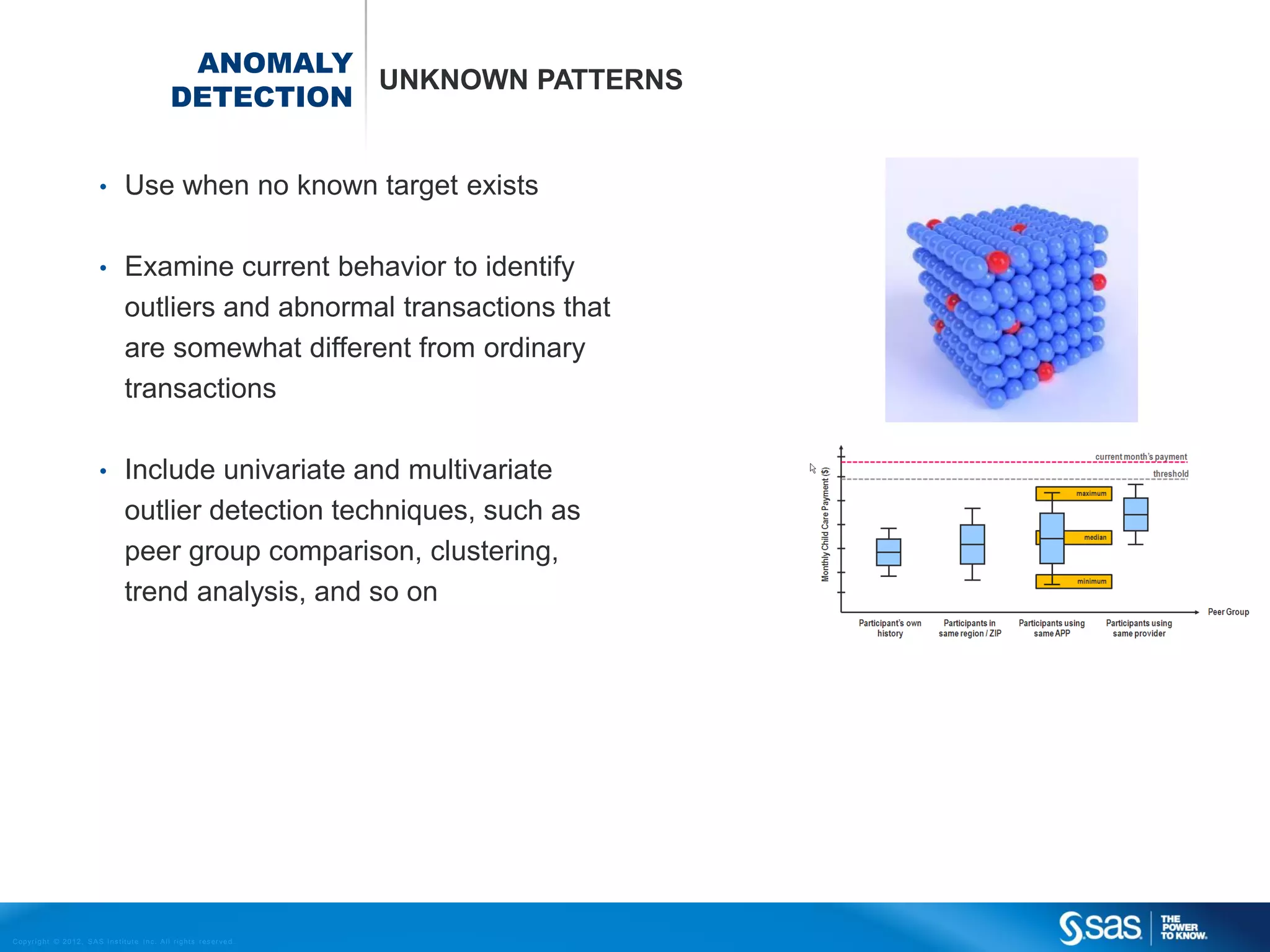

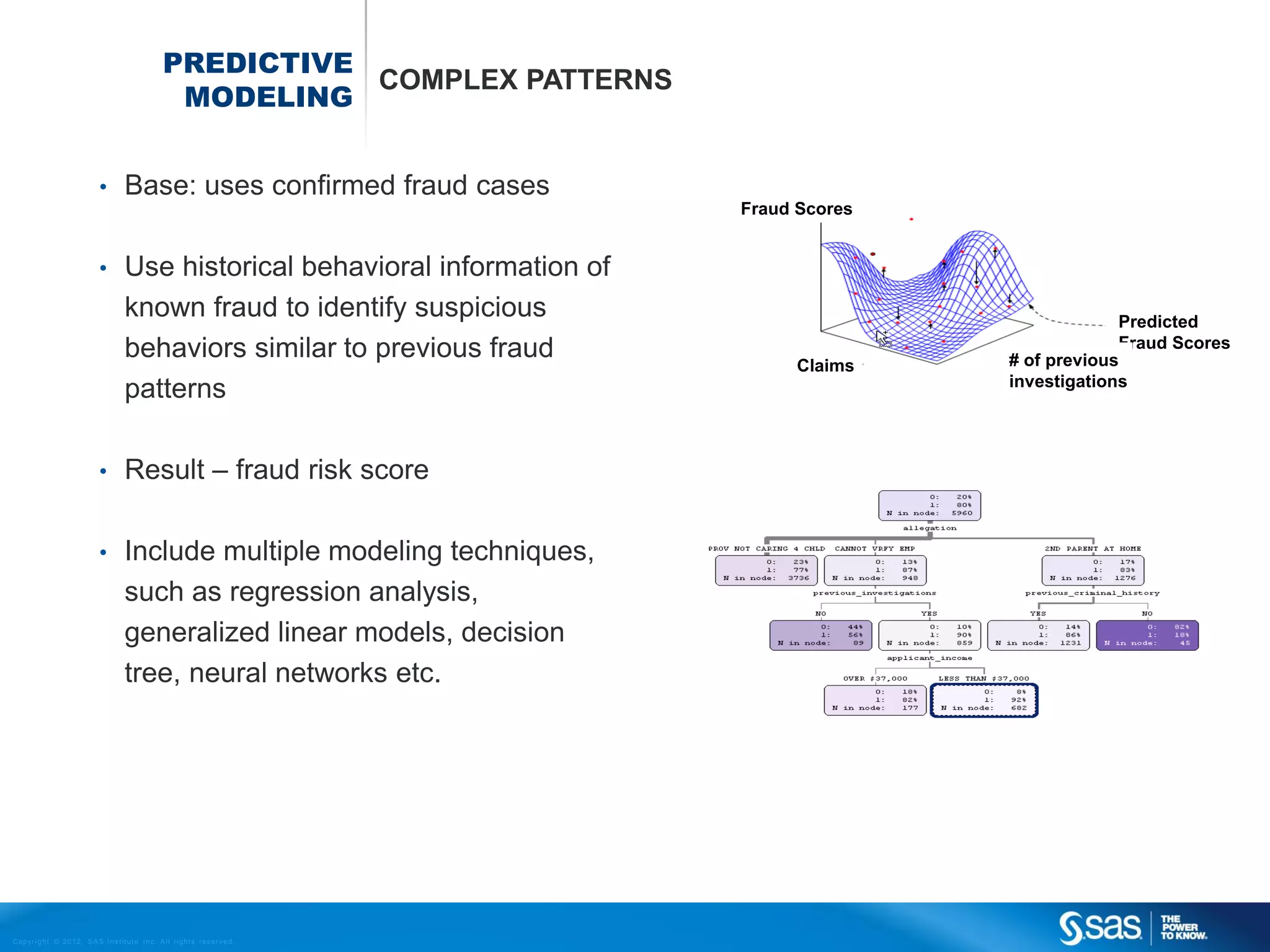

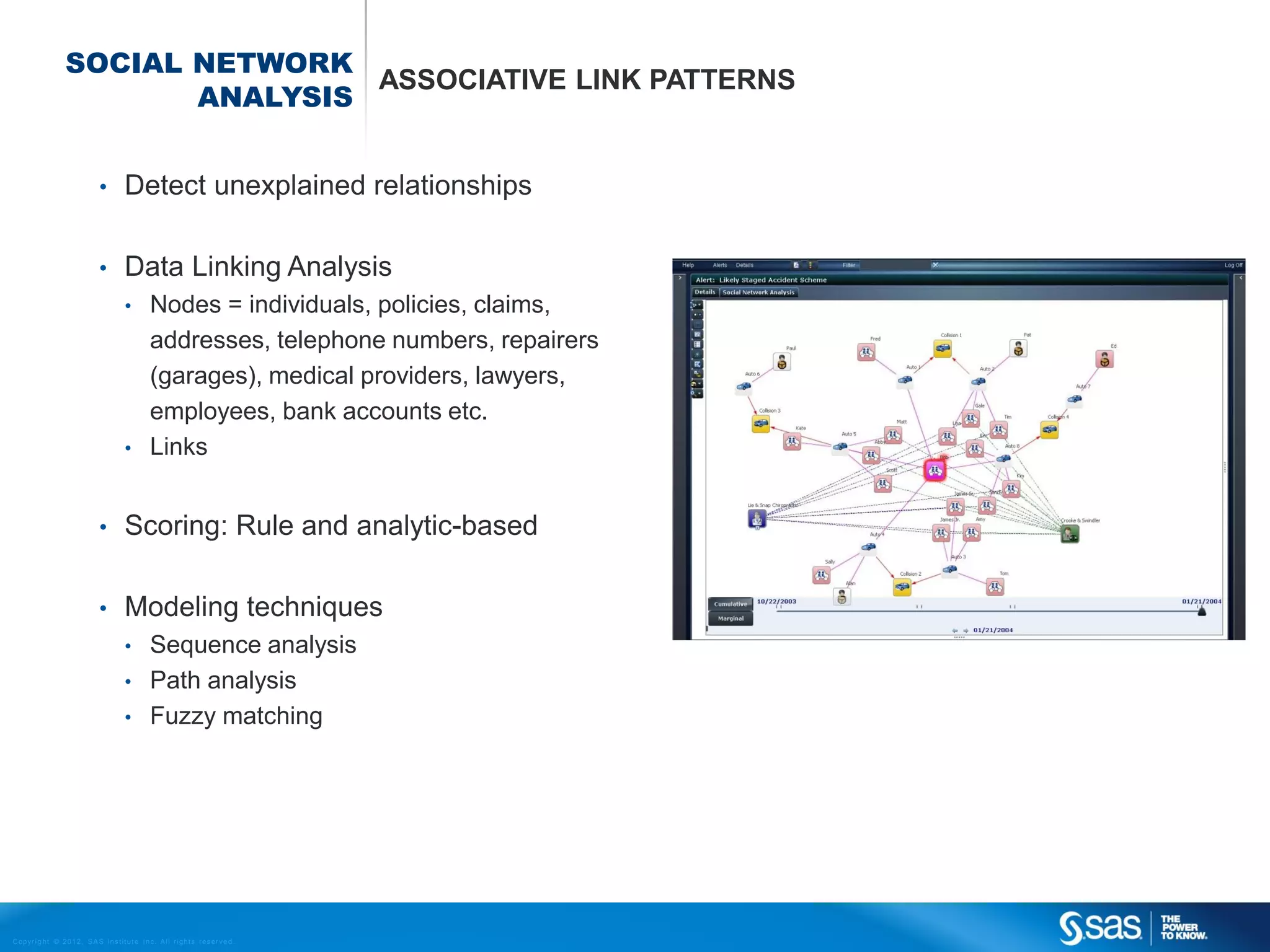

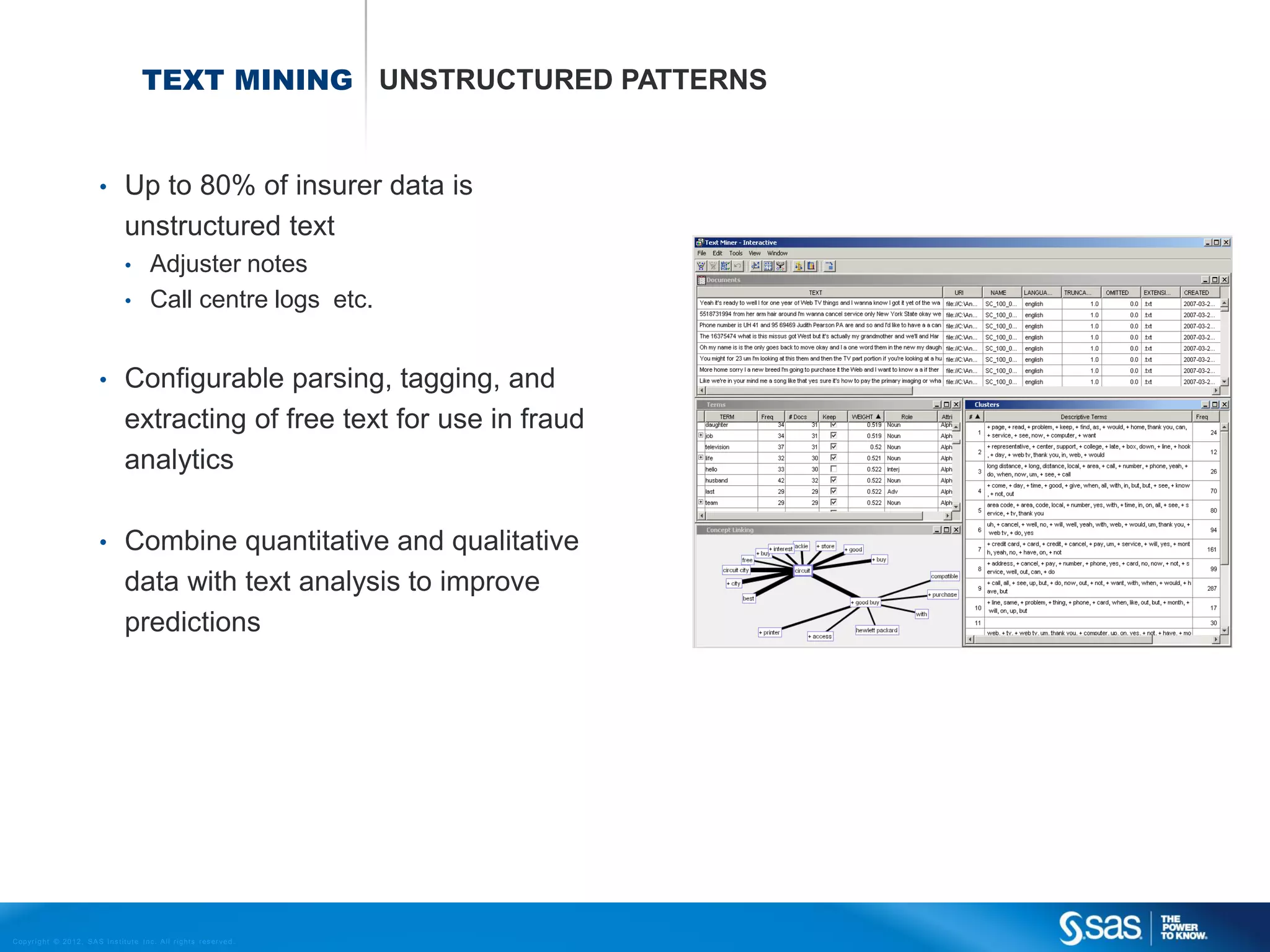

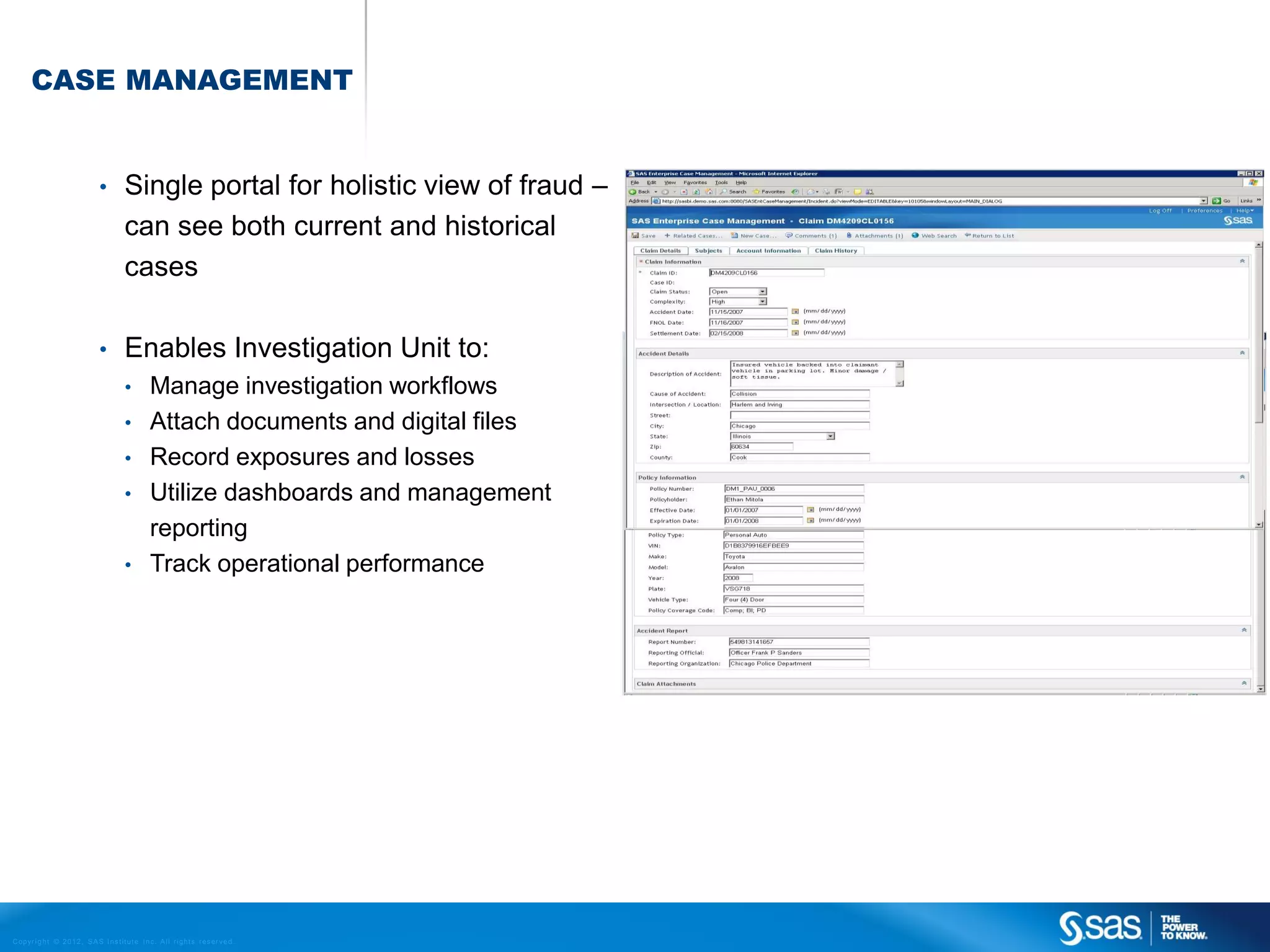

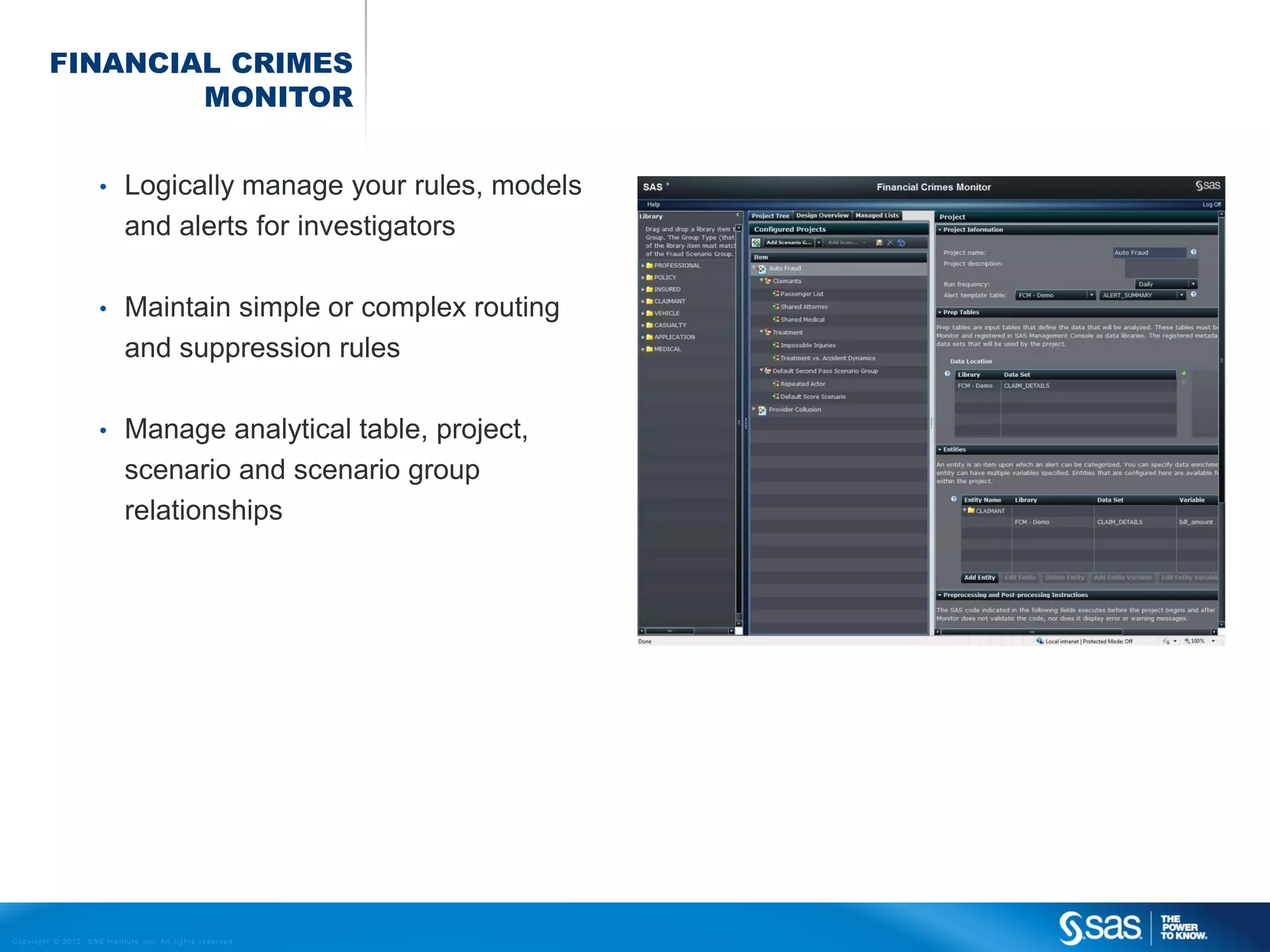

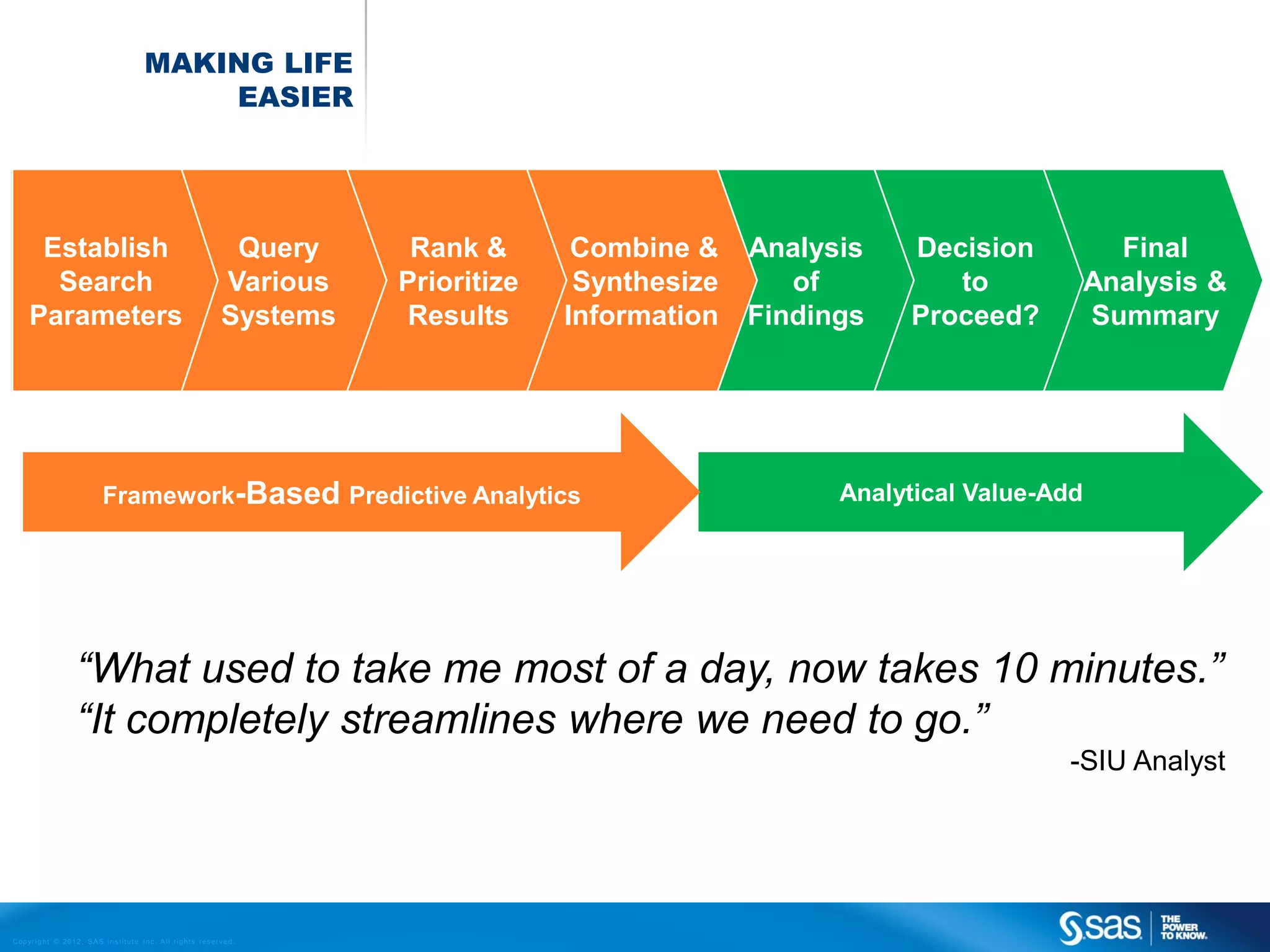

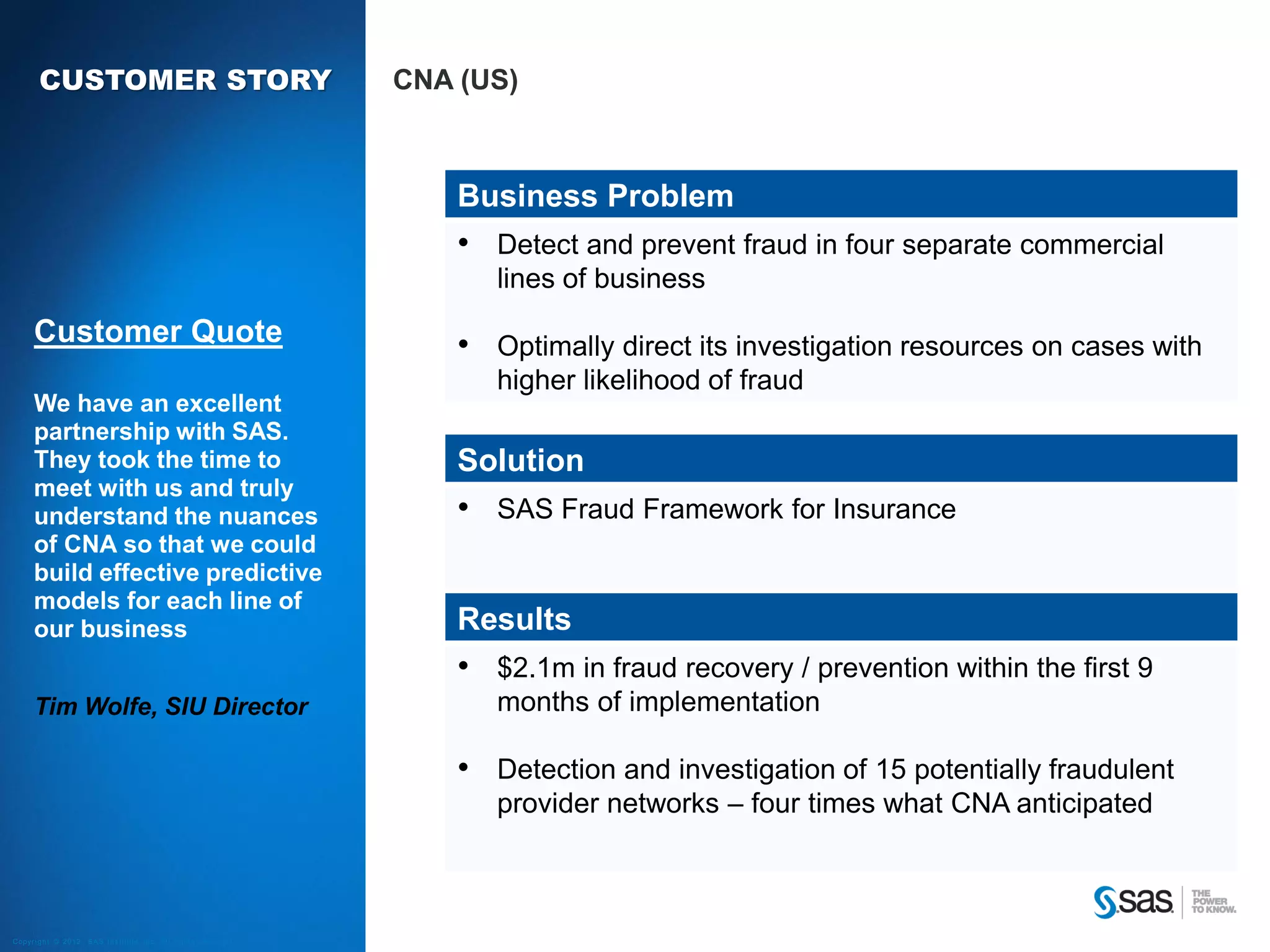

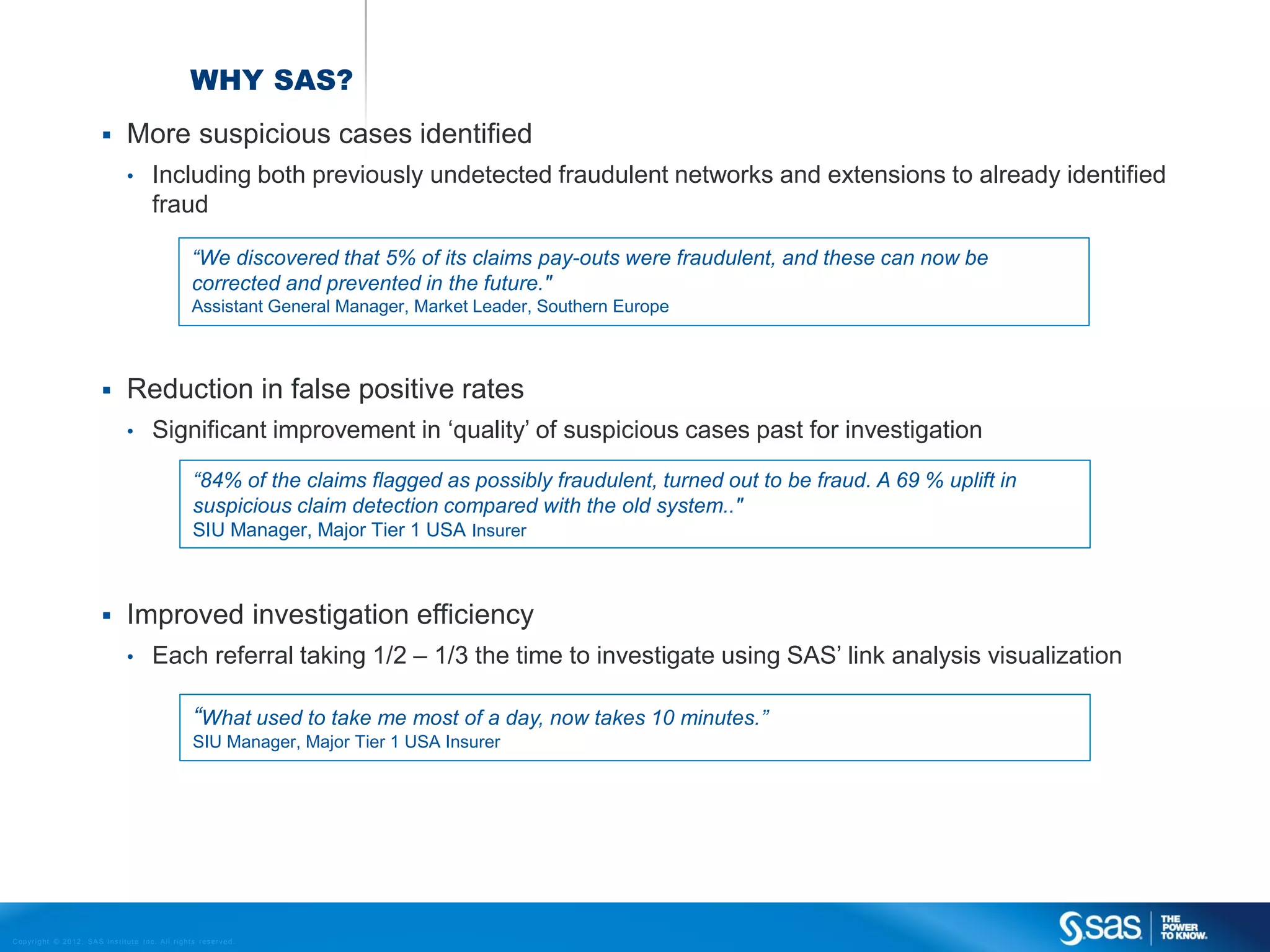

The document outlines a comprehensive fraud framework developed by SAS for the insurance industry, addressing the rising sophistication and complexity of insurance fraud schemes that result in billions of dollars in losses annually. It details various analytical techniques and approaches for fraud detection, including predictive modeling, anomaly detection, and social network analysis, aimed at improving the efficiency and accuracy of fraud investigations. The framework also emphasizes the importance of leveraging advanced analytics to enhance detection rates and reduce false positives in insurance claims.