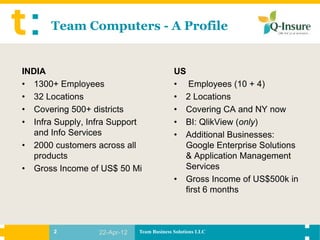

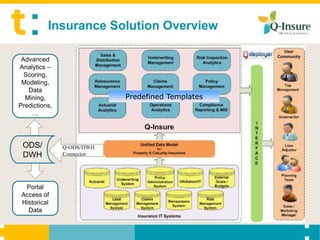

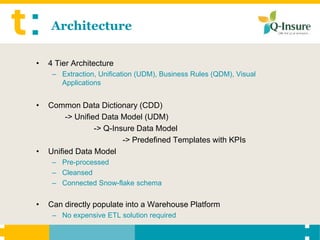

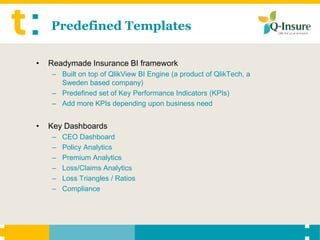

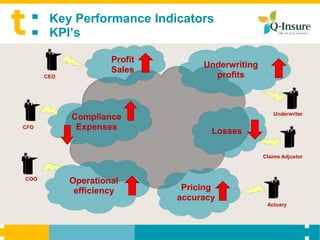

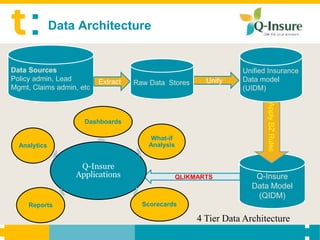

Interactive Insurance Analytics provides a readymade insurance reporting and analytics solution built on the QlikView platform. It features predefined templates and dashboards for key insurance functions that integrate various insurance data sources using a unified insurance data model. The solution is designed to provide concise, accurate insights while keeping the cost per report low and time to deploy short.

![Bill of Materials

Sl. No. Item Qty Remarks

1. Q-Insure Core (Installer, Data 1 Base component

Manager, Monitor)

2. Q-Insure Life Data Model 1

3. Q-Insure P&C Data Model 1

4. Q-Insure Deployer 1

5. Q-Insure ODS/DWH Connector 1

6. Admin Enablement 1 10 days on-site

7. Qlikview Server 1 Production Server

8. QlikView Test Server 1 Test / UAT Server

9. QlikView Local Clients 5 Development Client

10. QlikView Named CALs [n] # of power users

11. QlikView Document CALs [m] # of User / Document combinations for non-

power users

12. Requirements Assessment Fixed 10 days consulting

Mapping, Design, Develoment, Testing, Integration & Deployment service as needed.

Estimates after Requirements Assessment](https://image.slidesharecdn.com/q-insure-120422053114-phpapp01/85/Q-insure-20-320.jpg)