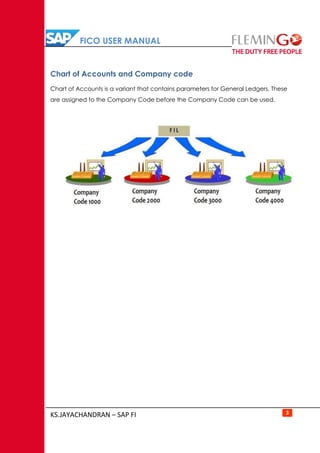

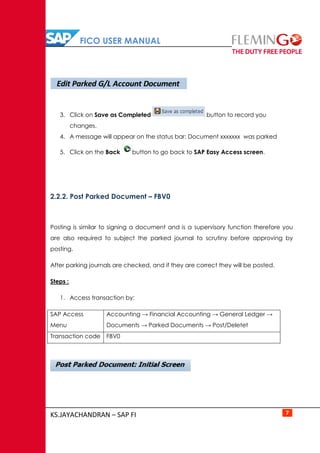

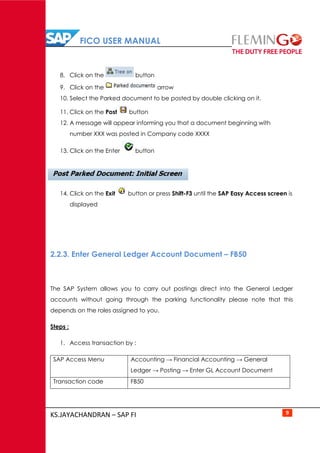

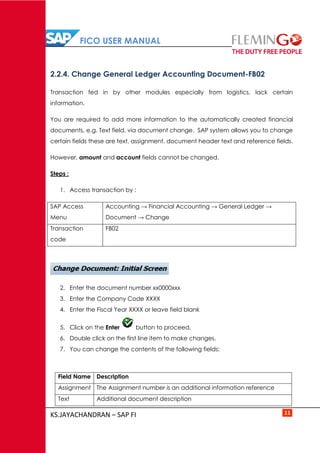

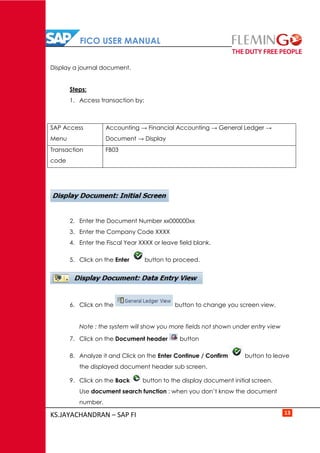

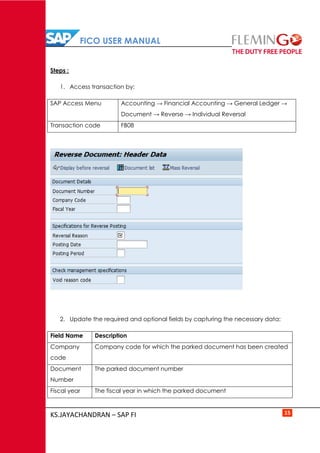

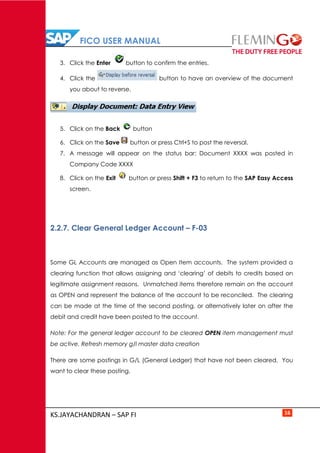

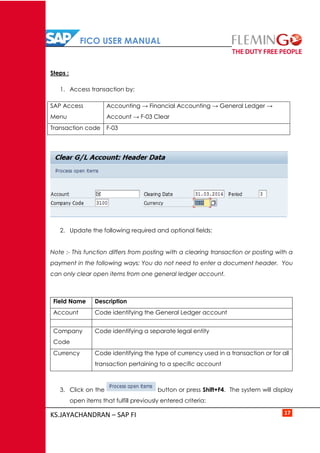

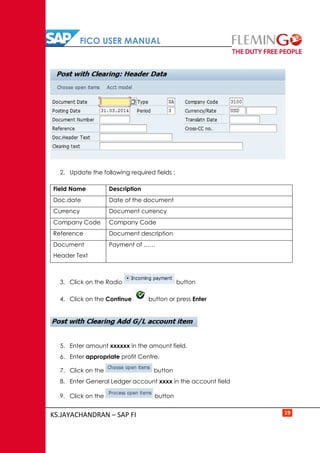

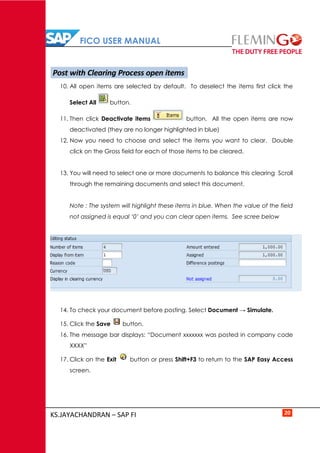

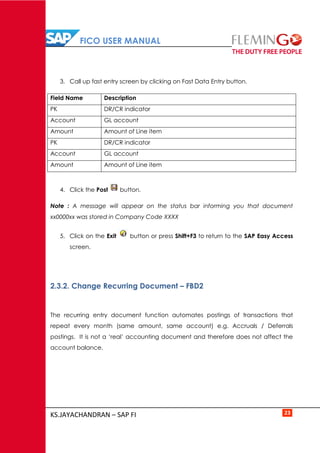

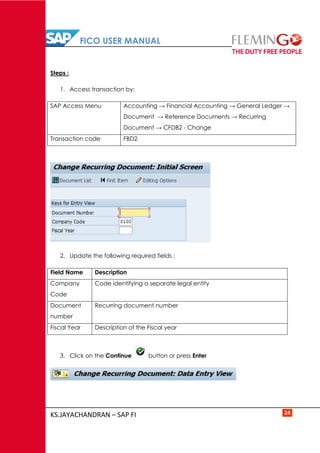

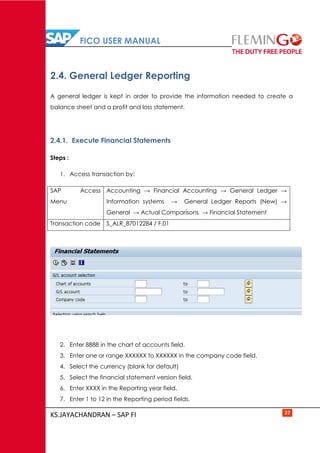

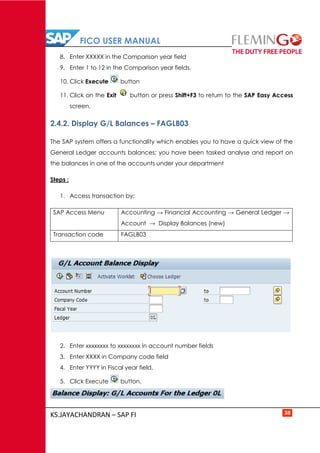

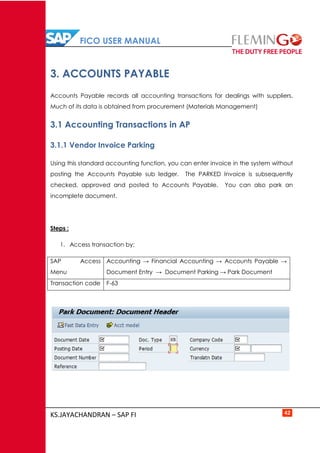

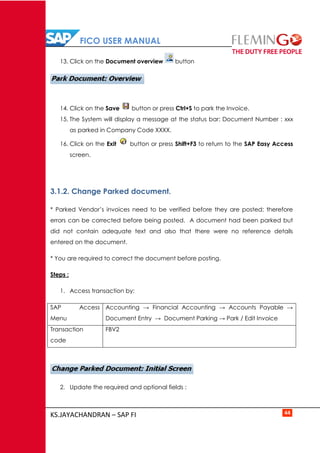

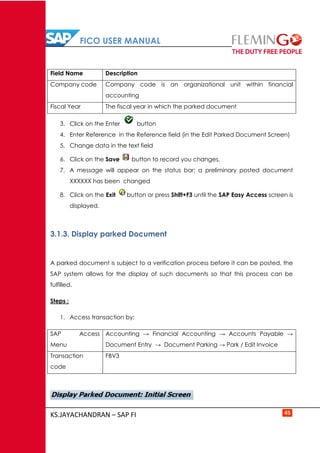

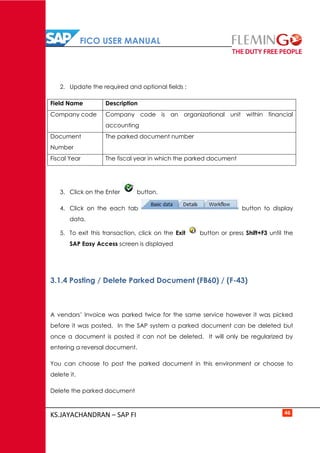

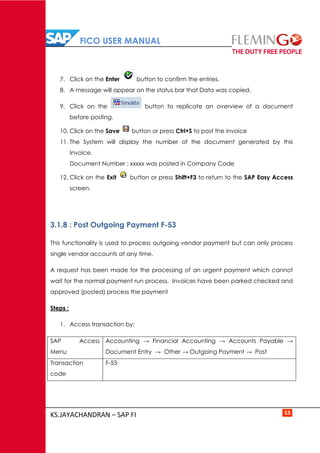

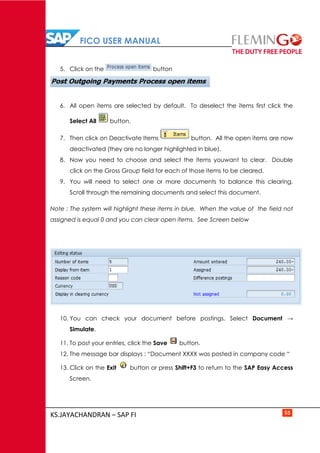

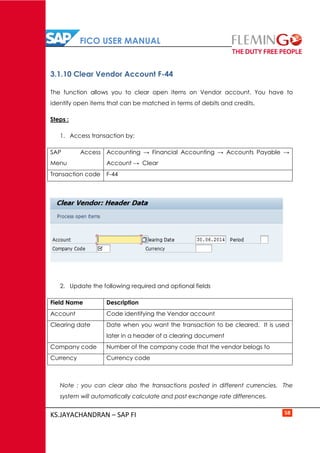

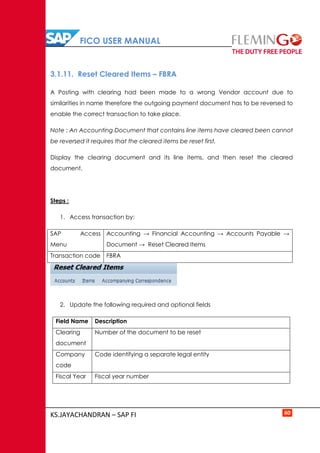

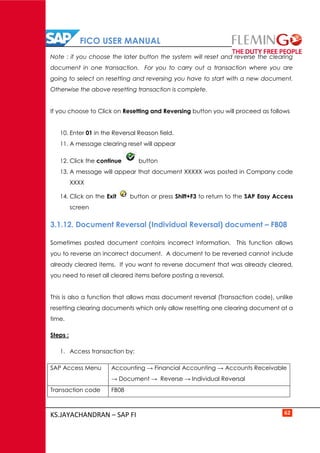

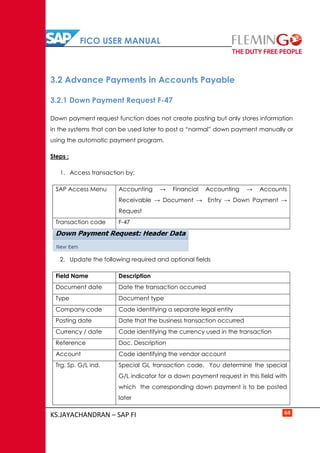

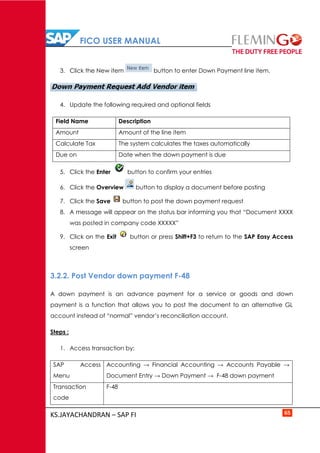

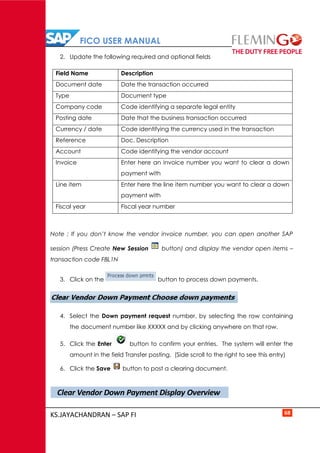

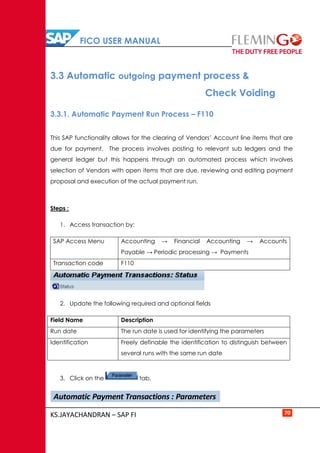

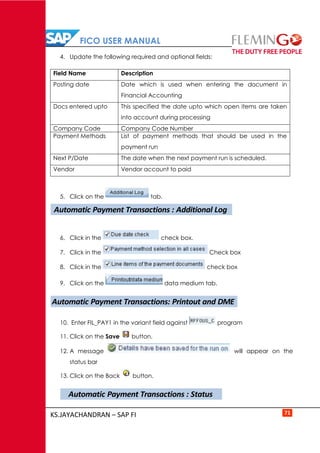

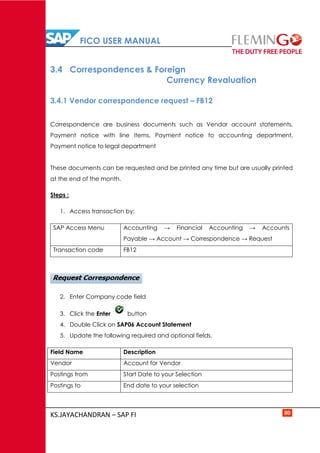

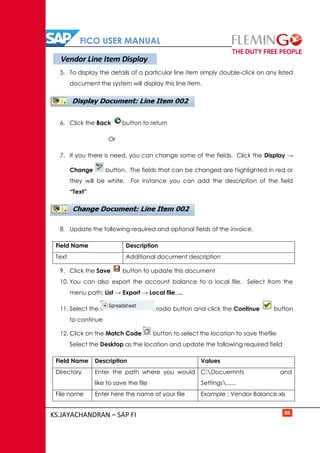

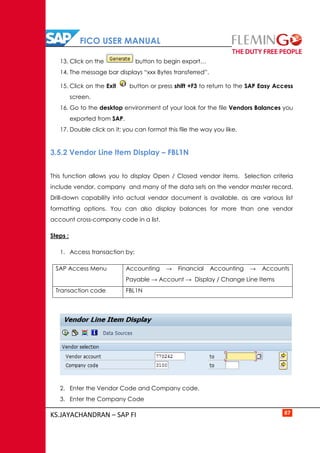

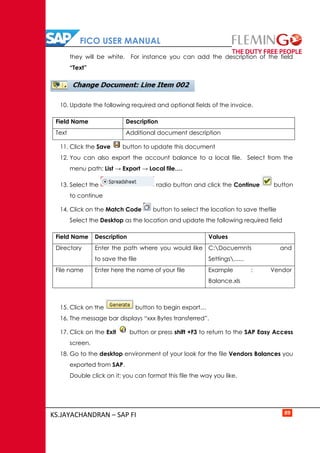

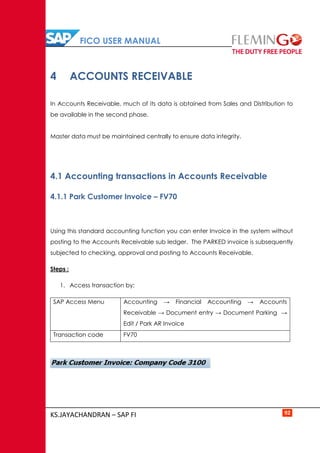

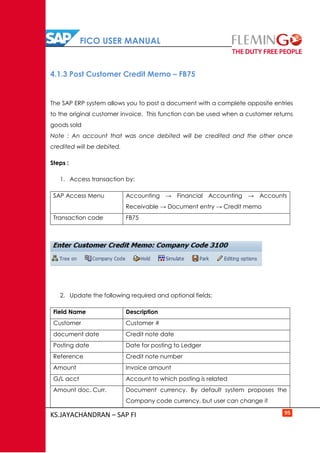

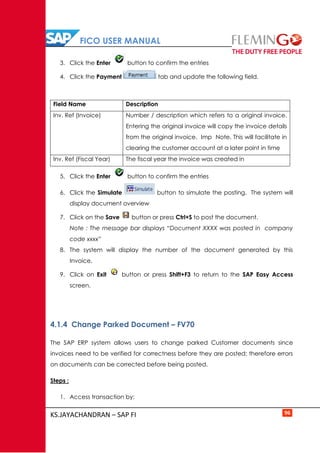

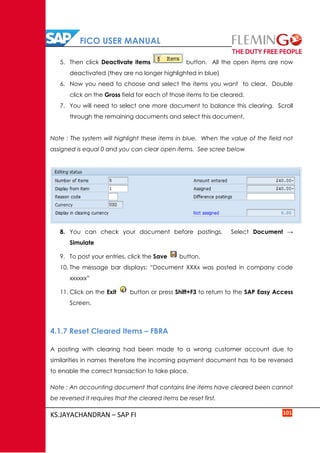

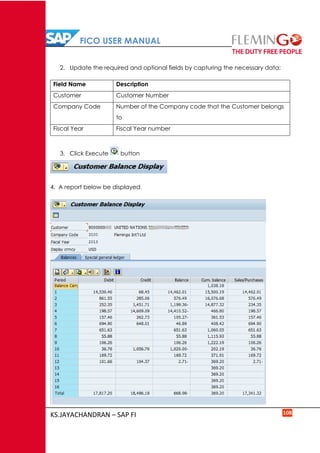

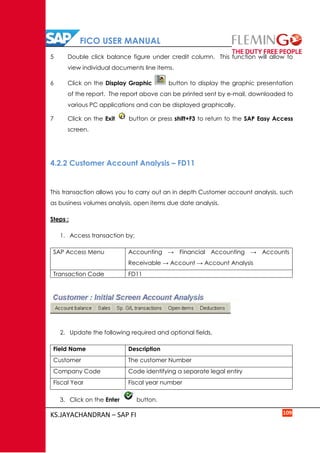

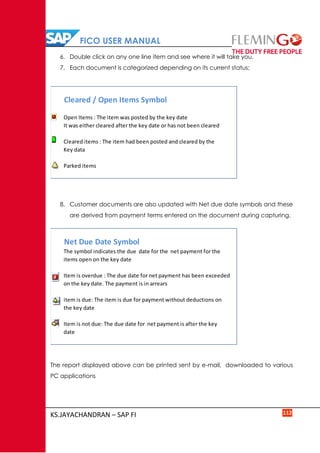

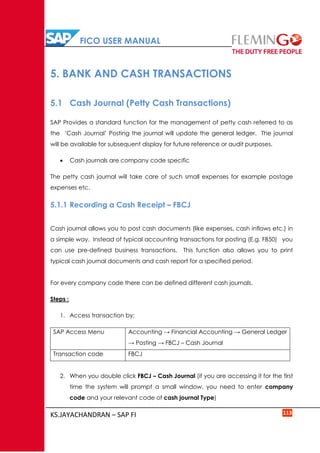

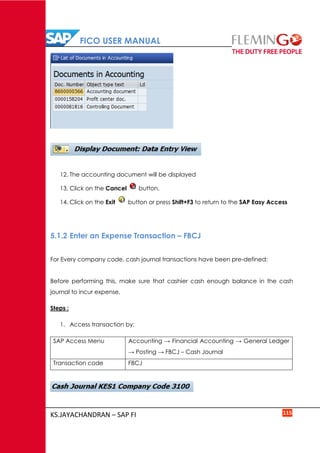

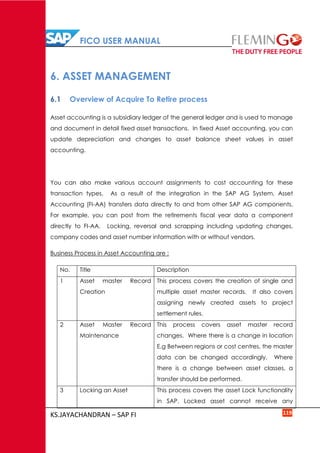

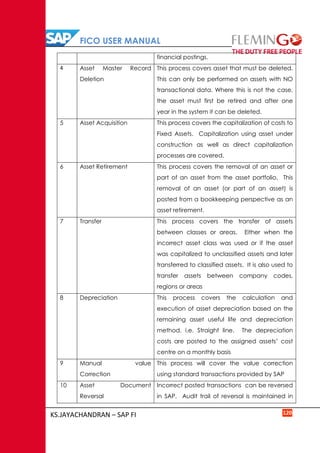

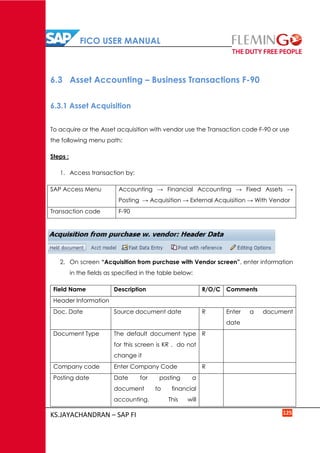

The document provides a user guide for SAP FICO (Financials and Controlling) modules. It describes the key processes in general ledger accounting like entering, parking, posting, changing, and reversing journal entries. It also explains accounts payable processes like invoice parking, posting, payments, and reports. Accounts receivable processes like invoice parking, posting, payments, and customer reports are covered as well. The guide also touches on processes for bank transactions, asset management, and financial reporting.