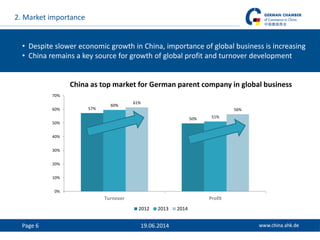

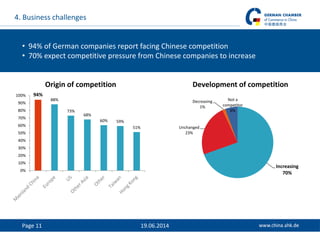

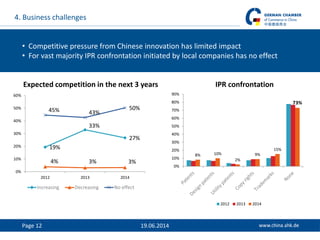

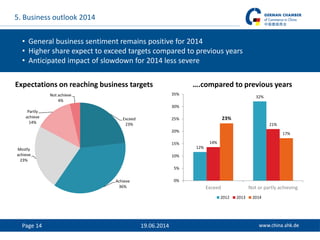

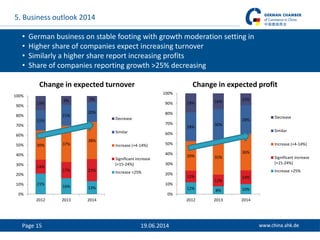

The 2014 business confidence survey indicates that German companies in China are experiencing stable conditions despite slower economic growth, with a majority operating in China for over a decade. Key challenges include HR issues and slow internet speed, though the impact of government reforms is perceived positively. Overall, the sentiment remains cautiously optimistic with moderate growth in turnover and profits expected.