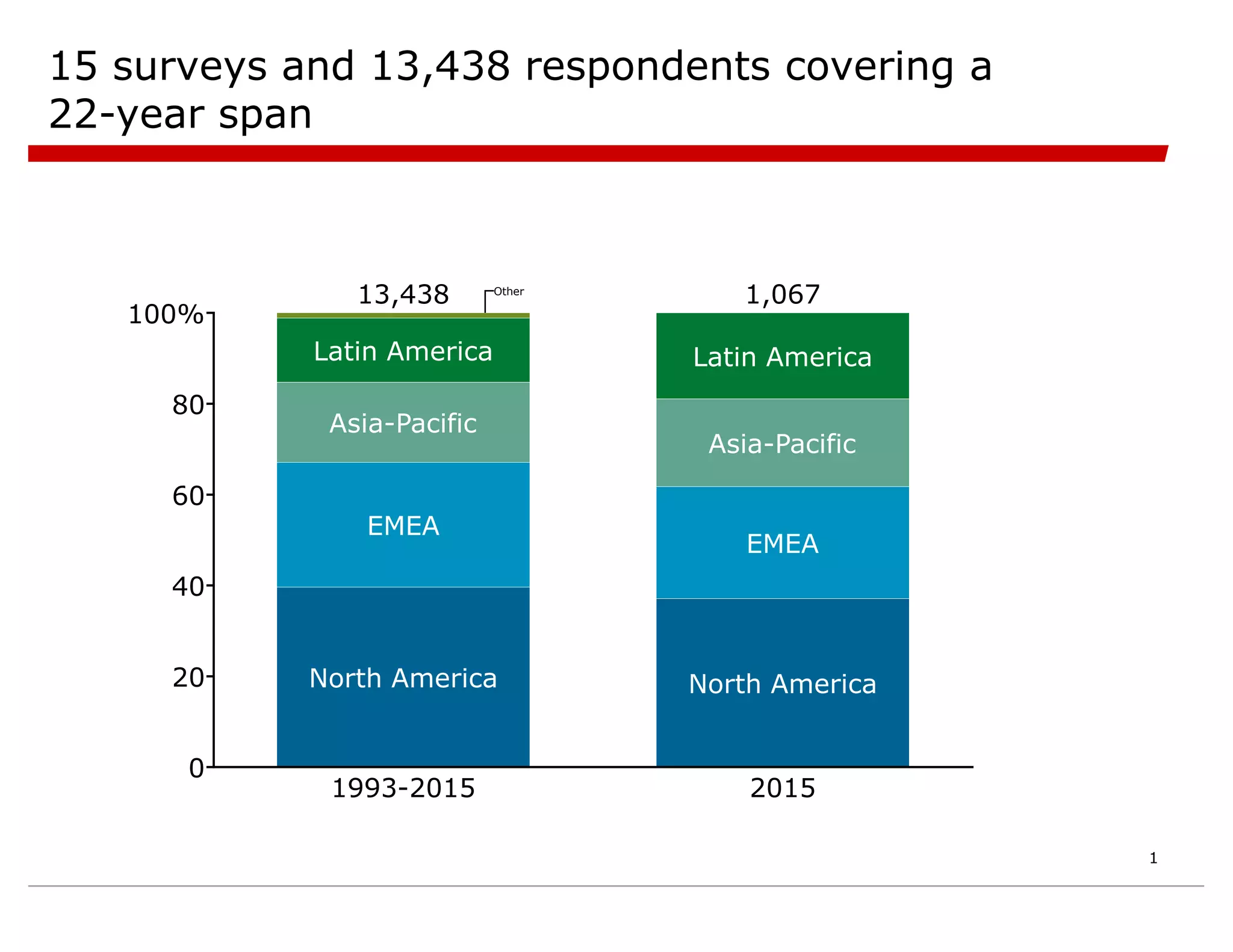

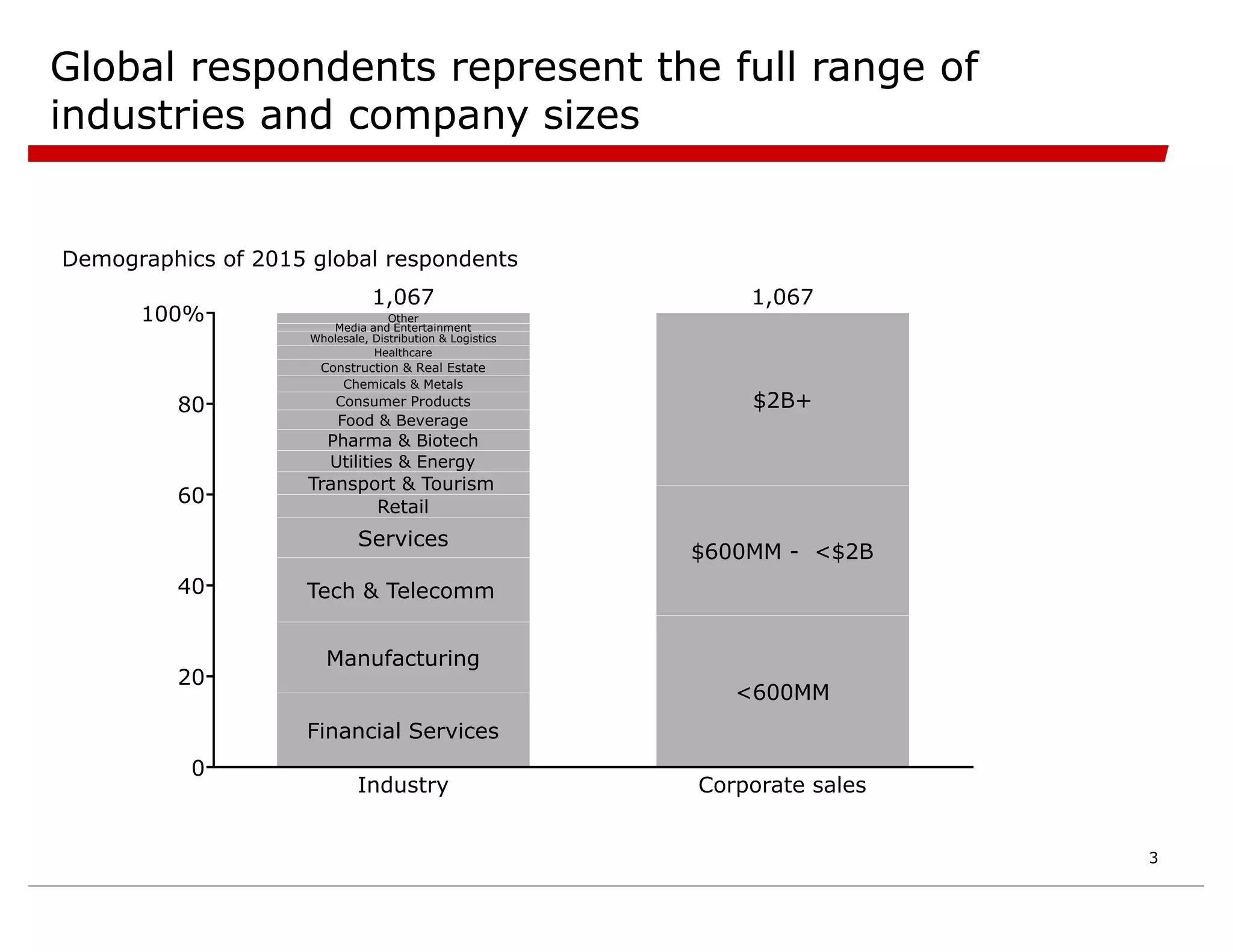

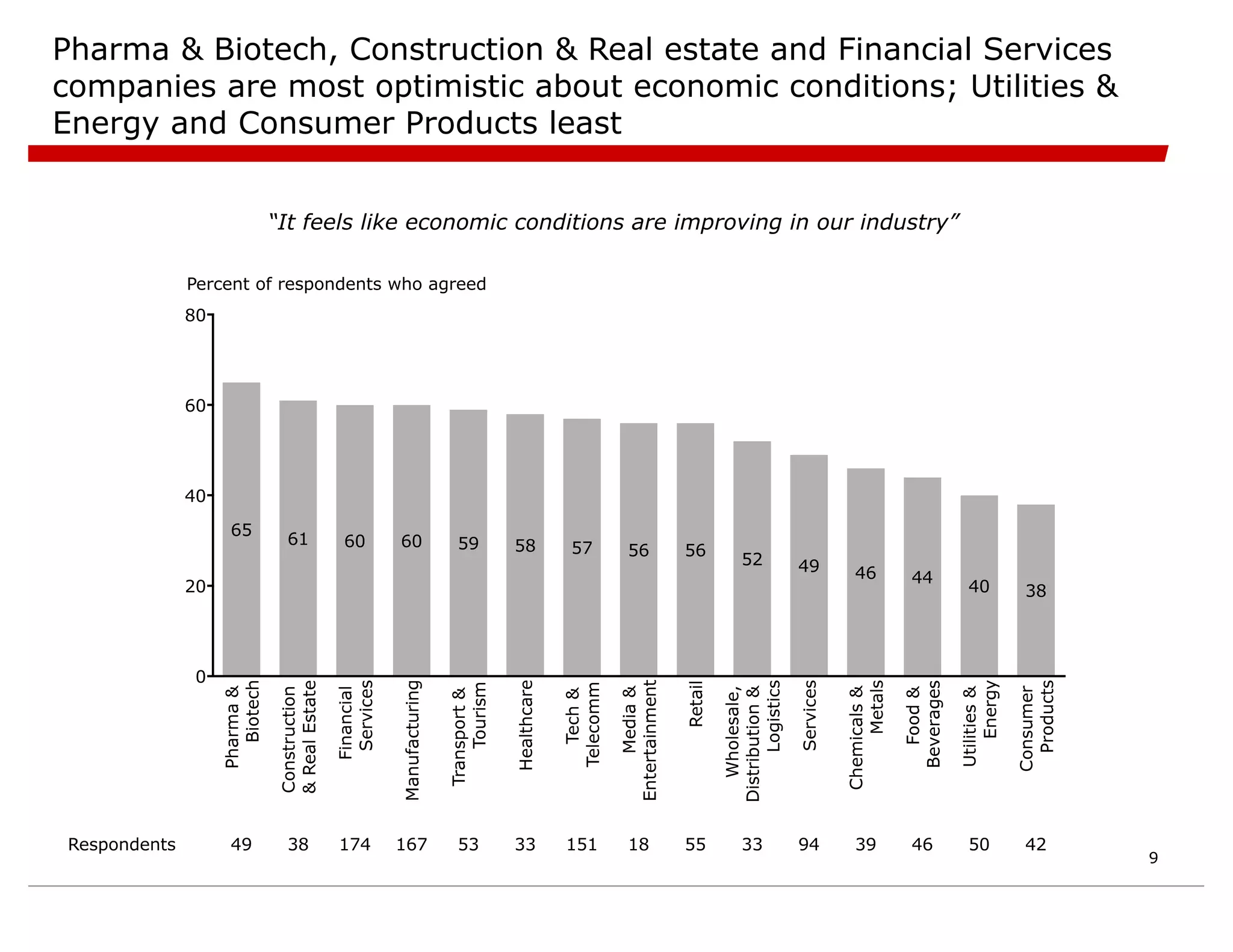

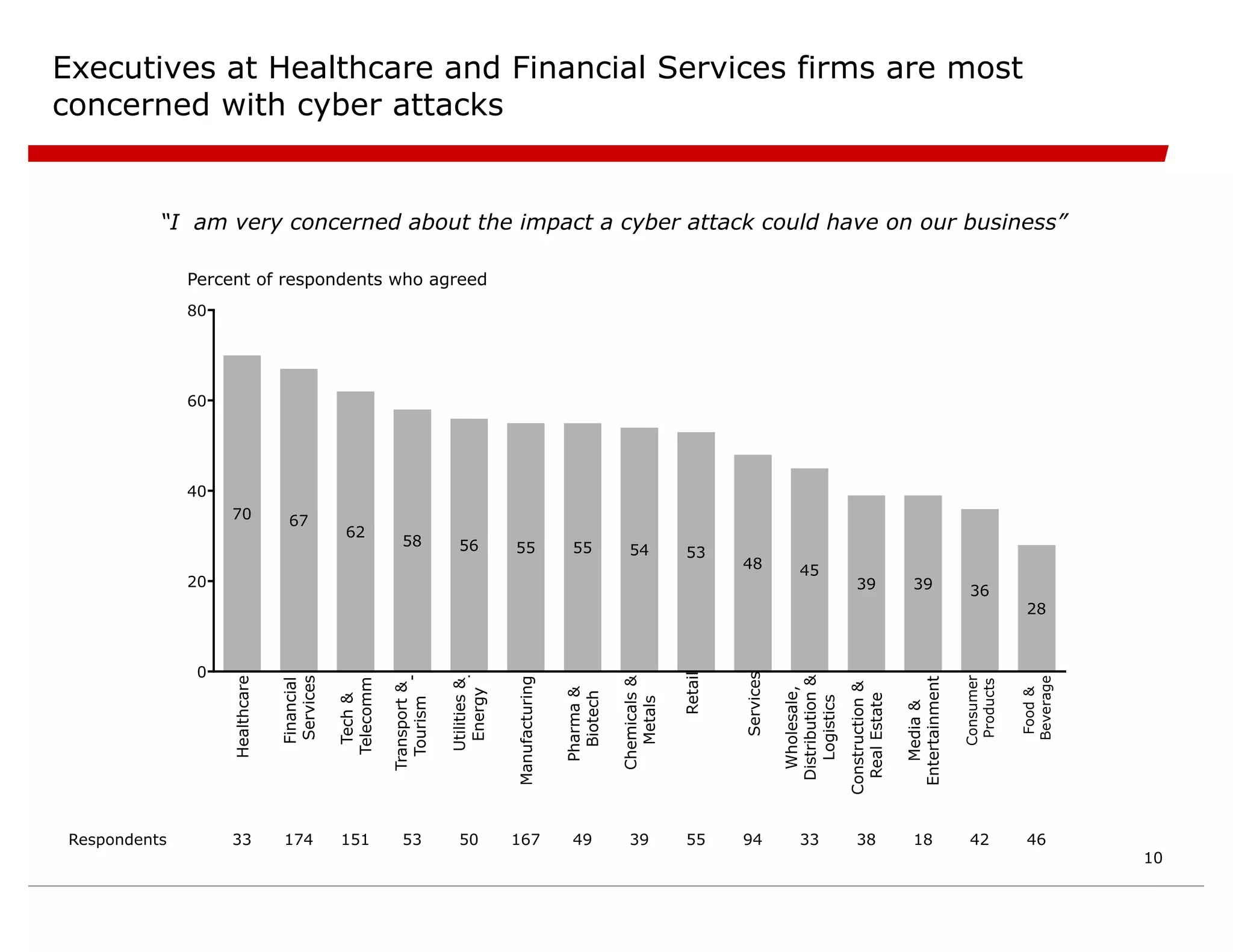

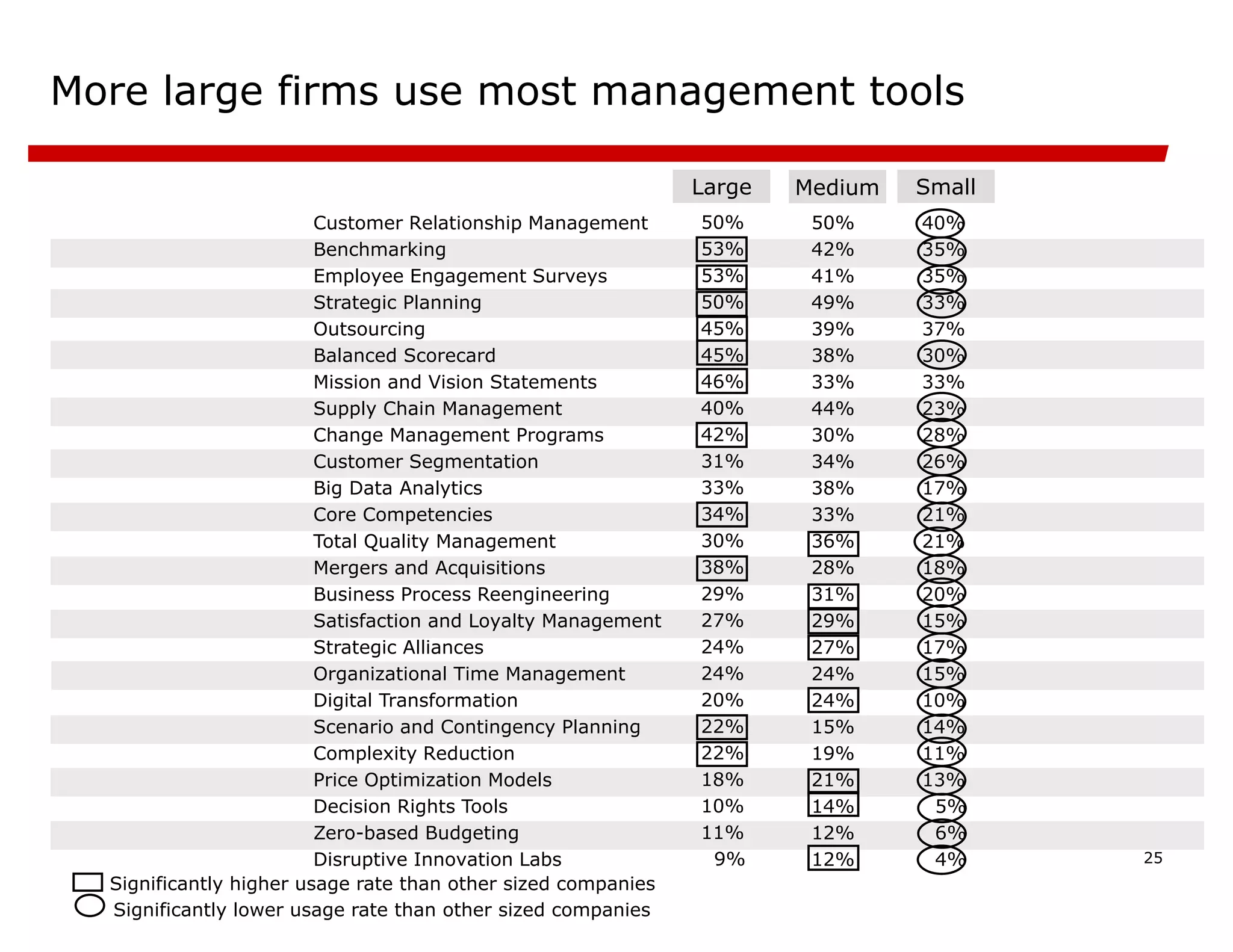

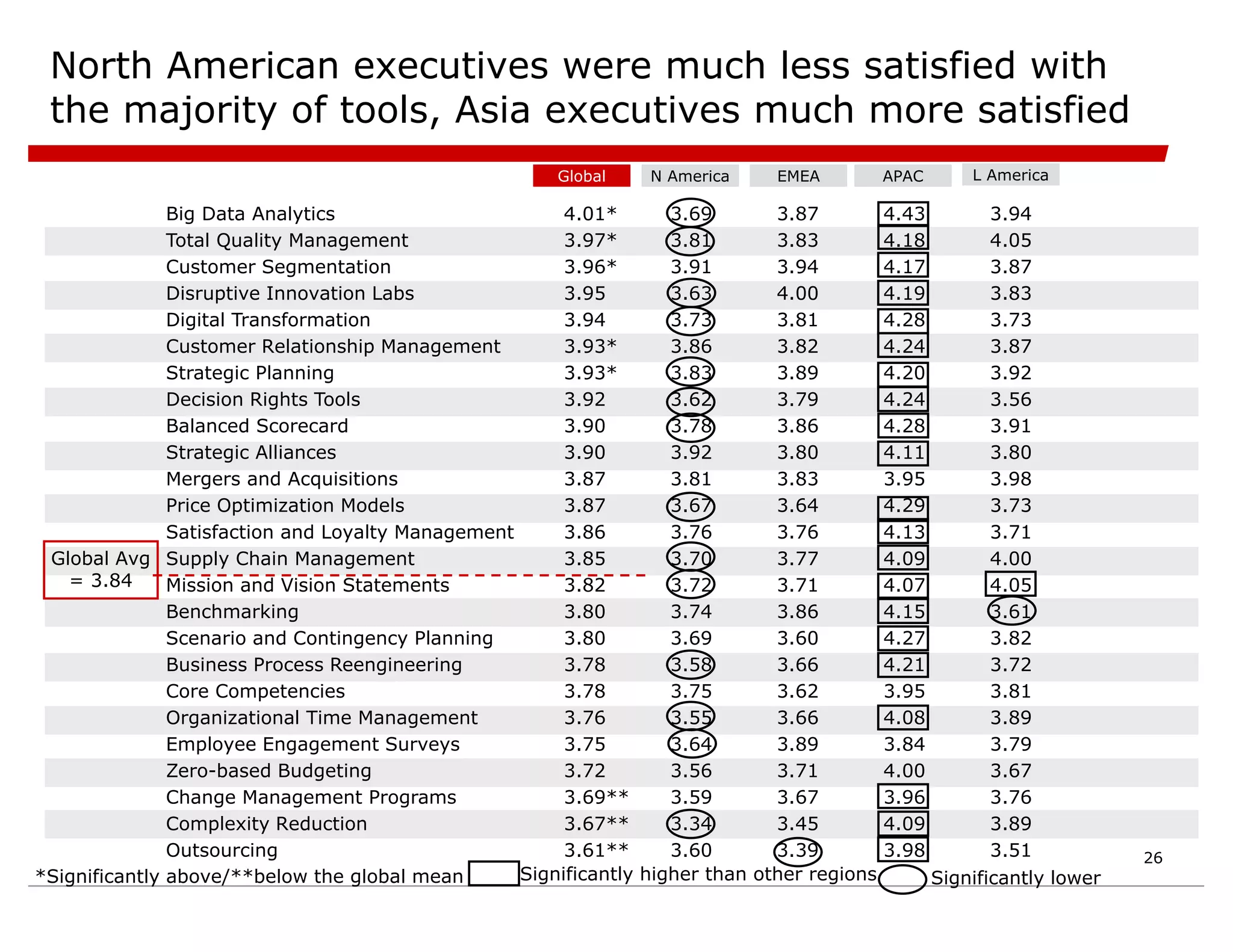

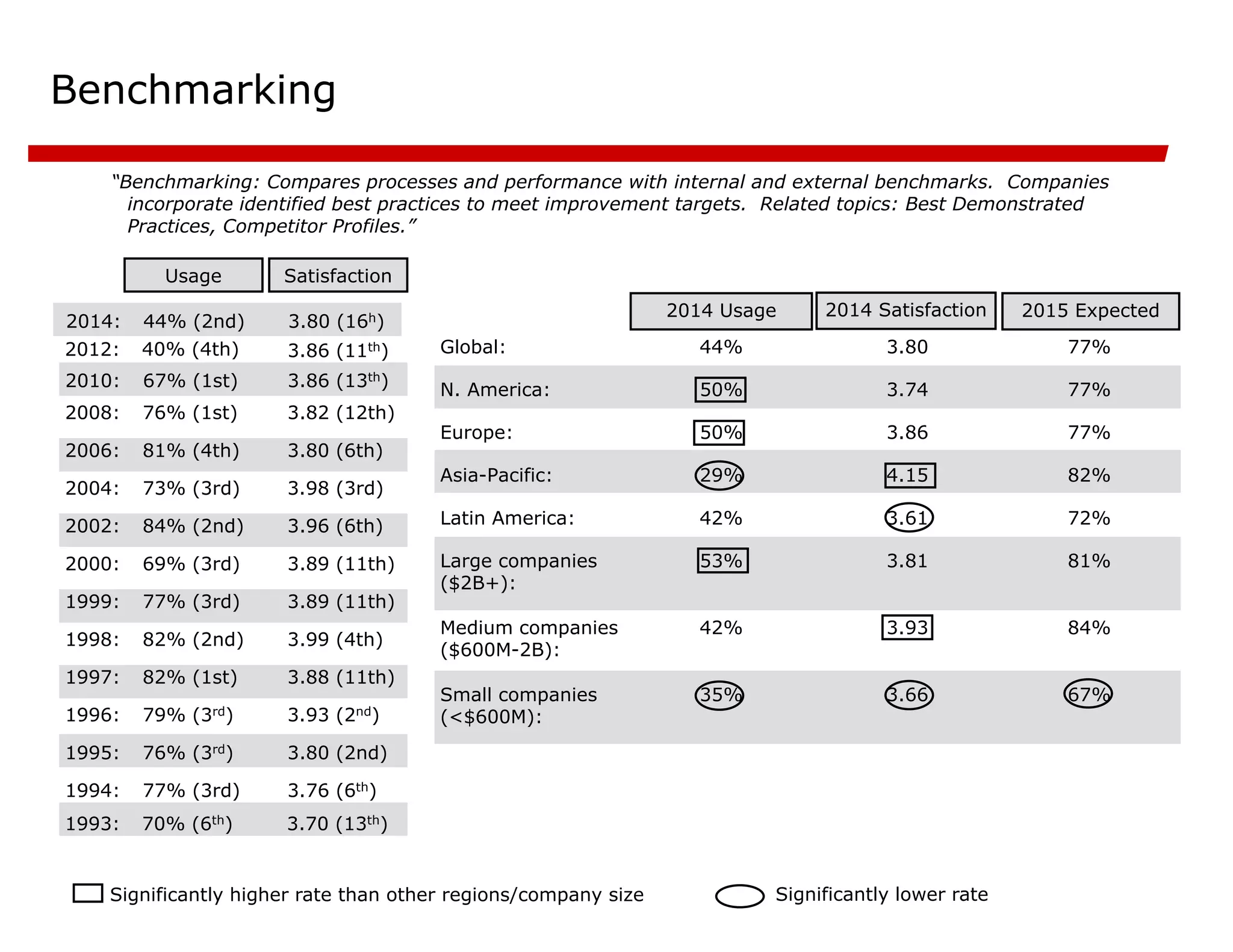

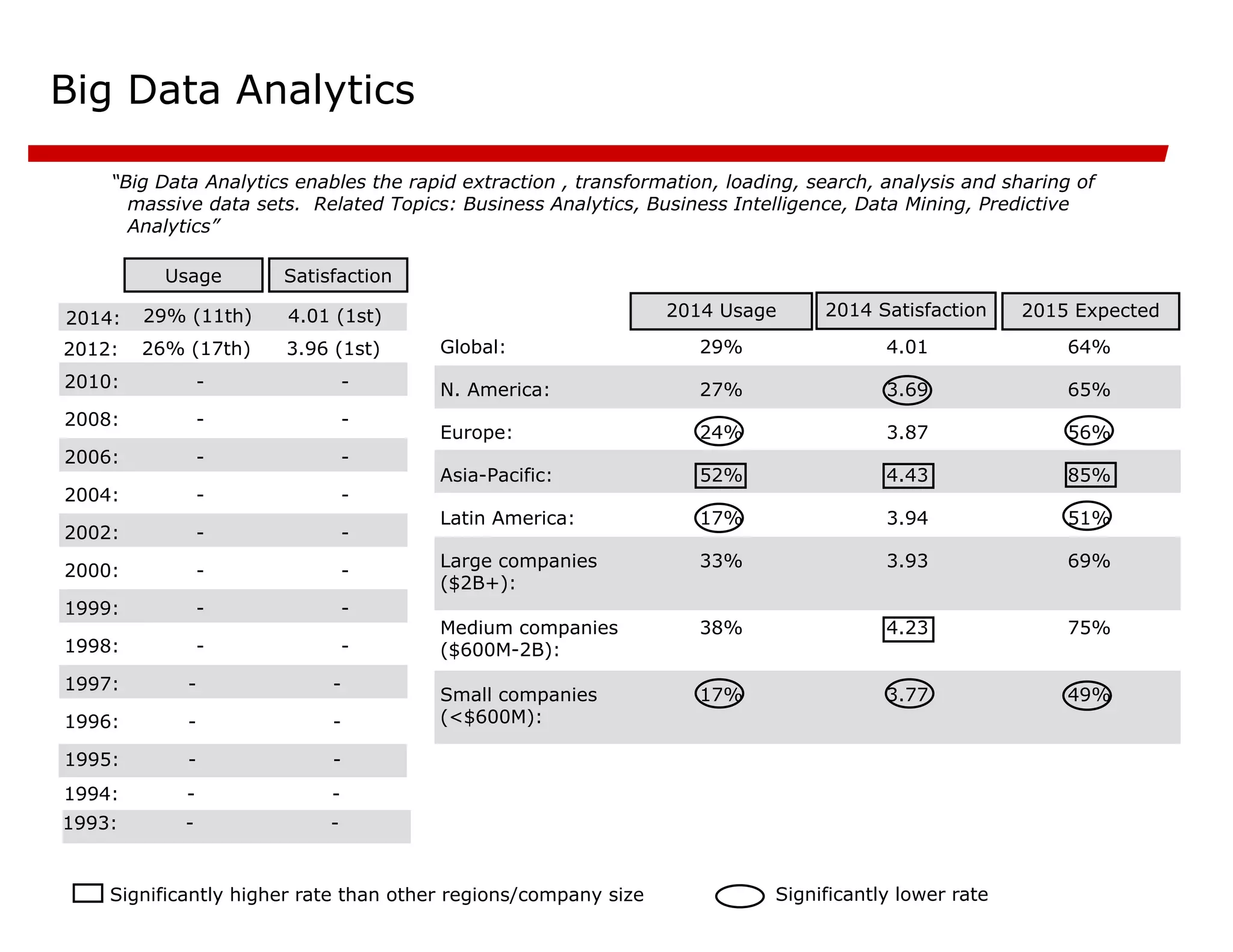

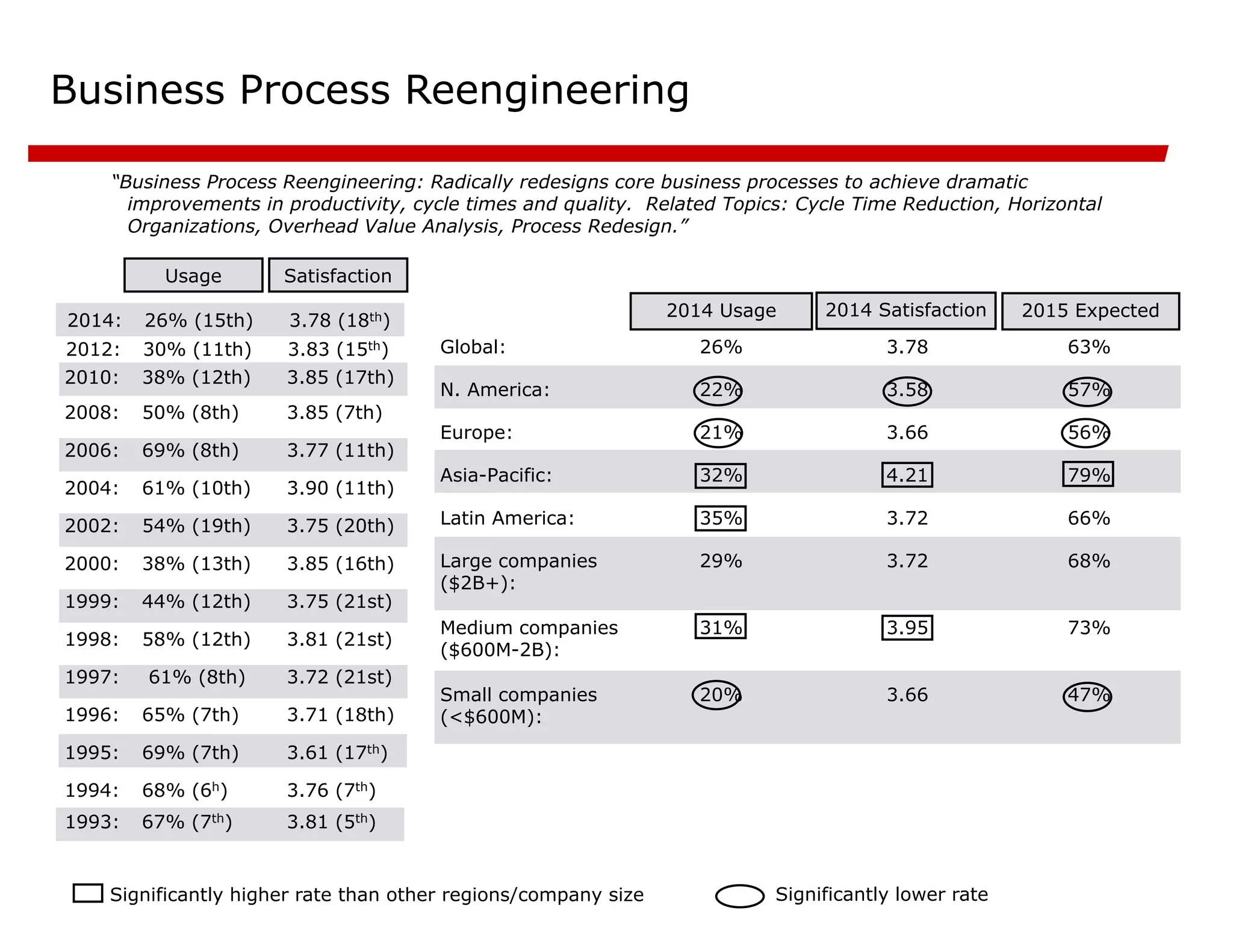

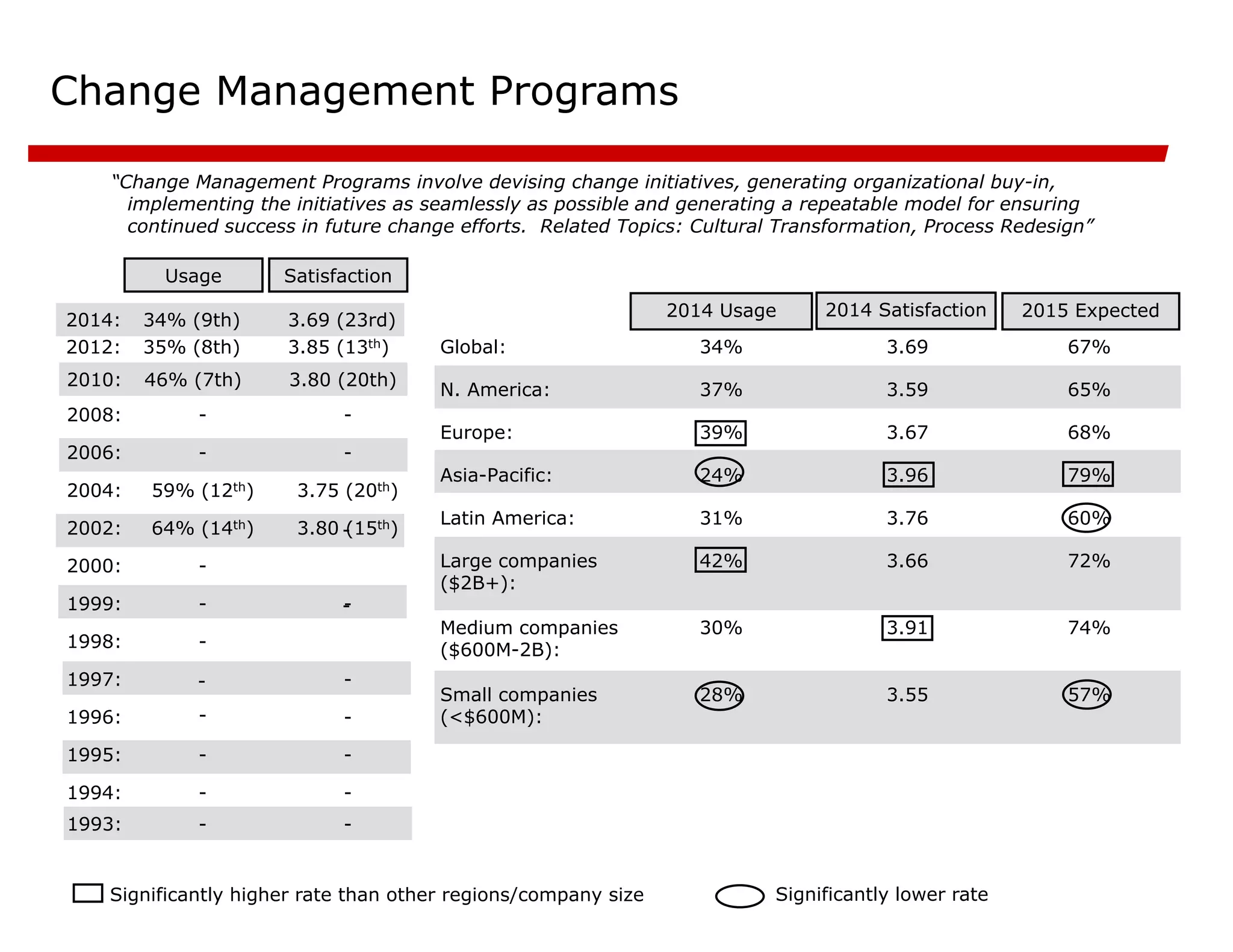

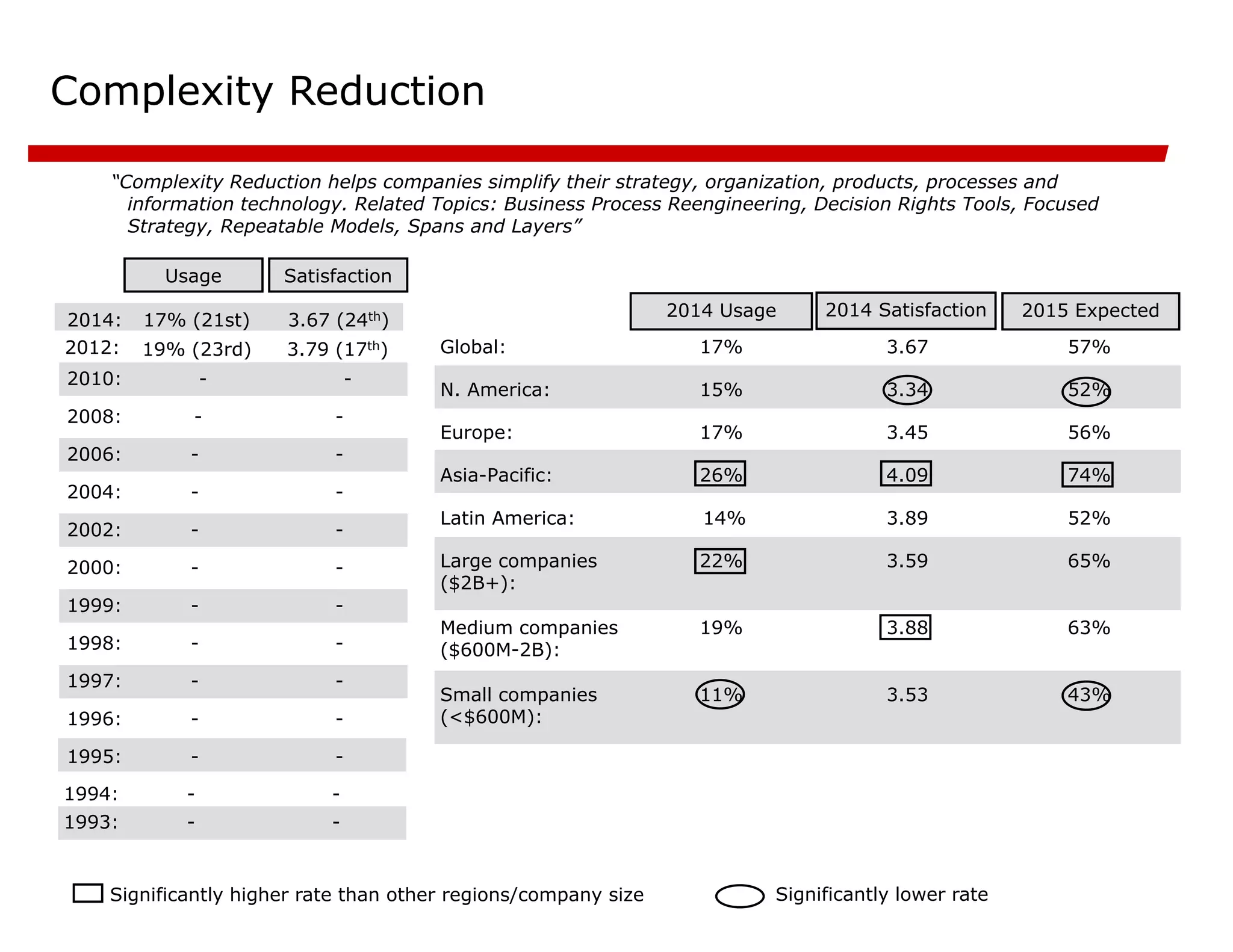

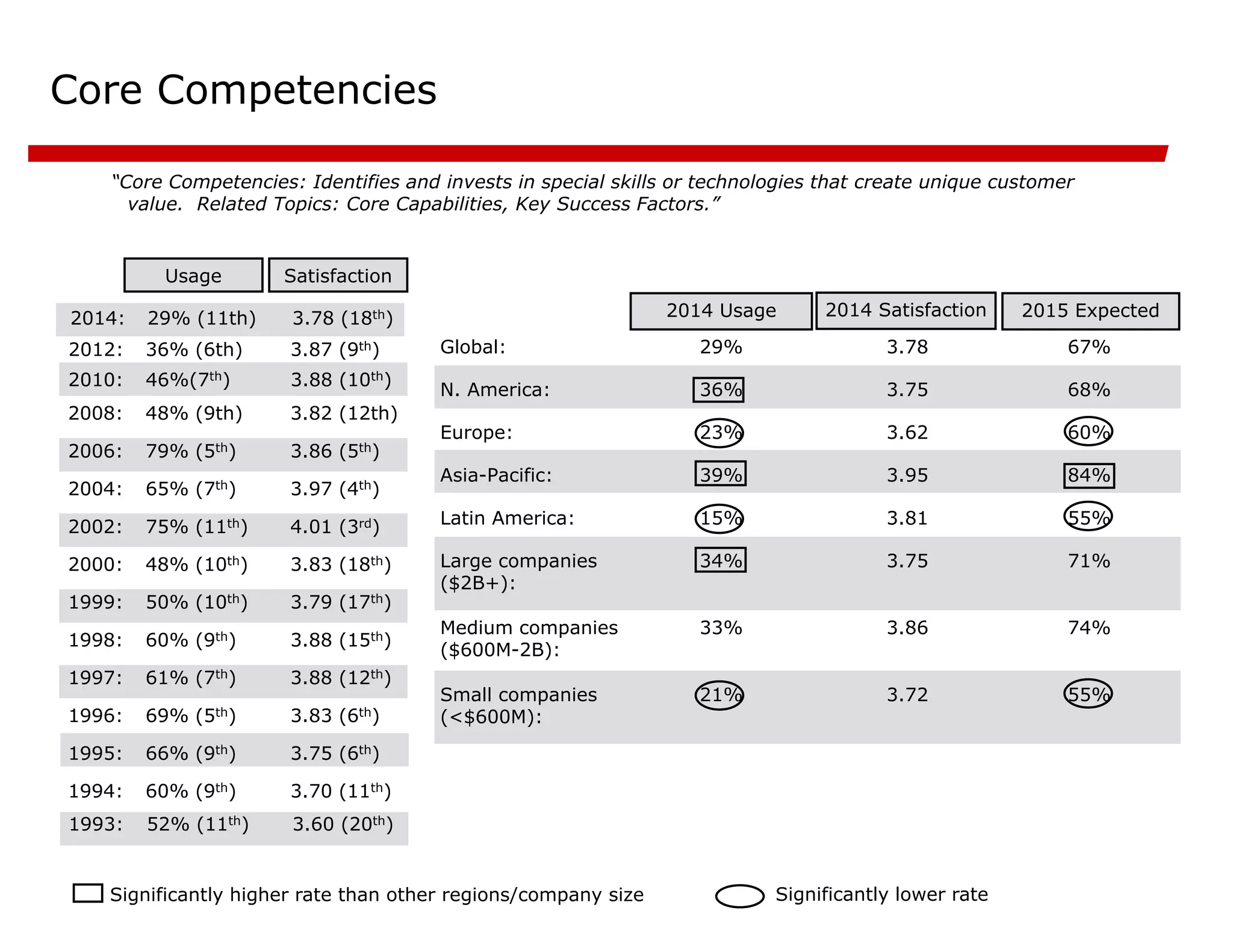

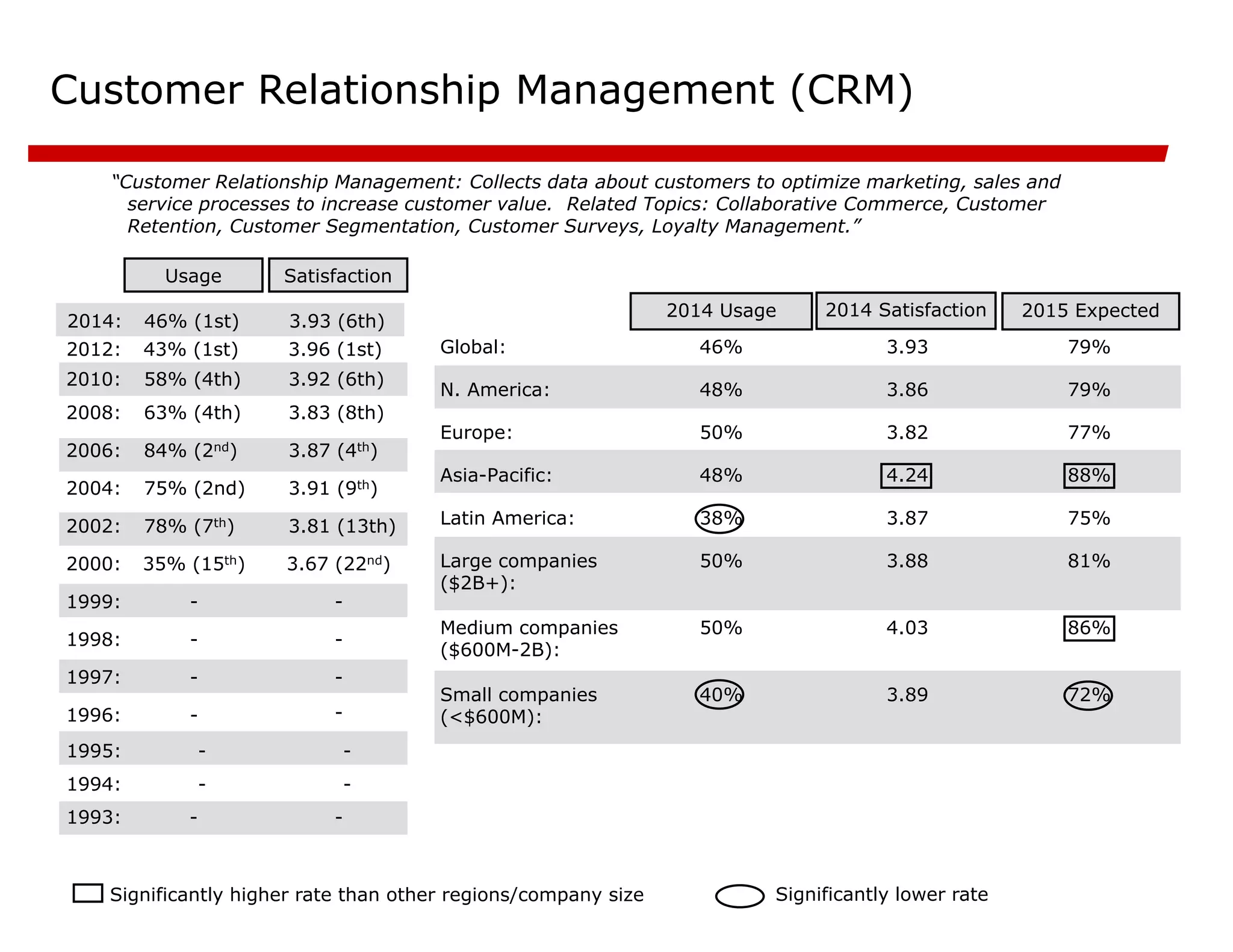

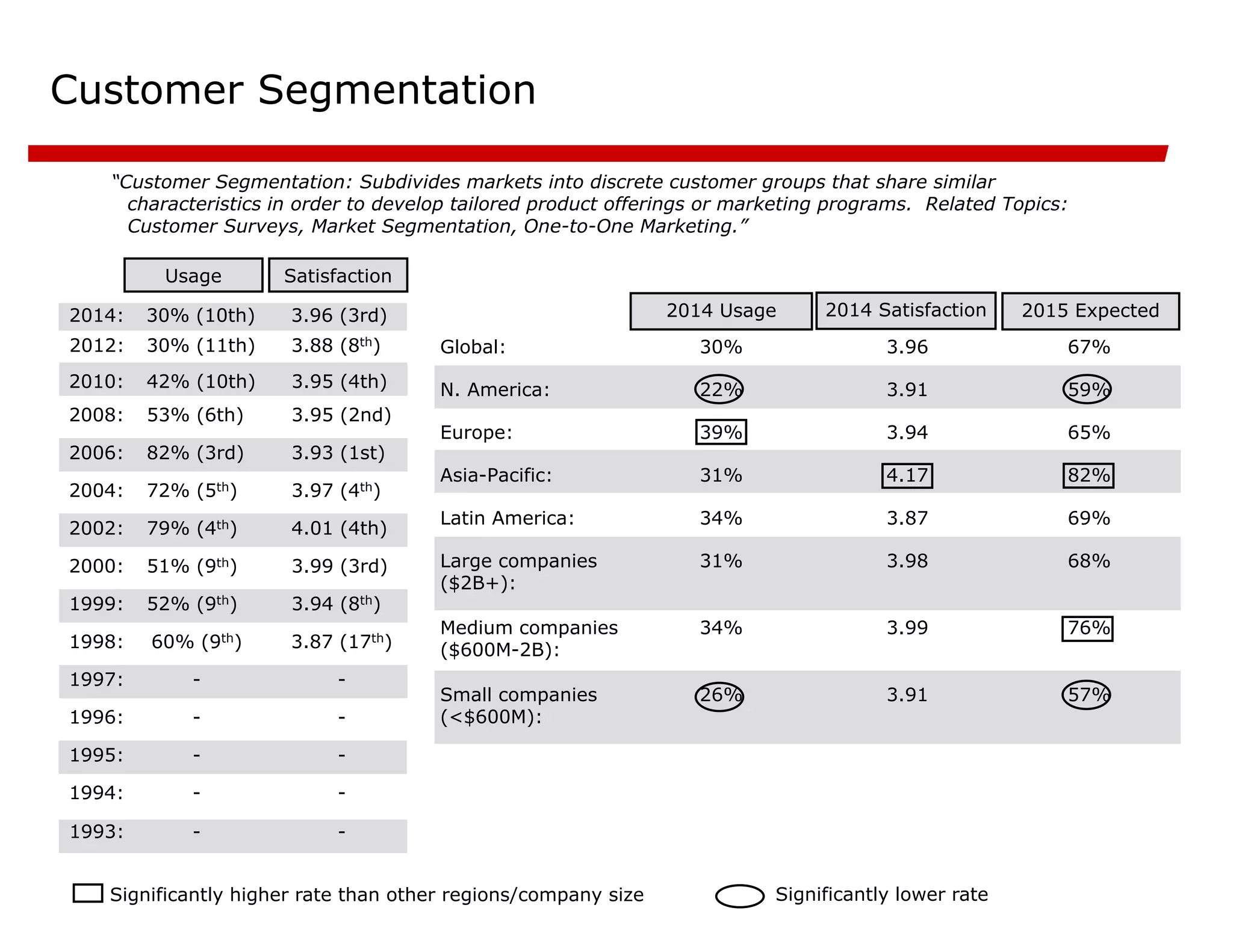

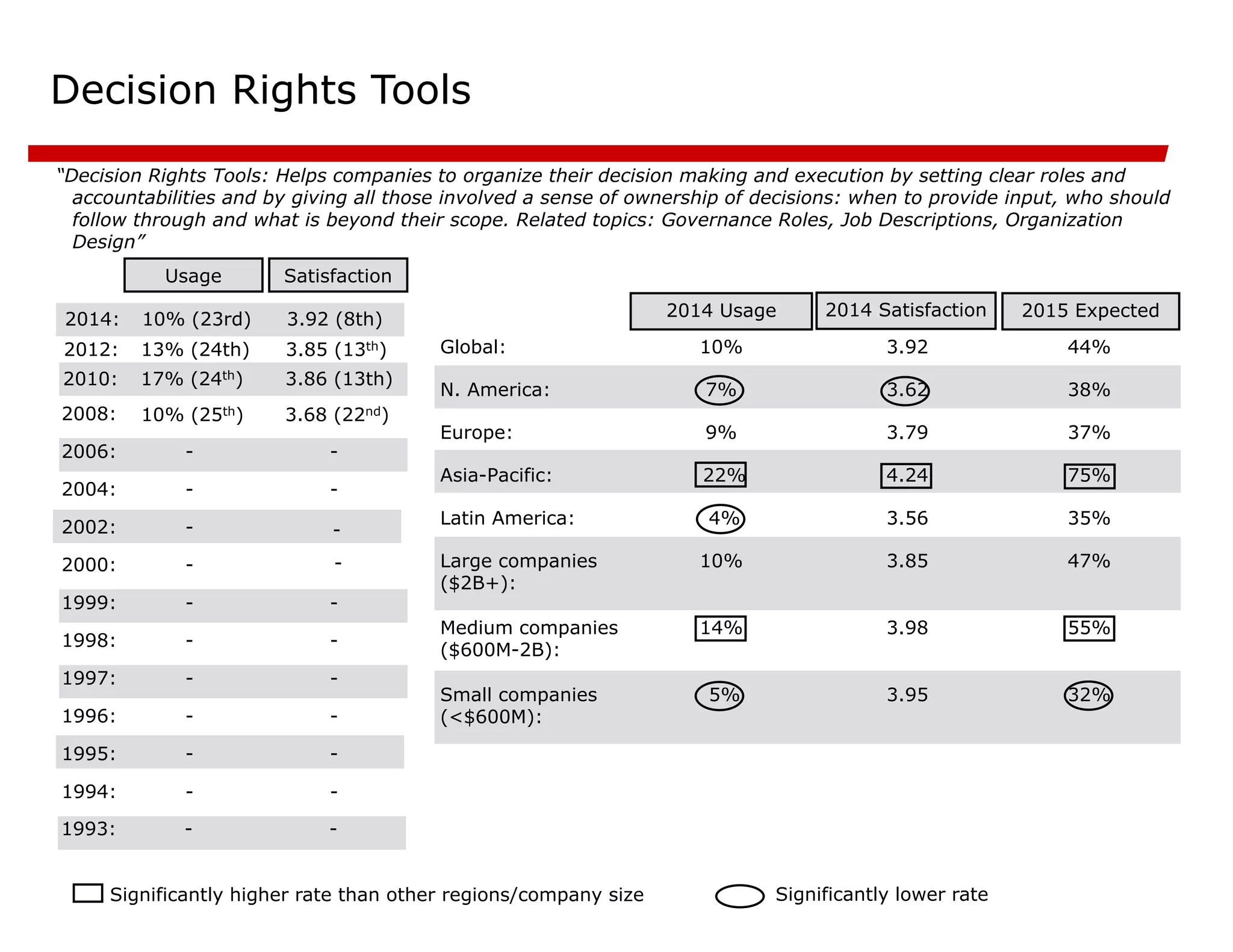

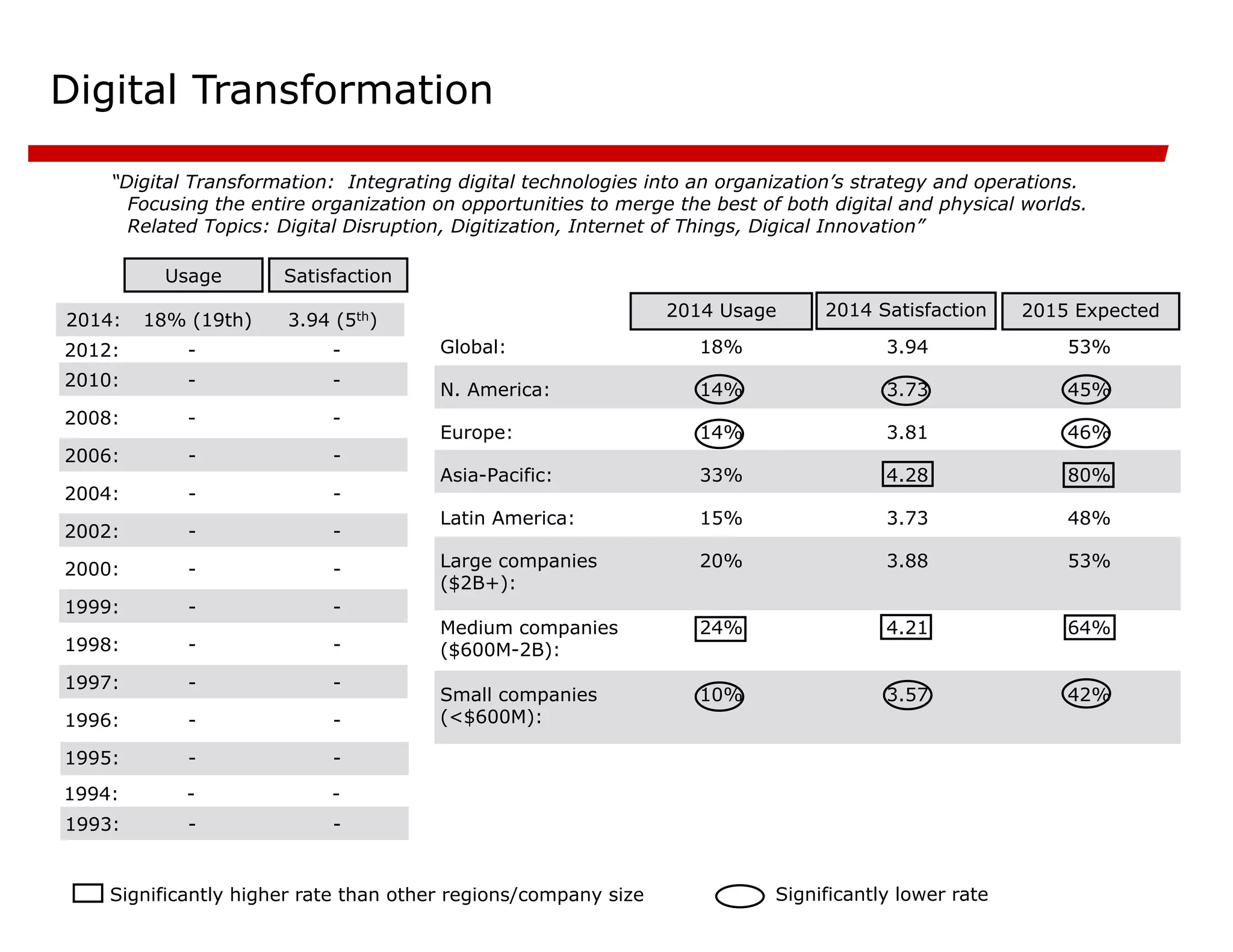

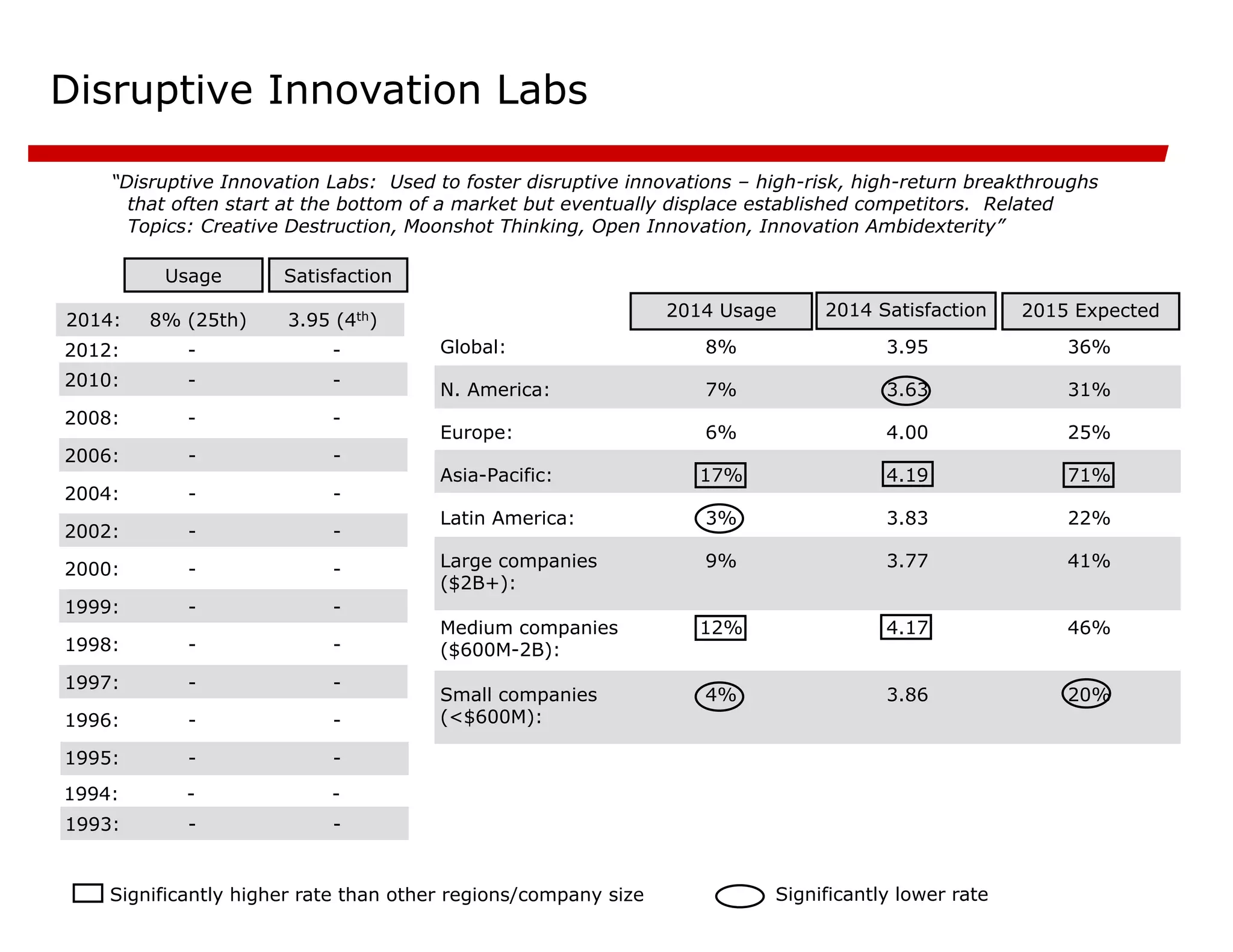

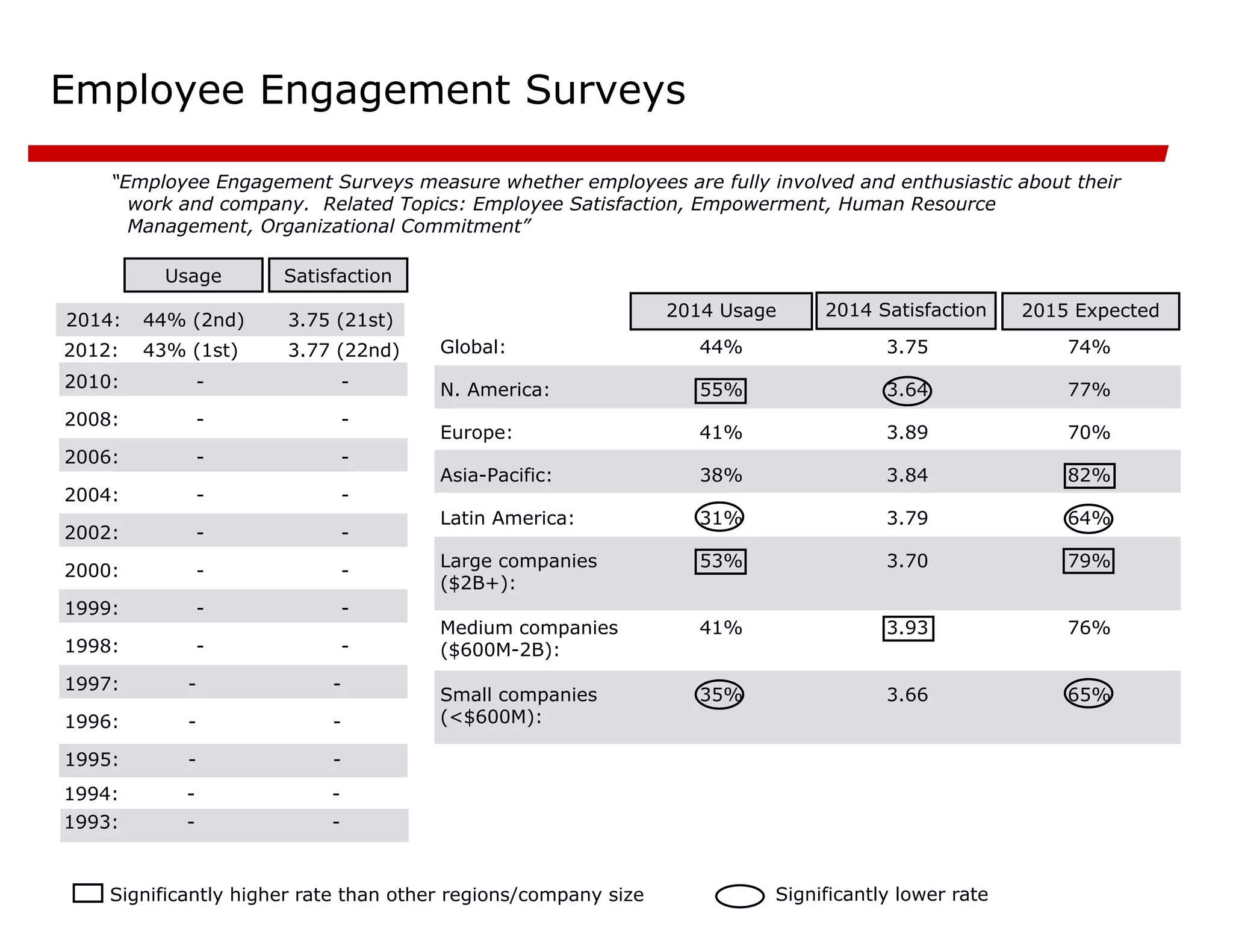

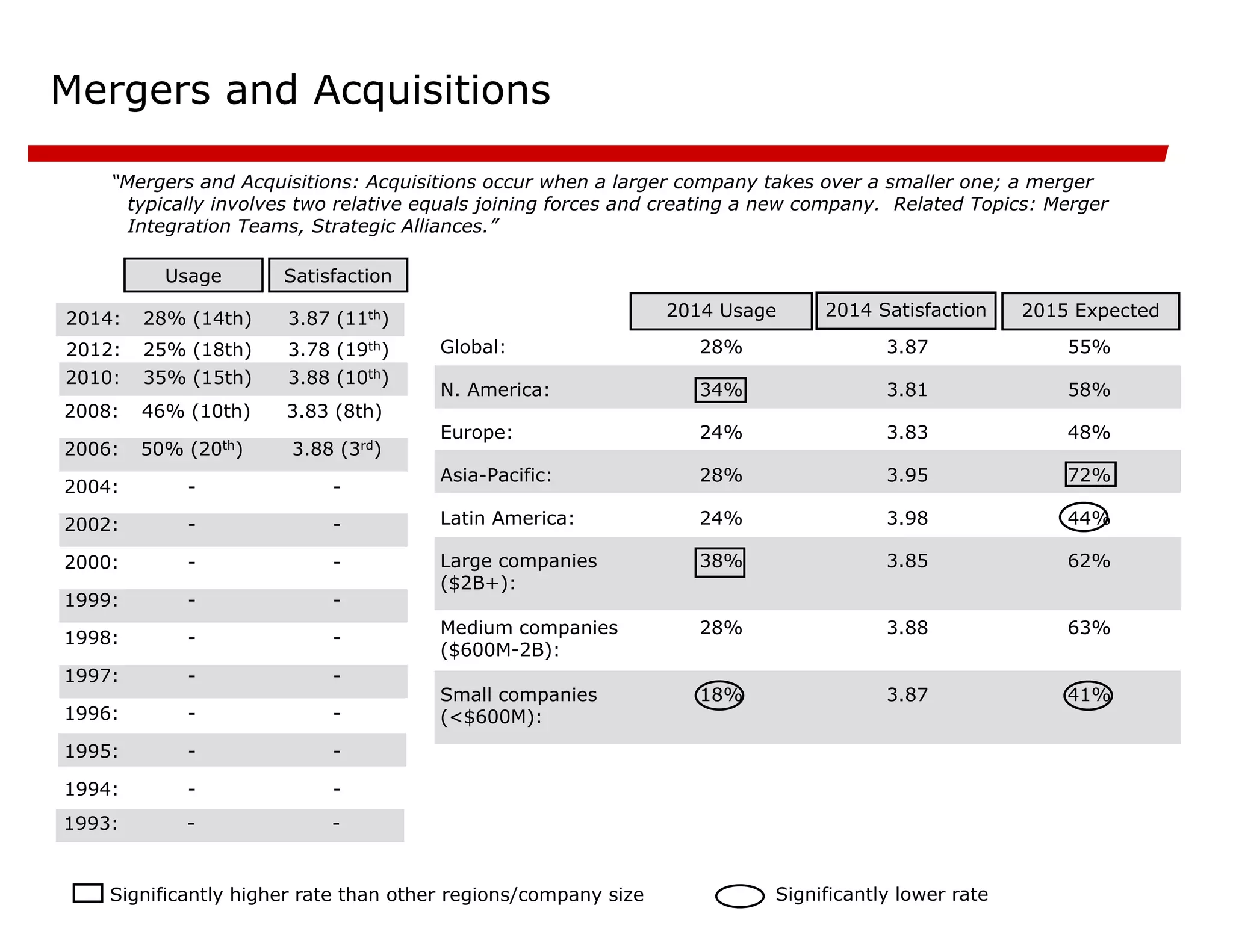

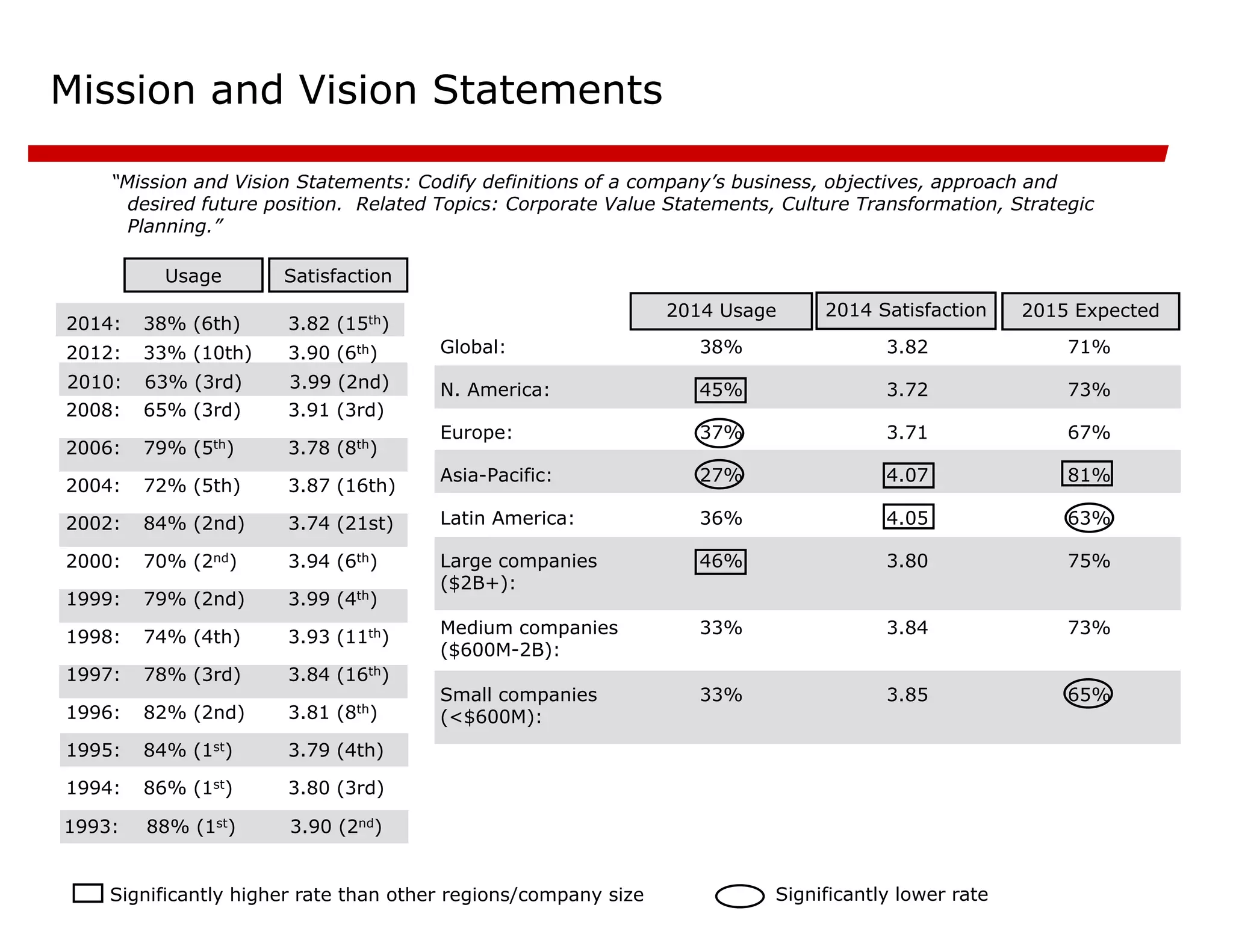

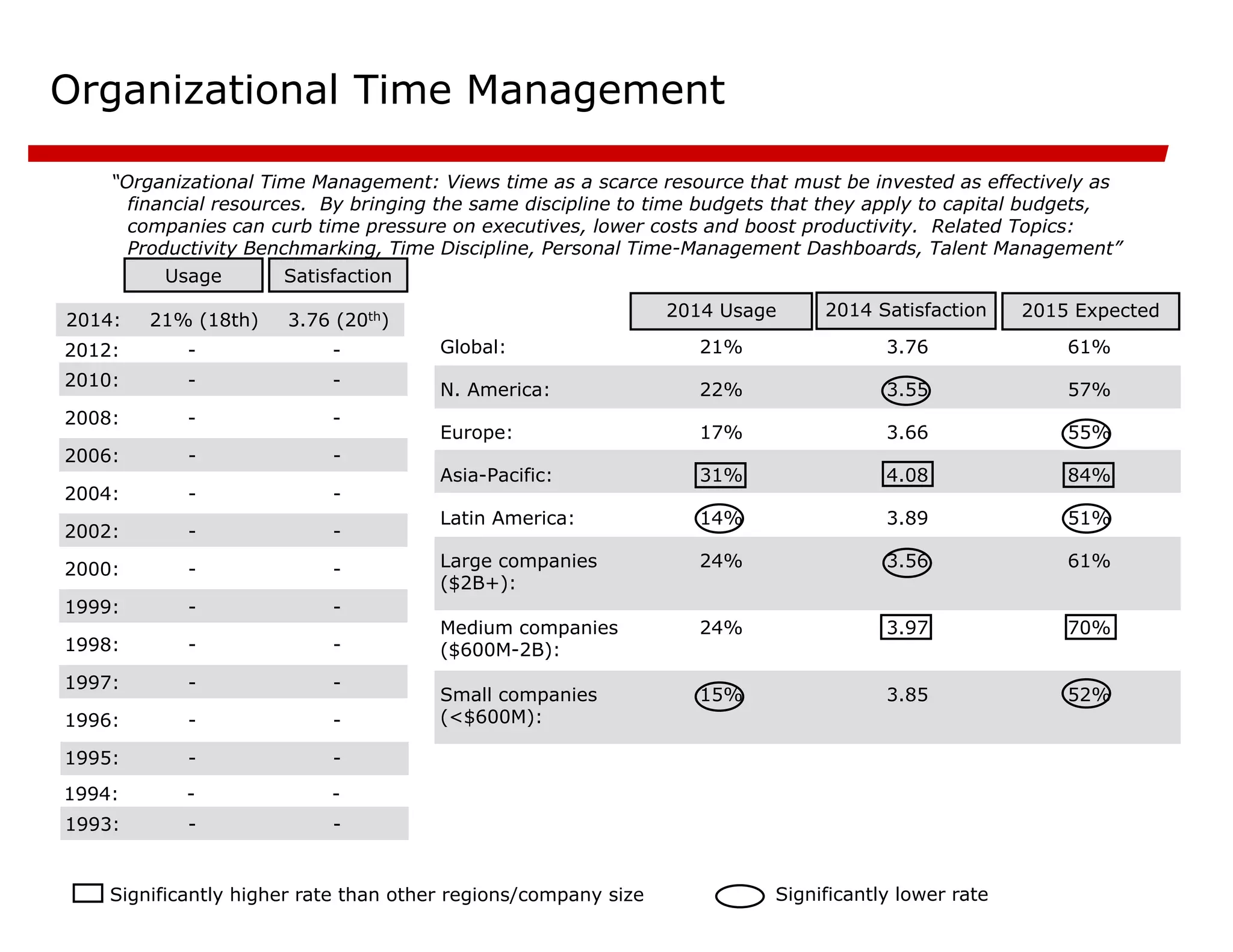

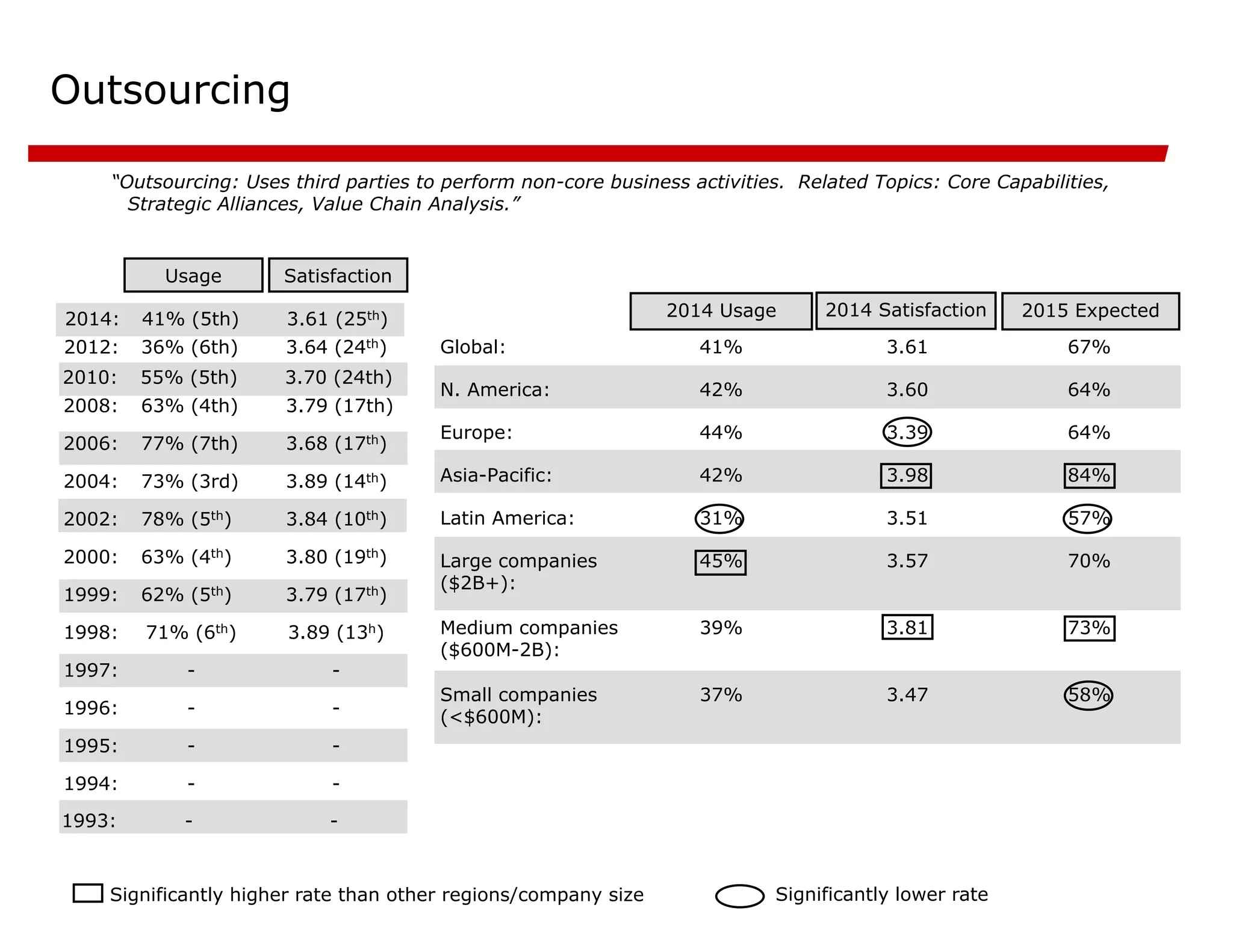

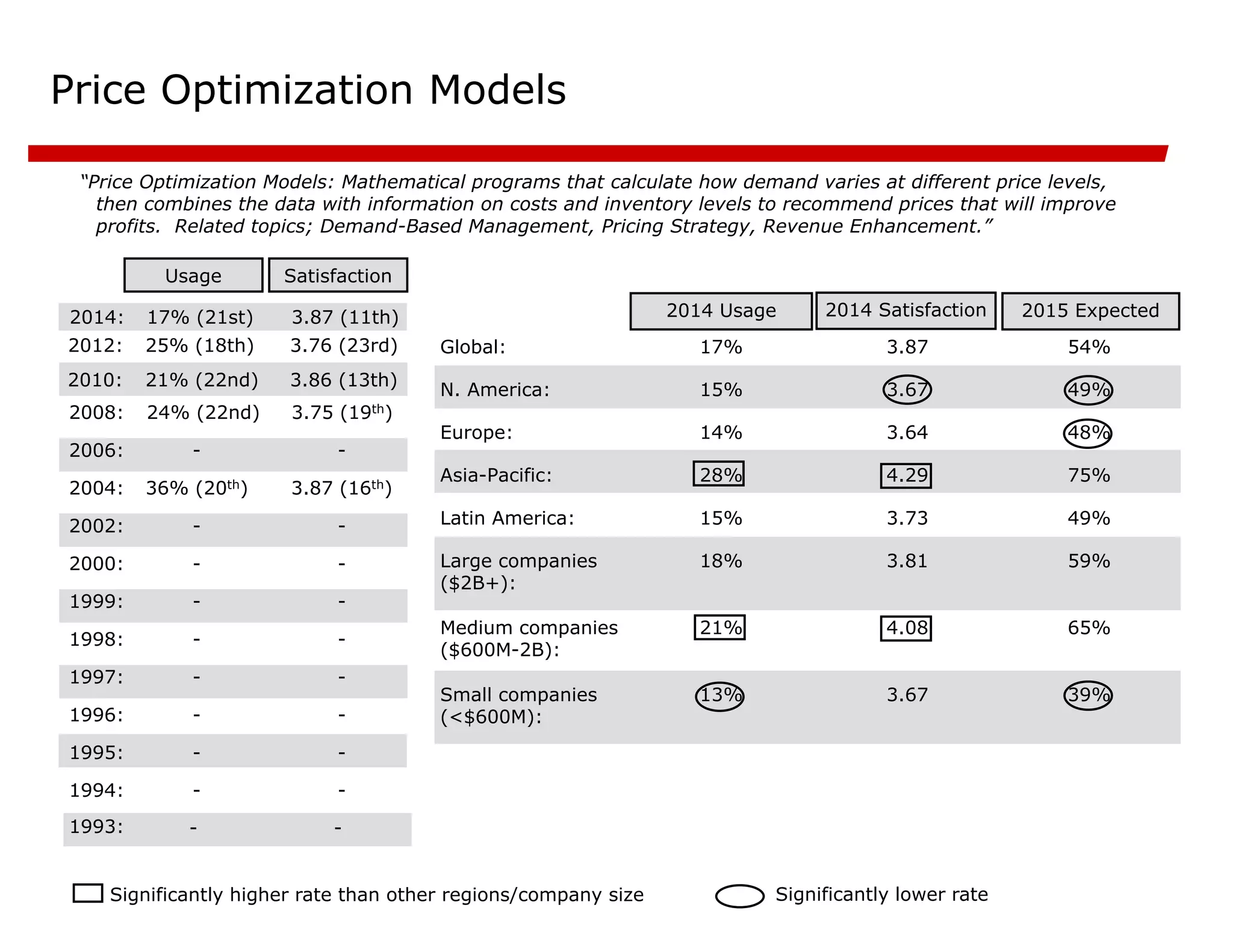

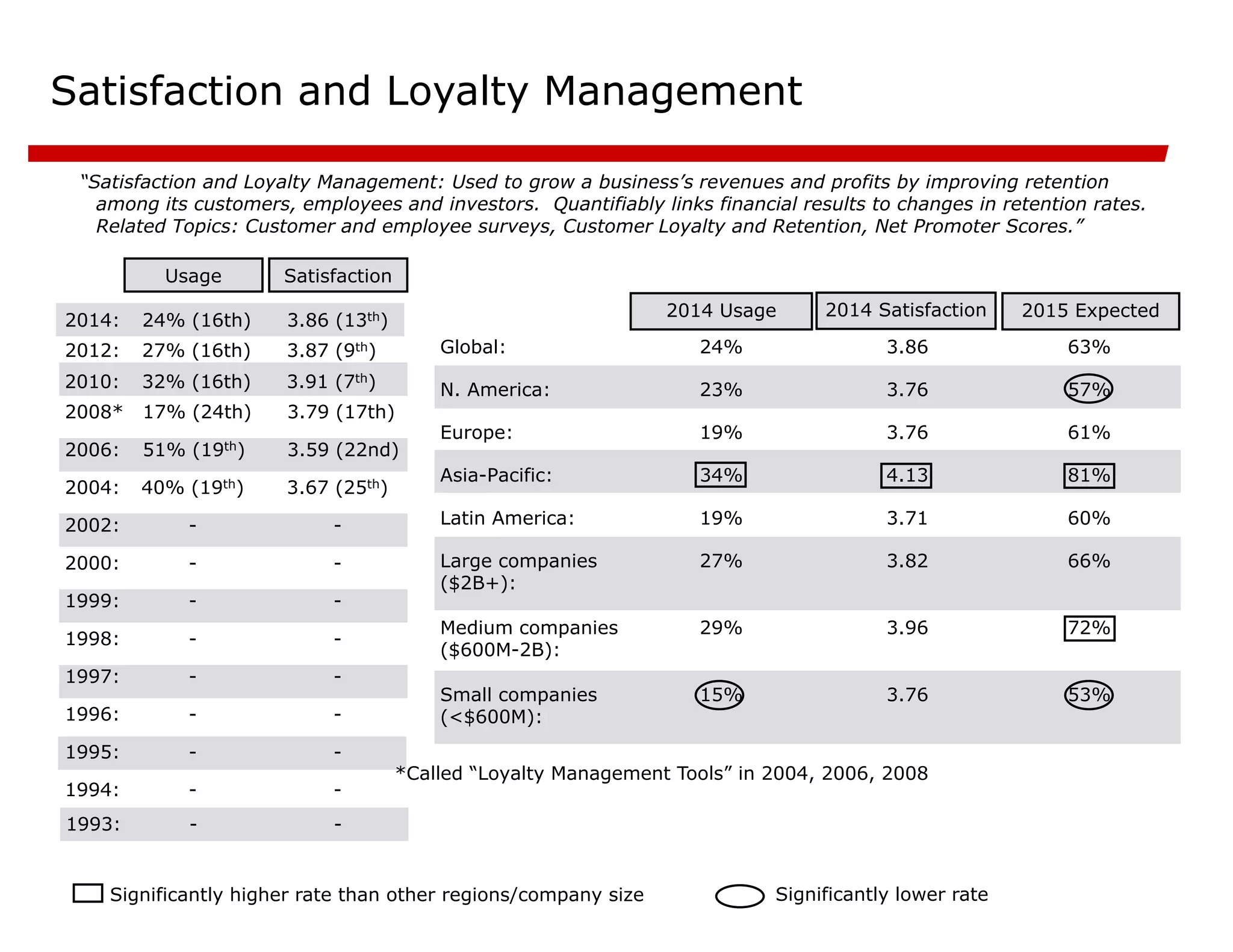

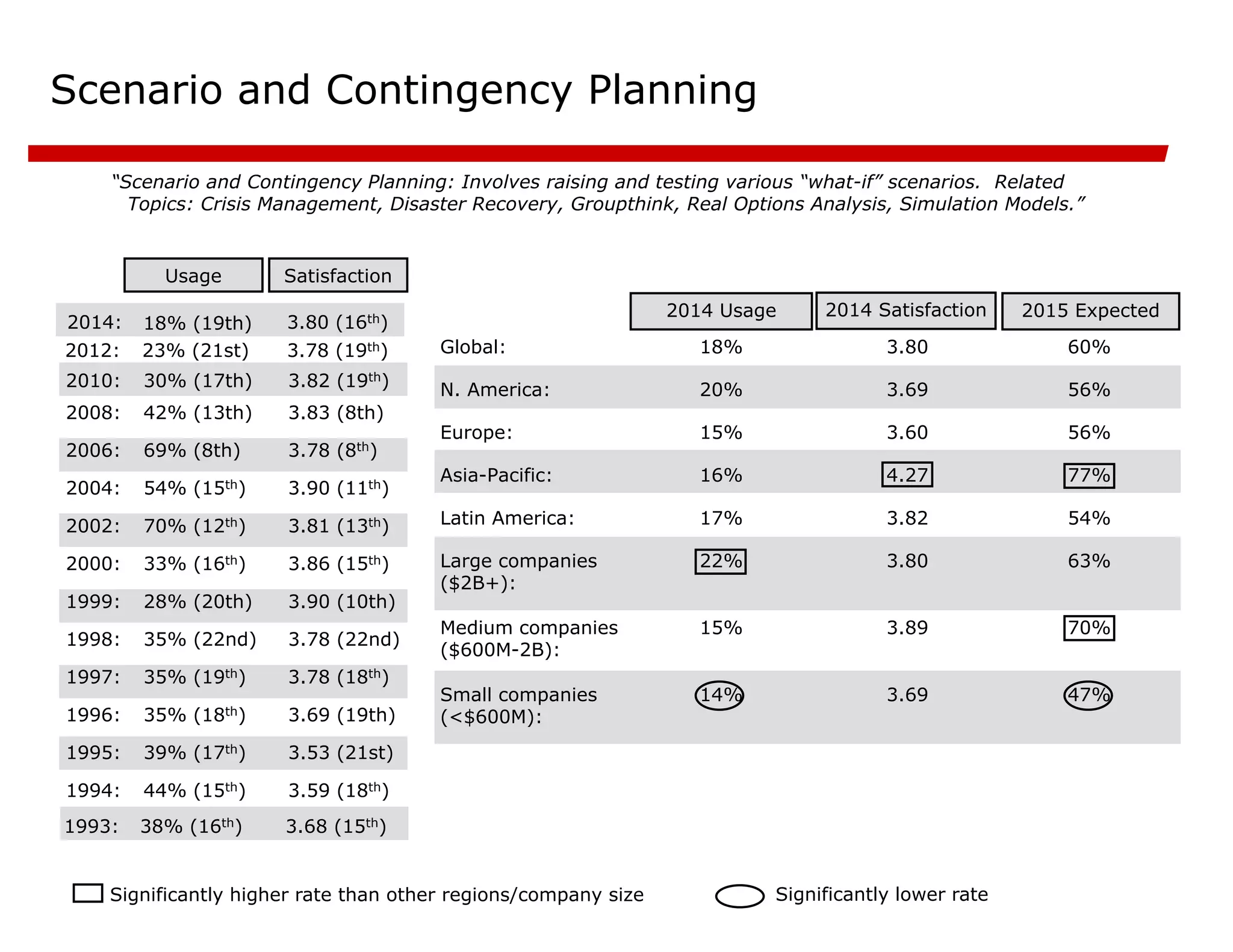

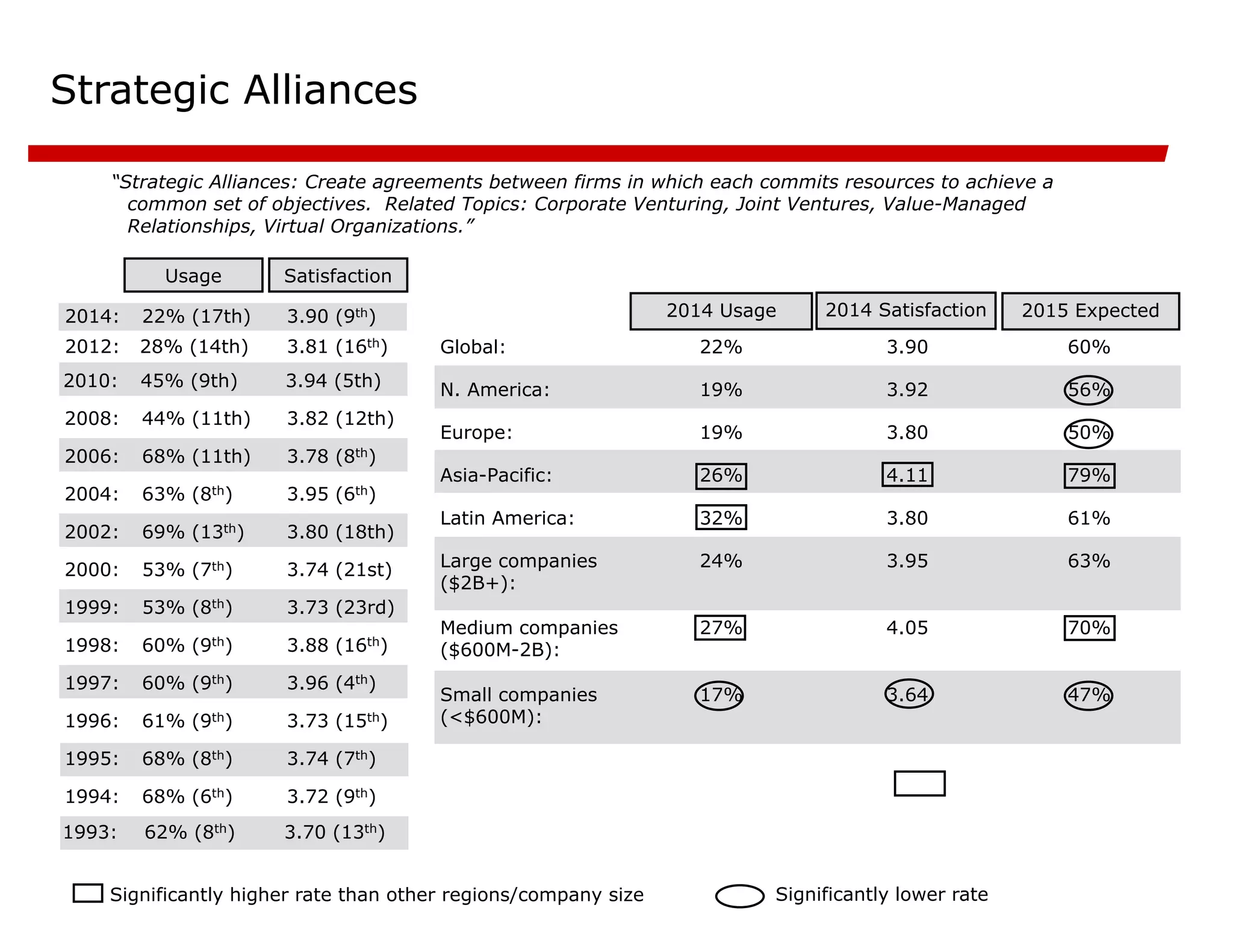

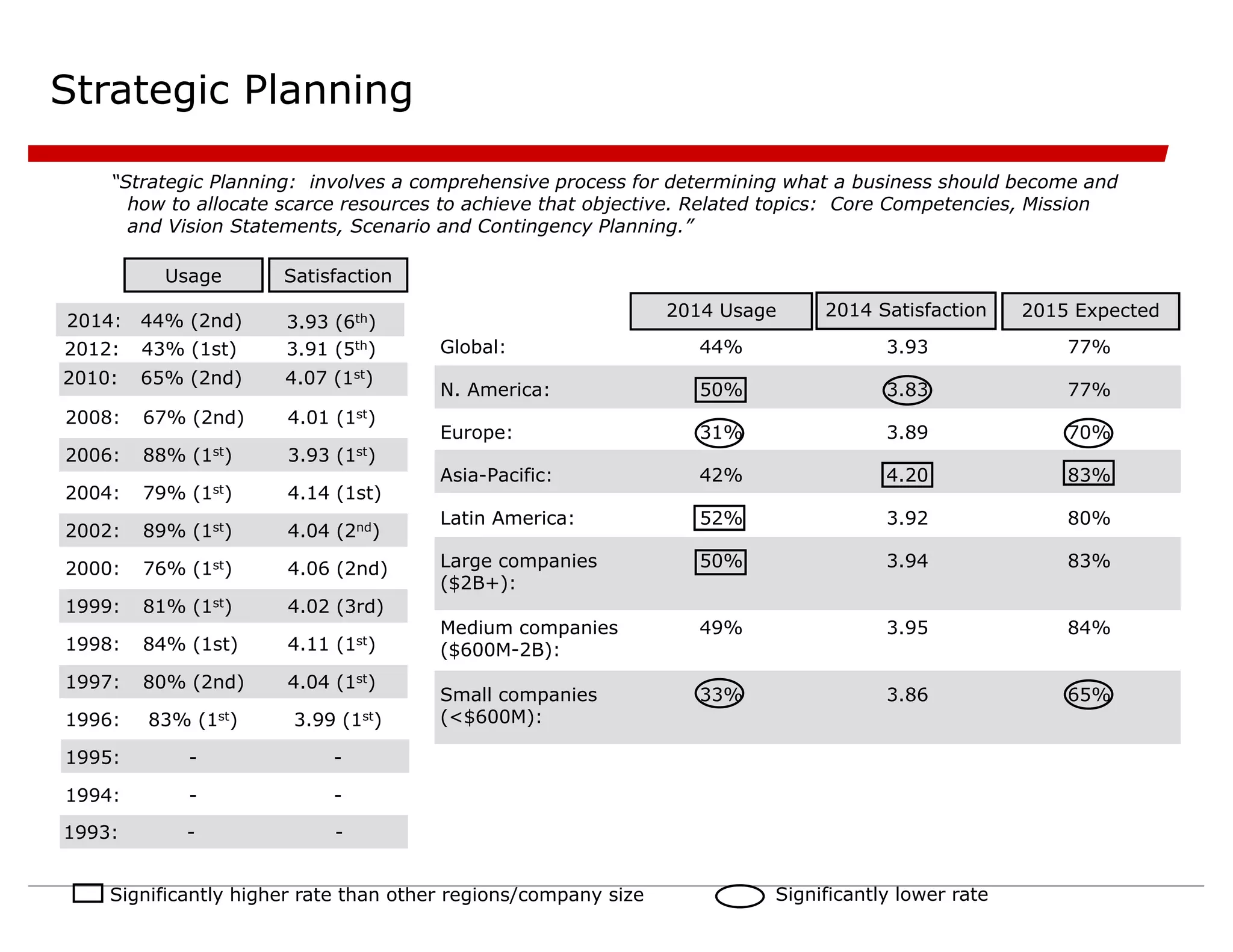

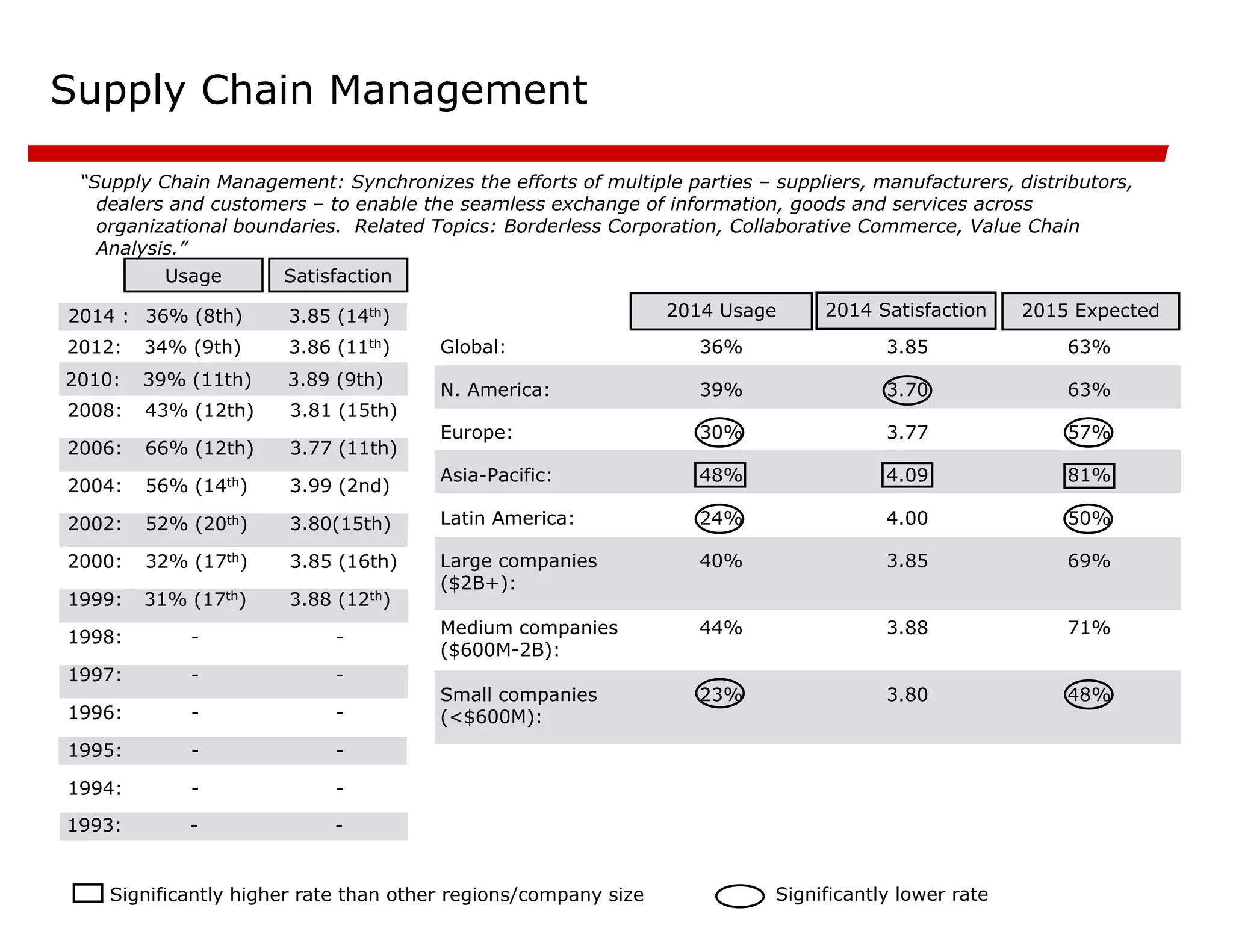

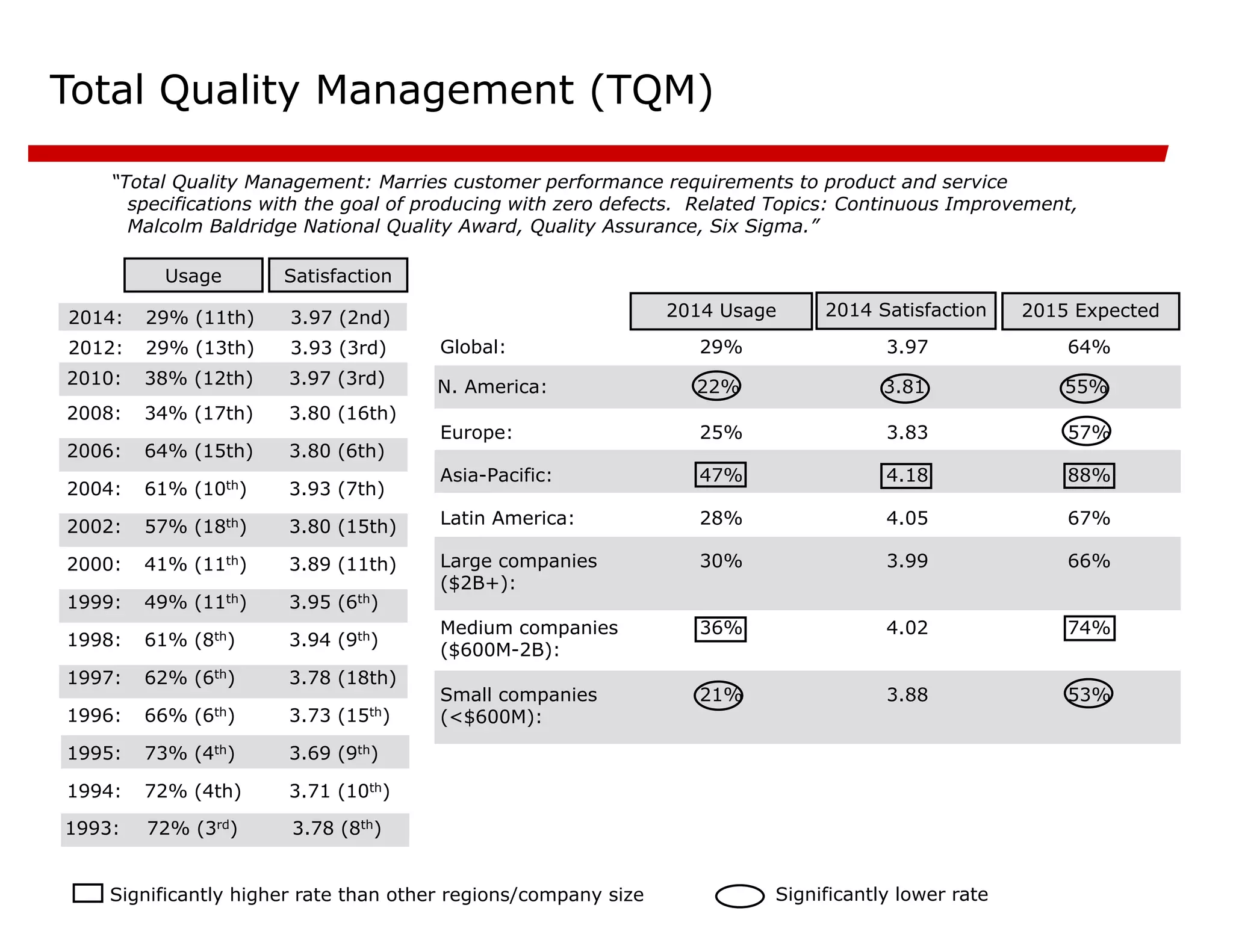

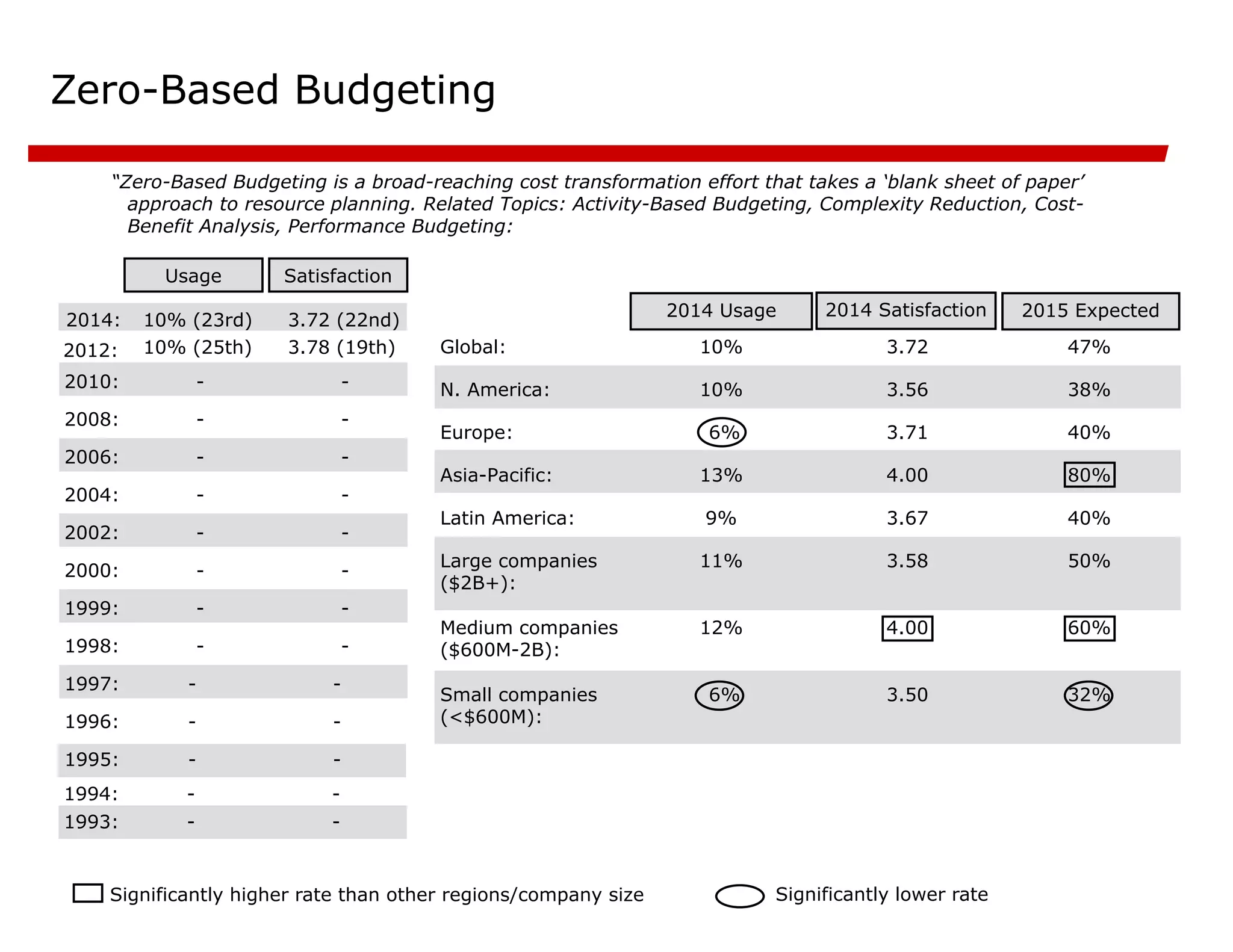

This document summarizes the findings of a survey of over 1,000 executives from 70 countries on the use of management tools and trends. Some key findings include:

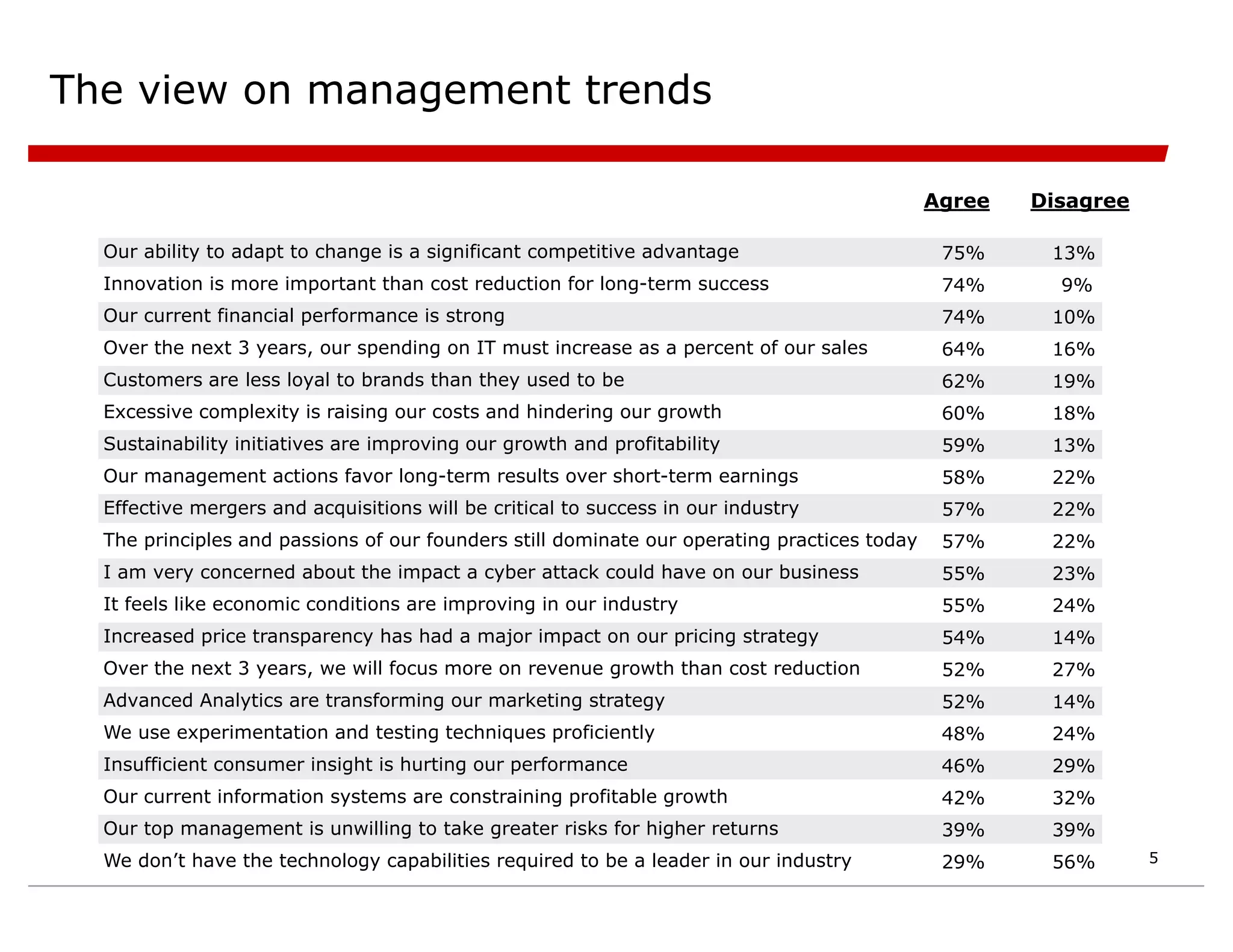

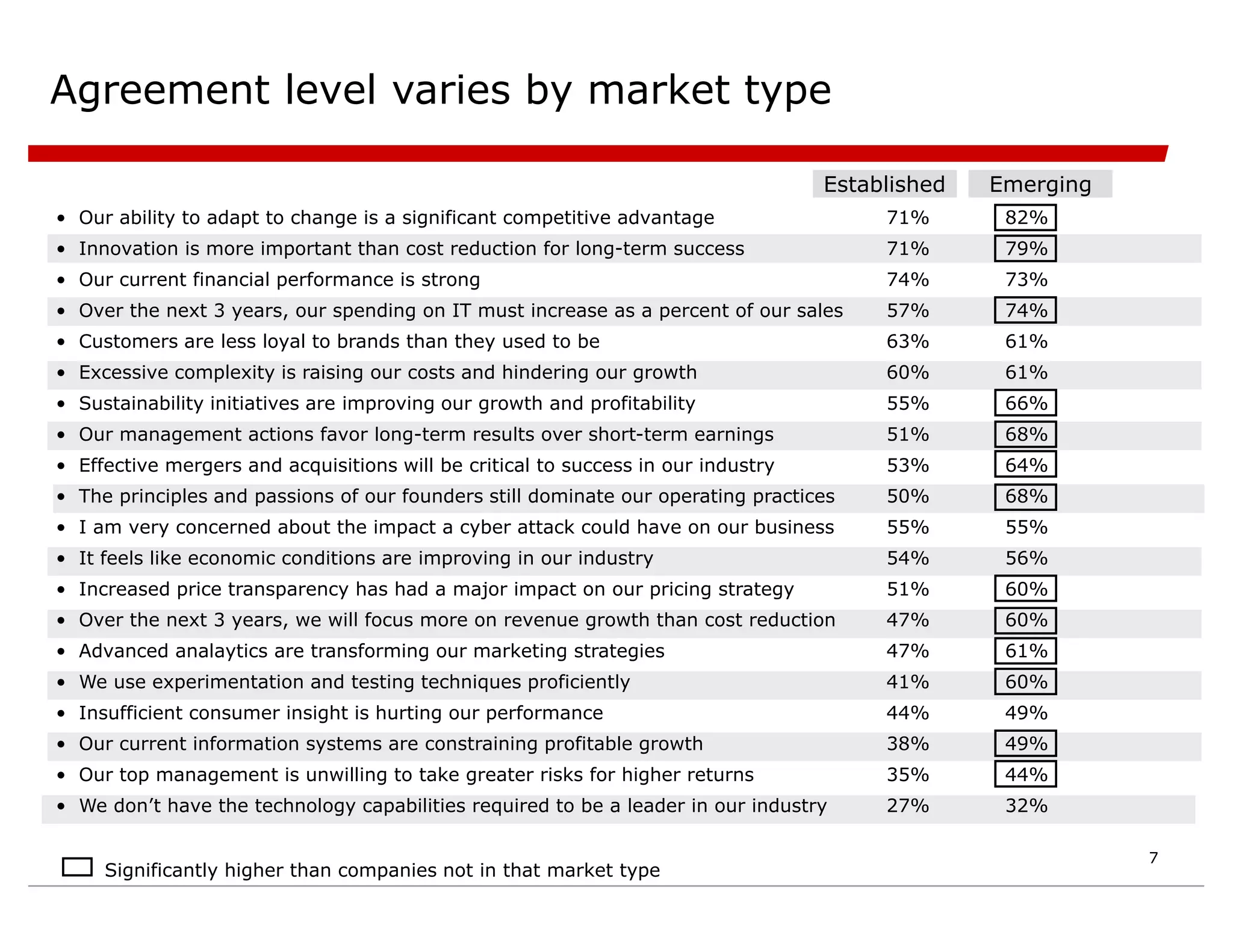

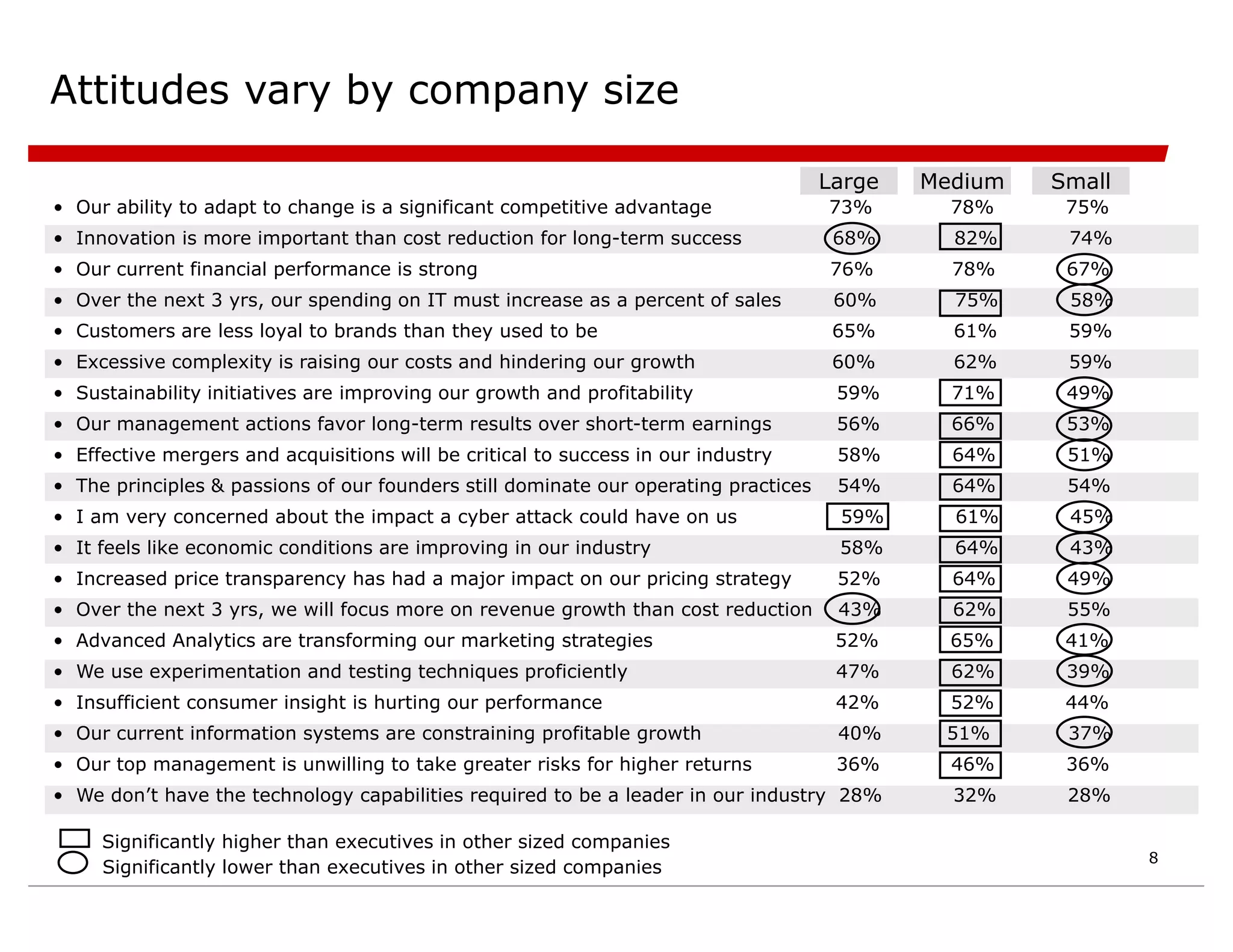

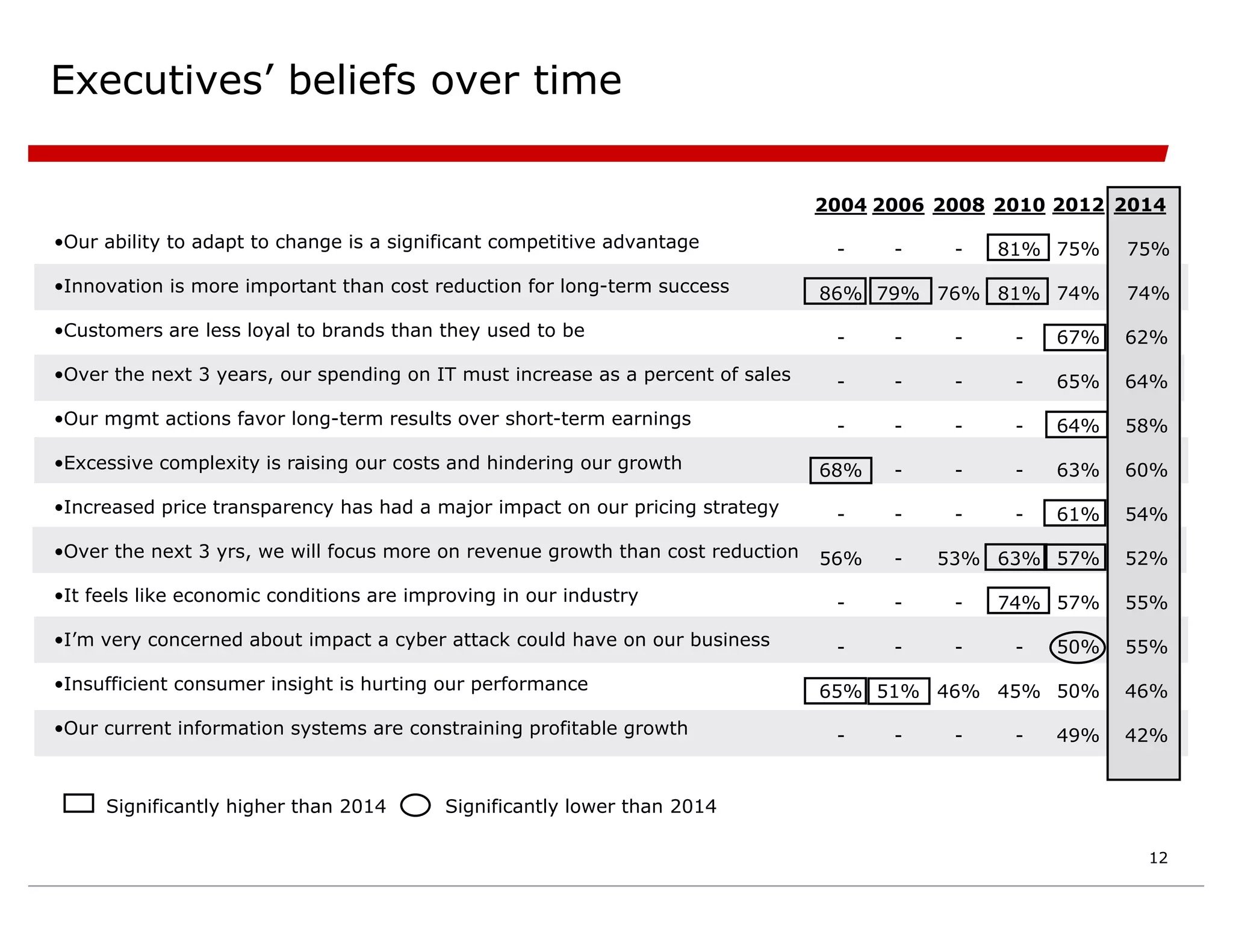

- Executives feel positive about their ability to adapt but face challenges like customer loyalty, complexity, and cybersecurity threats.

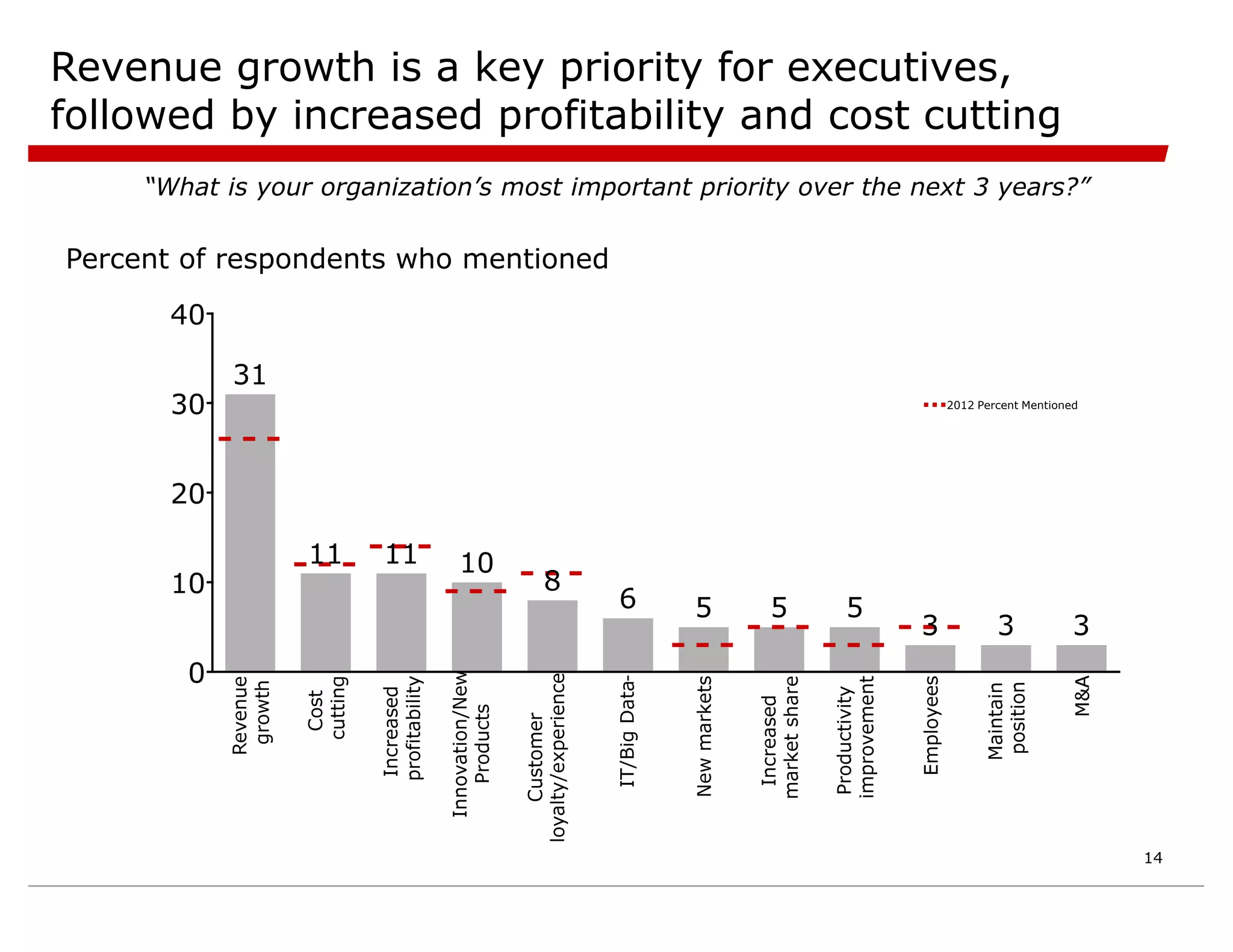

- Opinions are split on whether to prioritize long-term results or short-term earnings and growth vs cost cutting.

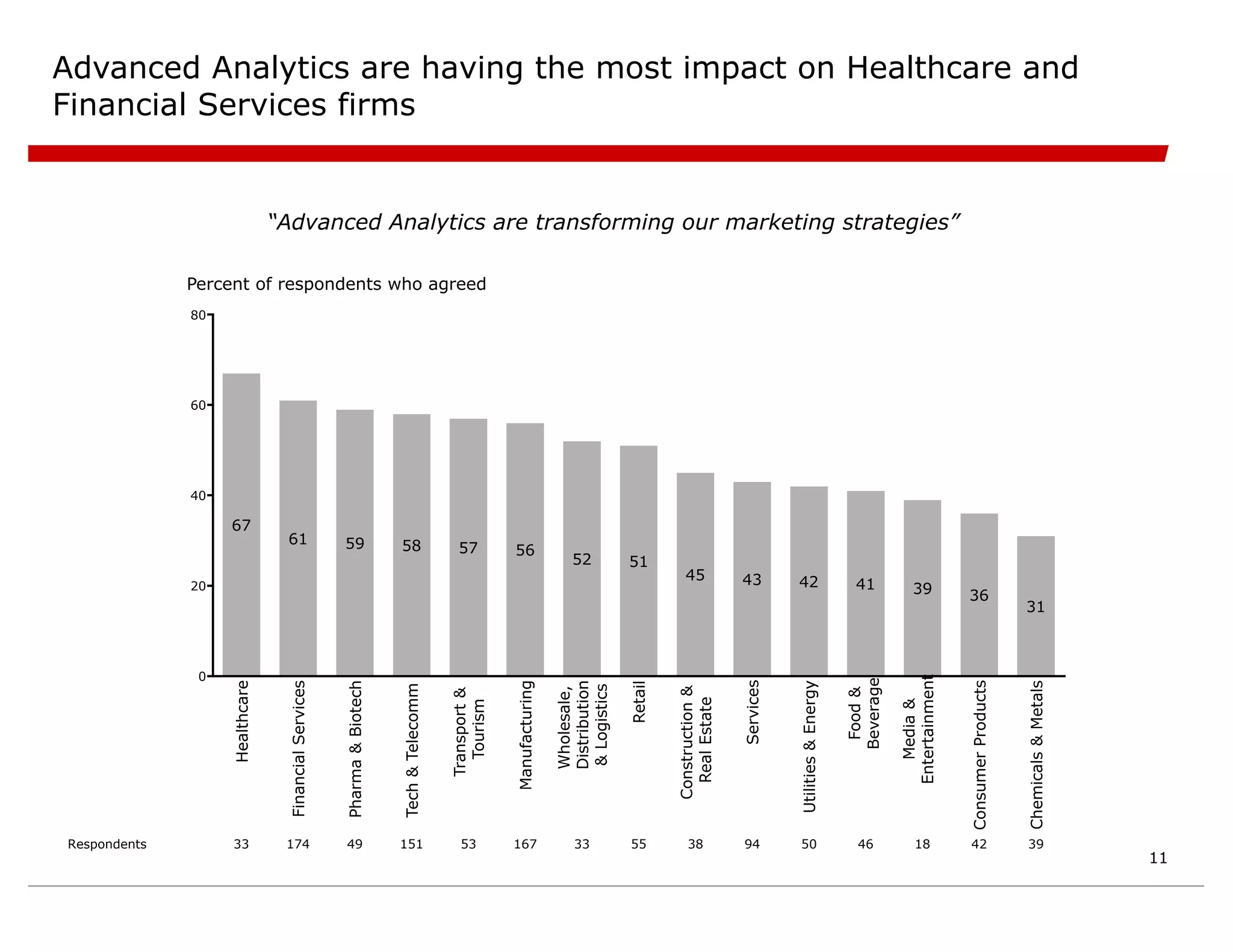

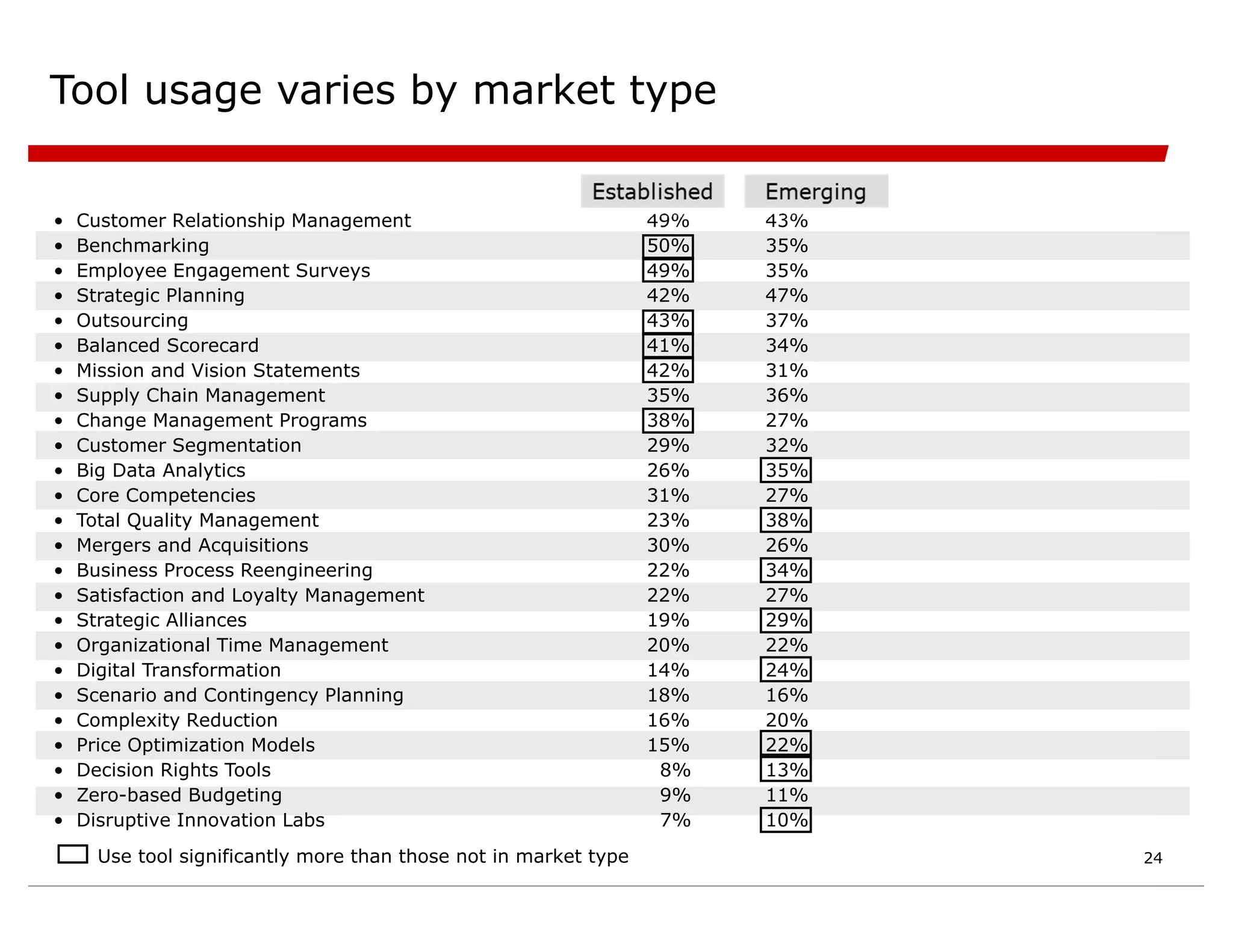

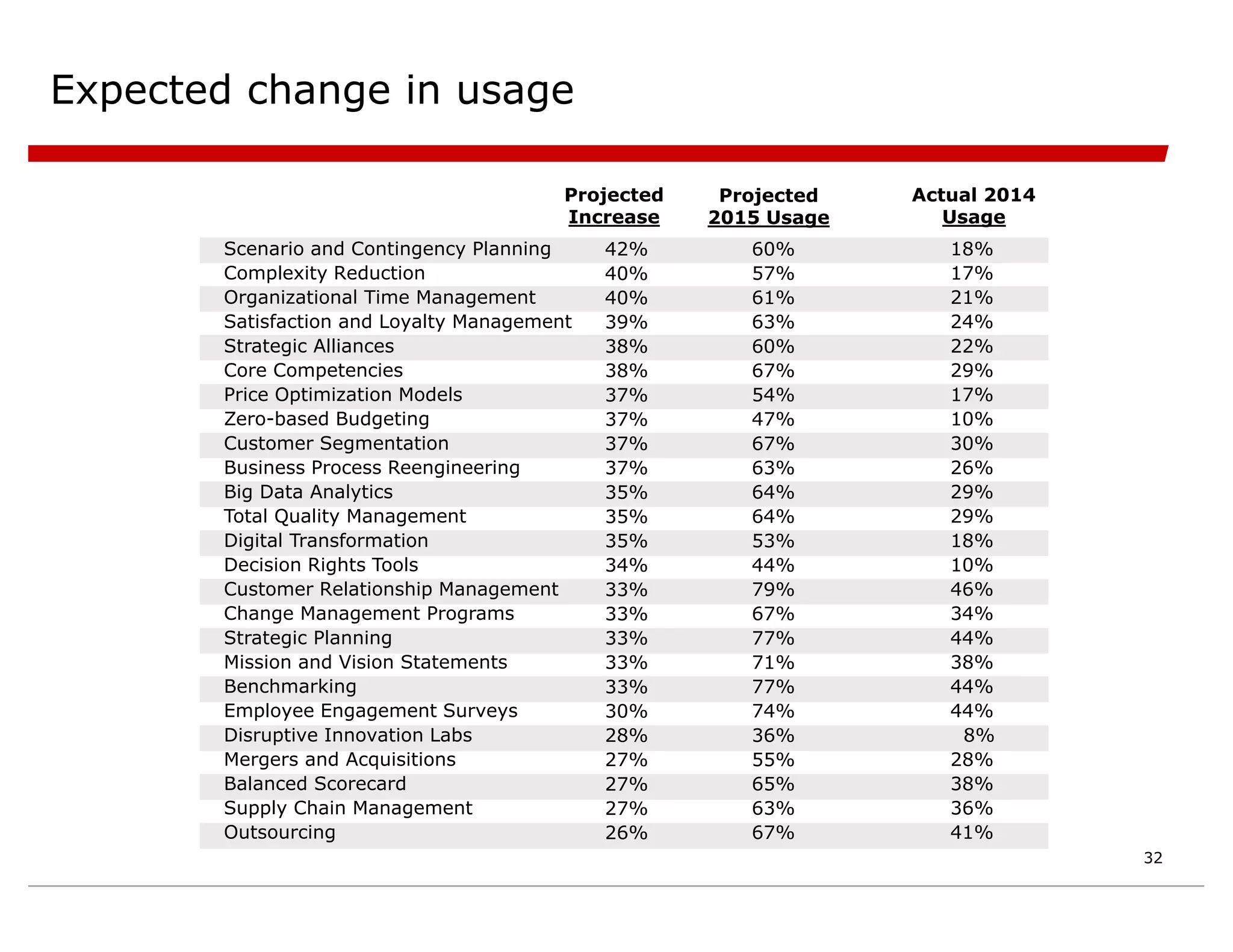

- Half of firms are trying new techniques like advanced analytics and experimentation to address challenges.

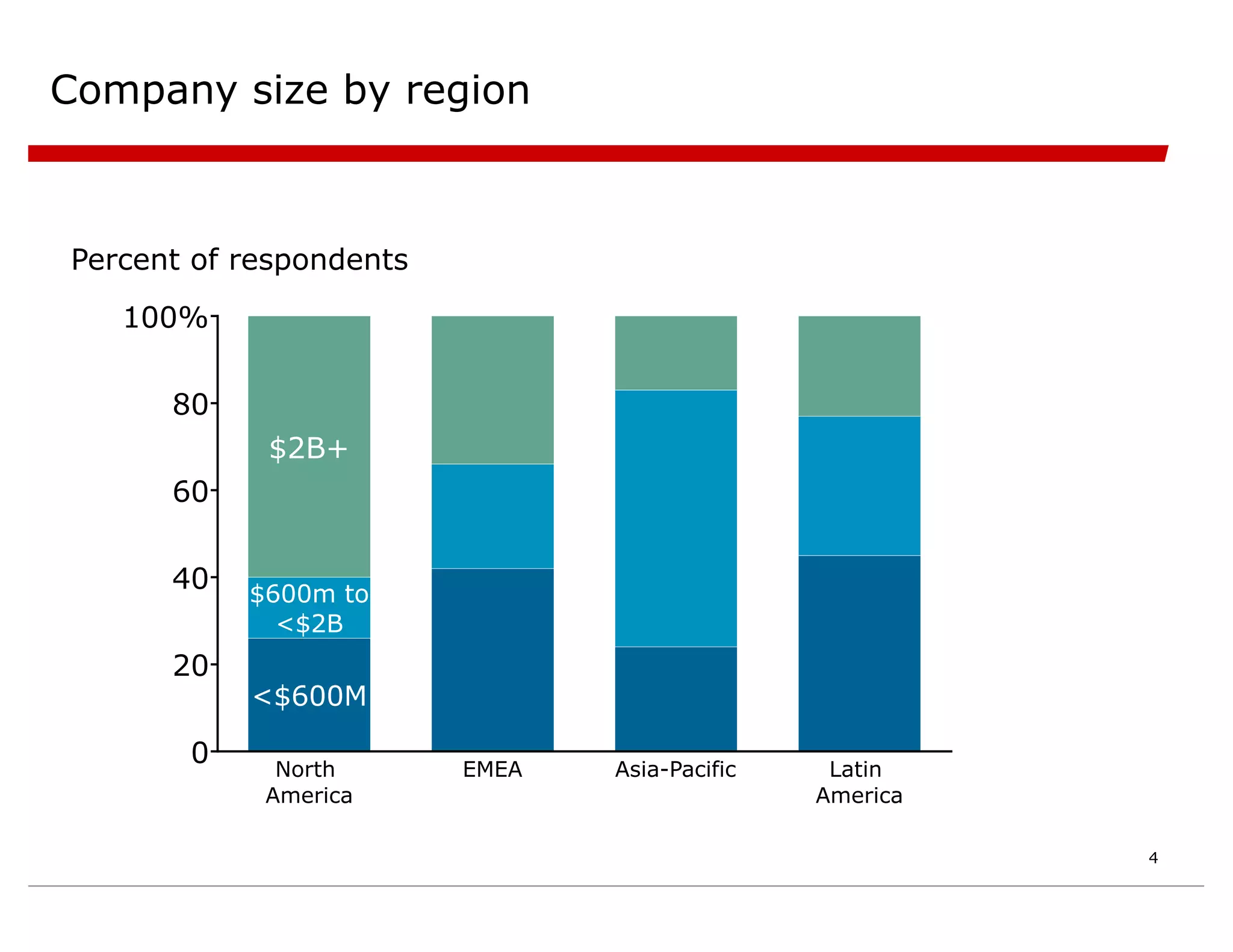

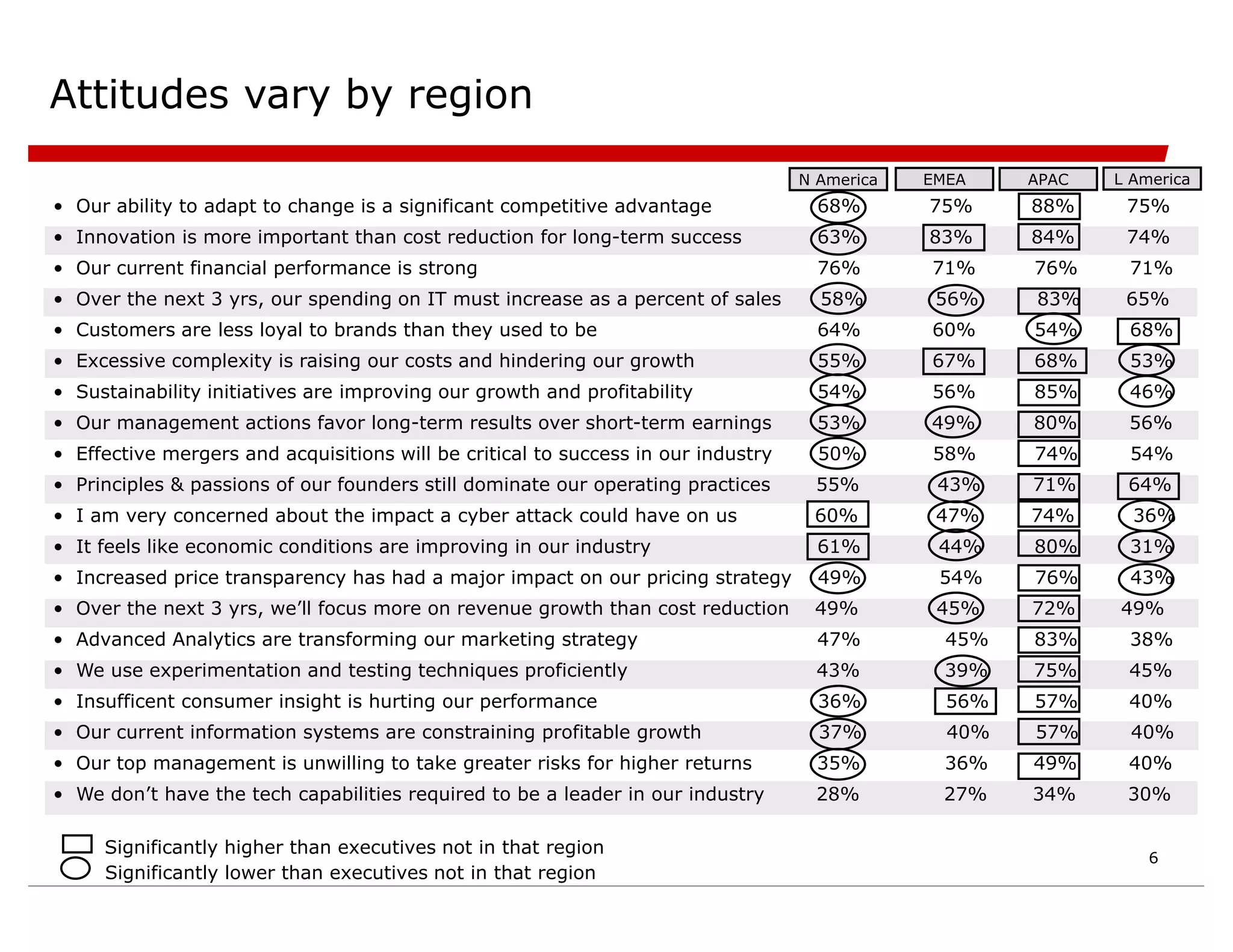

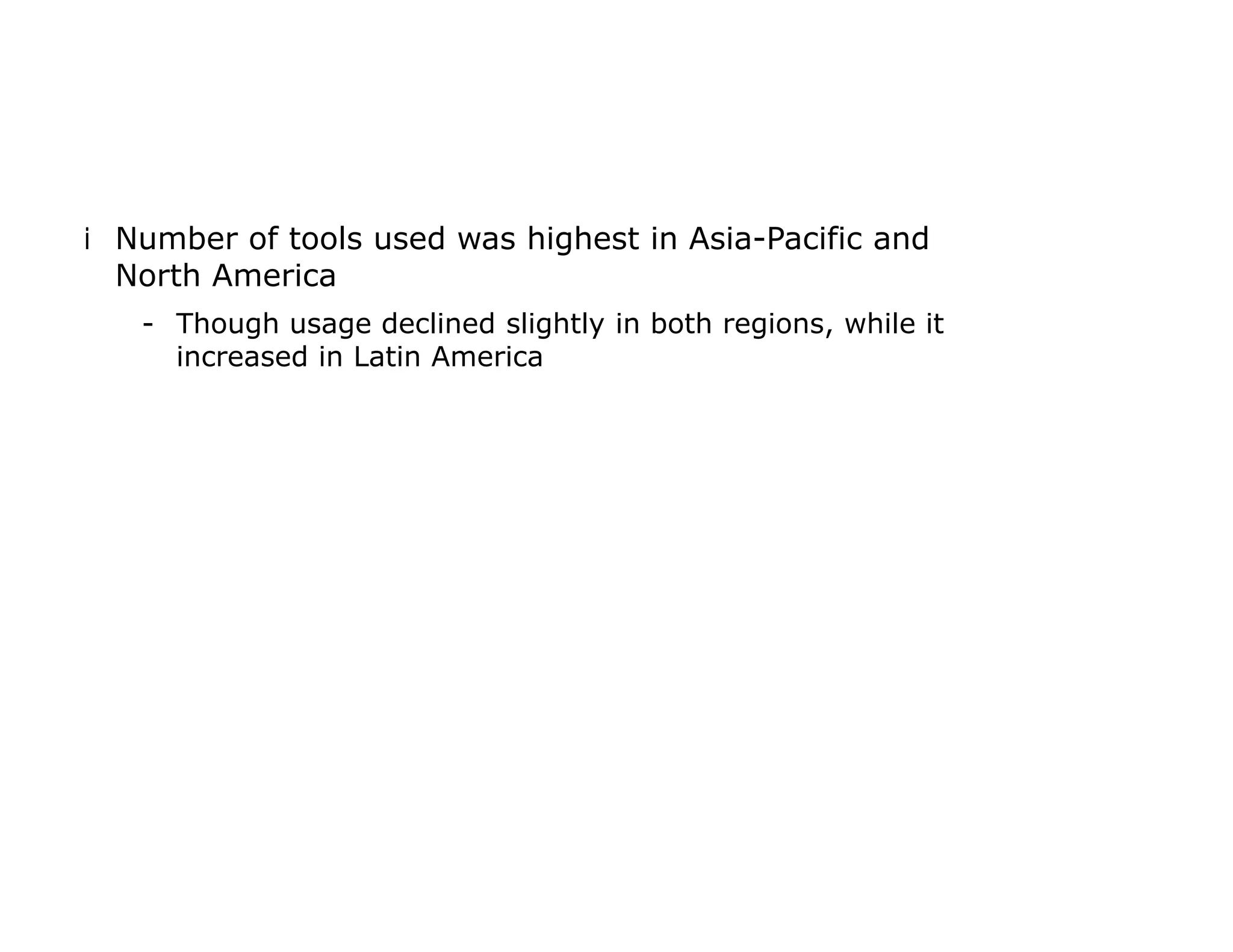

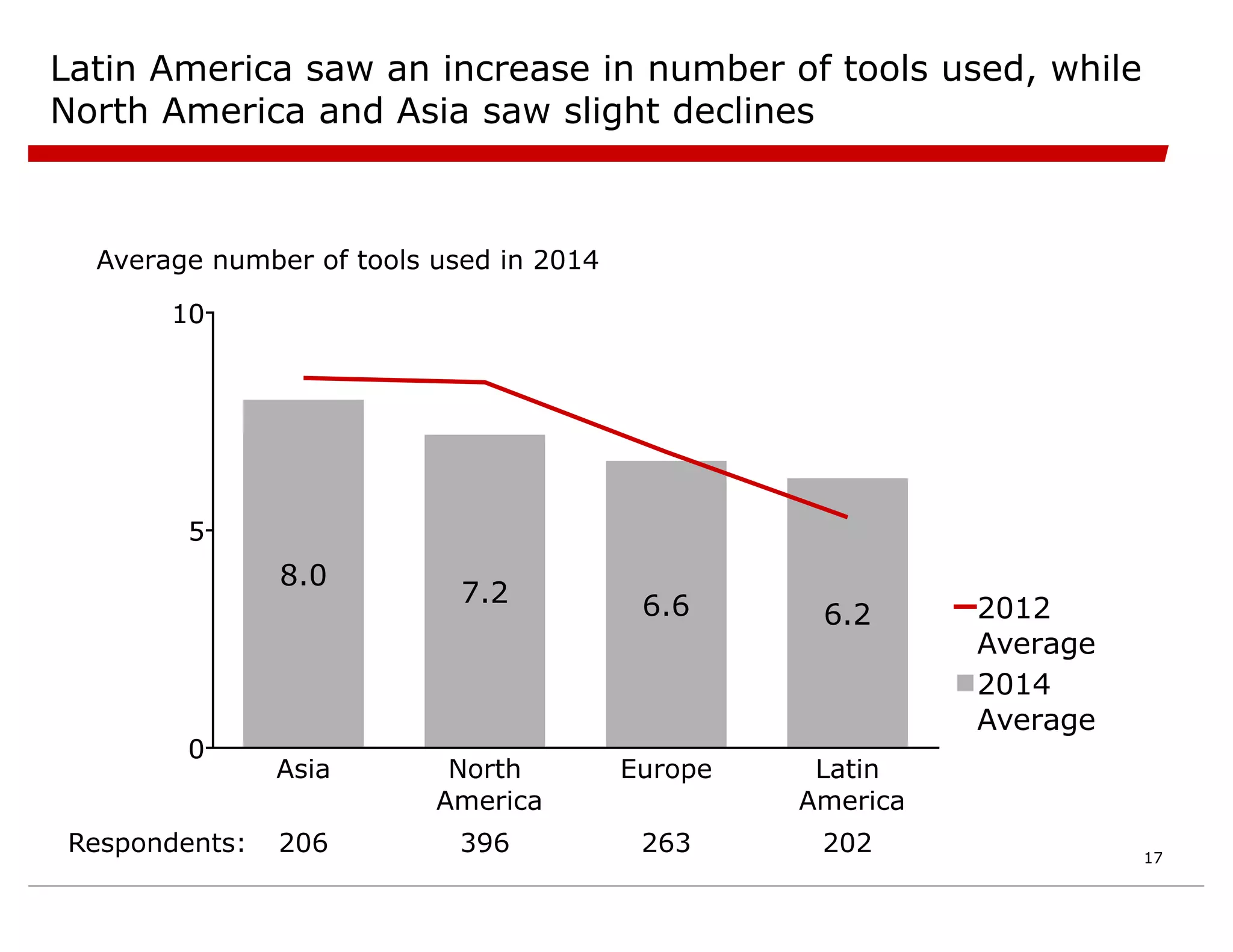

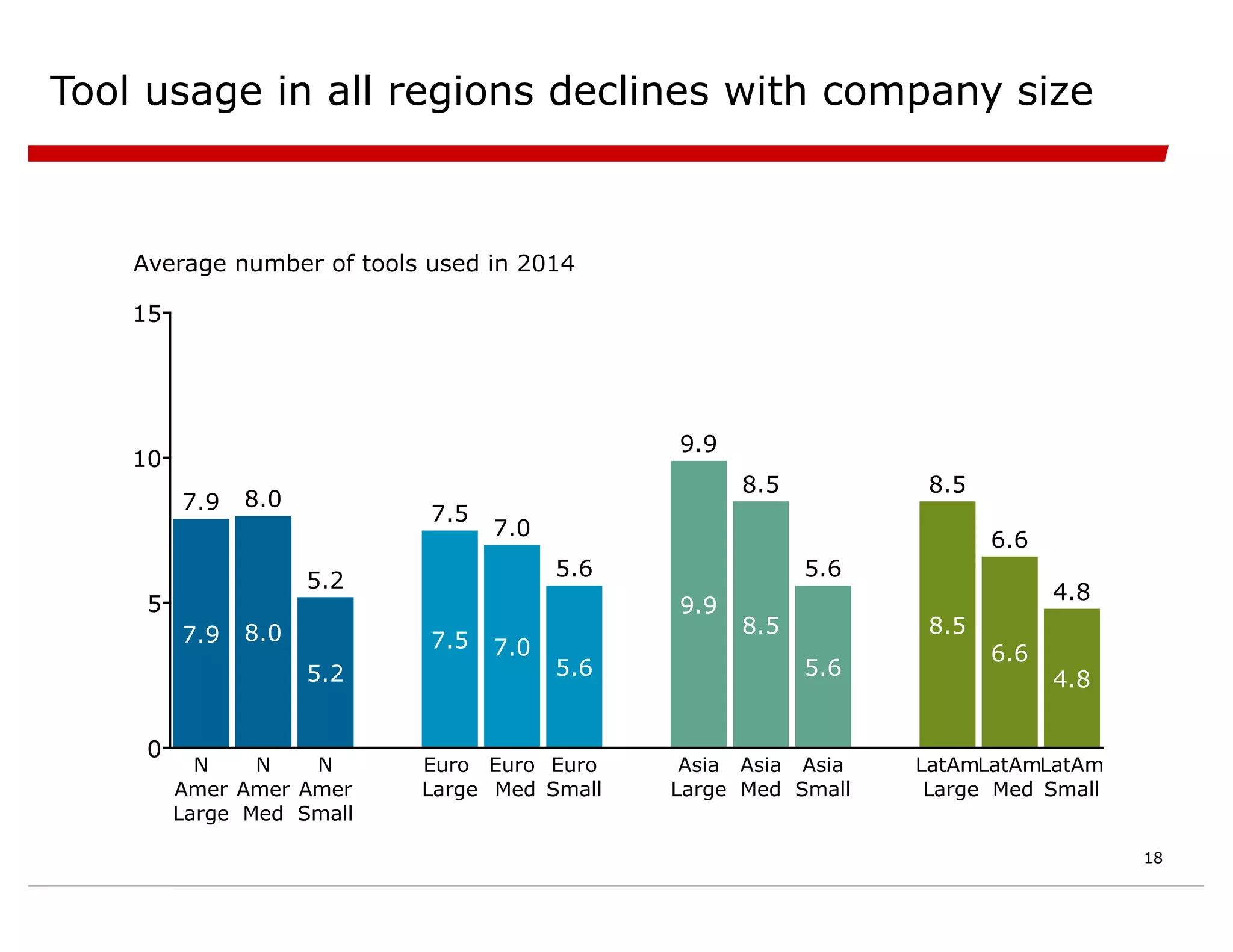

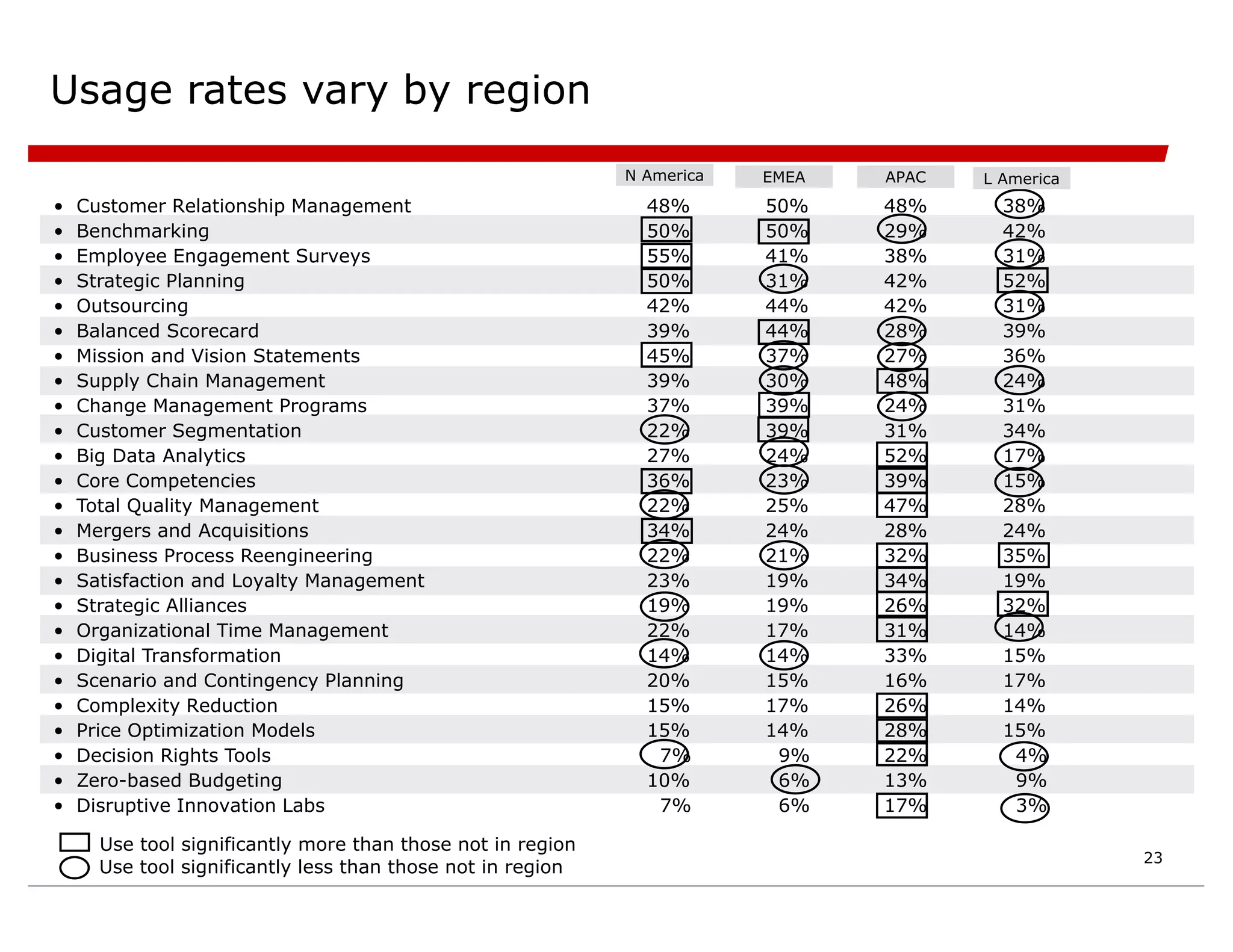

- Attitudes vary regionally, with Asia-Pacific executives most optimistic and EMEA most concerned about issues like consumer insight.