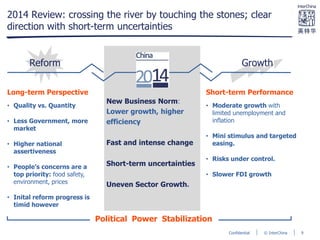

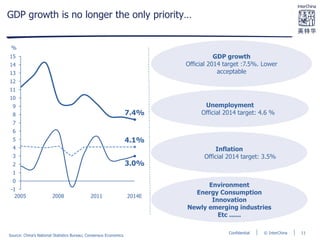

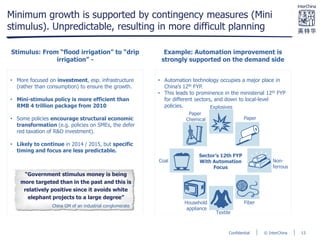

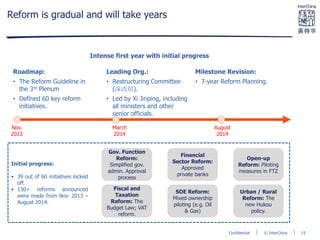

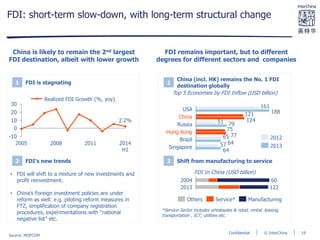

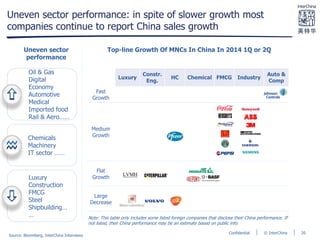

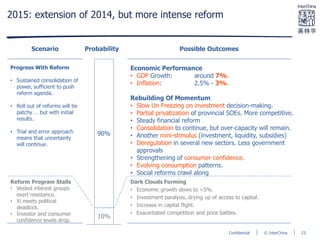

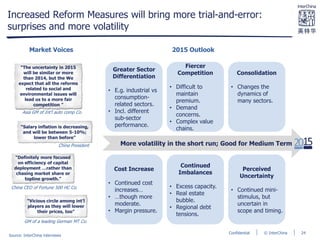

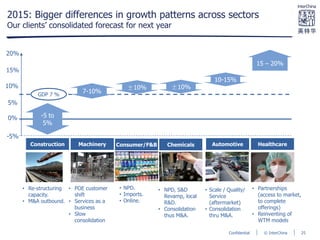

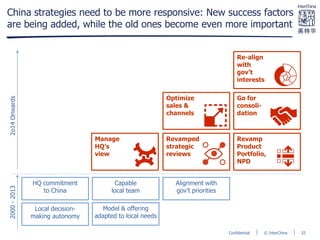

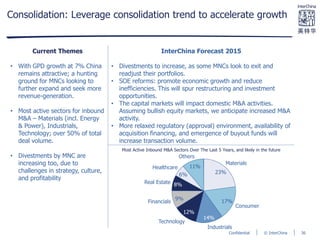

China's business environment in 2015 is expected to remain volatile as economic reforms continue under Xi Jinping. While reforms will cause short-term uncertainties, new opportunities will emerge for companies in different sectors. International companies need to focus on sector opportunities and avoid distractions from volatility. Recent reforms have opened state-controlled sectors like oil and gas to private investment. However, prospects vary significantly between sectors and require individual assessment.