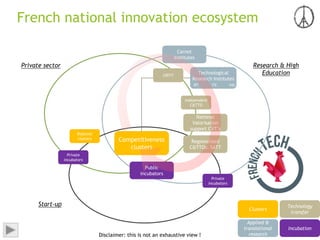

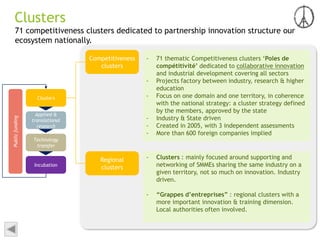

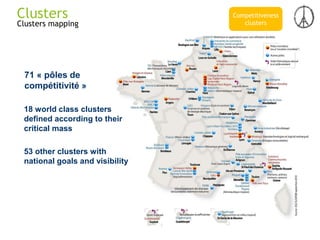

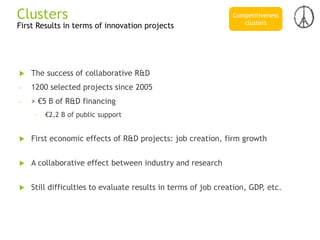

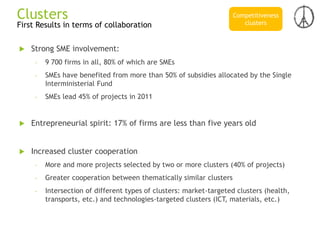

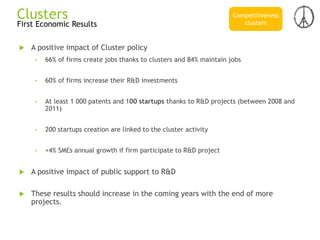

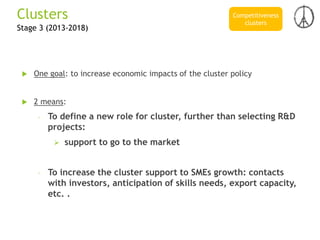

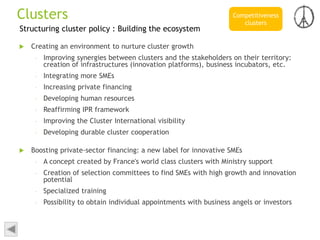

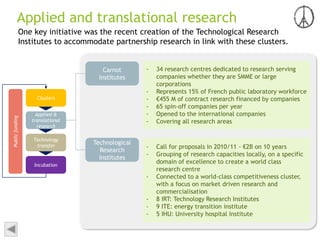

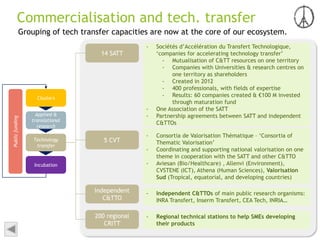

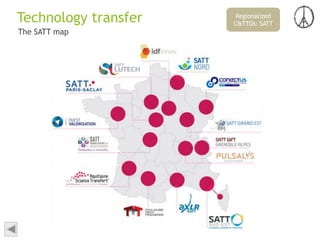

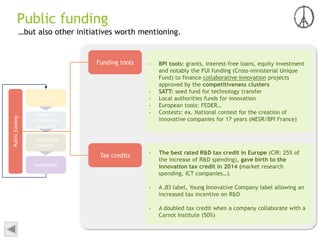

71 competitiveness clusters dedicated to partnership innovation structure France's national ecosystem. Key initiatives include the creation of 34 Carnot Institutes for applied research and the 14 SATTs that group technology transfer capacities regionally. One goal is to better support SME growth through clusters and strengthen the commercialization of innovative projects.