Rollover report aug sep 2011

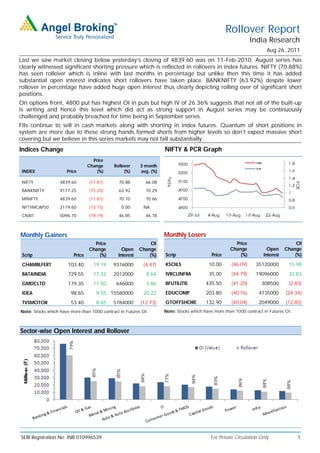

- 1. Rollover Report India Research Aug 26, 2011 Last we saw market closing below yesterday’s closing of 4839.60 was on 11-Feb-2010. August series has clearly witnessed significant shorting pressure which is reflected in rollovers in index futures. NIFTY (70.88%) has seen rollover which is inline with last months in percentage but unlike then this time it has added substantial open interest indicates short rollovers have taken place. BANKNIFTY (63.92%) despite lower rollover in percentage have added huge open interest thus clearly depicting rolling over of significant short positions. On options front, 4800 put has highest OI in puts but high IV of 26.36% suggests that not all of the built-up is writing and hence this level which did act as strong support in August series may be continuously challenged and probably breached for time being in September series. FIIs continue to sell in cash markets along with shorting in index futures. Quantum of short positions in system are more due to these strong hands formed shorts from higher levels so don’t expect massive short covering but we believe in this series markets may not fall substantially. Indices Change NIFTY & PCR Graph Price Change Rollover 3 month INDEX Price (%) (%) avg. (%) NIFTY 4839.60 (11.81) 70.88 66.08 BANKNIFTY 9177.25 (15.25) 63.92 70.29 MINIFTY 4839.60 (11.81) 70.10 70.66 NFTYMCAP50 2119.60 (13.15) 0.00 NA CNXIT 5096.70 (19.19) 46.85 46.78 Monthly Gainers Monthly Losers Price Ol Price Ol Change Open Change Change Open Change Scrip Price (%) Interest (%) Scrip Price (%) Interest (%) CHAMBLFERT 103.40 19.19 9316000 (4.47) KSOILS 10.00 (46.09) 35120000 15.98 BATAINDIA 729.55 17.32 2012000 8.64 IVRCLINFRA 35.00 (44.79) 19096000 32.83 GMDCLTD 179.35 11.50 646000 3.86 BFUTILITIE 435.50 (41.20) 308500 (2.83) IDEA 98.65 9.55 15580000 20.22 EDUCOMP 203.80 (40.76) 4735000 (24.34) TVSMOTOR 53.40 8.65 5784000 (12.73) GTOFFSHORE 132.90 (40.04) 2049000 (12.85) Note: Stocks which have more than 1000 contract in Futures OI. Note: Stocks which have more than 1000 contract in Futures OI. Sector-wise Open Interest and Rollover SEBI Registration No: INB 010996539 For Private Circulation Only 1

- 2. Derivative Report | India Research Banking and Financials Unlike last month AXISBANK (82.36%) has seen high rollovers and significant addition of short positions. Counter if corrects to its strong support zone of 900-920 then its must buy for investors. IDFC (81.99%) too has witnessed high rolls and pilling up of short positions. After filling gap between 99-104 levels there can be a short covering bounce in the counter. Most of the mid-cap banks have reduced substantial open interest in last series viz. IOB (74.43%), DENABANK (84.92%), VIJAYABANK (81.30%), ANDHRABANK (73.89%), CENTRALBK (83.49%). Oil and Gas CAIRN (92.06%) has considerable short positions and rollover is also high. Stock is trading around its support. Thus, it is advisable to be cautious while trading in the stock. RELIANCE (85.53%) is still not showing any kind of strength till now. Avoid forming long for the time being. ONGC (83.20%) outperformed the market and it can reach around 290 levels. The level can be used to book profit in it. After less rollover last month GAIL (75.82%) added considerable short positions during the month. It may give further correction. Metal & Mining JSWSTEEL (95.27%) has seen highest rollover in this sector with significant addition of short positions as it corrected around 21% in last series. We don’t expect much of short covering here; avoid positional long positions in it. TATASTEEL (80.75%) to our disbelief has also corrected with addition of short positions. Support zone of 395-410 is where we may see some of these shorts getting covered. Unlike last month SAIL (79.89%) and NATIONALUM (70.22%) have witnessed low rollover with significant decline in OI. SAIL appears to be decent buy around 95 odd levels. In this space, HINDZINC (68.09%) witnessed very For Private Circulation Only SEBI Registration No: INB 010996539 2

- 3. Derivative Report | India Research Auto and Auto Ancillary One of the out performers in the sector and even in the market BAJAJ-AUTO (82.94%) witnessed around average rollover and stock is still showing strength. We may see a positive move up to 1575 levels. TATAMOTORS (89.76%) and TATAMTRDVR (89.38%) are the biggest underperformer of the sector. TATAMOTORS still has considerable short positions and rollover is also higher then average. Small bounce due to short covering can be expected. Few stocks where rollover is high in terms of open interest are APOLLOTYRE (89.19%), ASHOKLEYLAND (82.98%) and M&M (79.19%). Information Technology Among heavy weights HCLTECH (74.71%) added lot of short positions and underperformed while INFY (79.41%) had flat OI and TCS (82.61%) corrected due to long unwinding. We don’t expect any major short covering activity in them. ROLTA (68.31%) has seen significant decline in open interest and rollover is also less. Short positions have not been rolled over. Keep eye on it. Least affected counter in this space was FINANTECH (90.32%) and it did see highest rollover too. 680-820 is a broad range for it. Trade accordingly with positive bias. Consumer Goods and FMCG In the past few trading sessions, ITC (78.72%) and HINDUNILVR (81.89%) witnessed some long formation. We believe in such a volatile market these defensives may again reach around 210 and 335 levels respectively. Long positions are still standing in TITAN (82.32%) though the stock witnessed considerable unwinding during the month. I don’t expect major correction till the stock is holding 193 levels. Stocks where rollover is high are RUCHISOYA (97.96%), PANTALOONR (95.06%) and KSOILS (81.62%). For Private Circulation Only SEBI Registration No: INB 010996539 3

- 4. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) AUTO & AUTO ANCILLARIES APOLLOTYRE 55.65 (26.19) 8624000 (35.06) 4.68 0.11 89.19 73.94 ASHOKLEY 24.85 (2.17) 26936000 (19.31) (31.47) 0.14 82.98 73.74 BAJAJ-AUTO 1517.40 4.77 1299500 (0.76) 2.03 0.53 82.94 84.18 BHARATFORG 272.85 (17.36) 5064000 (1.82) 6.50 0.00 94.51 85.09 BOSCHLTD 7135.45 1.50 14375 (16.67) 6.09 0.00 73.91 72.91 ESCORTS 68.65 (31.14) 5338000 (16.02) 6.08 0.45 86.77 86.84 EXIDEIND 151.10 0.87 1648000 (35.12) 6.90 0.00 89.68 75.97 HEROMOTOCO 1902.20 4.30 2029000 (8.43) (0.08) 0.93 71.35 70.82 M&M 697.40 (2.61) 3153000 (9.37) 4.41 0.71 79.19 72.74 MARUTI 1110.80 (6.33) 2983750 (10.67) 4.74 0.71 86.28 83.23 MRF 6366.30 (10.36) 55750 (26.64) 2.65 1.33 54.04 87.44 TATAMOTORS 714.25 (24.87) 8114750 (3.93) 5.04 0.25 89.76 84.55 TATAMTRDVR 411.55 (24.56) 2251000 (2.83) 5.70 4.50 89.38 93.35 TVSMOTOR 53.40 8.65 5784000 (12.73) 4.88 0.67 92.53 77.16 BANKING & FINANACIALS ALBK 173.70 (13.82) 2126000 (12.19) 2.10 0.16 76.25 82.11 ANDHRABANK 123.05 (10.08) 1938000 (35.44) (2.97) 0.49 73.89 79.77 AXISBANK 1019.25 (21.69) 4563750 69.23 4.25 0.35 82.36 74.64 BAJAJHLDNG 743.70 (3.65) 102000 12.09 9.75 0.00 68.14 77.41 BANKBARODA 714.25 (17.77) 1867750 34.18 1.31 0.15 66.52 80.82 BANKINDIA 307.15 (22.78) 3594500 (25.67) 5.26 0.07 72.74 71.84 CANBK 415.95 (12.84) 2668000 10.41 5.64 0.19 66.98 76.44 CENTRALBK 96.35 (18.62) 3658000 (32.11) 9.20 0.07 83.49 86.91 DCB 43.45 (23.37) 9400000 (29.05) 8.40 0.12 82.81 83.14 DENABANK 78.30 (2.97) 8724000 (37.17) 6.66 0.25 84.92 83.22 DHANBANK 72.95 NA 1478000 NA 5.72 0.00 78.08 NA FEDERALBNK 349.50 (19.26) 1091000 90.40 2.83 0.00 61.87 71.84 HDFC 628.20 (8.74) 8061000 12.22 6.06 0.17 75.23 76.88 HDFCBANK 443.65 (8.96) 19831250 (0.29) 6.23 0.49 80.17 77.91 ICICIBANK 833.85 (18.05) 12653250 20.09 6.57 0.35 72.89 73.98 IDBI 108.10 (16.56) 18998000 0.07 (47.27) 0.28 80.91 86.75 IDFC 106.90 (17.10) 27294000 15.15 6.83 0.26 81.99 82.14 IFCI 37.75 (17.58) 87152000 1.50 (19.34) 0.19 92.21 91.15 INDIAINFO 72.80 (13.13) 5108000 (16.48) 5.73 0.00 52.94 88.95 INDIANB 194.05 (13.51) 906000 (12.63) 4.03 0.00 74.06 82.33 INDUSINDBK 234.60 (14.41) 3736000 6.71 5.11 0.00 67.08 84.09 IOB 108.55 (20.21) 1150000 (41.15) 11.05 0.17 74.43 75.32 For Private Circulation Only SEBI Registration No: INB 010996539 4

- 5. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) JINDALSWHL 609.60 (32.32) 550750 (10.52) 8.81 0.00 86.34 91.70 KOTAKBANK 422.95 (7.74) 4501000 4.96 4.56 0.61 77.26 79.53 KTKBANK 91.90 (20.64) 4888000 (17.38) 6.81 0.06 92.64 88.14 LICHSGFIN 205.70 (2.93) 14153000 (20.94) (3.80) 0.32 83.76 81.67 ORIENTBANK 307.60 (13.19) 1004000 2.45 (17.97) 0.11 56.87 72.24 PFC 136.70 (26.53) 9697000 10.80 (1.91) 0.18 89.07 62.98 PNB 960.80 (12.68) 4480500 19.30 (14.38) 0.61 78.37 83.55 RECLTD 175.05 (17.16) 5728000 (38.79) (26.51) 0.12 80.95 76.71 RELCAPITAL 391.25 (31.75) 4908000 8.13 (12.66) 0.26 89.15 86.54 SBIN 1959.75 (16.84) 6019250 37.05 5.06 0.31 80.26 78.77 SOUTHBANK 20.25 (13.83) 3393000 (15.09) 7.72 0.01 68.70 NA SREINFRA 37.25 (22.96) 6248000 (13.89) 7.00 1.67 94.49 85.27 SRTRANSFIN 592.10 (11.10) 1285500 (25.97) 2.82 0.00 90.24 80.98 SYNDIBANK 93.35 (20.08) 2332000 (17.30) 2.79 0.42 80.36 82.21 UCOBANK 66.40 (22.02) 14388000 (21.07) 7.85 0.19 88.34 89.21 UNIONBANK 244.10 (15.08) 2704000 (2.91) (9.61) 0.00 64.13 72.41 VIJAYABANK 56.30 (11.27) 9068000 (35.69) (4.63) 0.20 81.30 82.39 YESBANK 267.35 (13.88) 4938000 (6.10) 5.46 0.24 87.69 81.20 CAPITAL GOODS ABB 814.85 (5.63) 685000 9.42 (9.85) 0.00 81.53 81.87 APIL 519.65 (9.60) 581500 (28.34) 6.82 0.81 85.90 85.52 AREVAT&D 211.65 (14.83) 770000 1.05 0.49 0.00 83.38 84.12 BEL 1563.25 (10.03) 51875 4.80 5.67 0.00 73.98 77.37 BEML 446.45 (18.30) 279500 (34.39) 6.31 0.00 78.18 85.55 BGRENERGY 308.80 (24.27) 1336500 (16.94) (26.68) 0.30 88.70 89.11 BHEL 1749.25 (5.33) 2877250 (19.04) 4.35 0.29 83.38 85.13 CROMPGREAV 136.75 (20.82) 7605000 (30.28) 4.96 0.06 82.20 66.67 CUMMINSIND 591.50 (9.62) 251500 (23.56) 0.26 0.00 78.33 82.44 HAVELLS 325.90 (10.11) 682000 (29.40) 7.68 0.00 74.49 80.07 LT 1546.50 (11.13) 5333750 18.15 4.35 0.29 85.23 78.03 PRAJIND 69.20 (20.51) 8056000 (26.01) 7.54 0.07 83.61 83.97 SIEMENS 871.60 (5.56) 486750 (32.79) 6.10 0.83 76.58 68.65 VOLTAS 112.45 (20.59) 4454000 (9.91) 4.17 0.15 72.16 82.83 CEMENT ACC 1014.75 (0.72) 1374500 15.58 4.11 1.08 78.25 76.81 AMBUJACEM 136.40 2.40 12472000 (5.84) (2.68) 0.97 81.80 84.52 GRASIM 2162.25 (2.02) 430875 (10.98) (3.16) 0.07 83.20 77.92 INDIACEM 64.70 (8.94) 5088000 (16.81) 6.45 0.10 81.21 91.42 ULTRACEMCO 1068.20 4.11 529500 (36.70) 2.88 0.00 86.07 75.46 ACC 1014.75 (0.72) 1374500 15.58 4.11 1.08 78.25 76.81 For Private Circulation Only SEBI Registration No: INB 010996539 5

- 6. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) CHEMICAL & FERTILIZERS CHAMBLFERT 103.40 19.19 9316000 (4.47) 3.53 0.53 43.80 77.26 GUJFLUORO 484.80 NA 287000 NA 6.45 0.00 94.60 NA NAGARFERT 26.35 (17.53) 9632000 (45.55) 3.96 0.09 64.53 85.29 TATACHEM 342.10 (5.65) 668000 (26.83) 5.03 0.46 68.41 85.48 UNIPHOS 134.15 (17.50) 6010000 (12.13) 7.00 0.30 88.12 82.08 CONSUMER GOODS & FMCG ASIANPAINT 3264.80 4.61 175125 (38.93) 5.24 0.00 88.01 75.32 COLPAL 966.15 (1.43) 213250 (35.13) 1.62 0.00 68.35 80.57 HINDUNILVR 320.30 (0.79) 18038000 (7.39) 4.56 0.81 81.89 82.78 ITC 202.35 (1.89) 21550000 (4.58) 6.96 0.47 78.72 74.33 JUBLFOOD 937.50 8.58 404500 97.32 (2.00) 0.52 77.87 NA KSOILS 10.00 (46.09) 35120000 15.98 5.21 0.20 81.62 85.93 MCDOWELL-N 902.90 (11.29) 1011250 (16.72) 6.53 0.00 83.19 88.15 MCLEODRUSS 233.55 (13.99) 6559000 (2.21) 6.70 0.00 96.74 95.10 RUCHISOYA 102.40 4.54 23668000 0.83 (2.55) 1.18 97.96 95.97 TATAGLOBAL 92.15 (14.68) 9316000 (21.50) 8.49 0.18 81.97 91.48 TITAN 206.10 (9.59) 12482500 (21.33) (2.02) 0.33 82.32 77.15 TTKPRESTIG 2559.25 (14.83) 68250 14.95 1.59 0.25 82.78 NA HOTEL HOTELEELA 38.40 (16.61) 4272000 (7.45) 6.79 2.40 90.45 84.33 INDHOTEL 72.95 (2.99) 8628000 0.98 8.58 0.20 89.29 92.40 INFRASTRUCTURES GMRINFRA 26.40 (12.15) 41360000 (20.14) 7.90 0.13 88.84 90.76 GVKPIL 16.50 (8.84) 52440000 (24.25) 12.64 0.15 87.81 88.04 HCC 27.45 (11.02) 29608000 (30.28) (1.90) 0.07 90.79 89.22 IRB 146.75 (13.55) 3236000 (21.38) 5.33 0.58 87.27 80.47 IVRCLINFRA 35.00 (44.79) 19096000 32.83 (7.45) 0.09 78.55 85.74 JPASSOCIAT 59.30 (14.68) 51508000 (26.30) 0.88 0.19 85.52 85.59 LITL 15.75 (13.46) 60448000 (18.09) 9.93 0.19 82.48 87.62 MUNDRAPORT 140.40 (9.39) 4310000 (13.70) 5.20 0.00 80.32 81.26 NCC 53.20 (27.47) 4240000 (12.83) 8.82 0.64 86.42 82.20 PATELENG 95.55 (29.20) 3110000 (20.30) 8.19 0.05 77.11 87.73 PUNJLLOYD 54.55 (23.92) 23960000 (8.55) 6.69 0.10 76.94 87.48 RELINFRA 448.25 (17.50) 5712500 (23.21) (10.59) 0.25 83.73 88.24 INFORMATION TECHNOLOGY 3IINFOTECH 26.10 (35.95)SEBI11616000 No: (14.64) Registration INB 010996539 9.99 0.10 84.50 90.39 6 For Private Circulation Only

- 7. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) COREPROTEC 314.60 4.38 5539000 71.43 (35.30) 0.00 19.05 78.77 EDUCOMP 203.80 (40.76) 4735000 (24.34) 3.84 0.14 88.93 87.70 FINANTECH 744.00 (8.97) 894000 (10.24) (0.28) 0.18 90.32 89.12 FSL 11.85 (32.67) 35940000 (11.63) 13.20 0.20 85.91 93.04 HCLTECH 372.35 (24.16) 3936500 26.72 5.60 0.48 74.71 81.95 HEXAWARE 71.20 (18.68) 8044000 (28.94) 4.39 0.12 89.26 86.91 INFY 2183.40 (20.64) 3609125 2.41 7.19 0.32 79.41 NA MOSERBAER 24.25 (35.85) 6104000 (7.96) (12.90) 0.22 73.26 87.90 MPHASIS 367.25 (20.14) 1157500 (8.21) 4.26 0.31 81.43 81.18 OFSS 1745.10 (17.32) 371250 (7.85) 8.52 0.00 86.23 93.03 PATNI 266.40 (17.45) 751000 (17.92) 15.85 1.00 83.95 66.49 POLARIS 129.10 (26.54) 3720000 (14.05) (1.21) 0.14 88.55 84.93 ROLTA 98.80 (15.19) 2196000 (46.33) 6.33 0.19 68.31 81.14 STRTECH 37.25 (30.18) 3736000 (35.76) 1.40 0.00 80.73 86.96 TCS 950.40 (15.86) 6235500 (1.54) 4.99 0.49 82.61 75.48 TECHM 618.55 (21.14) 411000 (13.20) 4.47 0.00 74.94 73.65 WIPRO 328.20 (16.91) 4050500 (8.58) 5.24 0.52 77.97 74.35 LOGISTICS ABGSHIP 343.65 (9.67) 3901000 17.96 3.49 0.00 87.08 92.62 EKC 69.80 (24.54) 3148000 (39.65) 10.46 0.00 81.58 83.21 GESHIP 226.85 (16.49) 482000 (18.31) 3.22 0.00 67.63 67.08 JETAIRWAYS 272.50 (39.91) 1544000 64.69 5.74 0.02 82.38 78.39 KFA 25.00 (28.77) 13944000 (5.37) 2.09 0.13 83.59 90.31 MLL 22.95 (37.47) 10744000 (16.89) 9.09 0.24 86.45 90.21 SCI 82.65 (20.26) 4634000 (12.07) (30.28) 0.11 90.12 91.88 MEDIA DCHL 52.40 (25.62) 10484000 (37.16) 8.96 1.83 88.21 92.79 DISHTV 76.70 (9.98) 13936000 (25.20) 4.08 0.22 83.50 87.55 SUNTV 304.05 (10.67) 715000 (58.72) (8.75) 0.33 68.67 59.95 ZEEL 116.50 (13.74) 6818000 (28.25) 2.24 2.20 82.31 82.29 METAL & MINING BHUSANSTL 321.85 (19.25) 686500 (27.08) (11.34) 0.33 76.69 72.38 COALINDIA 374.75 NA 3136000 NA 1.11 0.28 76.79 NA GMDCLTD 179.35 11.50 646000 3.86 (9.01) 0.67 61.30 79.19 HINDALCO 143.30 (14.68) 21934000 (2.39) (4.00) 0.39 86.61 84.11 HINDZINC 122.55 (13.64) 1604000 (18.50) 6.81 0.00 87.91 76.23 For Private Circulation Only SEBI Registration No: INB 010996539 7

- 8. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) JINDALSAW 115.00 (23.59) 1842000 (3.46) (0.91) 1.25 85.78 82.35 JINDALSTEL 470.40 (23.35) 5141500 10.87 3.66 0.30 79.05 82.80 JSWISPAT 14.20 (21.55) 55197000 (23.66) 3.67 0.14 90.82 88.58 JSWSTEEL 646.75 (21.06) 9559000 11.04 5.40 0.25 95.27 92.28 NATIONALUM 63.40 (16.08) 2136000 (27.74) 4.11 0.00 70.22 87.80 NMDC 217.55 (11.73) 1091000 20.15 (0.24) 0.00 73.42 81.74 SAIL 106.50 (16.60) 10194000 (33.44) 6.36 0.34 79.89 82.60 SESAGOA 217.80 (25.08) 9957000 (7.25) 5.03 0.28 86.25 85.73 STER 124.75 (23.54) 21366000 4.47 7.11 0.16 86.09 73.20 TATASTEEL 443.70 (21.97) 19079000 19.83 4.94 0.23 80.75 86.69 OIL & GAS ABAN 366.25 (26.55) 2318500 (19.66) (10.11) 0.18 78.56 88.45 BPCL 688.90 5.27 1366000 7.56 (18.09) 0.42 73.76 80.49 CAIRN 261.75 (15.88) 15316000 7.87 7.57 0.28 92.06 93.55 ESSAROIL 85.60 (26.78) 7326000 (24.74) 7.92 0.04 84.08 89.93 GAIL 413.00 (10.03) 2124000 (17.00) 6.82 0.29 75.82 66.78 GSPL 97.05 (5.46) 5064000 (37.51) (2.15) 0.06 84.60 82.29 GTOFFSHORE 132.90 (40.04) 2049000 (12.85) 10.59 0.00 94.09 92.43 HINDOILEXP 116.80 (34.51) 3996000 (10.68) 8.04 0.01 82.93 88.64 HINDPETRO 374.85 (1.12) 4536000 (32.47) (32.13) 0.32 92.97 89.76 IGL 432.40 5.03 352000 (18.71) 7.72 0.00 80.11 70.33 IOC 308.05 (3.14) 3295000 (29.31) (24.71) 0.04 90.80 89.00 MRPL 60.60 (23.48) 5236000 (26.09) 5.16 0.20 85.26 87.70 OIL 1310.00 0.75 27500 (10.57) (4.30) 0.00 80.00 74.44 ONGC 282.30 1.84 10106000 (4.13) 0.37 0.51 83.20 80.15 PETRONET 170.90 (5.03) 5118000 (41.46) 5.49 0.27 67.45 64.40 RELIANCE 753.50 (10.01) 19086000 (14.70) 6.78 0.35 85.53 83.24 ABAN 366.25 (26.55) 2318500 (19.66) (10.11) 0.18 78.56 88.45 PHARMACEUTICAL & HEALTH CARE AUROPHARMA 128.95 (24.83) 4732000 8.18 11.73 0.06 74.51 85.38 BIOCON 329.50 (9.40) 1290000 (23.85) 1.58 0.00 91.01 84.01 CIPLA 279.85 (9.14) 4439000 (16.32) 7.64 0.29 84.82 71.64 DABUR 107.20 0.70 4304000 (28.27) 0.97 0.75 84.94 81.71 DIVISLAB 698.85 (15.92) 1028500 (24.79) 8.28 0.29 80.60 80.73 DRREDDY 1456.05 (9.21) 981000 (15.41) 6.41 0.70 74.18 79.07 FORTIS 153.60 (8.16) 1370000 (29.38) 3.73 0.06 73.58 82.65 GLAXO 2104.70 (11.61) 17875 (32.86) 7.01 1.00 72.03 73.55 LUPIN 463.60 3.21 1620000 (17.77) 5.17 0.28 86.42 76.18 OPTOCIRCUI 267.45 (6.67) 901000 (31.59) (11.11) 0.00 86.02 78.61 ORCHIDCHEM 190.35 (14.45) 6104000 (8.07) 7.12 0.21 89.02 89.61 For Private Circulation Only SEBI Registration No: INB 010996539 8

- 9. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) PIRHEALTH 348.50 (8.92) 1765000 (2.67) 8.68 0.40 87.71 87.22 RANBAXY 465.05 (15.04) 2653000 27.55 3.14 0.31 78.99 67.09 SUNPHARMA 470.60 (9.40) 3329500 (0.34) (0.89) 0.54 84.89 80.05 POWER ADANIPOWER 90.85 (19.17) 11178000 93.66 (0.57) 0.03 81.16 89.35 BFUTILITIE 435.50 (41.20) 308500 (2.83) 7.06 0.00 81.52 NA CESC 297.60 (13.65) 870000 (33.38) 3.68 0.00 85.17 83.83 JPPOWER 32.90 (24.71) 7424000 2.09 7.92 0.00 81.57 87.48 JSWENERGY 53.55 (26.24) 2168000 (4.24) 3.89 0.50 79.70 NA NEYVELILIG 81.30 (17.46) 1772000 (26.90) (22.45) 0.08 87.36 87.46 NHPC 24.00 (2.83) 50751000 (10.18) (19.55) 0.18 94.79 92.31 NTPC 170.05 (3.57) 18462000 (10.32) 1.84 0.25 89.86 86.37 POWERGRID 99.70 (5.54) 9348000 (23.78) (6.28) 0.24 74.41 72.82 PTC 69.50 (14.25) 6104000 (7.85) (14.25) 0.29 89.12 90.85 RPOWER 82.00 (27.43) 21798000 (4.13) 3.82 0.29 91.27 87.43 SUZLON 35.85 (31.71) 90928000 (3.00) 5.82 0.20 85.47 90.49 TATAPOWER 1045.85 (18.95) 1177500 8.60 5.78 0.19 81.06 73.84 REAL-ESTATE DLF 187.10 (19.80) 21922000 (7.05) (3.07) 0.43 85.64 86.27 HDIL 100.50 (31.75) 19388000 (9.72) 5.71 0.17 87.49 84.23 IBREALEST 78.60 (22.29) 19604000 8.67 3.98 0.09 83.20 84.74 SOBHA 214.55 (17.64) 484000 (8.85) 0.73 0.00 83.06 82.82 UNITECH 26.35 (19.05) 64048000 (4.19) 1.98 0.31 80.83 84.71 SUGAR BAJAJHIND 53.60 (22.21) 8232000 (9.62) 0.00 0.03 85.37 87.85 BALRAMCHIN 53.60 (10.07) 16092000 (3.29) 7.78 0.30 91.47 84.55 RENUKA 54.65 (22.32) 29308000 (15.67) 7.63 0.18 84.20 89.39 TRIVENI 21.25 (36.19) 2910000 (16.23) 7.36 0.00 85.70 82.73 TELECOM BHARTIARTL 402.30 (6.62) 11987000 (20.77) 5.31 0.32 77.34 79.63 GTL 51.30 (24.56) 4987500 (12.84) 0.00 0.11 78.13 80.07 GTLINFRA 13.10 (4.73) 10320000 (43.62) (27.86) 0.05 NA 85.98 IDEA 98.65 9.55 15580000 20.22 (10.57) 0.50 75.07 81.53 MTNL 36.65 (23.08) 17424000 (14.45) 8.54 0.08 90.13 90.93 For Private Circulation Only SEBI Registration No: INB 010996539 9

- 10. Derivative Report | India Research Price OI Average Change Change Rollover Scrip Price (%) OI Futures (%) COC (%) PCR-OI Rollover (3month) ONMOBILE 56.50 (39.60) 2828000 (14.30) 4.61 0.18 72.42 83.49 RCOM 81.00 (19.48) 27270000 (13.58) 0.64 0.28 91.14 86.94 TATACOMM 197.00 (10.74) 3361000 16.22 4.50 0.70 72.39 89.74 TTML 18.80 (15.88) 33992000 (18.88) 13.87 0.22 90.98 88.77 TULIP 146.90 (4.36) 1106000 (29.10) (9.58) 0.00 82.46 76.96 TEXTILE ALOKTEXT 17.20 (30.65) 67100000 (14.33) (3.03) 0.20 92.94 93.65 ARVIND 76.30 (15.60) 2420000 (36.52) 2.05 0.24 77.69 NA BOMDYEING 301.25 (12.31) 647000 (40.15) 8.48 12.50 71.87 87.63 BRFL 277.85 (2.68) 2431000 37.03 (12.20) 4.20 71.37 67.51 CENTURYTEX 281.90 (18.34) 3108000 (17.52) 7.40 0.66 92.21 91.07 RAYMOND 344.45 (10.89) 1006000 (18.94) 6.66 0.00 87.77 78.26 SKUMARSYNF 44.20 (20.79) 21712000 7.83 (16.52) 0.20 94.14 88.05 WELCORP 123.85 (19.03) 6048000 5.15 7.58 0.29 89.78 89.73 MISCELLANIOUS ABIRLANUVO 834.65 (11.73) 1037500 (16.16) 2.12 0.00 79.13 93.25 ADANIENT 531.15 (28.66) 3665500 230.23 7.17 0.09 70.92 91.01 BATAINDIA 729.55 17.32 2012000 8.64 3.57 0.88 75.00 75.31 DELTACORP 89.45 NA 3804000 NA 7.00 0.03 83.39 NA GITANJALI 296.20 (8.74) 6321000 (25.37) 13.73 0.00 97.06 NA GODREJIND 190.40 (13.38) 4384000 (35.05) 9.86 0.20 89.32 88.75 JISLJALEQS 176.40 0.11 2602000 (22.97) (4.73) 0.67 88.09 87.53 MAX 181.45 (0.66) 722000 21.14 2.01 6.00 74.52 65.47 PANTALOONR 274.30 (21.03) 5832000 (20.18) 7.98 0.13 95.06 94.41 SINTEX 143.55 (19.29) 3090000 (35.95) 4.36 0.19 86.08 78.28 VIDEOIND 183.45 (2.19) 5710000 (22.02) (0.28) 0.00 81.75 71.90 VIPIND 830.60 (0.84) 590000 132.74 (11.86) 0.33 75.68 0 For Private Circulation Only SEBI Registration No: INB 010996539 10

- 11. Derivative Report | India Research DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward- looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Sebi Registration No.: INB 010996539 Derivative Research Team derivatives.desk@angelbroking.com For Private Circulation Only SEBI Registration No: INB 010996539 11