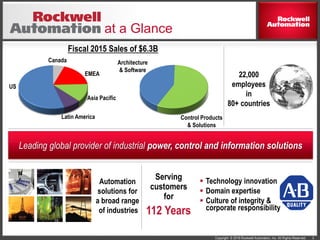

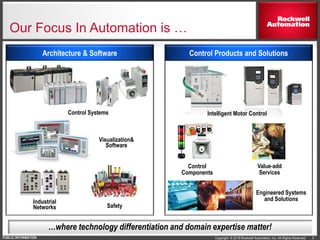

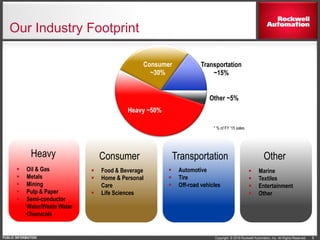

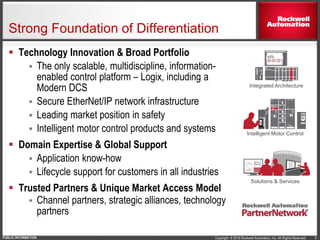

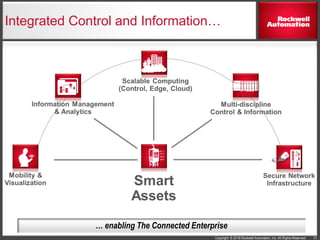

Rockwell Automation provides an overview of its company and financials. It is a leading industrial automation provider with $6.3B in annual sales and 22,000 employees globally. It has two business segments - Control Products & Solutions and Architecture & Software. Rockwell focuses on areas like control systems, industrial networks, and safety where technology differentiation matters. It serves industries like food & beverage, oil & gas, automotive, and aims for above-market growth through productivity gains, intellectual capital investments, and acquisitions.