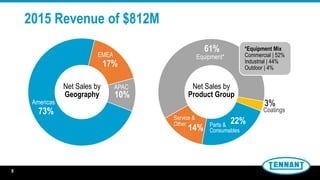

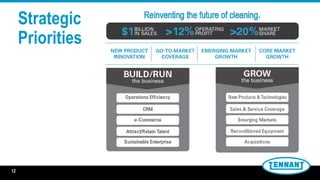

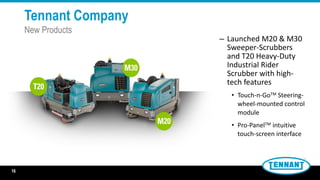

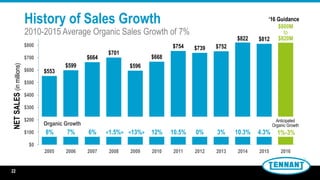

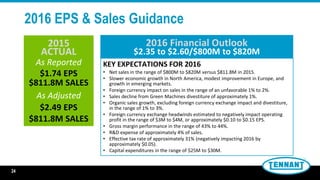

Tennant Co. provides a presentation for investors outlining its business strategy and financial outlook. The company aims to reach $1 billion in sales organically while maintaining an operating profit margin above 12%. Tennant has the strongest product pipeline in its history and is focusing on new product development, expanding in emerging markets, and increasing its sales and service coverage globally. For 2016, Tennant expects sales between $800-820 million and EPS between $2.35-$2.60, with challenges from foreign currency exchange rates and a slowing economy.