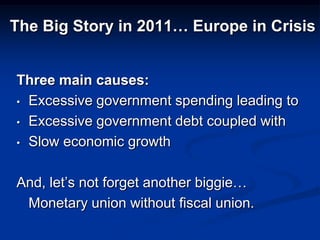

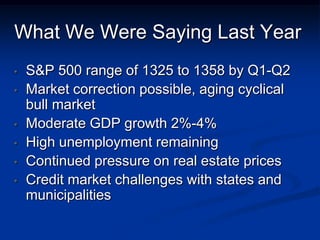

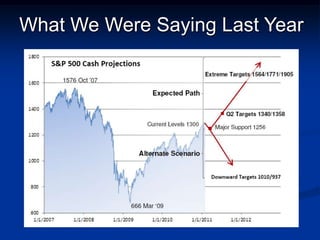

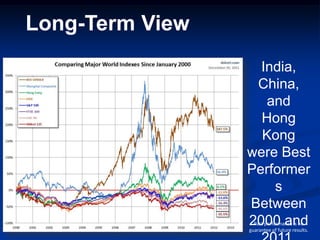

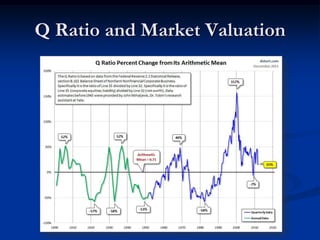

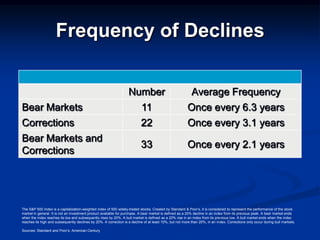

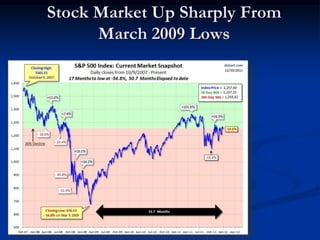

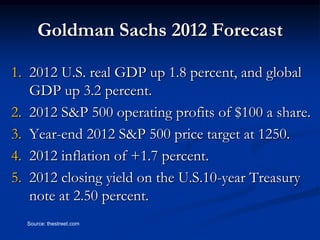

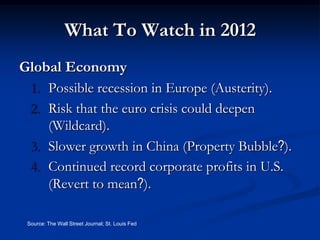

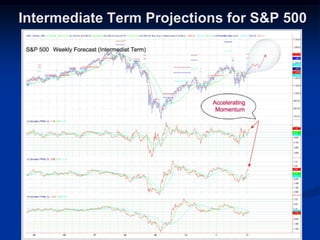

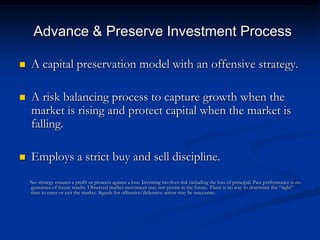

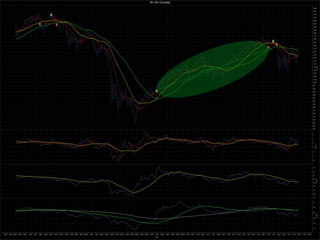

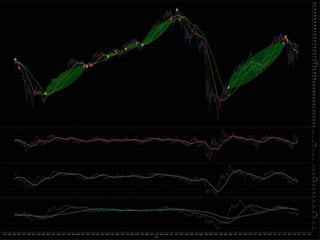

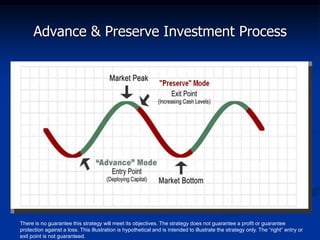

Growing and preserving wealth for generations requires a long-term perspective and disciplined process. In 2012, markets remained volatile due to ongoing challenges in Europe and moderate economic growth. However, stock valuations are reasonable and corporate profits remain strong. Looking ahead, following a prudent process focused on risk management and capital preservation should serve investors well, even if surprises emerge.