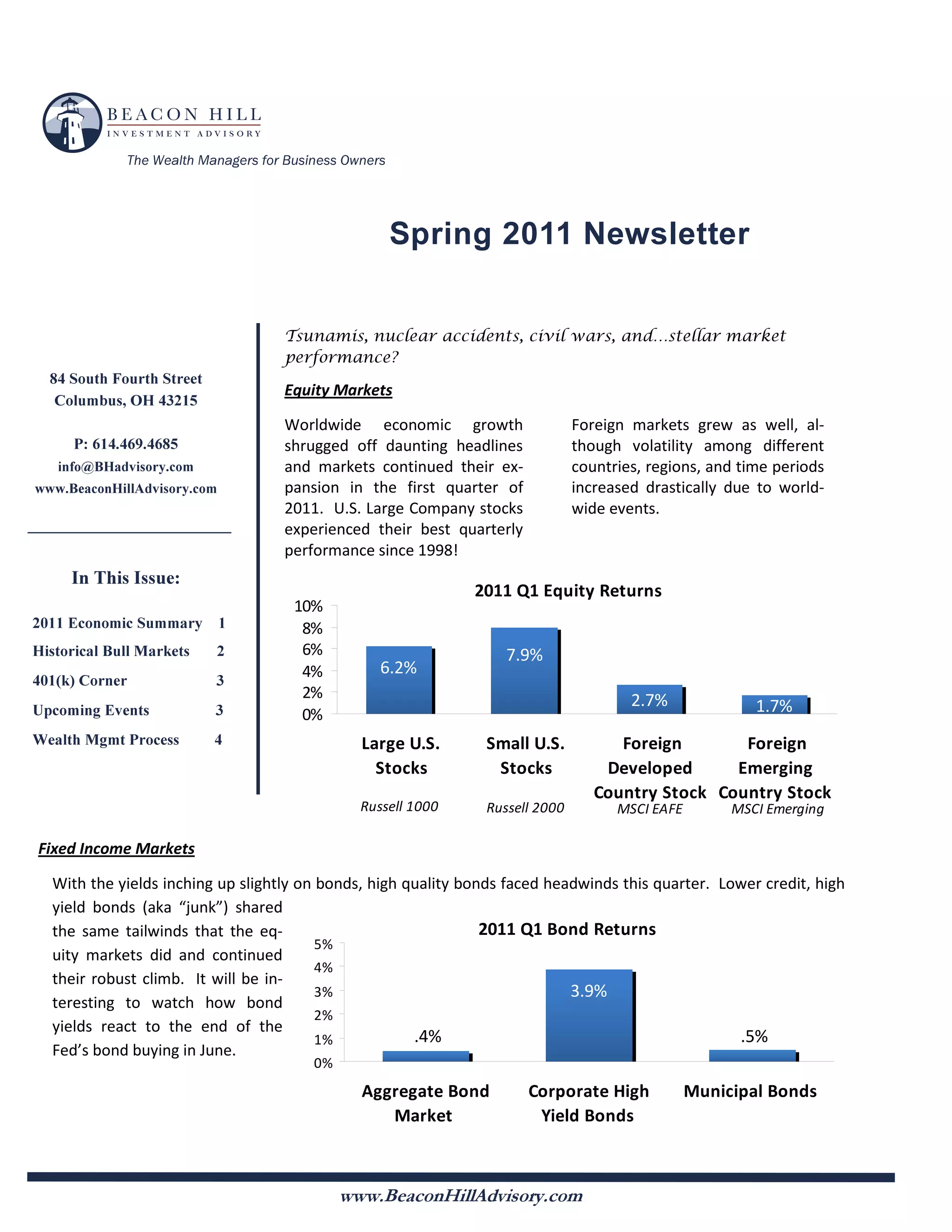

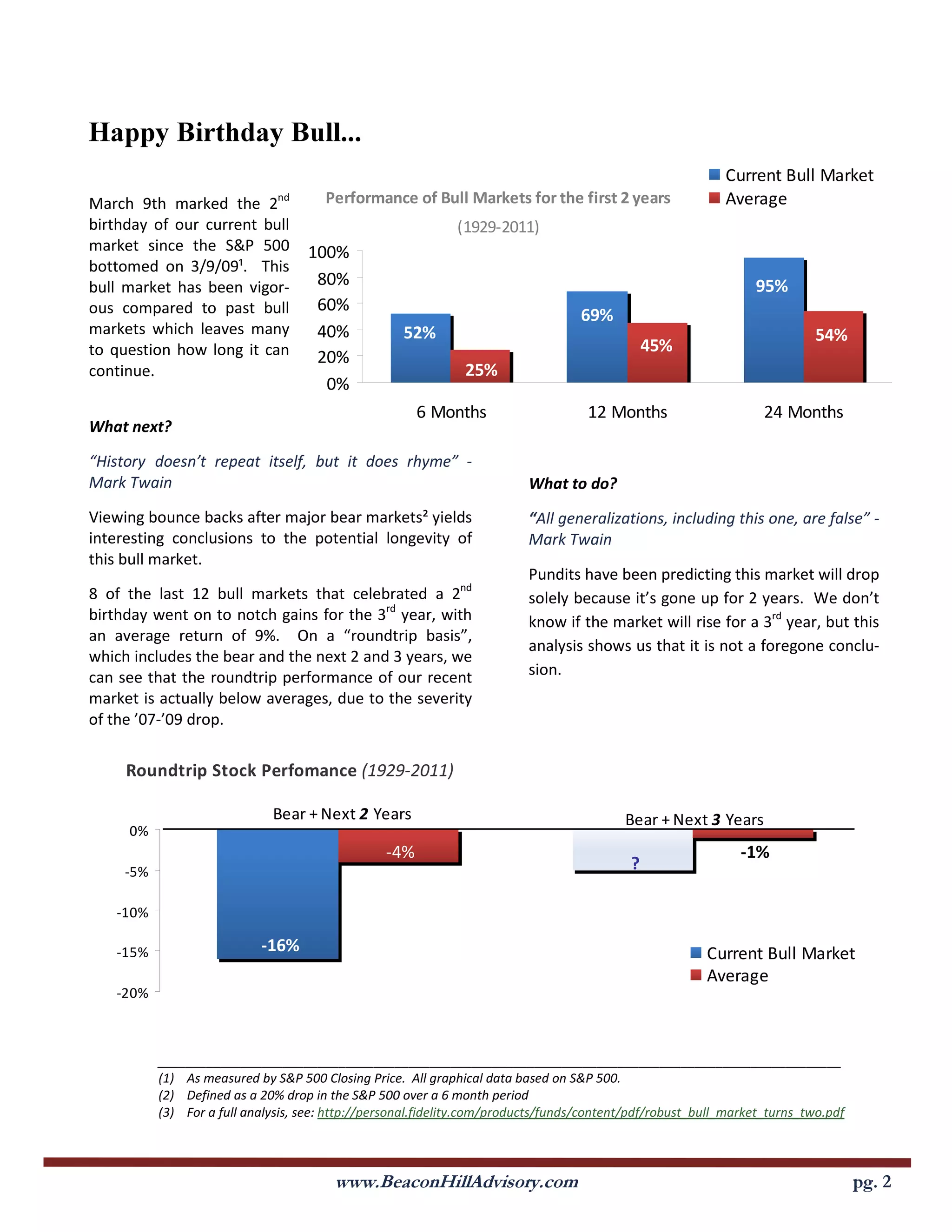

The document summarizes the Wealth Management Process quarterly newsletter. It discusses estate and legacy planning topics that help clients ease difficult transitions. It also covers succession planning for family businesses and identifying areas where further expertise is needed. The next quarter's topic will be on protection planning.