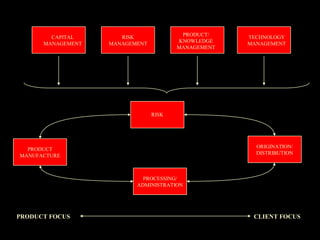

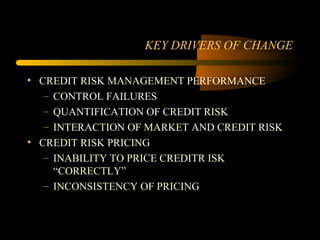

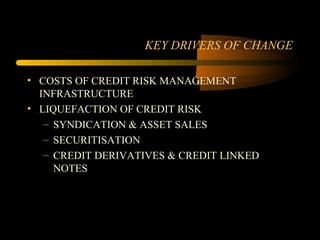

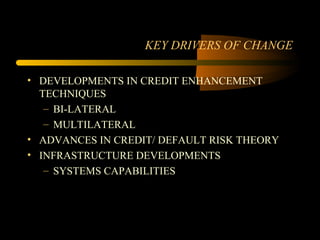

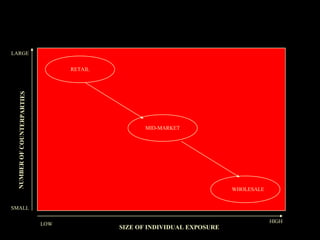

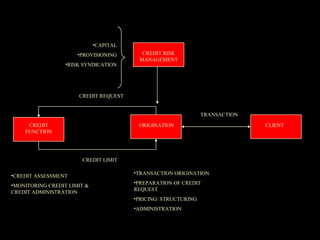

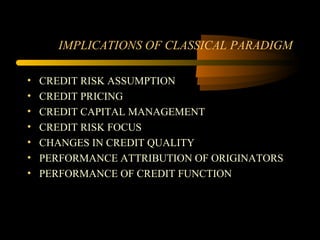

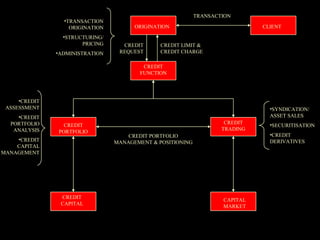

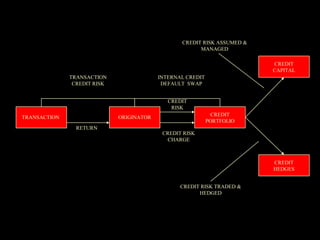

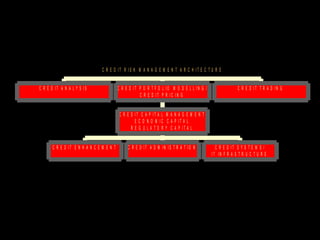

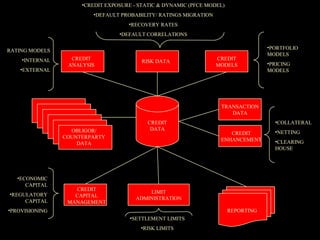

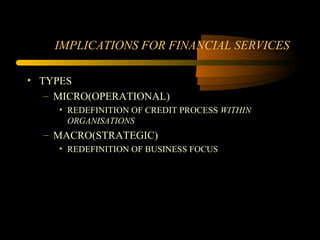

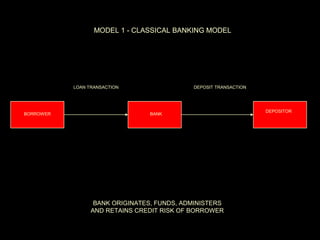

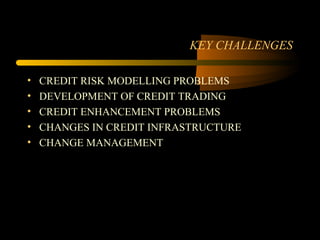

This document discusses trends in credit risk management. It outlines two paradigms - the classical paradigm which focuses on assessing risk and matching it with capital through diversification and collateral. The modern paradigm views credit risk as a tradable asset class managed dynamically through hedging and trading tools. The document also examines key drivers of change such as increased liquidity of credit risk and implications for credit risk management architecture and financial institutions.