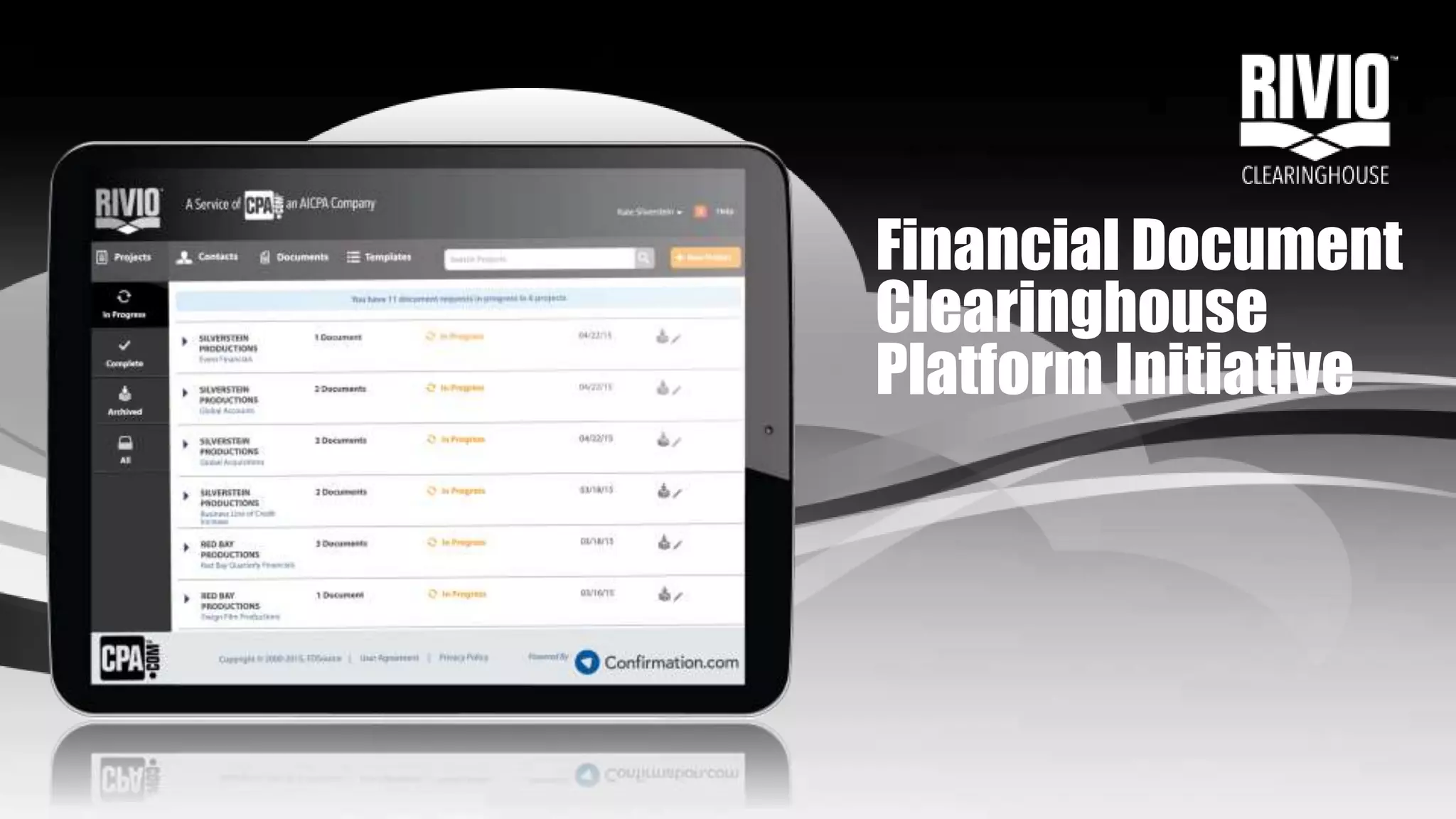

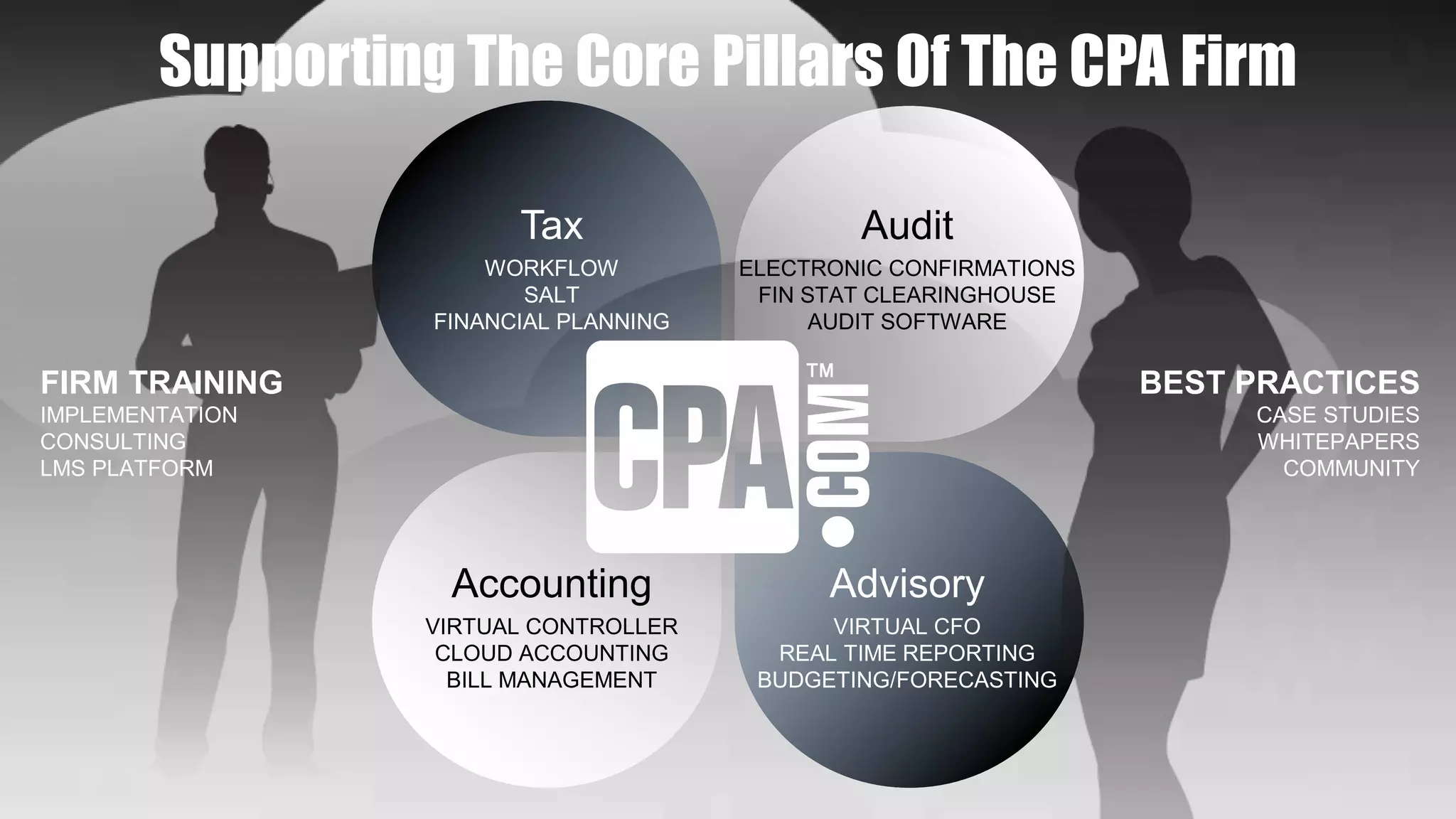

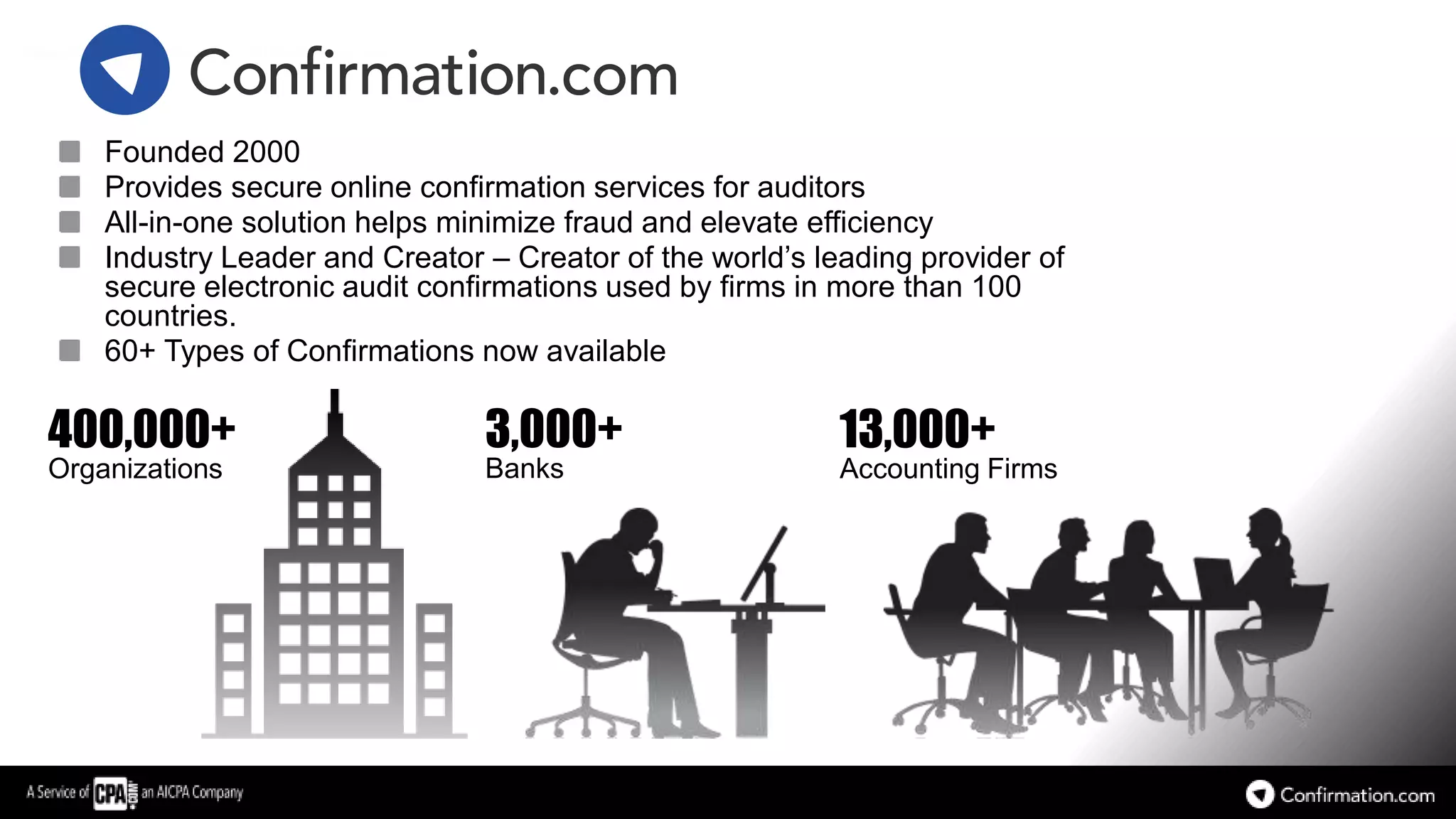

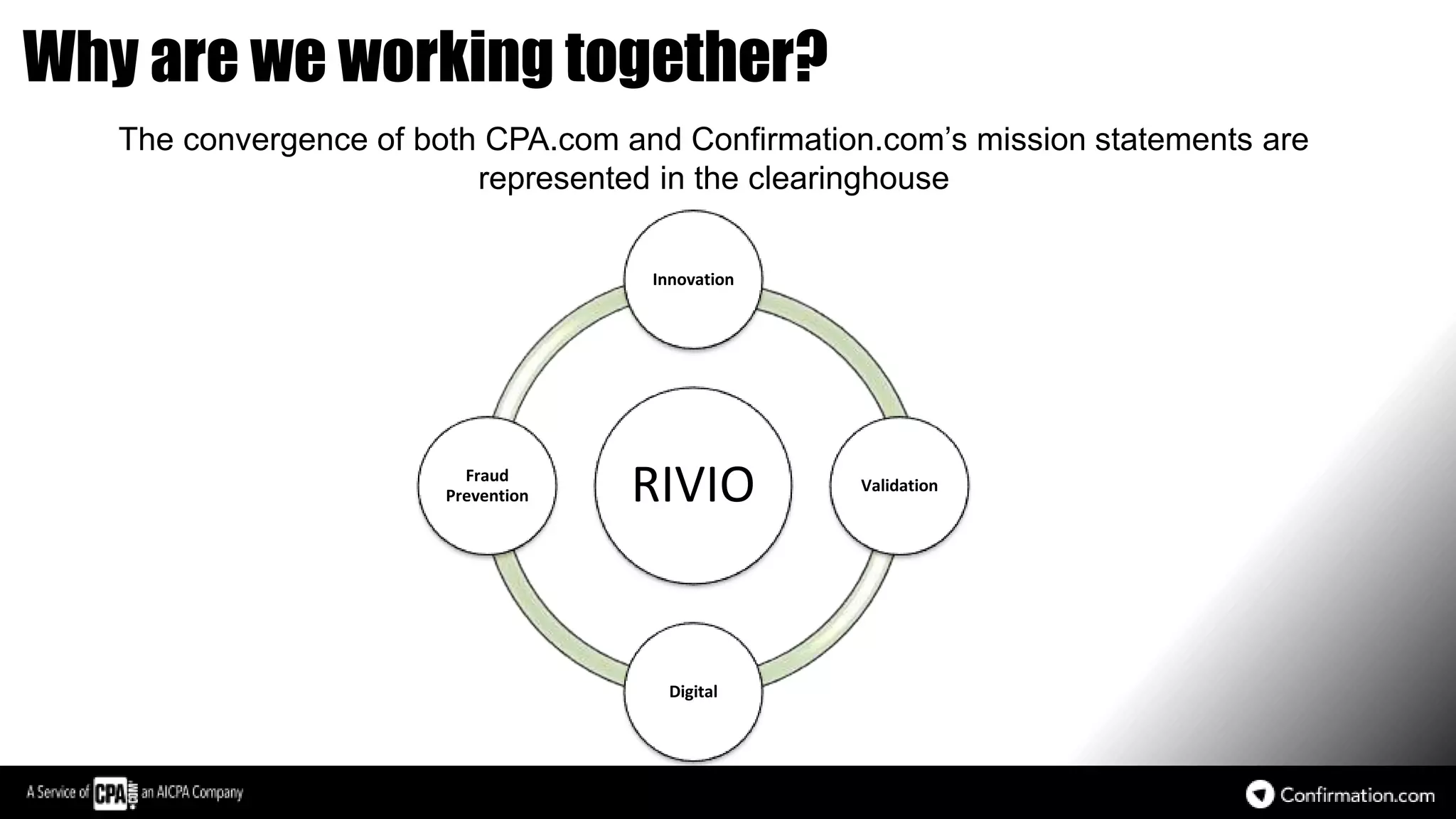

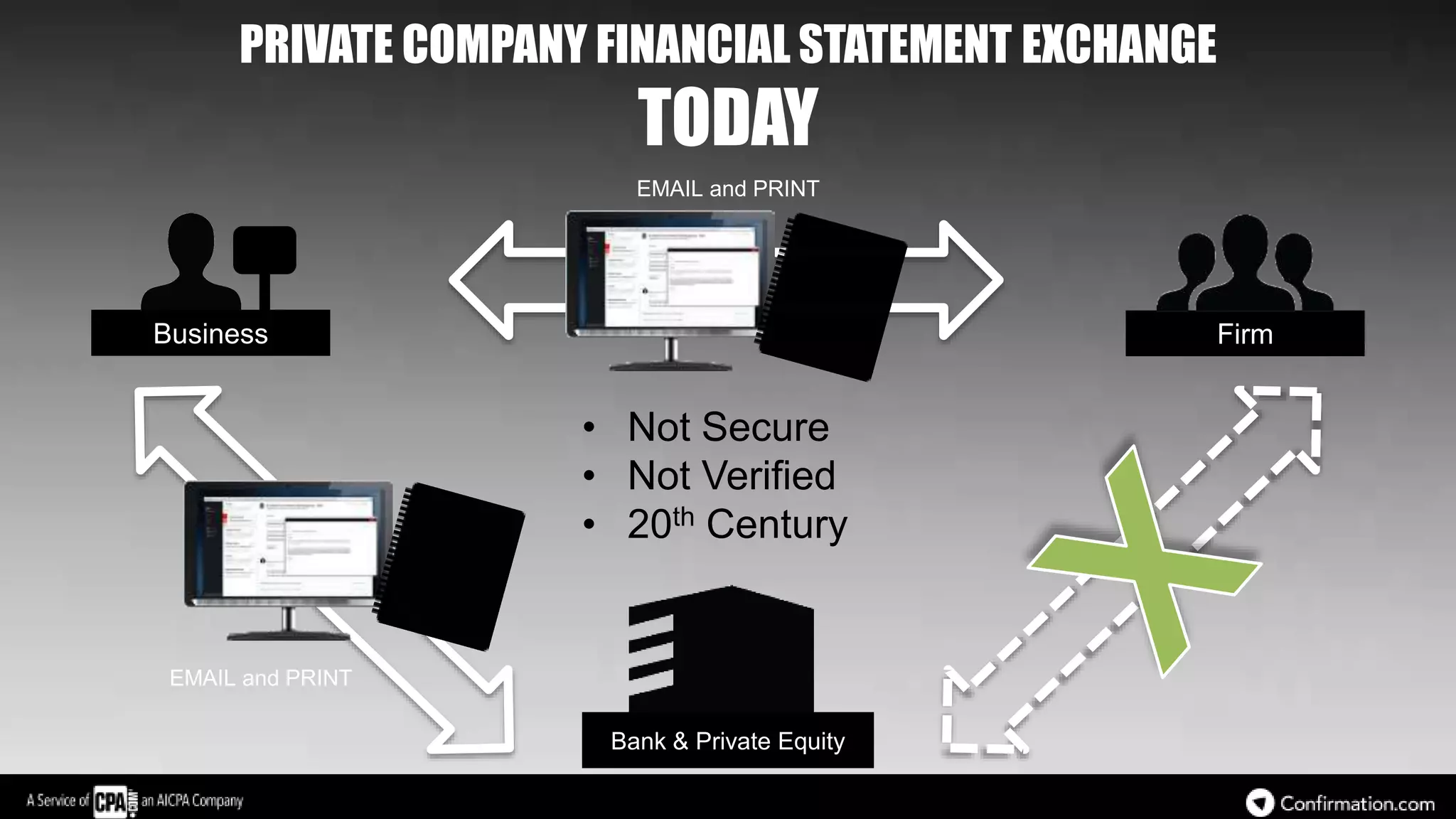

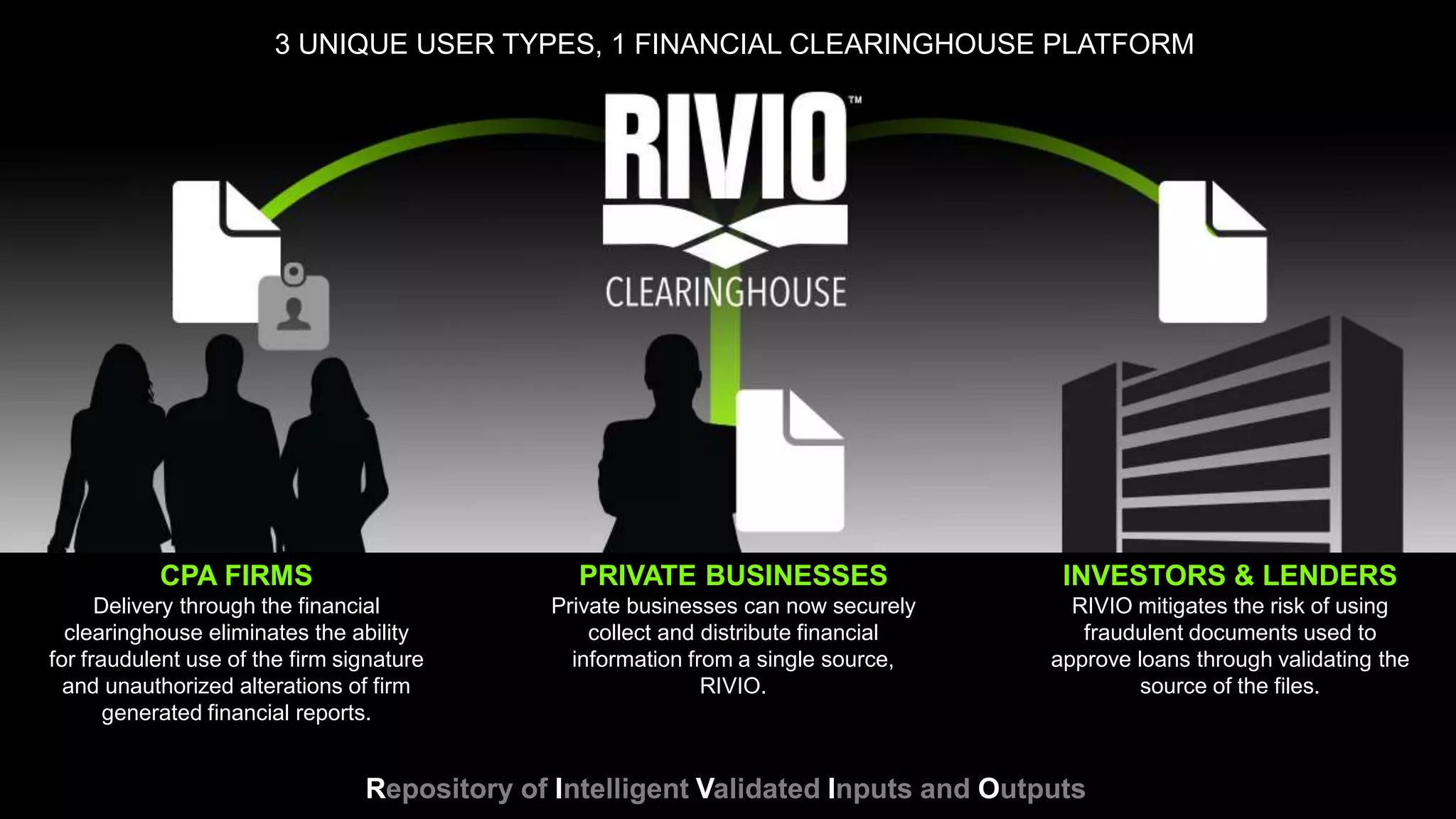

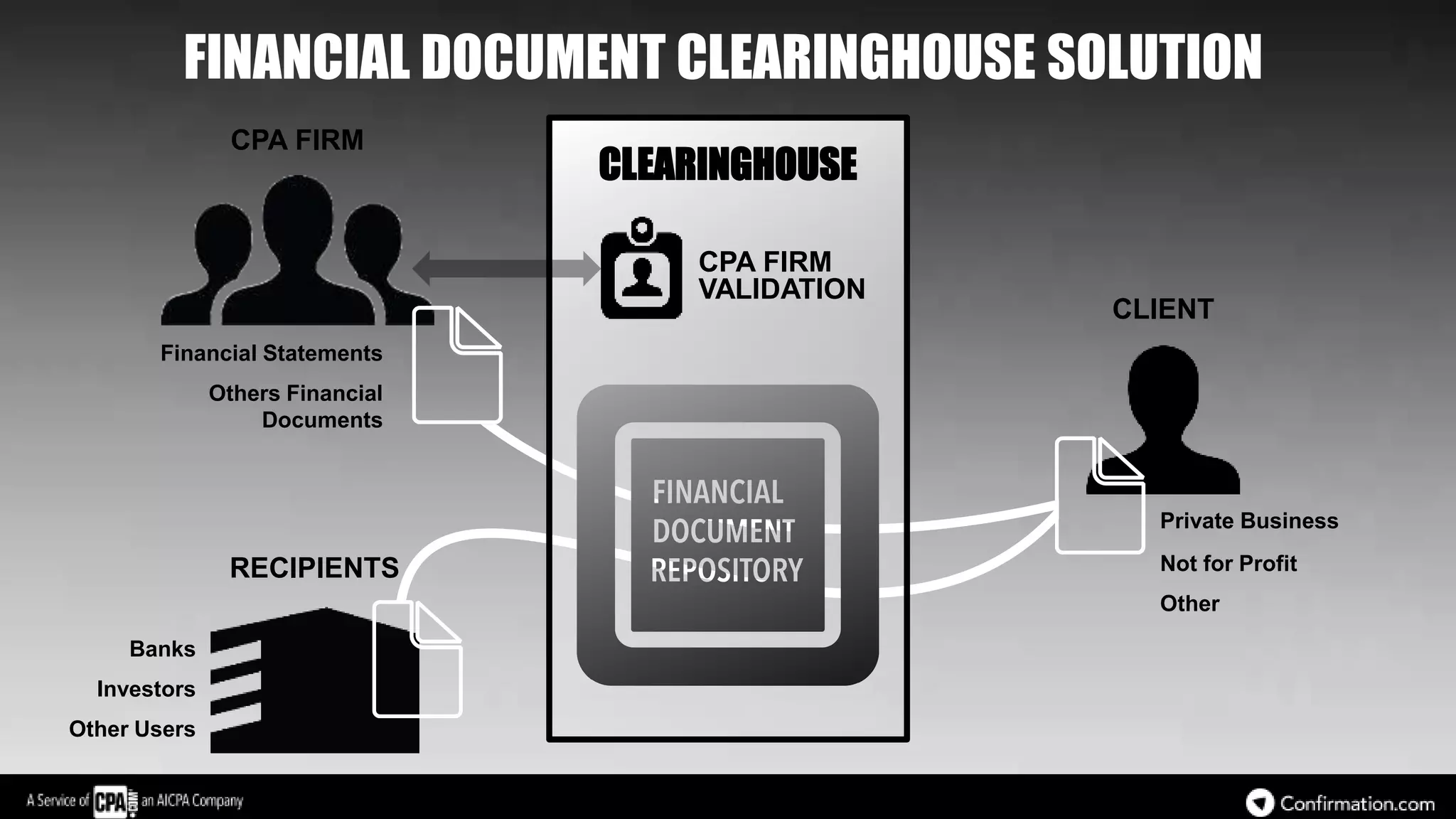

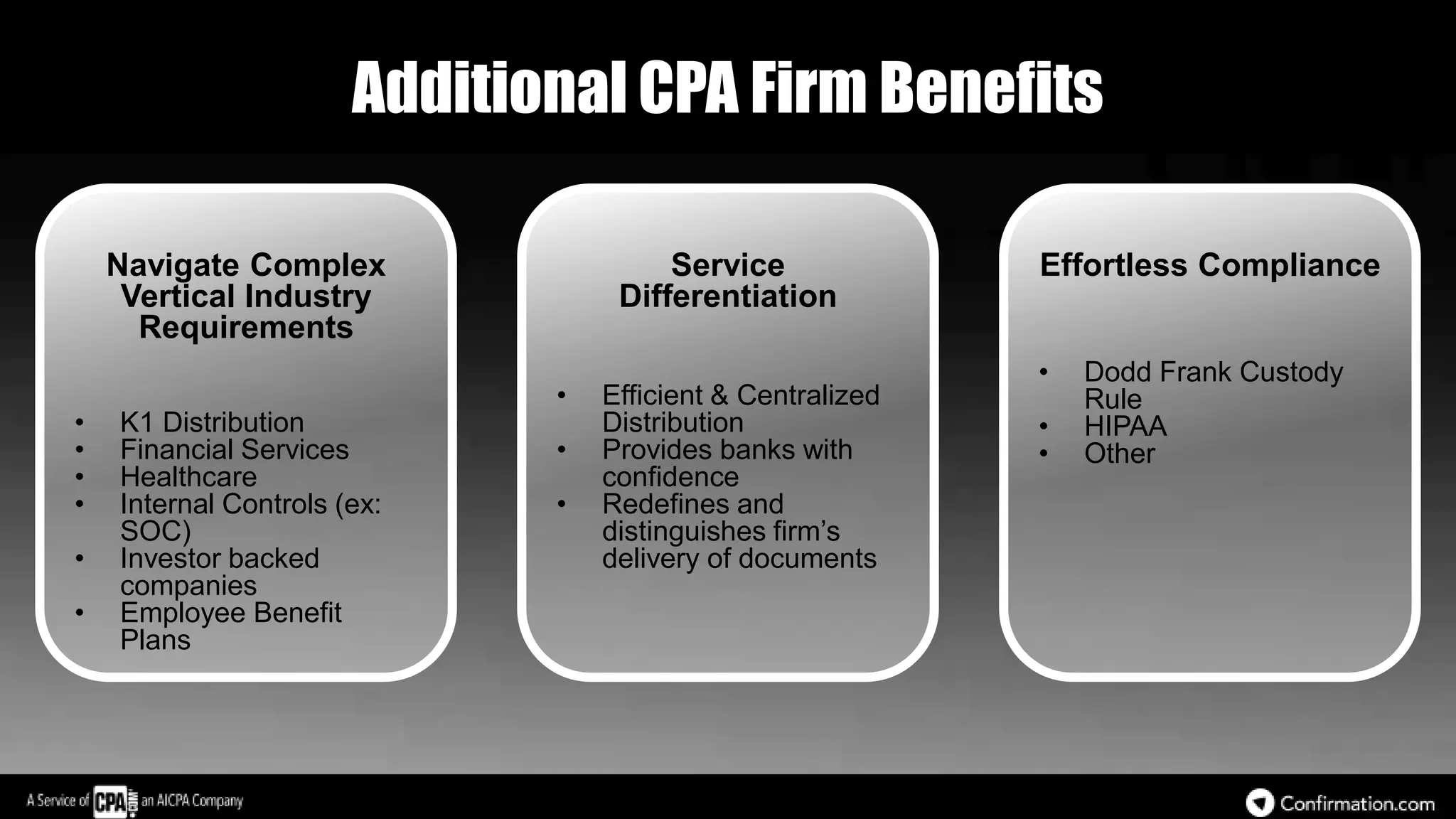

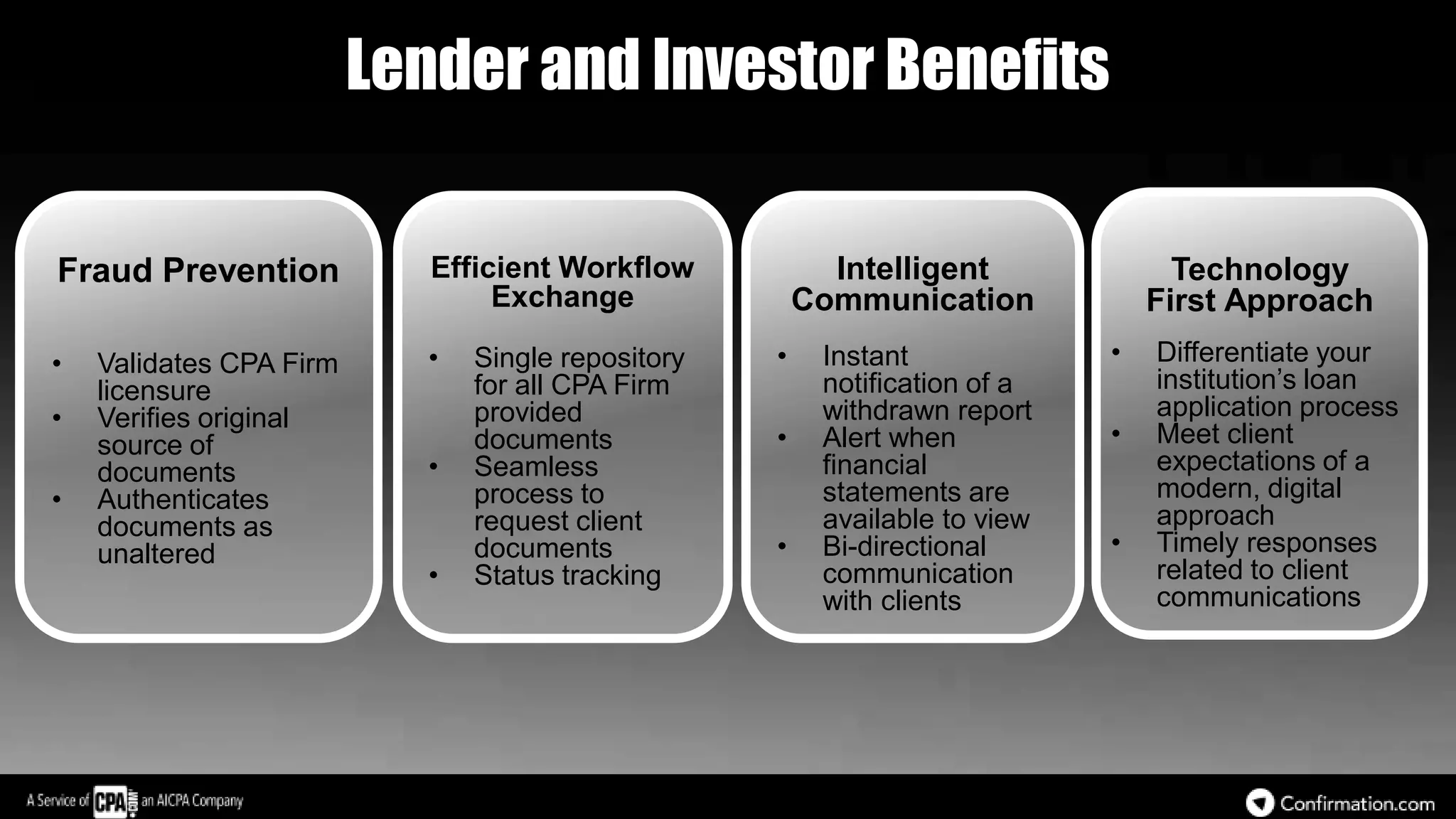

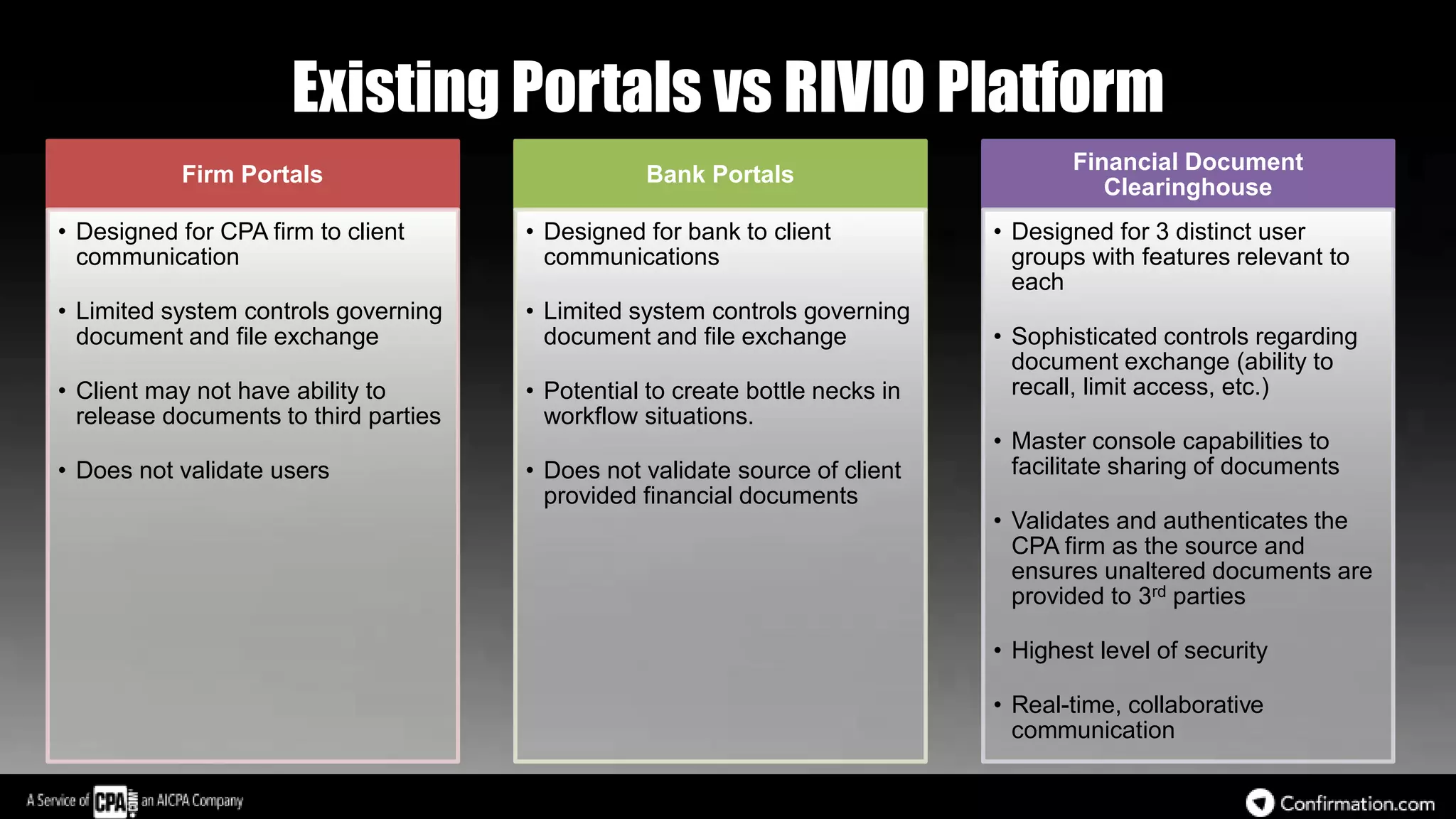

The financial document clearinghouse platform, Rivio, developed by CPA.com in partnership with Confirmation.com, allows private businesses to securely exchange validated financial documents with investors, lenders, and CPA firms, addressing concerns around document authenticity and inefficiency in traditional methods. It offers features that protect the privacy of firms, minimize fraud, and streamline communication, making it easier for firms and stakeholders to manage financial information. The platform enhances security through rigorous validation processes, distinguishing itself from existing portals by providing a centralized, user-friendly interface for document exchange.