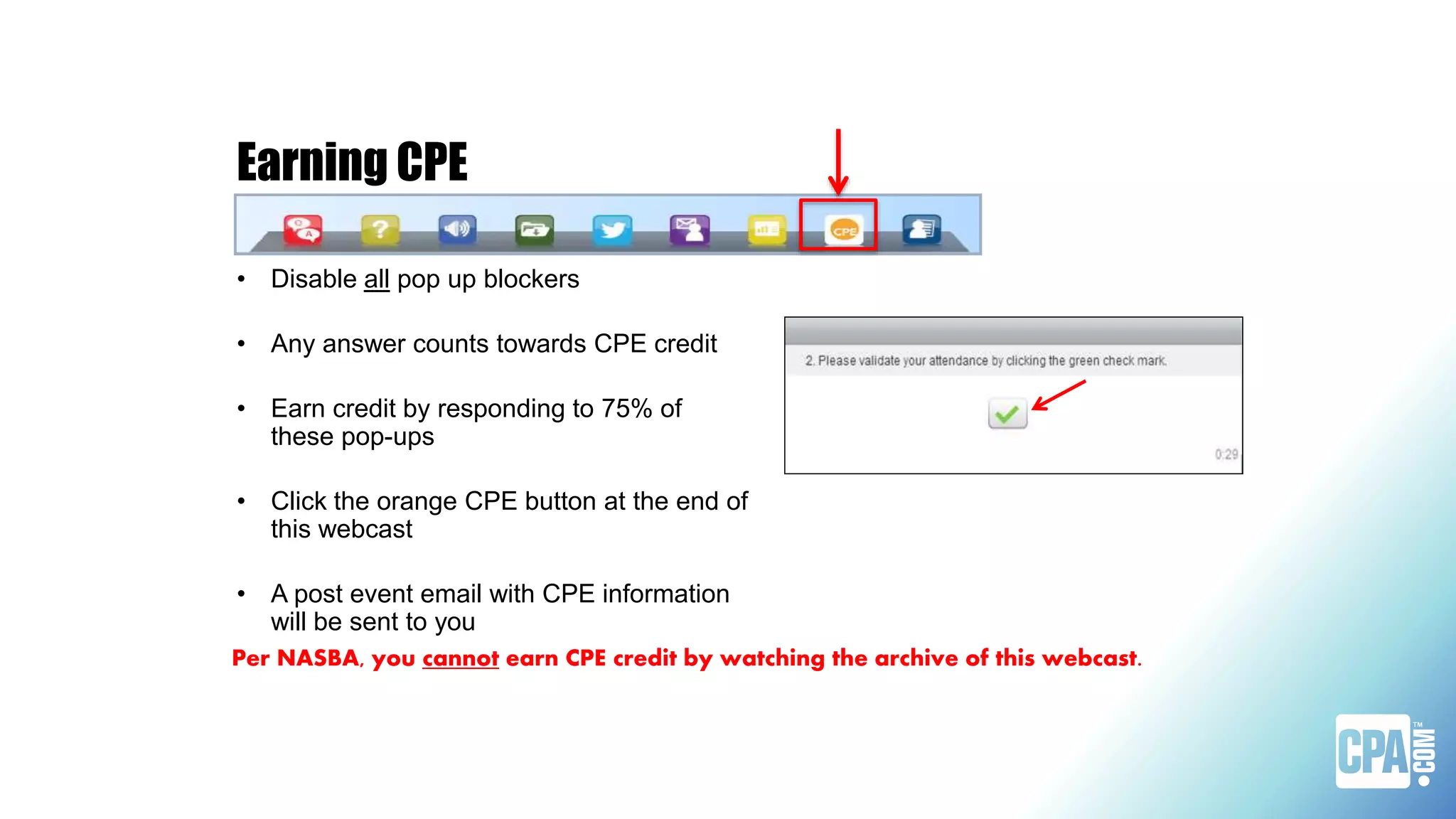

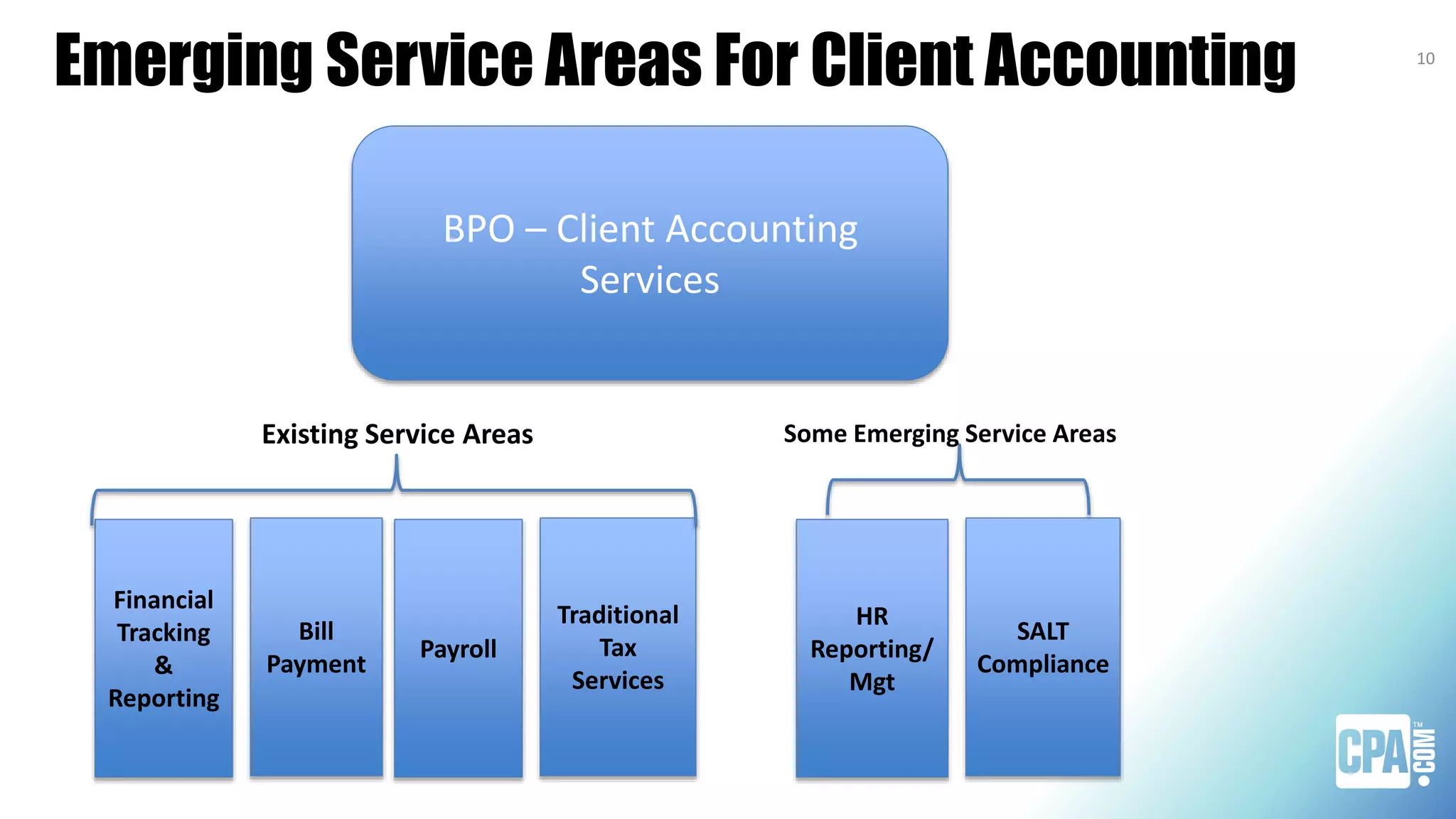

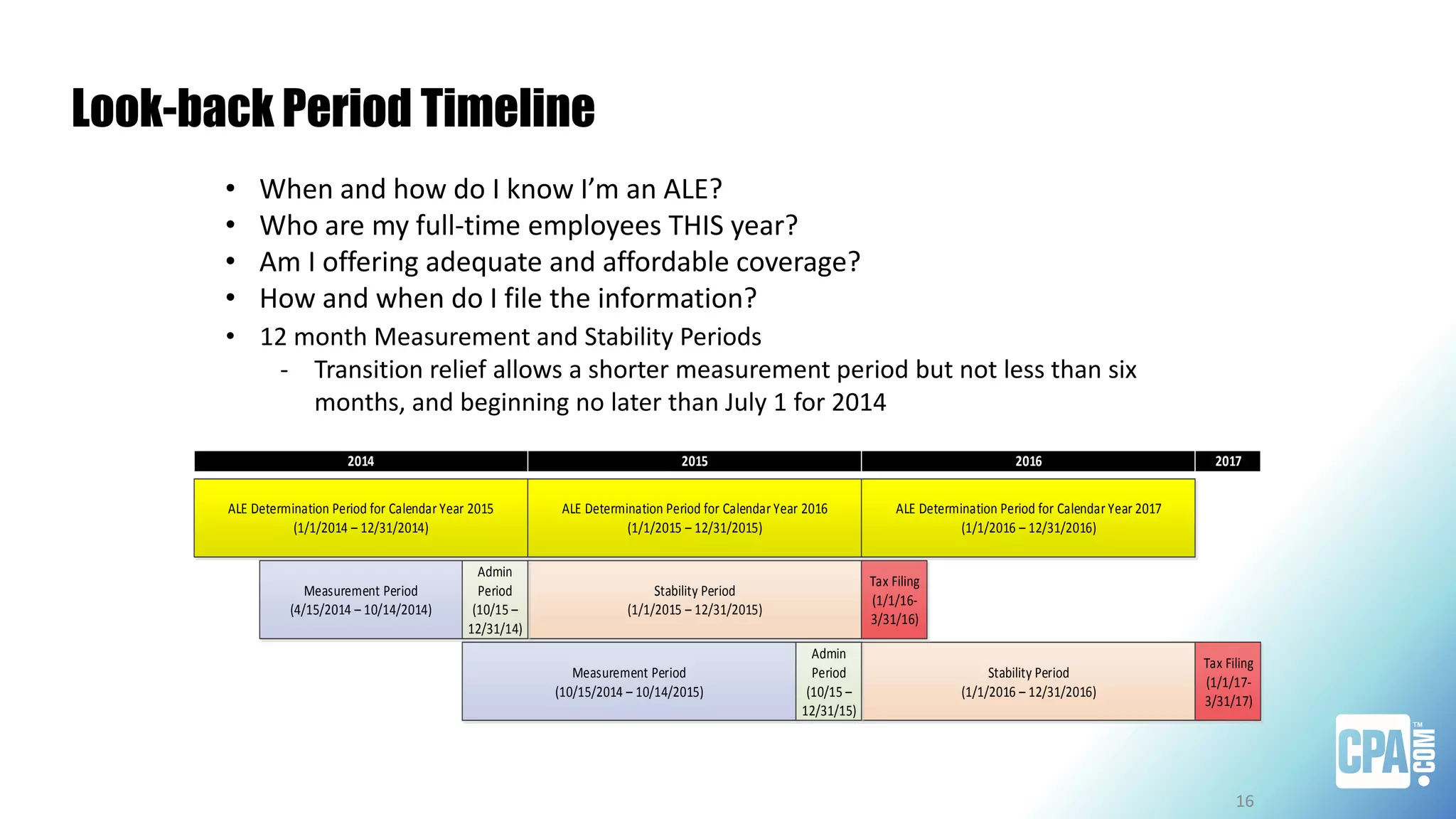

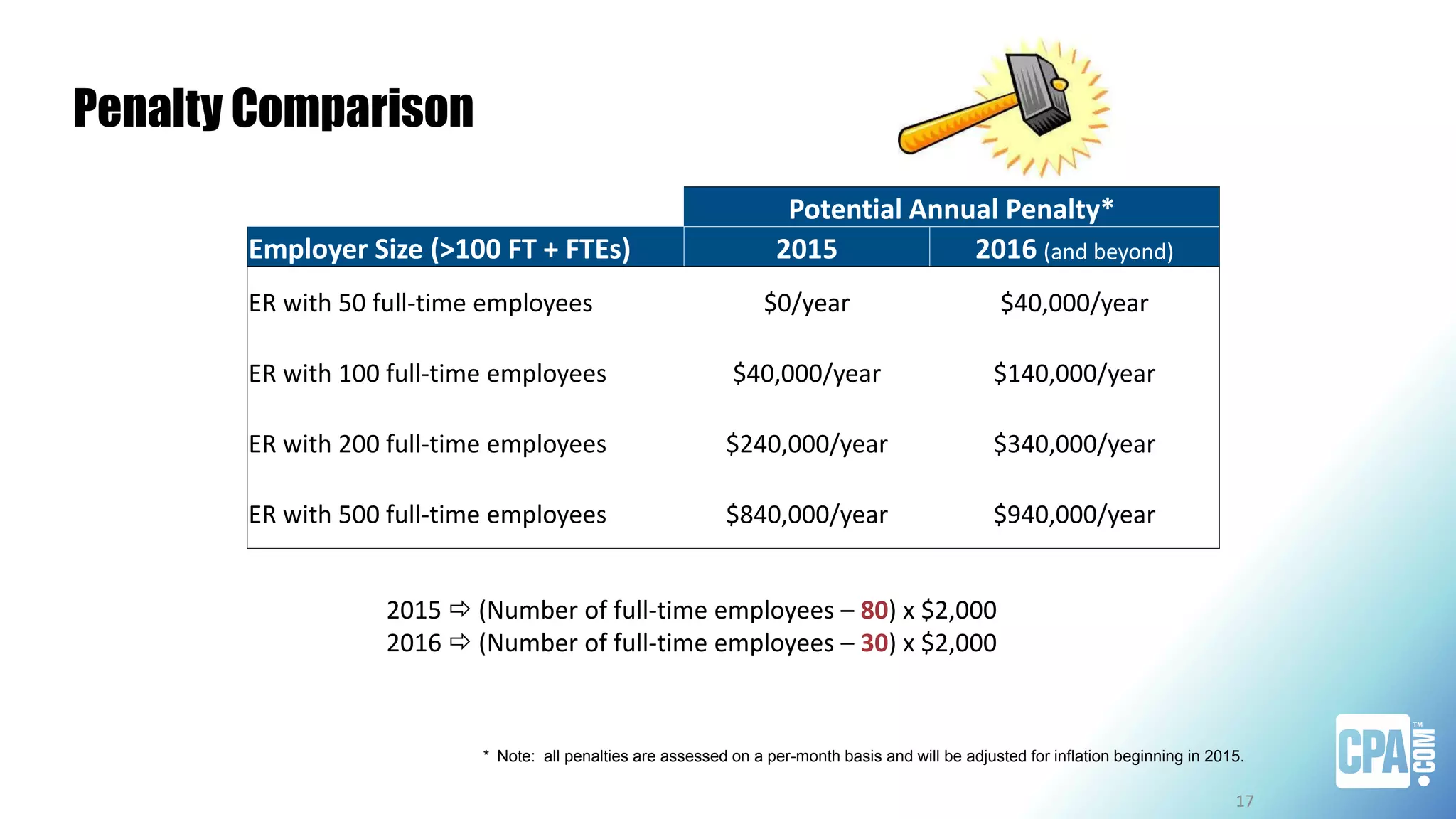

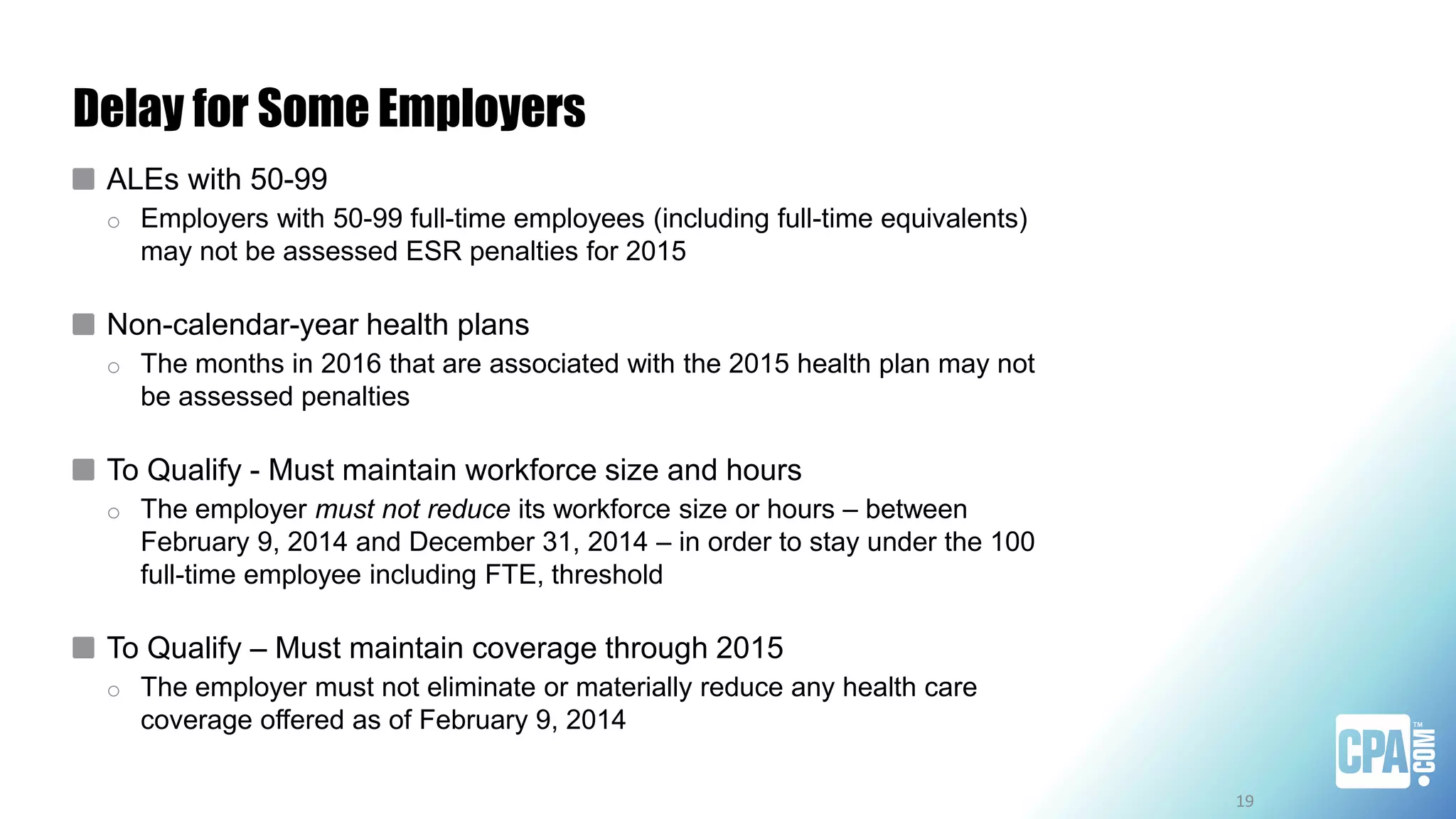

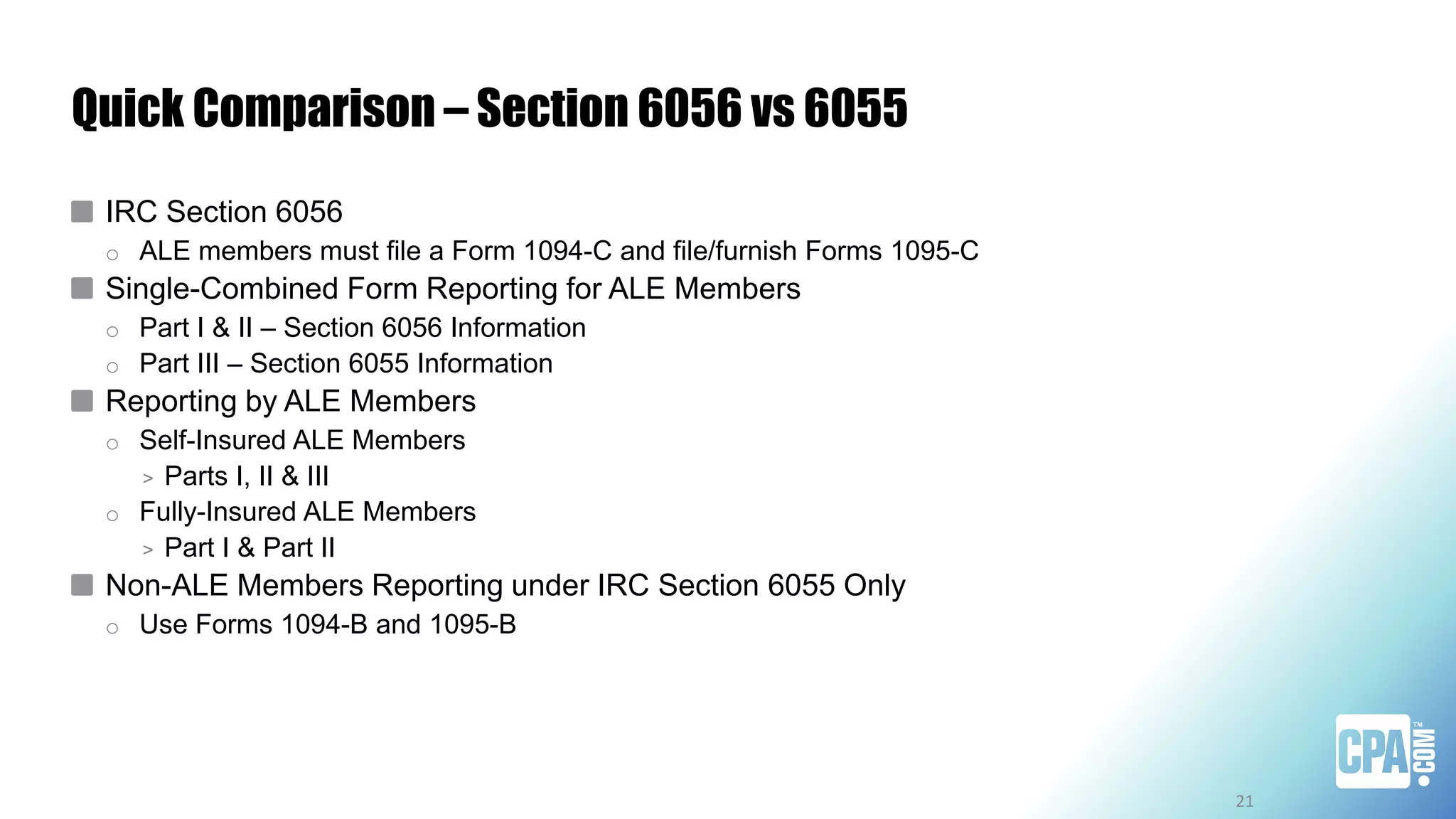

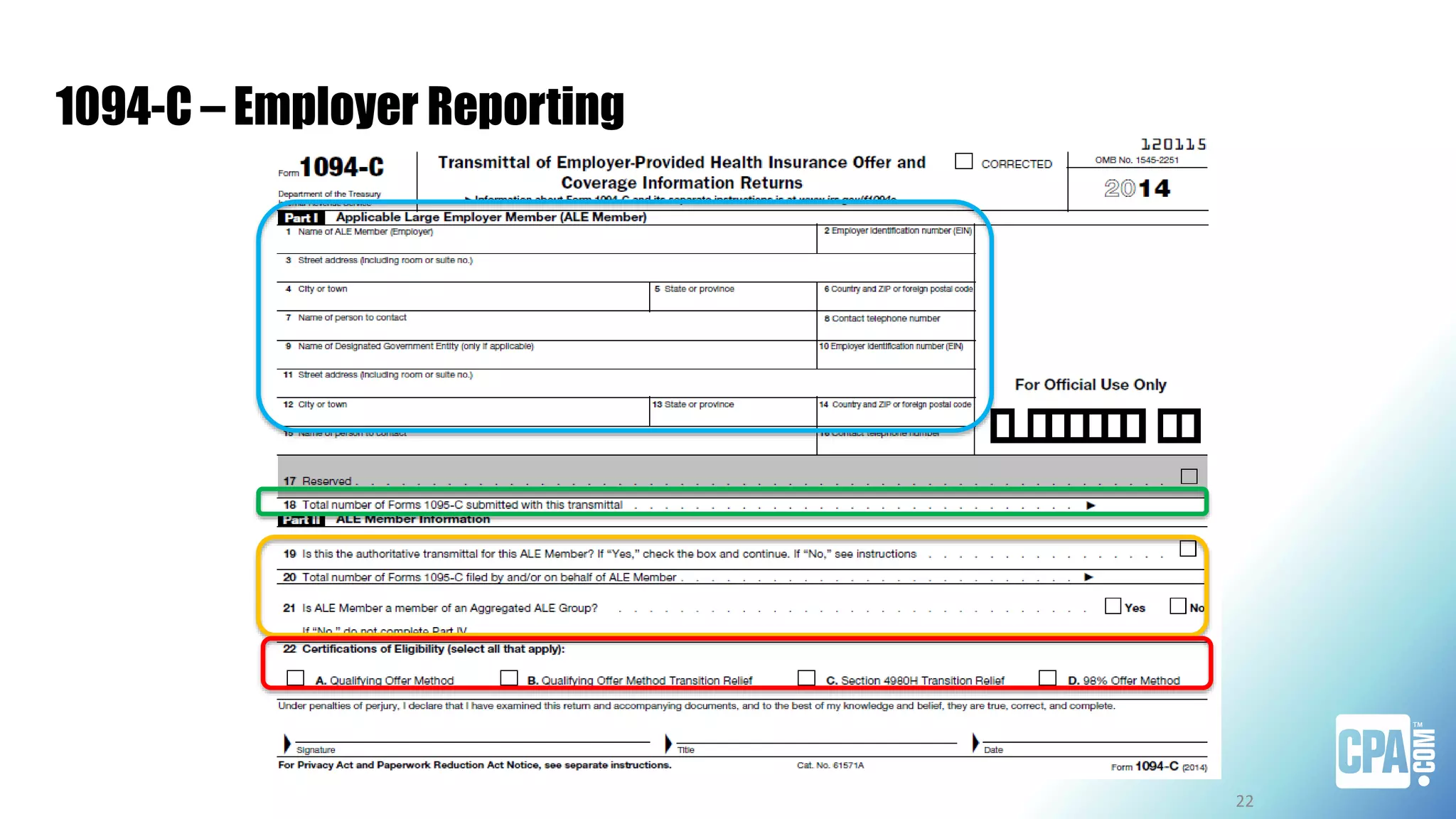

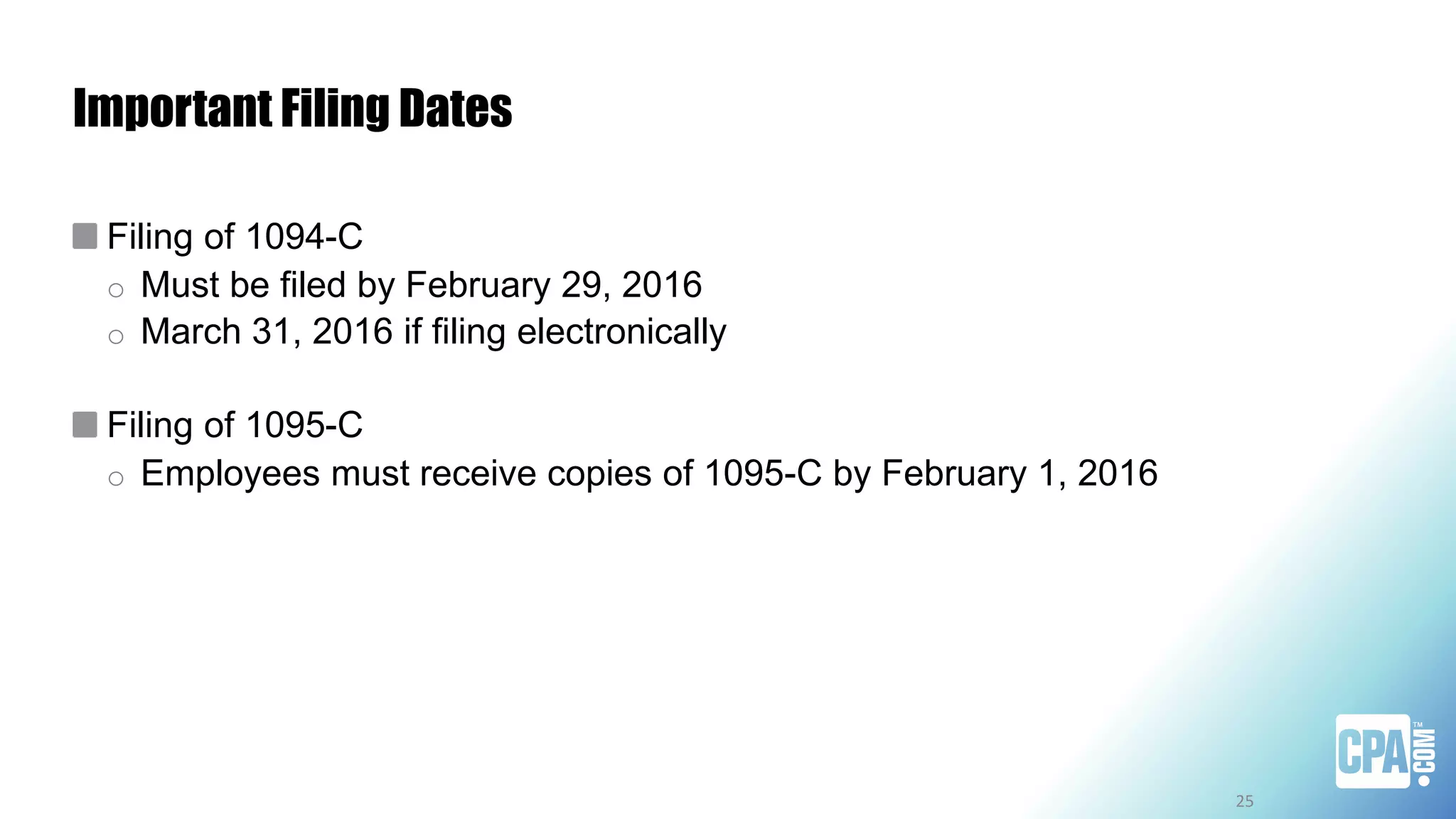

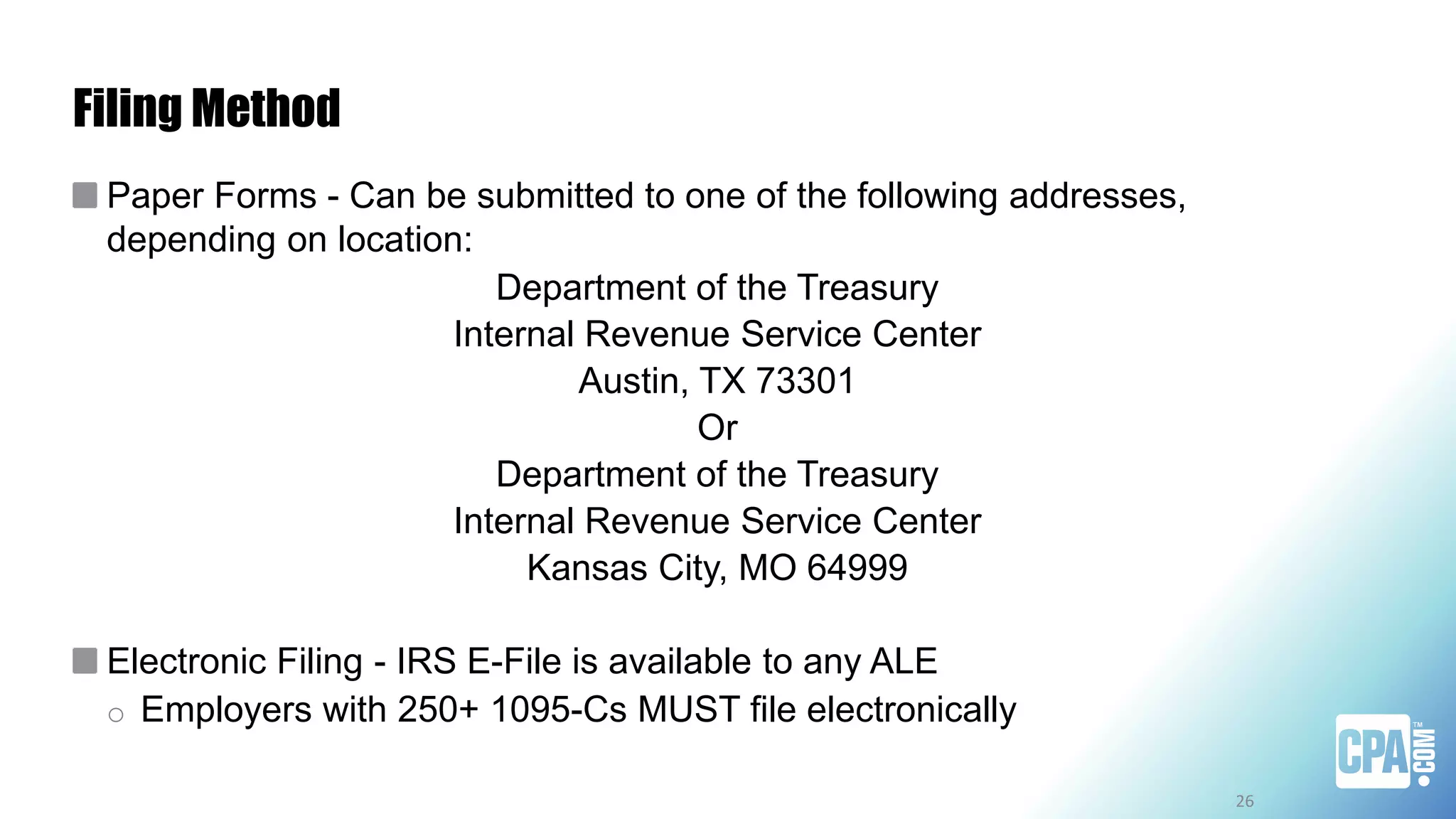

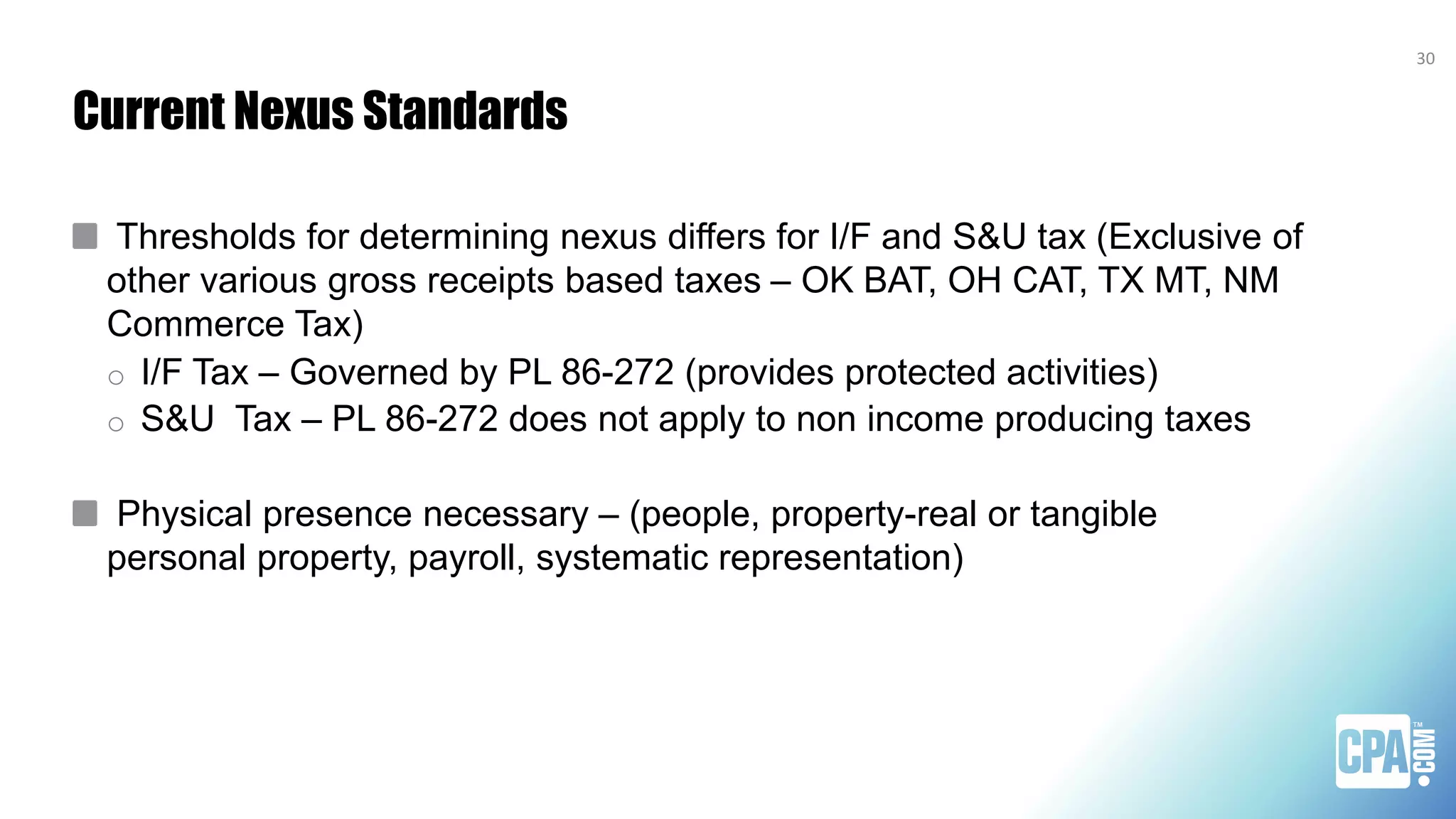

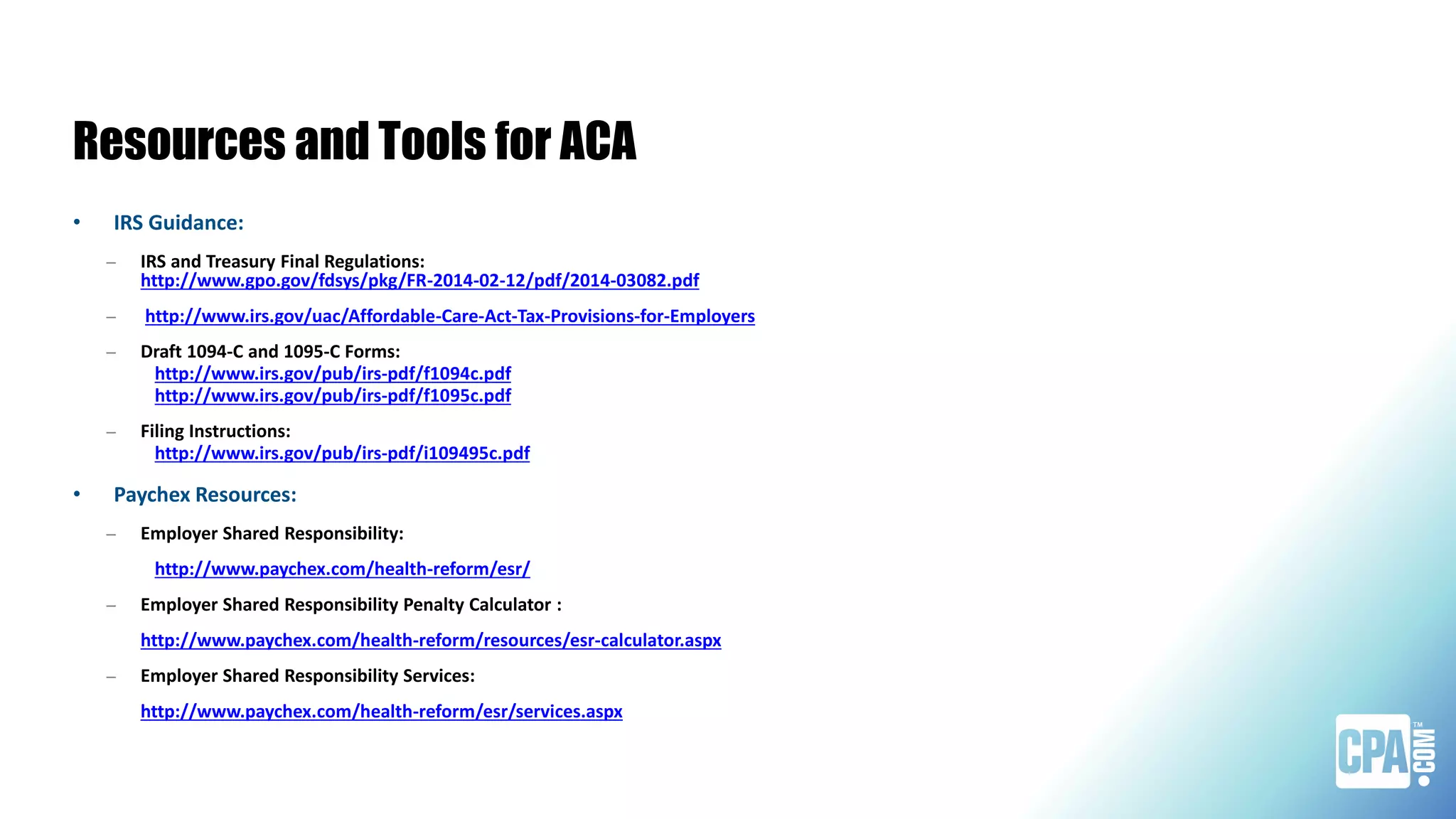

The Digital CPA Webcast Series discusses two emerging categories for trusted business advisors: the Affordable Care Act (ACA) and state and local tax services (SALT). Participants can earn CPE credits by engaging throughout the webinar and are encouraged to submit questions to the speakers. Key insights include strategies for navigating ACA compliance, understanding employer responsibilities, and identifying evolving tax service opportunities in the context of technological advancements.