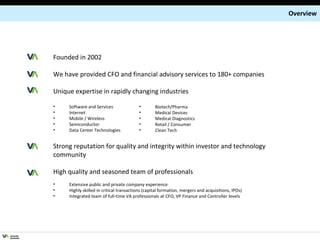

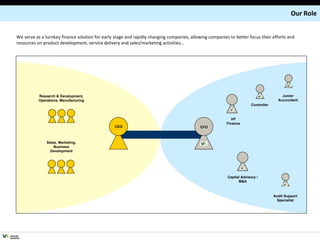

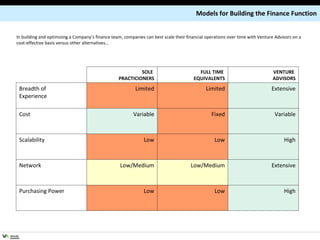

This document provides information about Venture Advisors, a firm that offers CFO and financial advisory services to early stage and rapidly changing companies. It describes the services Venture Advisors provides, including building and supporting finance organizations, capital raising, mergers and acquisitions support, and interim CFO services. The document also lists some of Venture Advisors' clients and discusses their models for staffing finance functions and engaging their services.

![Jim brings over twenty years of financial management experience to his clients. He has extensive hands-on experience in both private and public companies having raised over $100 million in venture financing. Most recently, he has served as interim CFO at several development stage companies guiding them through bridge, venture equity and debt financings. Previously, Jim was Vice President of Finance at Emulex (a leader in Fibre Channel Networking) with responsibilities for operations and investor relations. During his time at Emulex, he participated in several acquisitions and two convertible debt offerings raising more than $650 million. Prior to Emulex, Jim was CFO at Giganet where he led the company through three rounds of financing and sold the business in 2001 to Emulex for $650M . He has also been CFO or held senior financial positions in several software companies including Passkey Systems, DALim, Software Emancipation Technology, FASTech Integration and Bachman Information Systems. He holds an MBA from Boston University and a BS in Accounting from the University of Denver and he is a Certified Public Accountant. REPRESENTATIVE VA CLIENTS: Bug Labs, Equallogic, Going.com, Knewton, Noble Peak Vision, Perkstreet Jim Antes Partner - CFO [email_address] 781.273.6076 Experience Bob joined Venture Advisors in January 2004 and brings more than 25 years experience including 14 as CFO in both publicly traded and venture-backed emerging-growth companies in the technology and medical device industries. He has been instrumental in securing venture financings, restructurings and driving scalable best-in-class business practices and standards for a broad range of venture backed companies.. Prior to Venture Advisors, Bob has served as CFO of Synamics Corp., a multi-national communications company and BaseSix, an interactive IT services company. Prior to these entrepreneurial ventures, Bob was Vice President, CFO and Treasurer of Inso Corporation, a $70 million publicly traded enterprise software company. He also had a successful 14-year career at Data General, where he was CFO of a $625 million multi-national operating division. Bob began his career at Johnson & Johnson as an M&A Analyst and Marketing Accounting Manager. He holds an MBA from Suffolk University and is a graduate of the University of Massachusetts, Lowell. REPRESENTATIVE VA CLIENTS: DataTrac Corporation, Dimdim, Spectrum Transportation, Ze-gen Bob Dudley Partner - CFO [email_address] 781.273.6072 Doc offers his clients more than 30 years of experience as a CFO and COO, mainly with start-ups and emerging growth companies. He has led nine rounds of venture and strategic funding totaling $65 million and also led a successful IPO with an initial capitalization of $150 million, which grew to $280 million within several months. Doc has managed all aspects of finance, accounting and administration, and is well versed in building sound infrastructure to enable companies to scale through the various stages from start-up to mature, sustainable business. Doc has been CFO of both public companies, including Ludlow Corporation and Proteon, Inc., and private companies, including ManagedComp, Into Networks and Chinook Communications, and was the vice president of M&A at Tyco International. He has extensive experience negotiating a wide range of strategic agreements, intellectual property licenses, distribution and joint venture agreements and has executed acquisition/divestiture transactions in excess of $350 million. Doc was previously a principal with Arthur Young & Company, and he has also acquired significant experience in international operations. A magna cum laude graduate of Providence College, Doc received his MBA from Harvard Business School. He is a CPA and earned the Silver Medal for the CPA exam in Massachusetts. REPRESENTATIVE VA CLIENTS: DynamicOps , Innoveer Solutions, Lilliputian Systems, Neocleus, Ntru Cryptosystems, SiCortex Doc Honan Partner - CFO [email_address] 781.273.6070 Public Company / IPO Experience YES VC Backed CFO Experience YES Fundraising Experience YES M&A Experience YES Financial Credentials CPA / MBA Public Company / IPO Experience YES VC Backed CFO Experience YES Fundraising Experience YES M&A Experience YES Financial Credentials MBA Public Company / IPO Experience YES VC Backed CFO Experience YES Fundraising Experience YES M&A Experience YES Financial Credentials CPA / MBA](https://image.slidesharecdn.com/vaoverviewsummer2010-12821473490298-phpapp02/85/VA-Overview-Summer-2010-15-320.jpg)

![Experience David provides a range of advisory services to our clients focused on capital raise transactions and merger and acquisitions. David served as an investment banker at First Albany Corporation from 1991 to 2003. He was a Managing Director in the Corporate Finance Group, where he was responsible for leading the Boston group's efforts in IT services, software and enterprise hardware markets. His responsibilities included the origination and primary execution of public offerings, strategic mergers and acquisitions and private equity transactions. He has completed more than 60 investment banking transactions and advisory assignments, raising over $2.4 billion for such companies as Airwide Solutions, Forrester Research, NaviSite, NIC, USWeb, iXL, Ericsson, Critical Path and VeriSign. David holds a B.S. from Babson College with majors in Finance, Investments and Economics, graduating in two years with highest distinction. He also earned an MBA from the Wharton School at the University of Pennsylvania. REPRESENTATIVE VA CLIENTS: Airwide Solutions, eDialog, Katzenbach Partners, Ntru Cryptosystems, Optram, Threadsmith David Rauktys Partner – Advisory Services [email_address] 781.273.6073 Mark joined Venture Advisors in June 2009 and brings his experience in senior management and consulting to its clients. He has worked in life science and technology based companies from venture startups to mid-cap public companies. For over 20 years, he has served as CFO of a number of companies including BG Medicine, Inc., ONI Medical Systems, Clinical Data, Inc. and ADE Corporation. In that capacity, he has raised over $200 million in venture capital and private equity. He has also arranged debt transactions including working capital lines of credit, venture debt, asset-backed loans and mezzanine financings. Mark has participated in numerous mergers and acquisitions, involved in strategic analysis, negotiations, due diligence, closing and integration. He also has extensive experience in international business, establishing branch offices and subsidiaries throughout the world. His life science experience includes biotechnology, pharmaceuticals, medical device and diagnostics. In the technology sector, he has worked in the software, wireless communications, capital equipment and semiconductor industries. His experience in public companies includes SEC reporting, preparation for Sarbanes Oxley and IPOs. Earlier in his career Mark spent 15 years in public accounting with Deloitte & Touche and Wolf & Company, where he led the management consulting practice. He holds an MBA from The Ohio State University and a BS in Electrical Engineering from Rensselaer Polytechnic Institute and is a Certified Public Accountant. Mark Shooman CFO [email_address] 617.512.3002 Public Company / IPO Experience YES VC Backed CFO Experience NO Fundraising Experience YES M&A Experience YES Financial Credentials MBA Public Company / IPO Experience YES VC Backed CFO Experience YES Fundraising Experience YES M&A Experience YES Financial Credentials CPA / MBA](https://image.slidesharecdn.com/vaoverviewsummer2010-12821473490298-phpapp02/85/VA-Overview-Summer-2010-16-320.jpg)

![Experience Bob brings over 20 years of financial management experience to his clients with experience in both public and private companies. Most recently he served as the Corporate Controller/Treasurer at Amperion. In that role, he has successfully led the company through $40m of equity and bridge financing events. He has several years of broad based experience and specific expertise within the technology/manufacturing space with extensive knowledge overseeing financial operations and financial reporting. Prior to joining Amperion, Bob served as a Senior Financial Consultant for Parson Consulting, a high end financial consulting firm headquartered in Chicago, where he specialized in revenue recognition initiatives, SEC reporting, ERP implementations and process re-engineering efforts. He has held senior financial positions at several technology companies including Mercury Computer Systems, IDE Associates and Compugraphic. Bob holds an undergraduate degree from Bentley University and an MBA from Suffolk University. REPRESENTATIVE VA CLIENTS: Amperion, Exit41 Bob Mulcahy VP Finance [email_address] 978.835.9988 Peter Basius joined Venture Advisors in February 2007 and brings nineteen years of experience in technology companies. He most recently served as the Vice President of Finance for ChoiceStream. Before joining ChoiceStream, Peter managed his own consulting business providing accounting and finance services to early stage technology companies such as Incipient, DataPower, Affinnova, VoiceObjects and ChoiceStream. Previously Peter worked for CyberCFO providing accounting services to their clients and held the controller position at REON Broadband, NetCentric, 4-Sight and Dragon Systems. Peter also had financial roles of increasing responsibility at Parexel, Sequoia Systems and Davox. He received his B.S. in Business Administration from the University of New Hampshire and his M.B.A. from Rivier College. REPRESENTATIVE VA CLIENTS: Bit9, Incipient, Optiant, Sellmytimesharenow.com Pete Basius VP Finance [email_address] 781.856.1111 Leighanne Henkenmeier joined Venture Advisors in March 2010 and brings nineteen years of experience in technology, retail and financial services companies. She most recently served as the Vice President of Finance for Mercatus and its newly acquired subsidiary, Financial Research Corporation. Prior to this role, Leighanne started and managed two separate companies, a high-end retail business and her own CFO consulting business. Her consulting business focused on assisting early stage technology companies in raising venture financing and building finance systems and teams to manage rapid growth. Her clients included Maven Networks, Habama and Epesi Technologies. Previously, Leighanne held Director of Finance and Controller positions at Resonate and Mainspring, both venture-backed technology companies preparing for IPOs. Leighanne was also an Audit Manager in the technology practice of Price Waterhouse where she managed both private and publicly-traded clients. She received her B.S. in Business Administration from the University of Massachusetts and is also a Certified Public Accountant. Leighanne Henkenmeier VP Finance [email_address] 781.603.6203 Public Company / IPO Experience YES VC Backed CFO Experience YES Fundraising Experience YES M&A Experience NO Financial Credentials MBA Public Company / IPO Experience NO VC Backed CFO Experience YES Fundraising Experience YES M&A Experience YES Financial Credentials MBA Public Company / IPO Experience YES VC Backed CFO Experience YES Fundraising Experience YES M&A Experience YES Financial Credentials CPA](https://image.slidesharecdn.com/vaoverviewsummer2010-12821473490298-phpapp02/85/VA-Overview-Summer-2010-17-320.jpg)