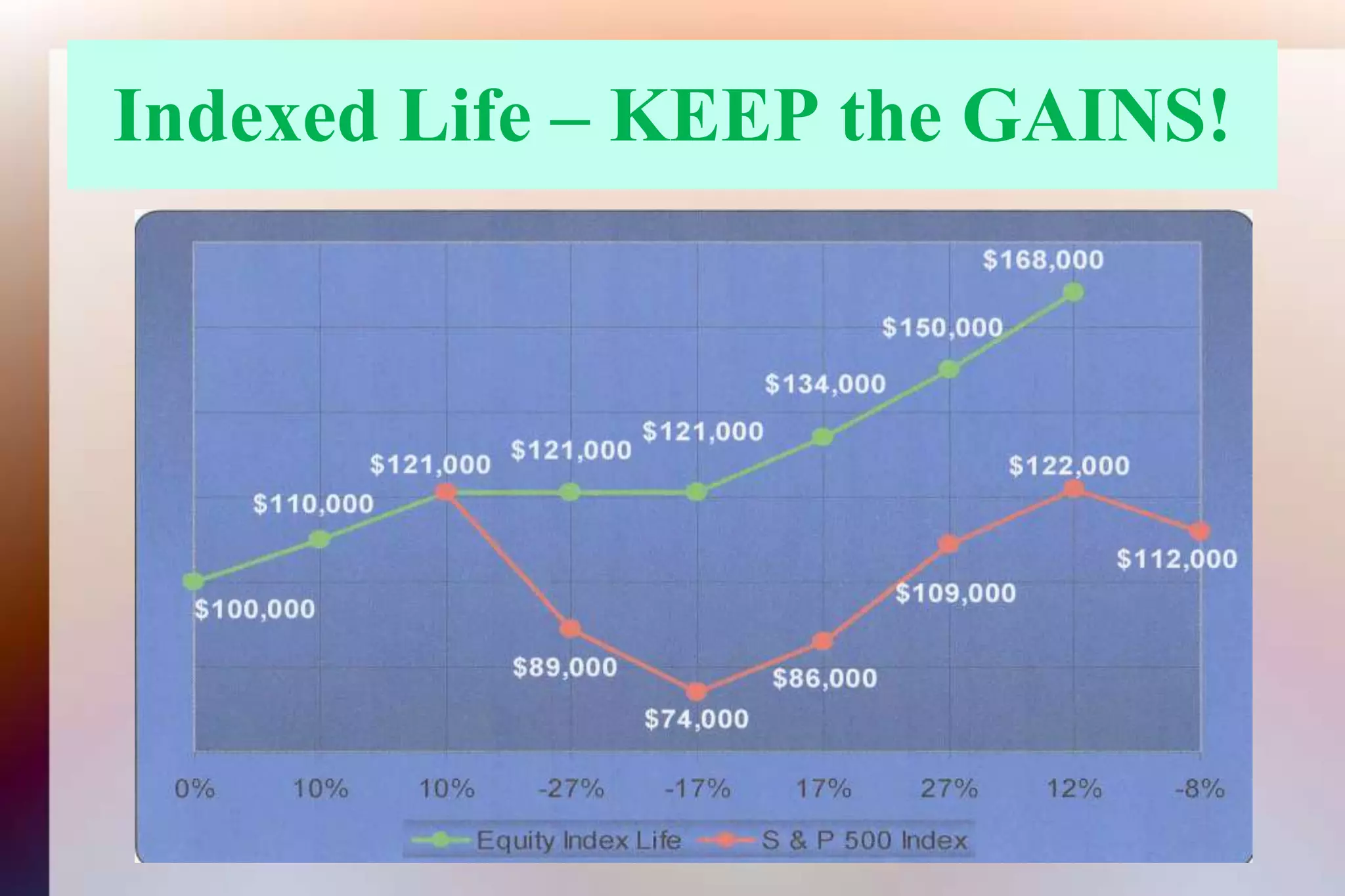

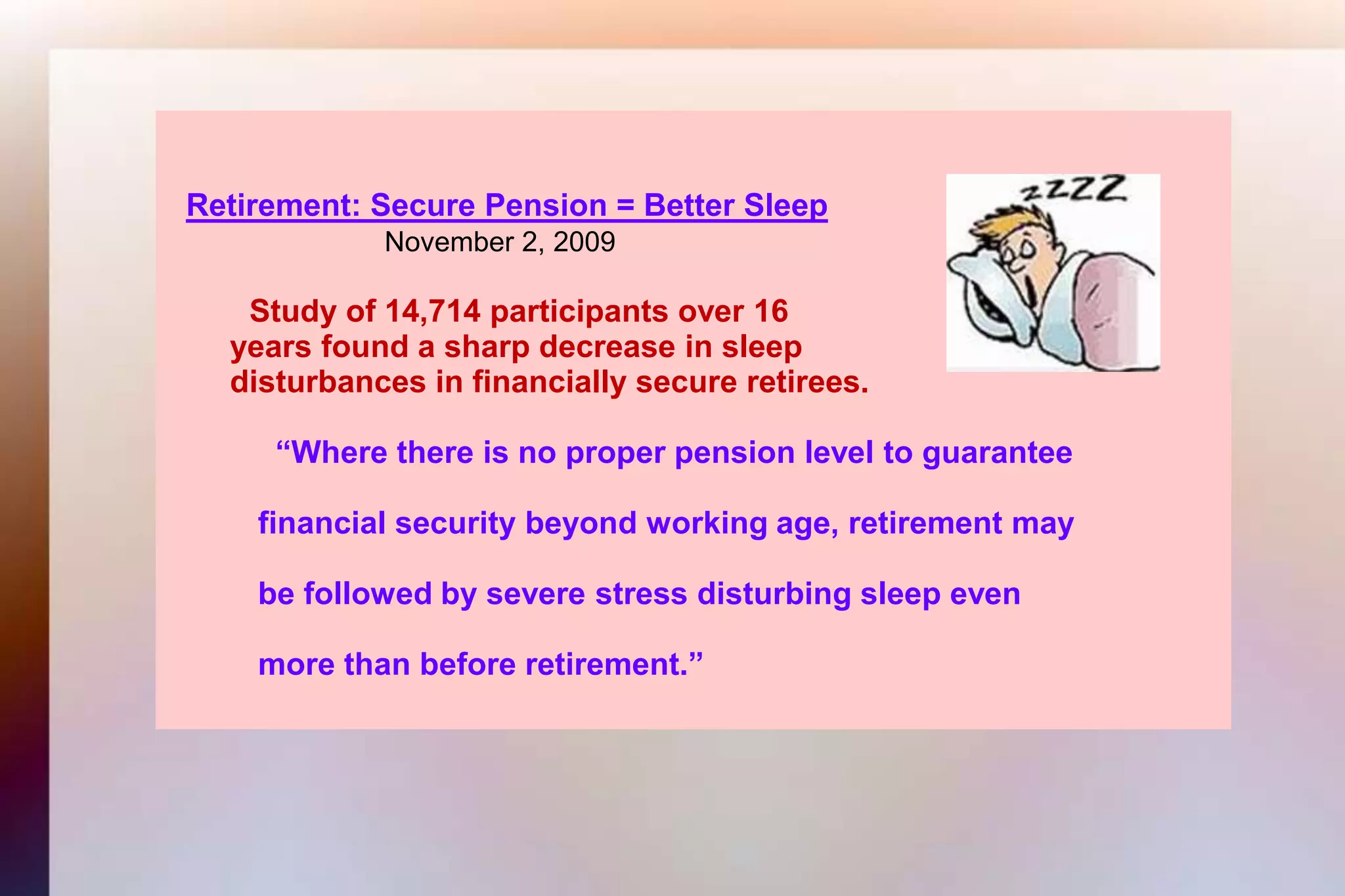

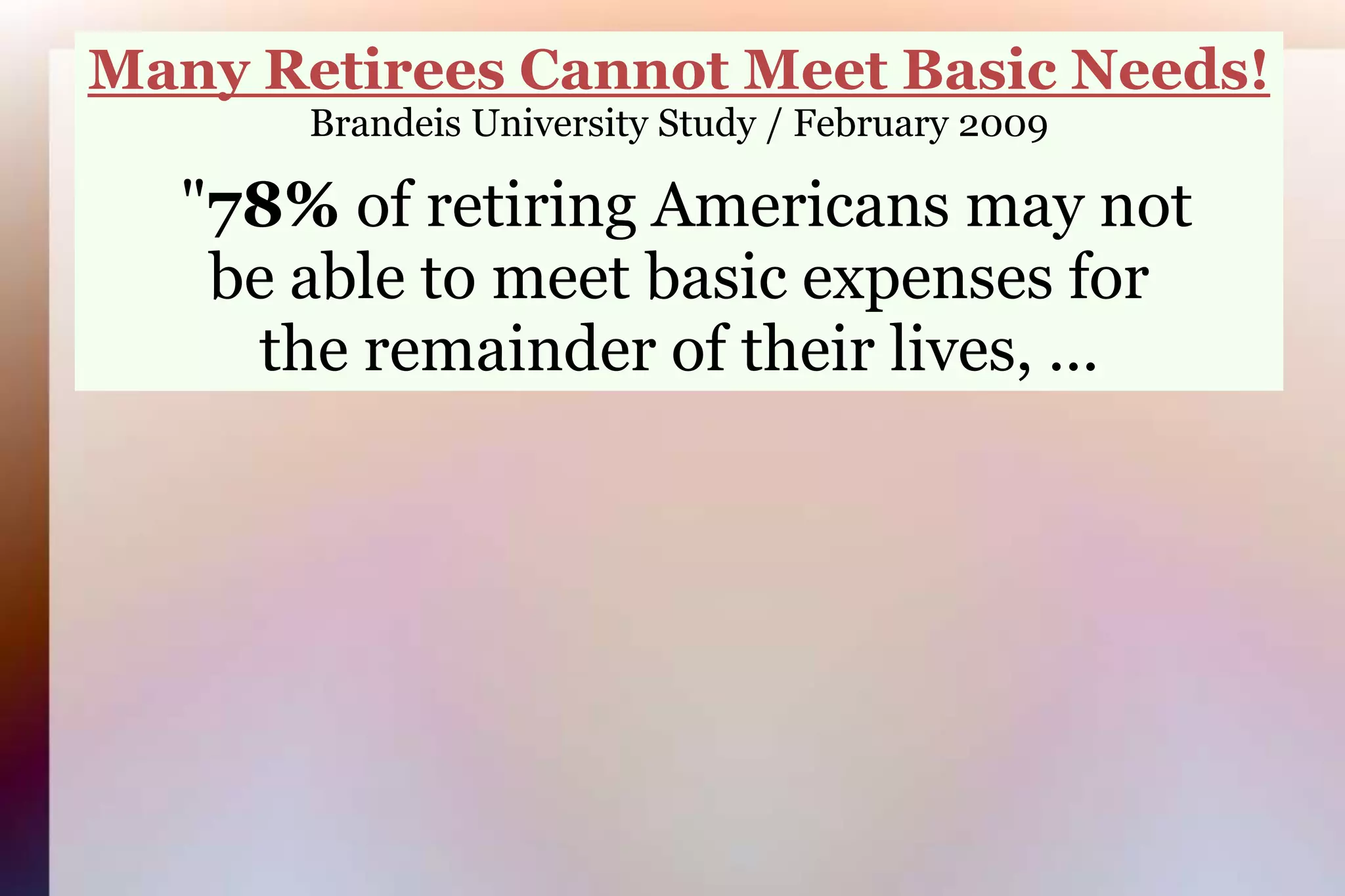

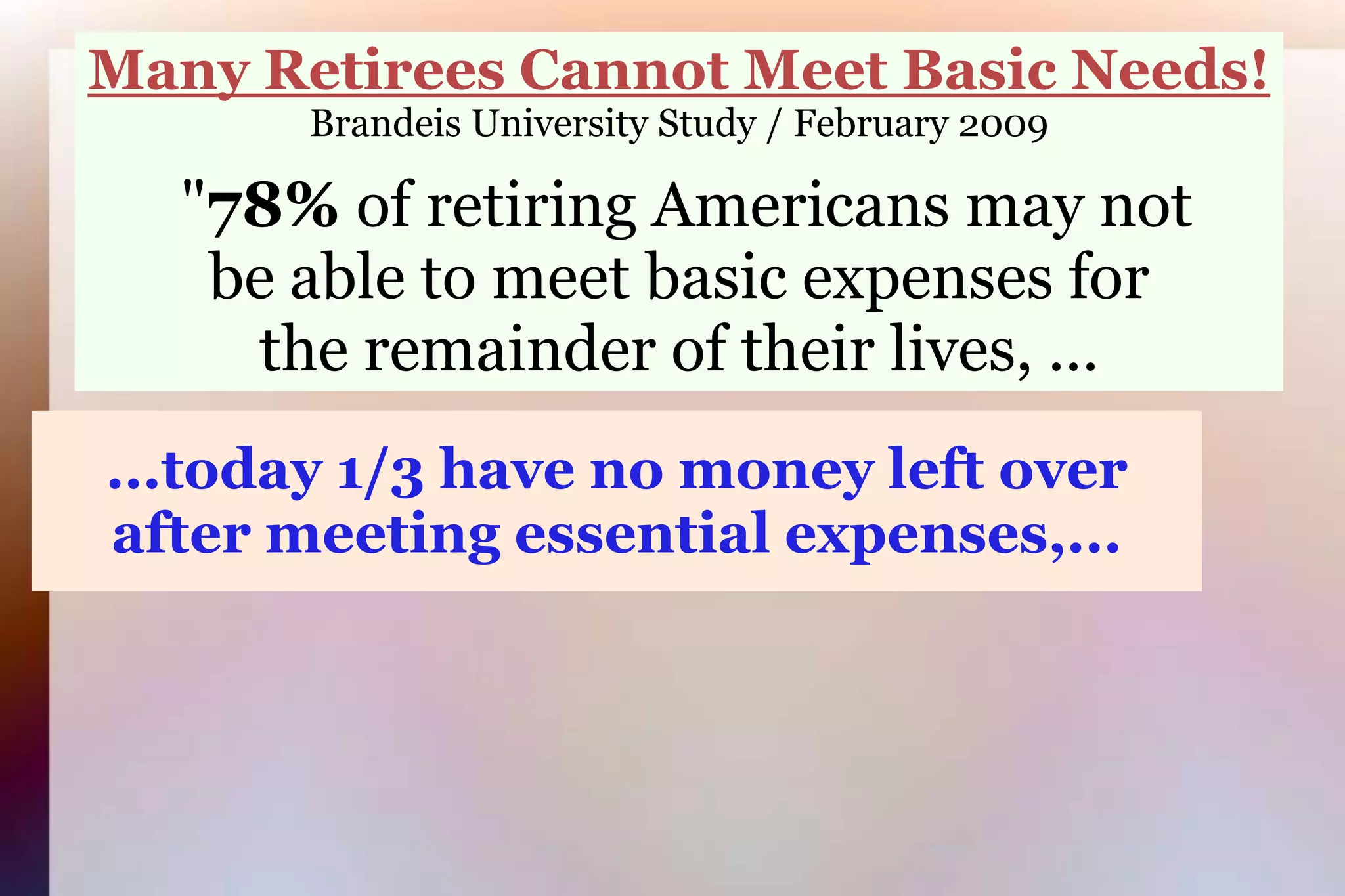

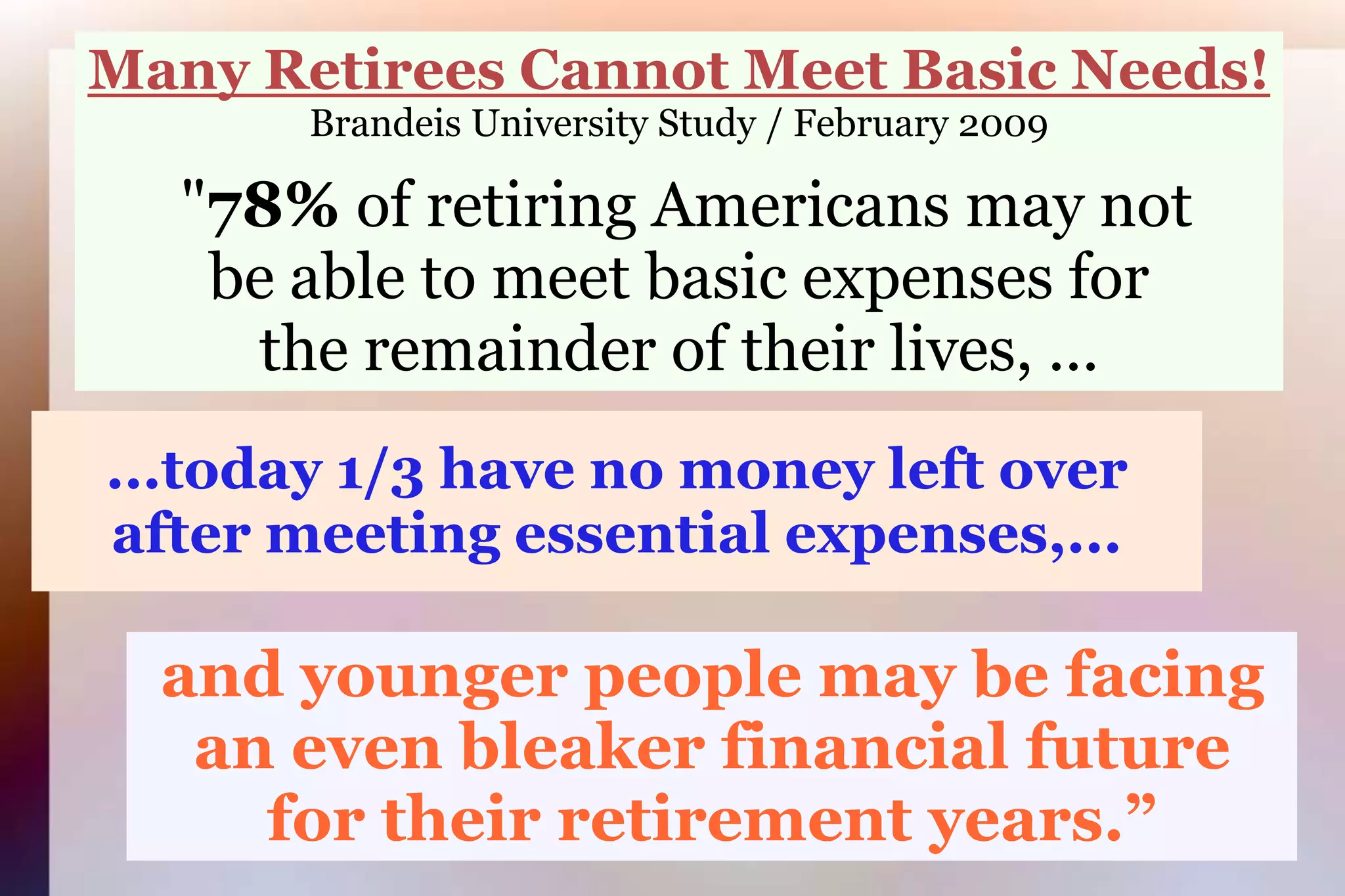

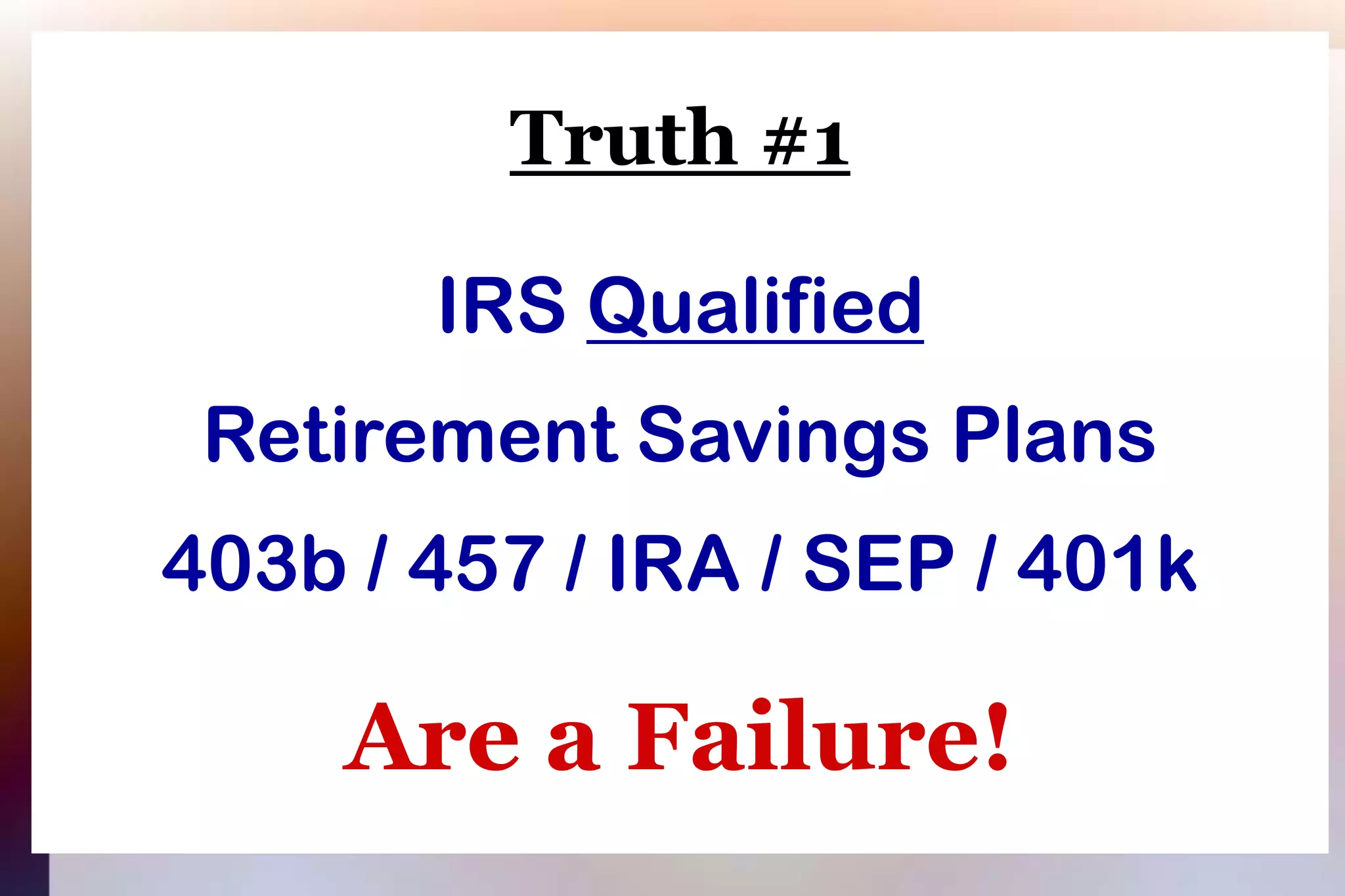

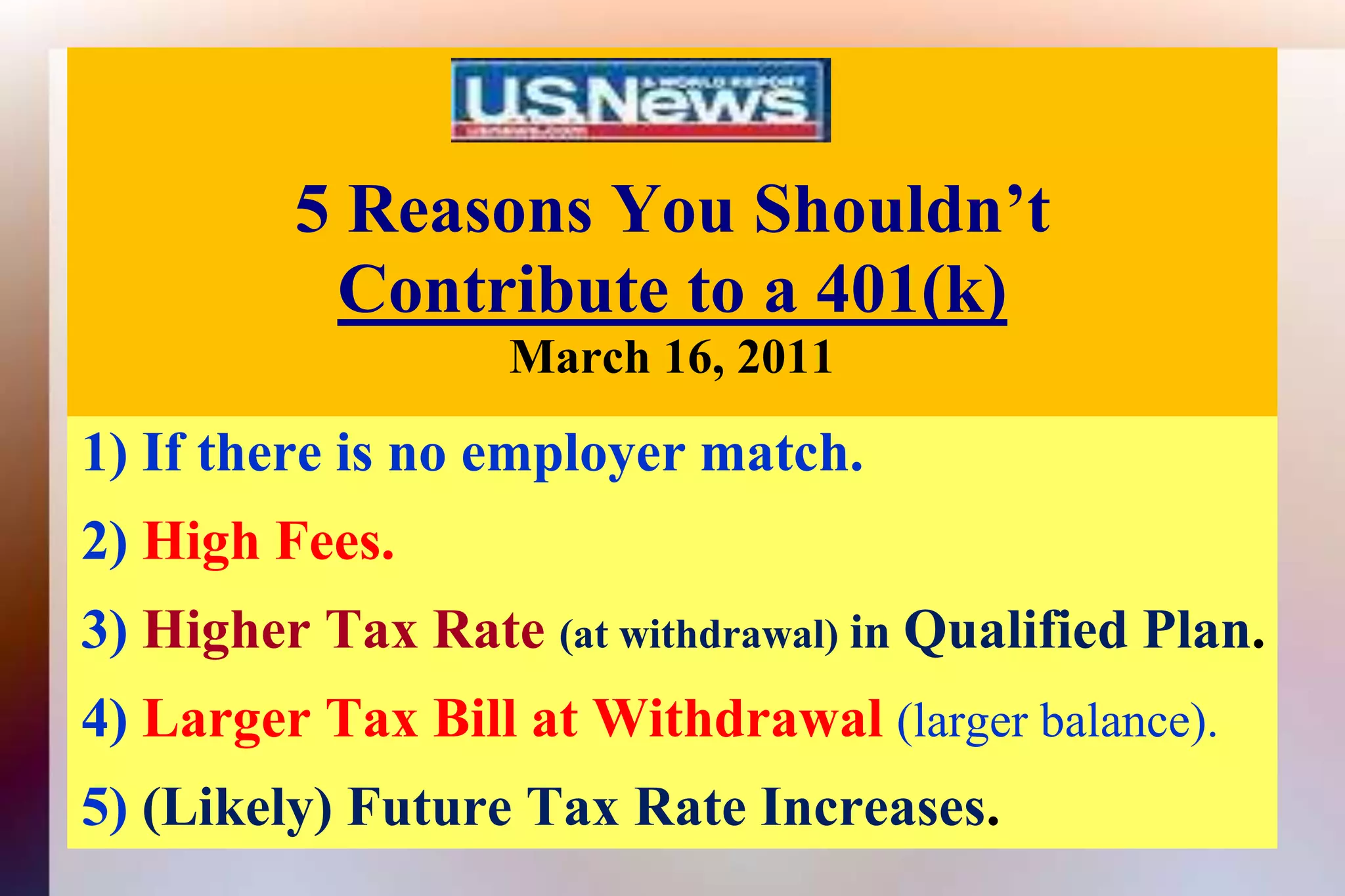

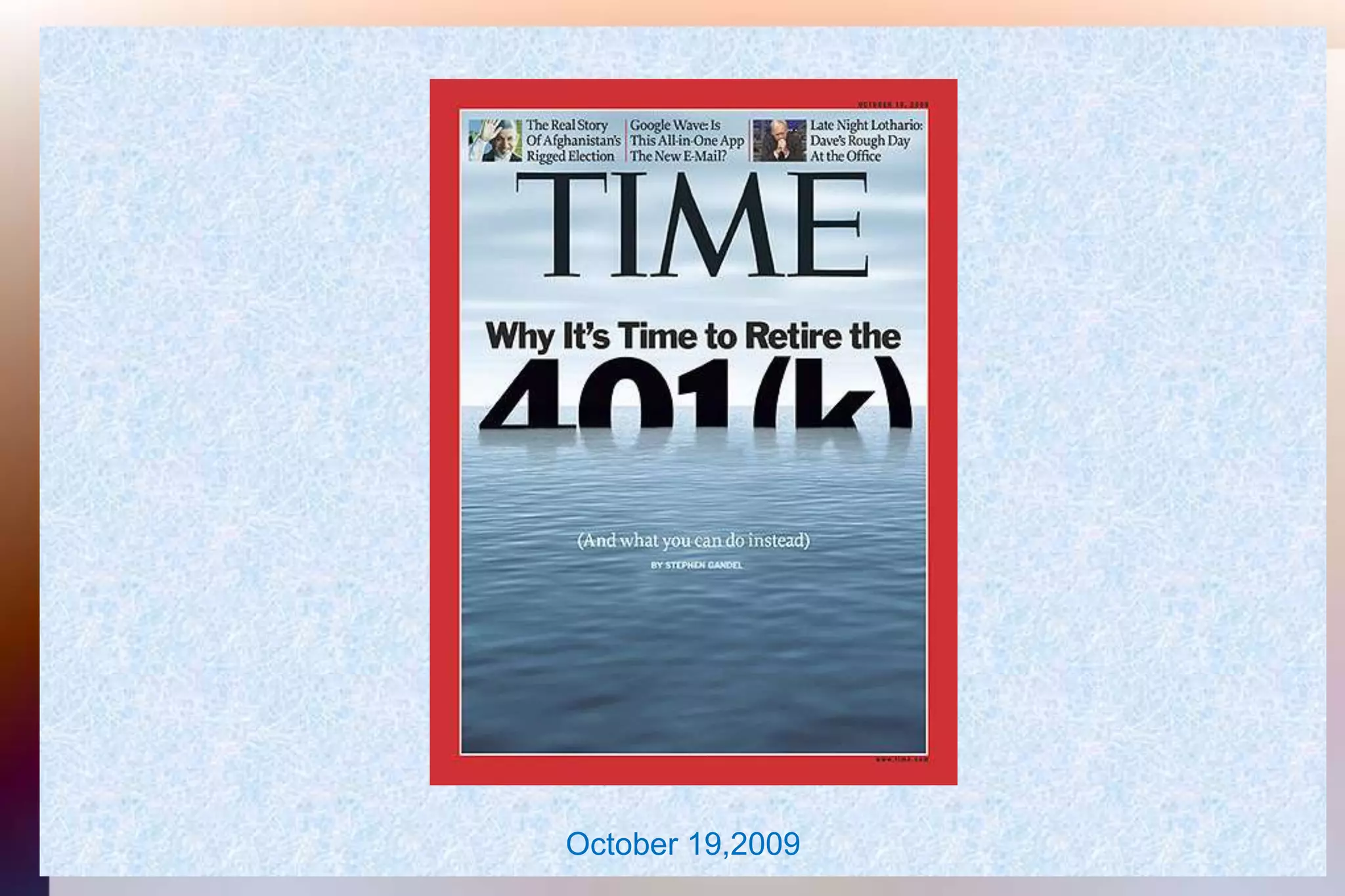

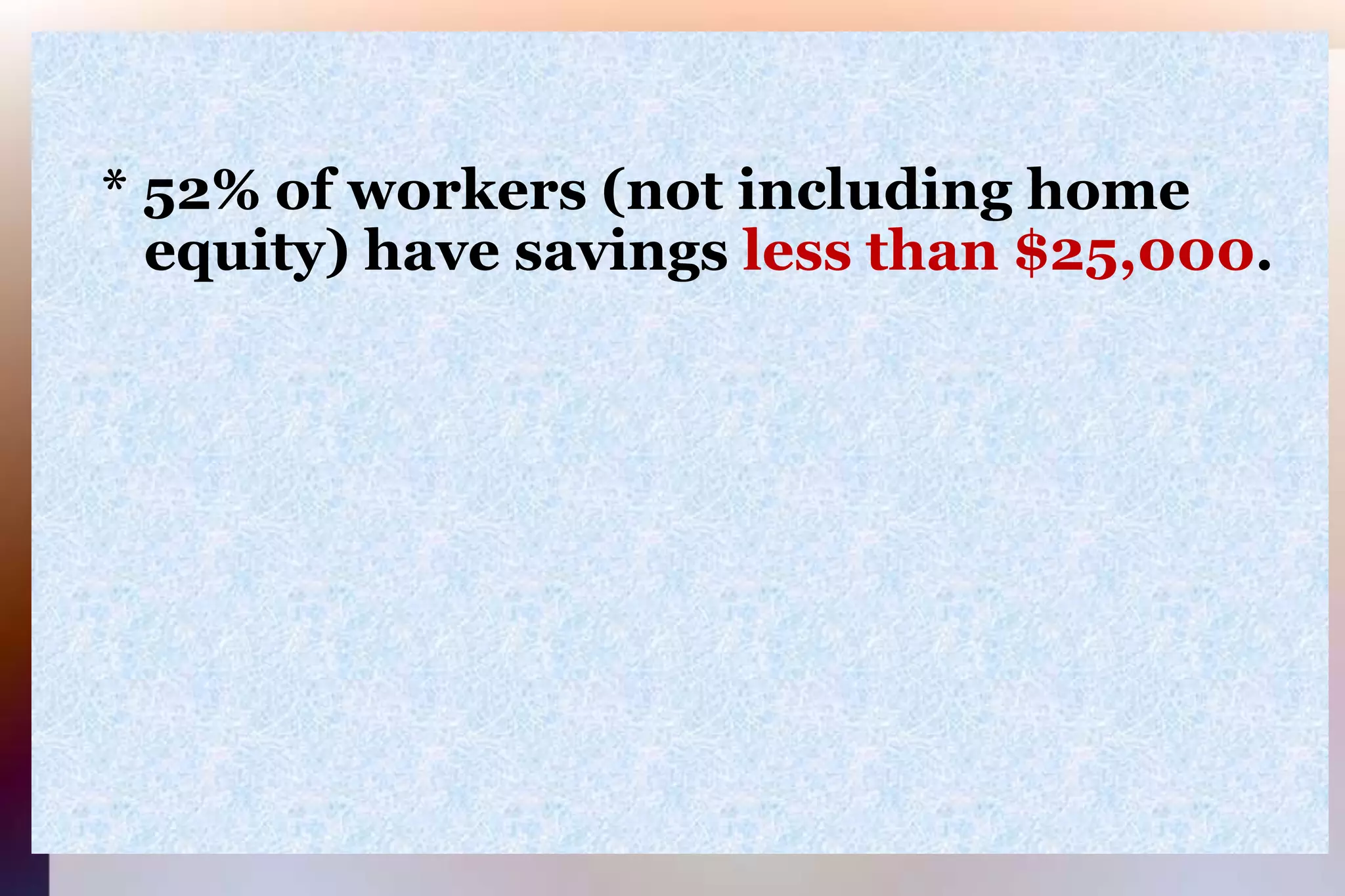

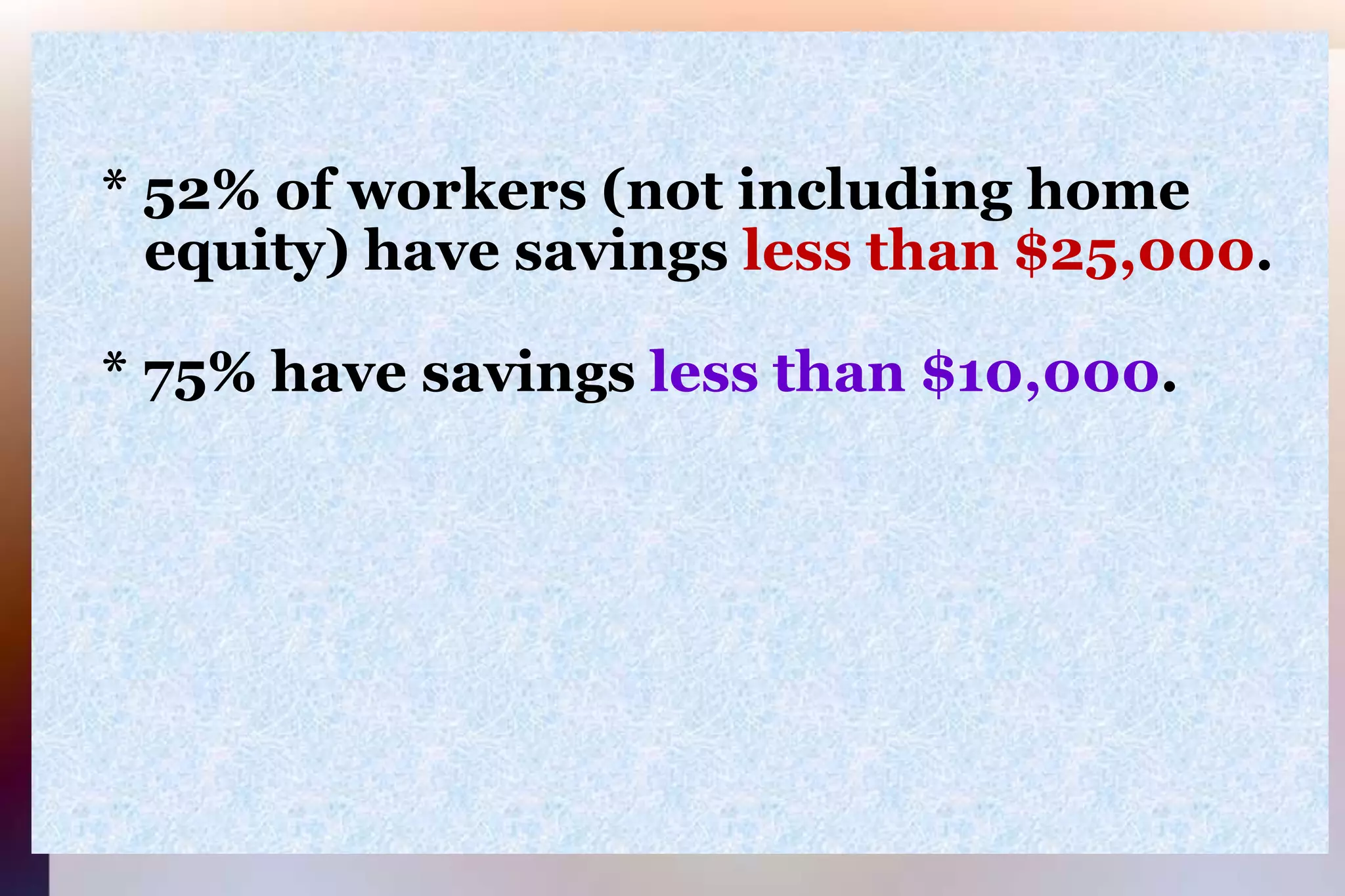

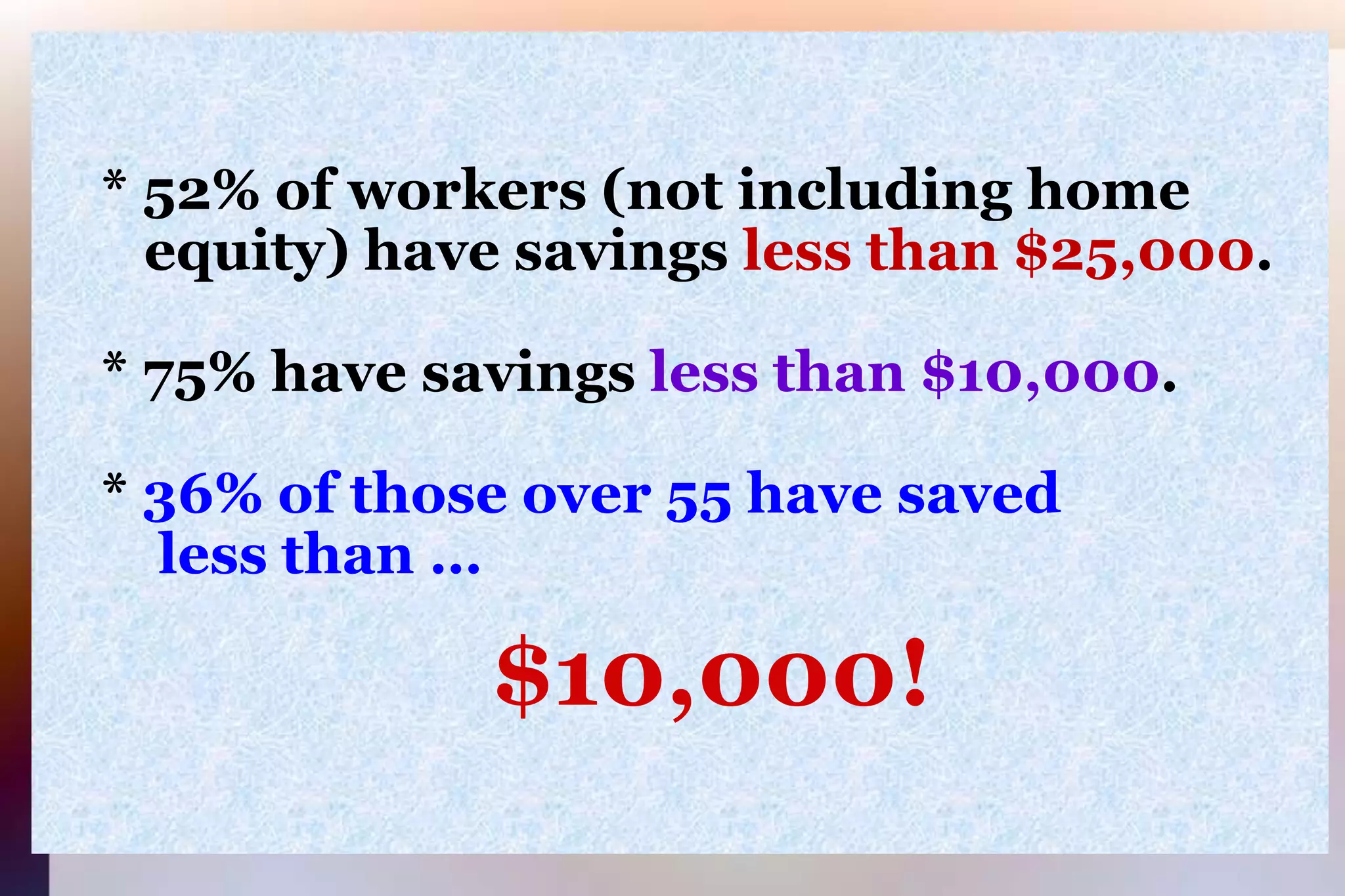

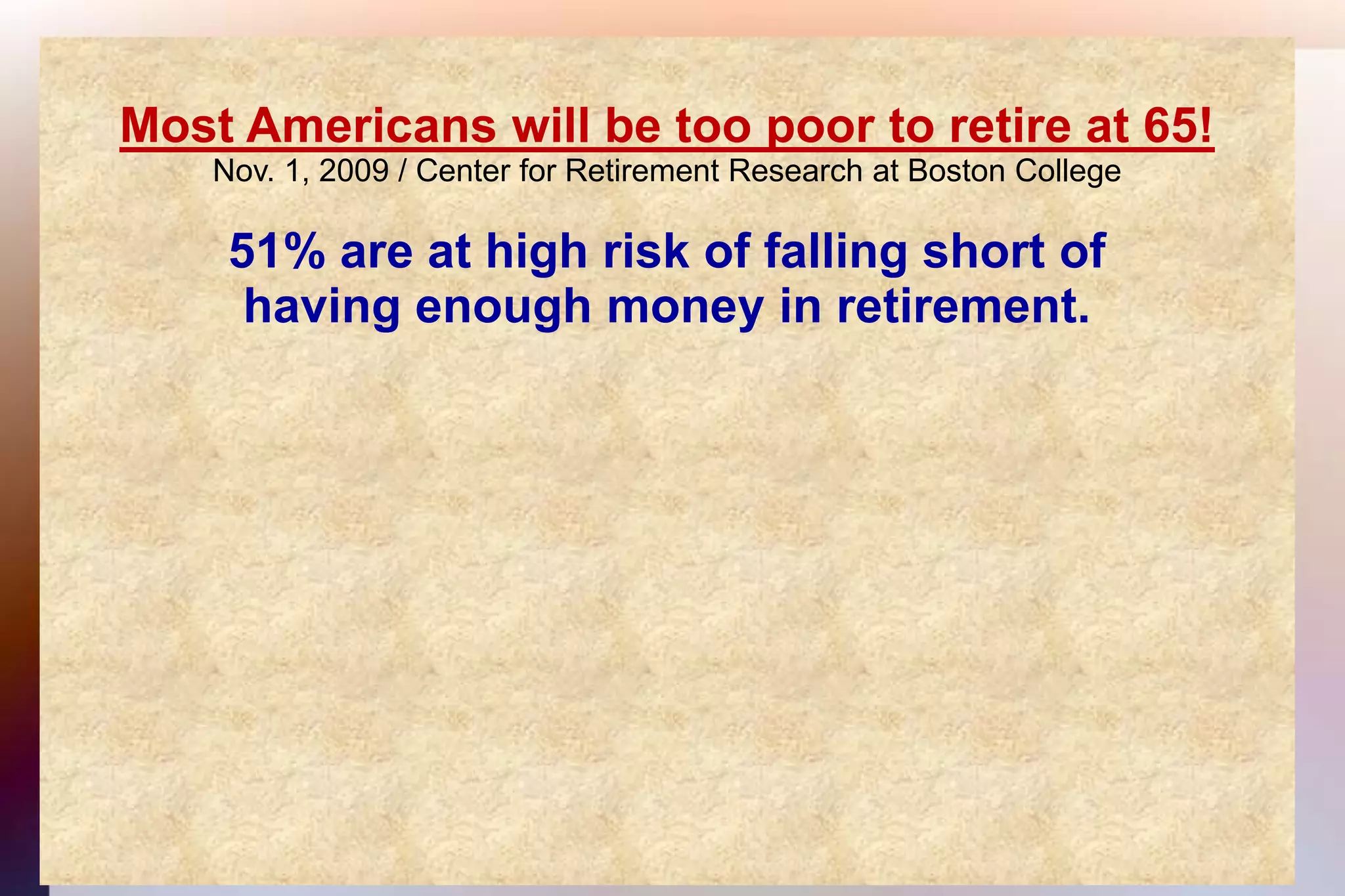

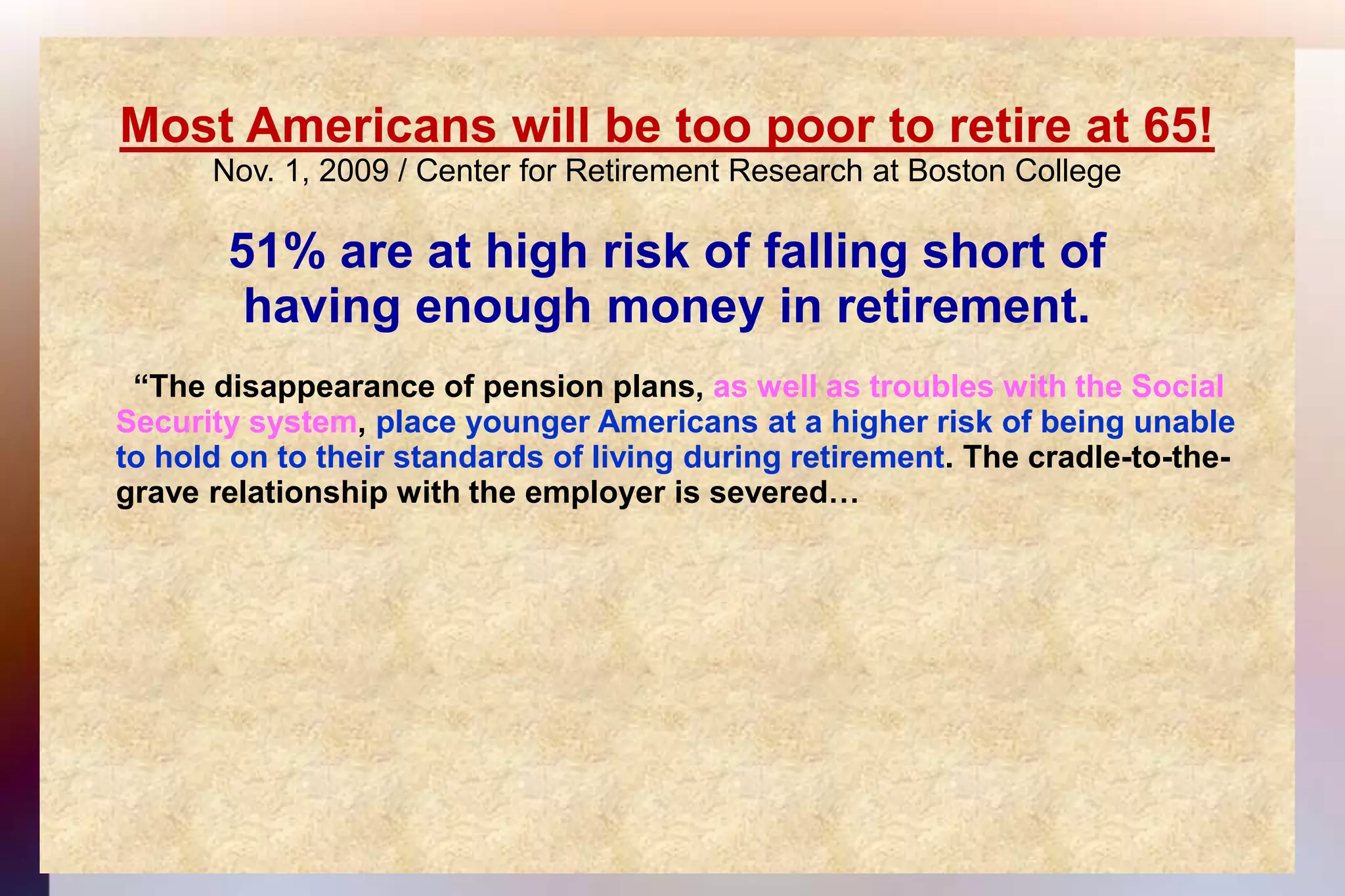

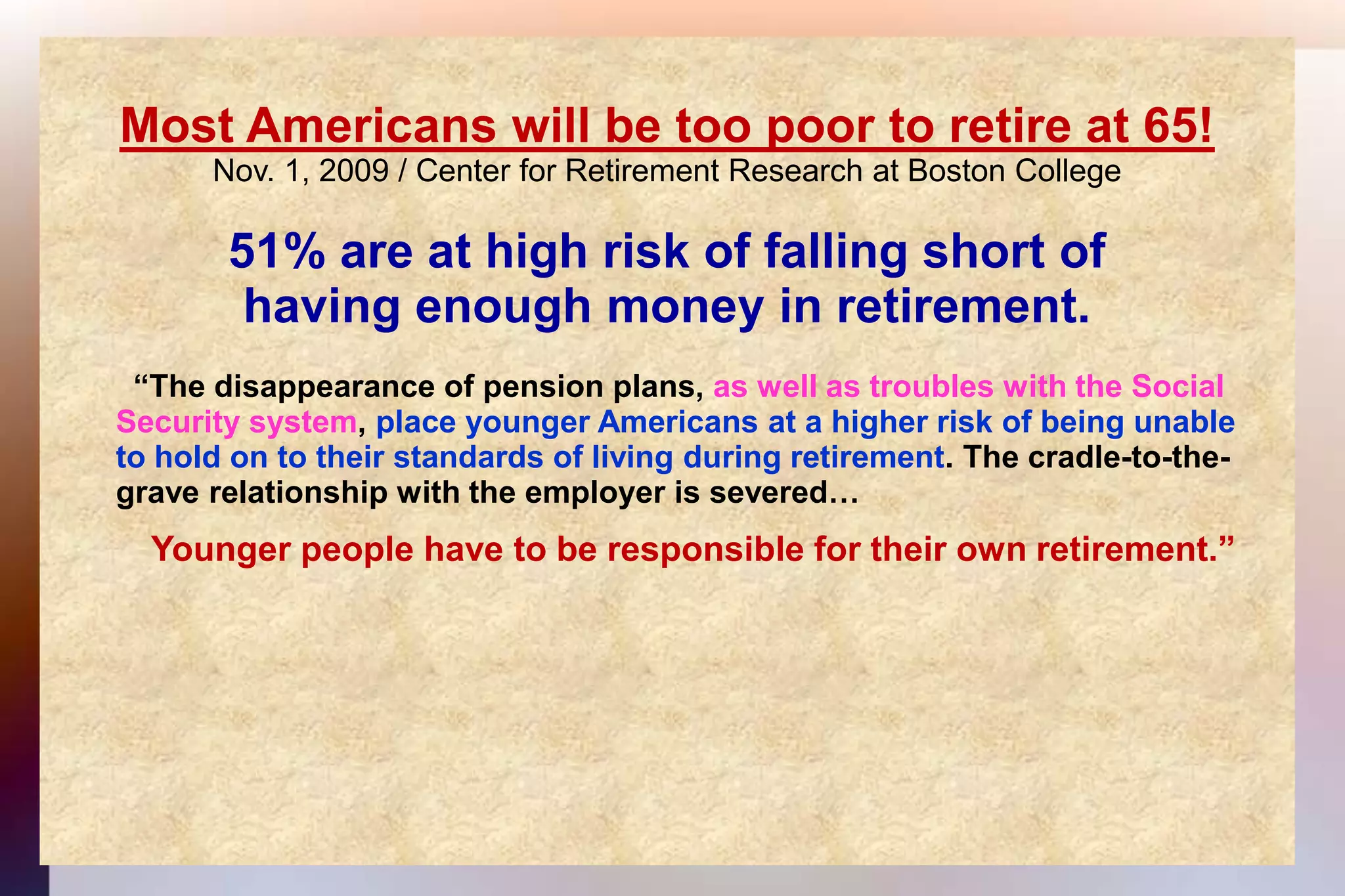

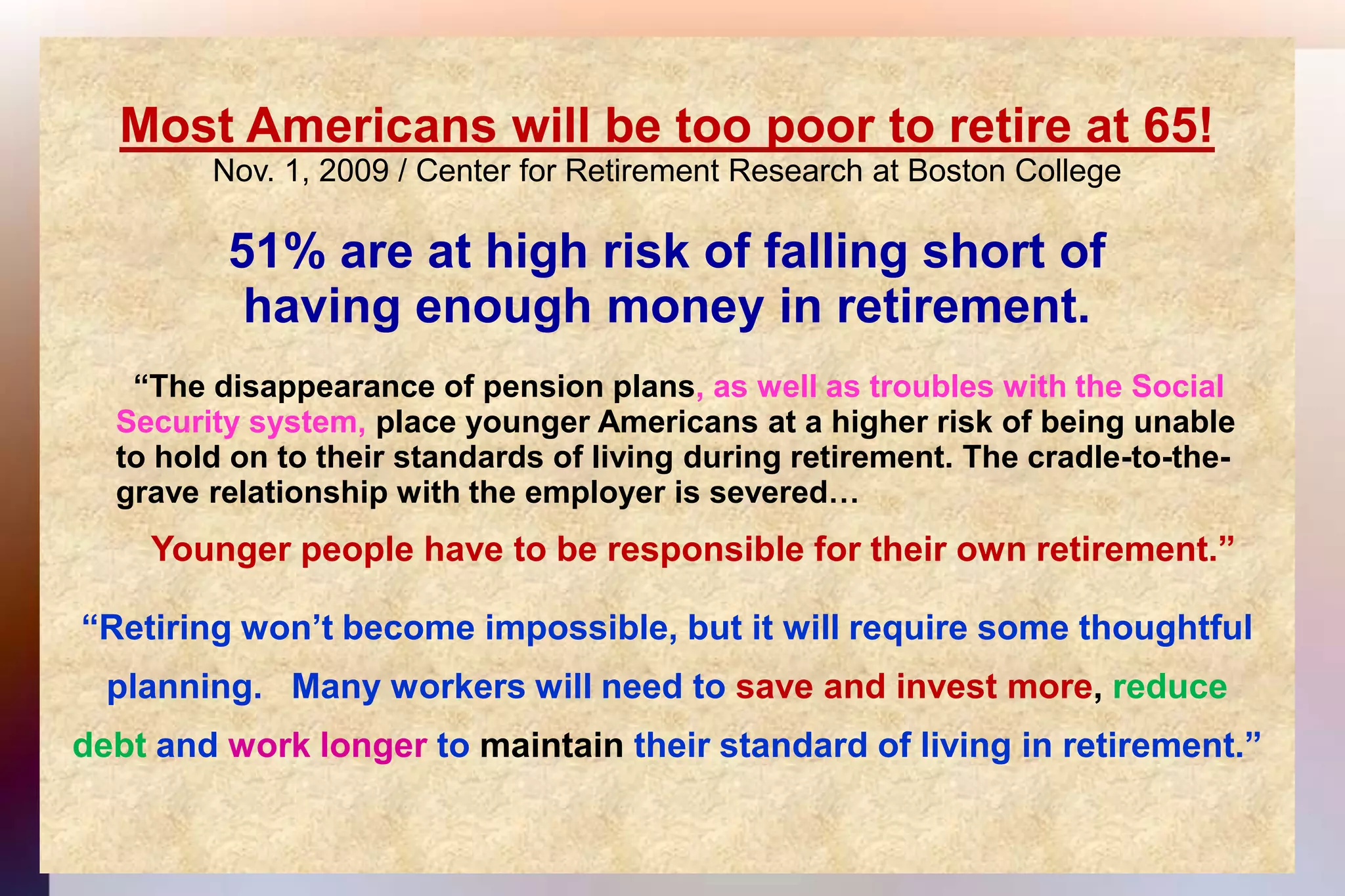

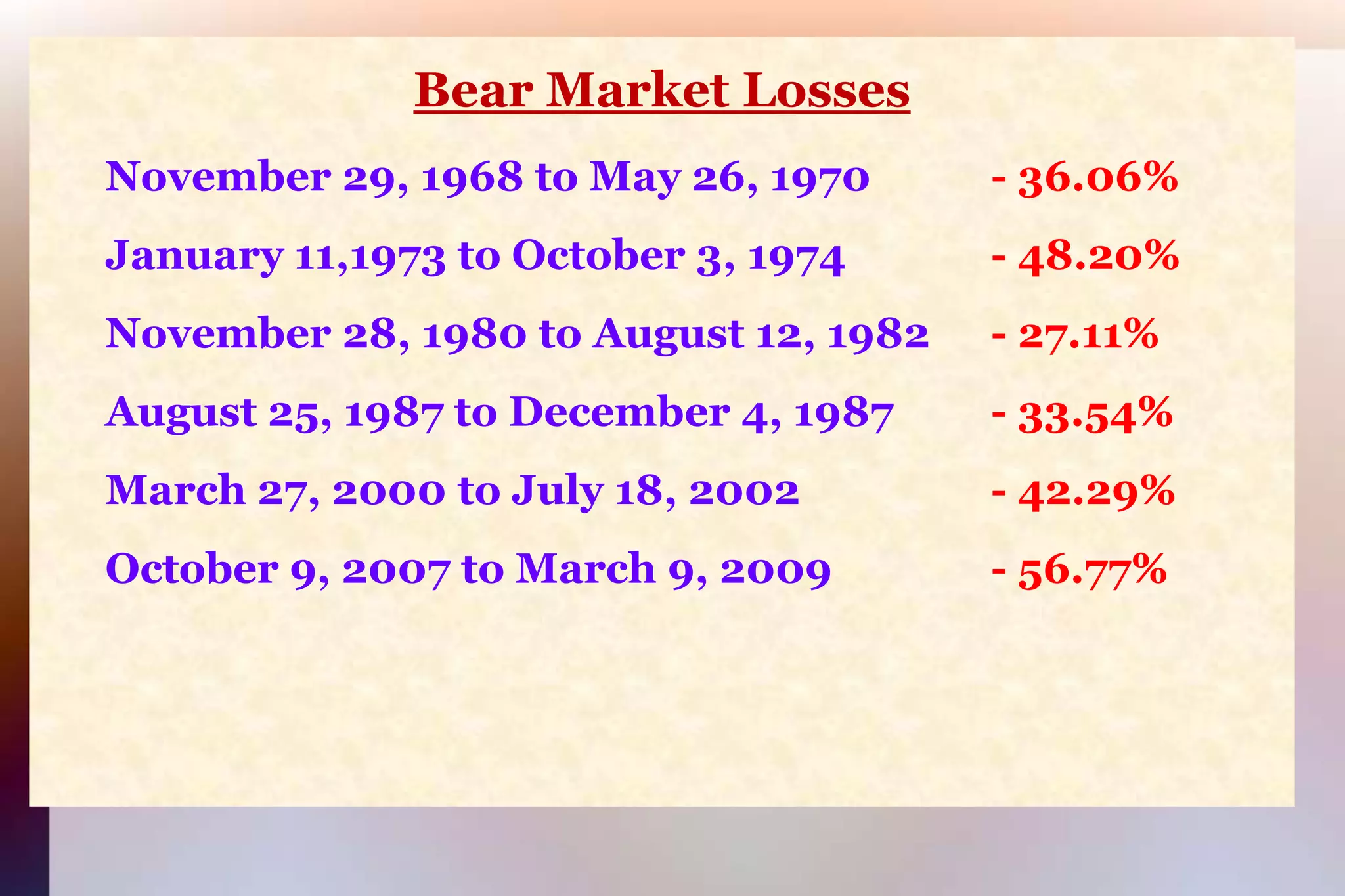

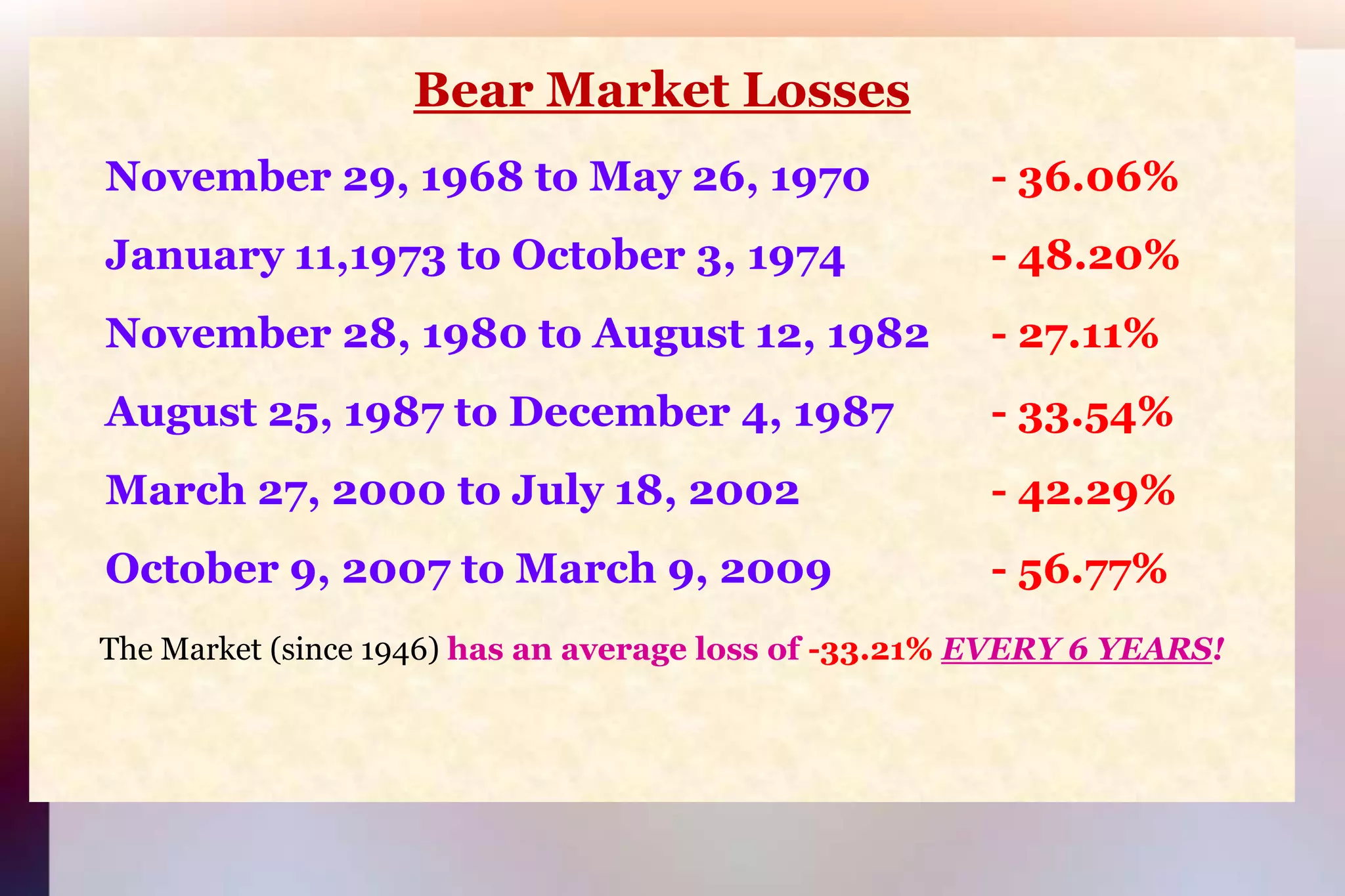

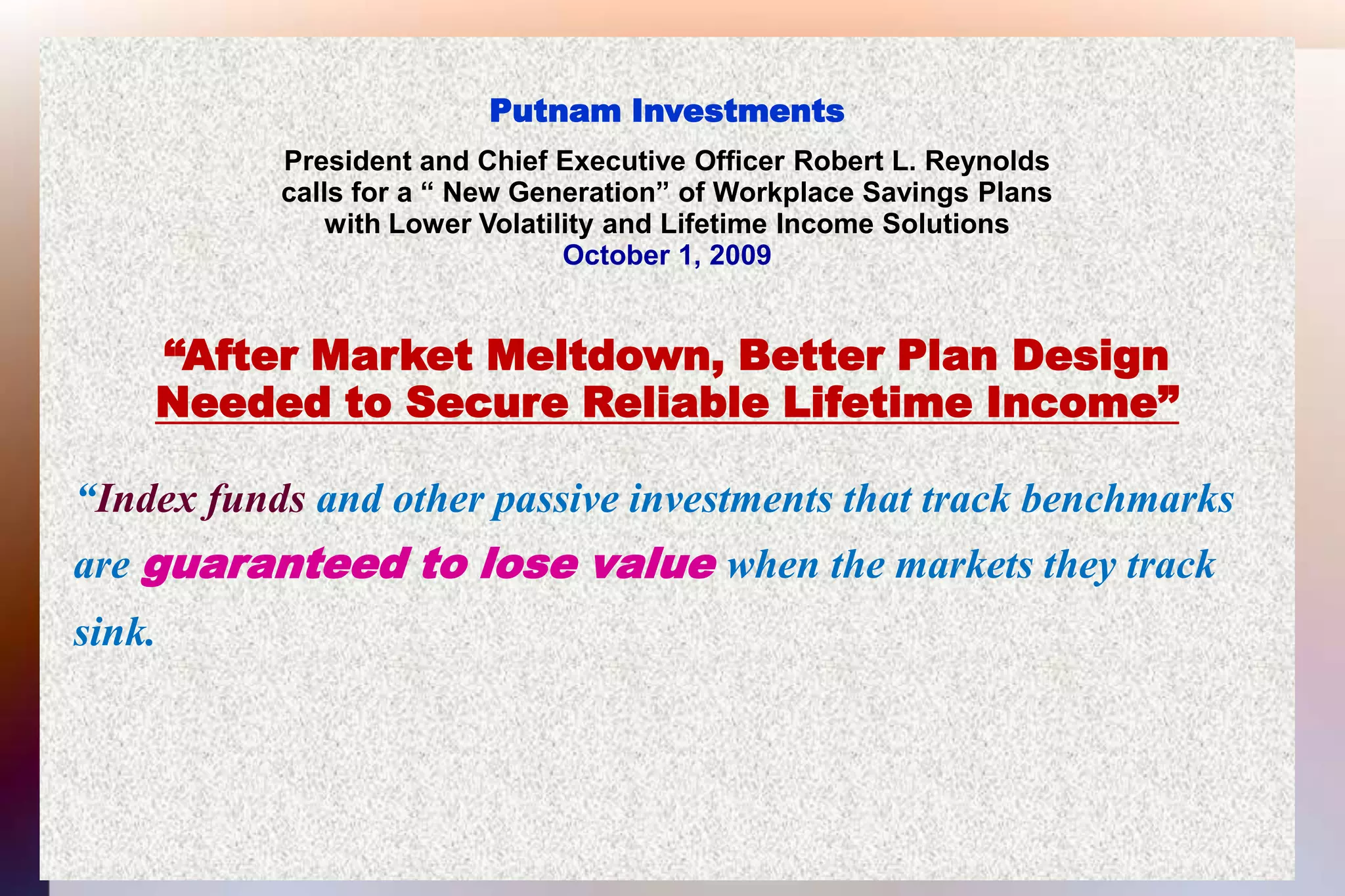

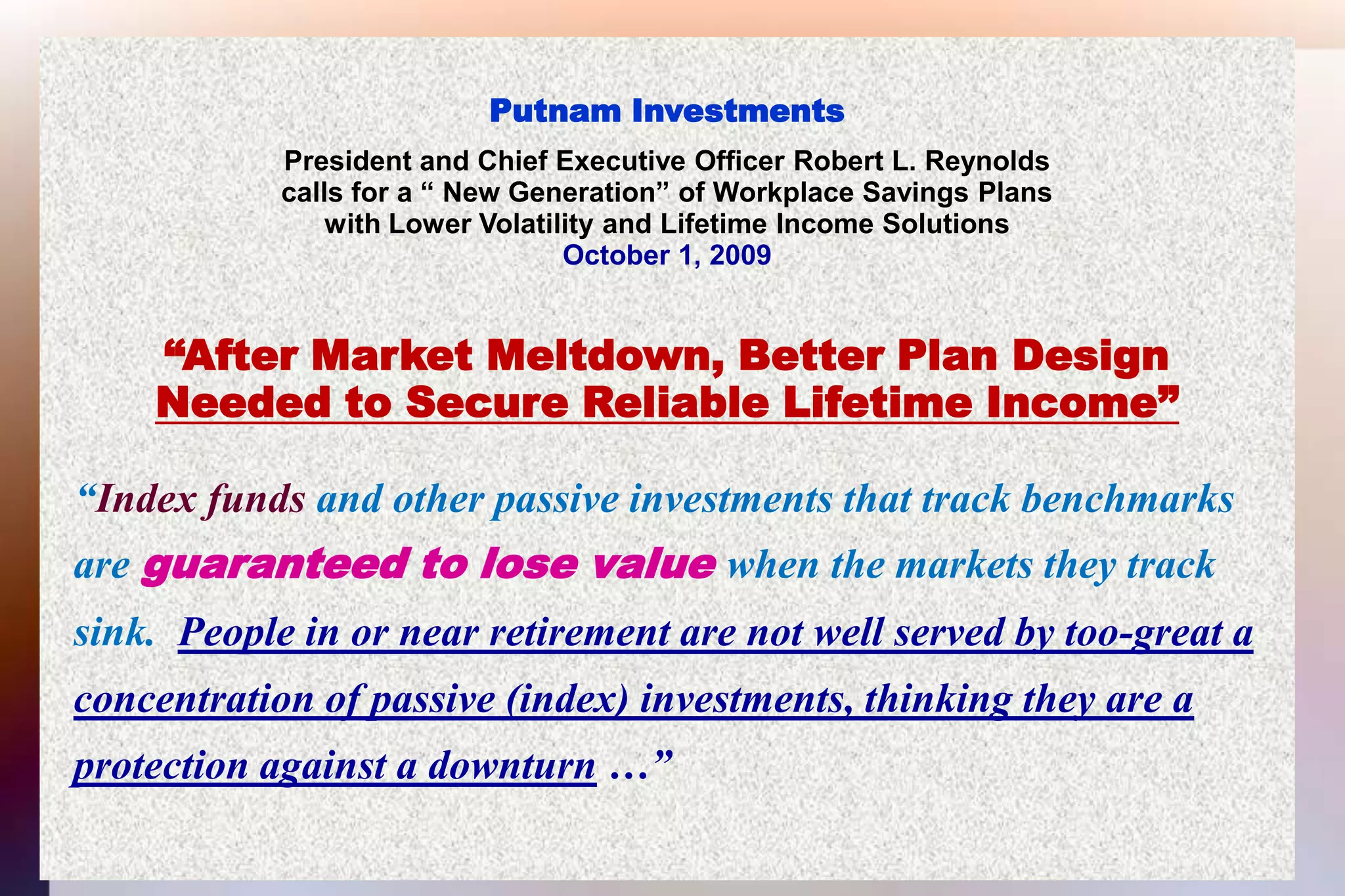

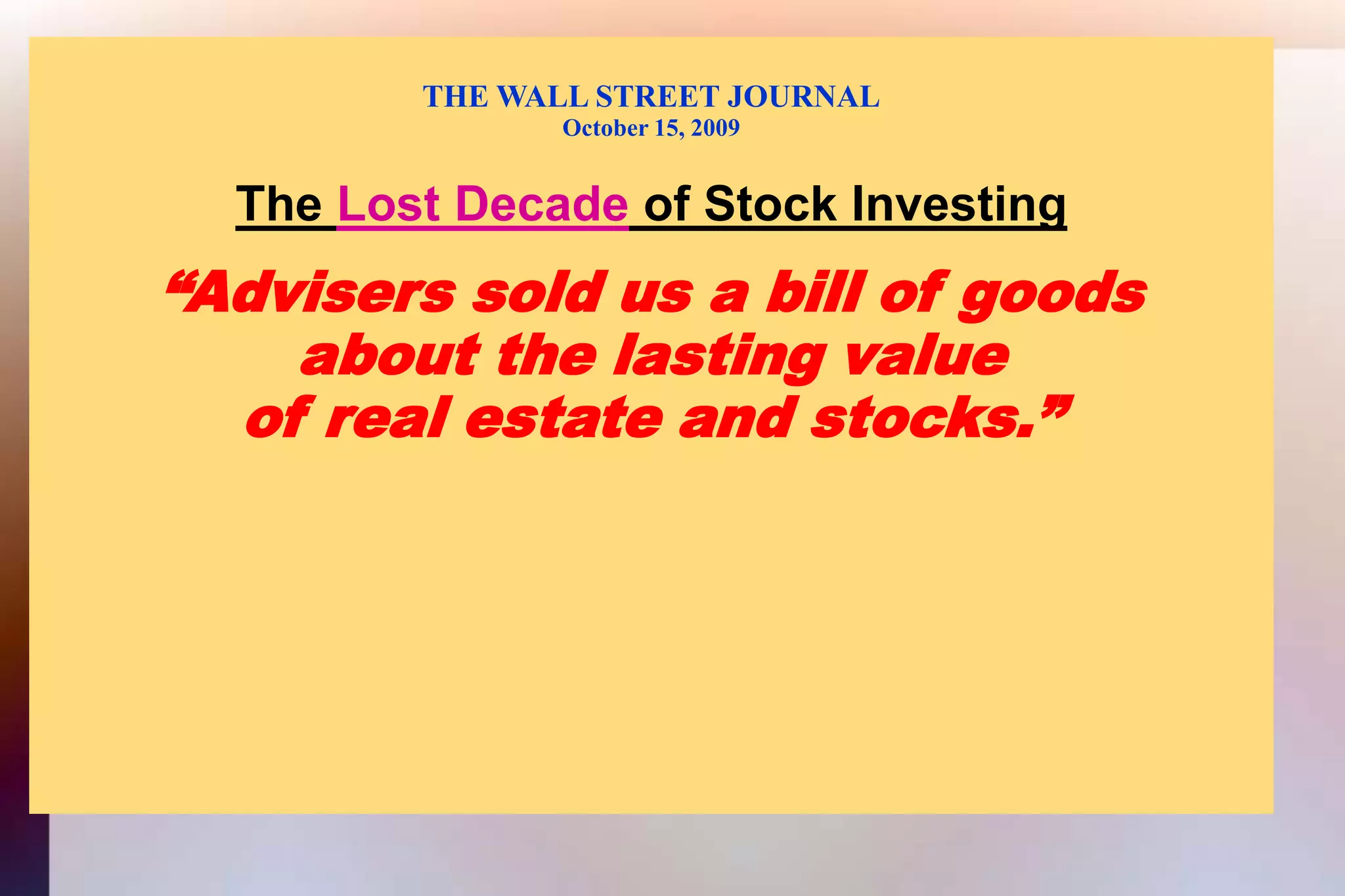

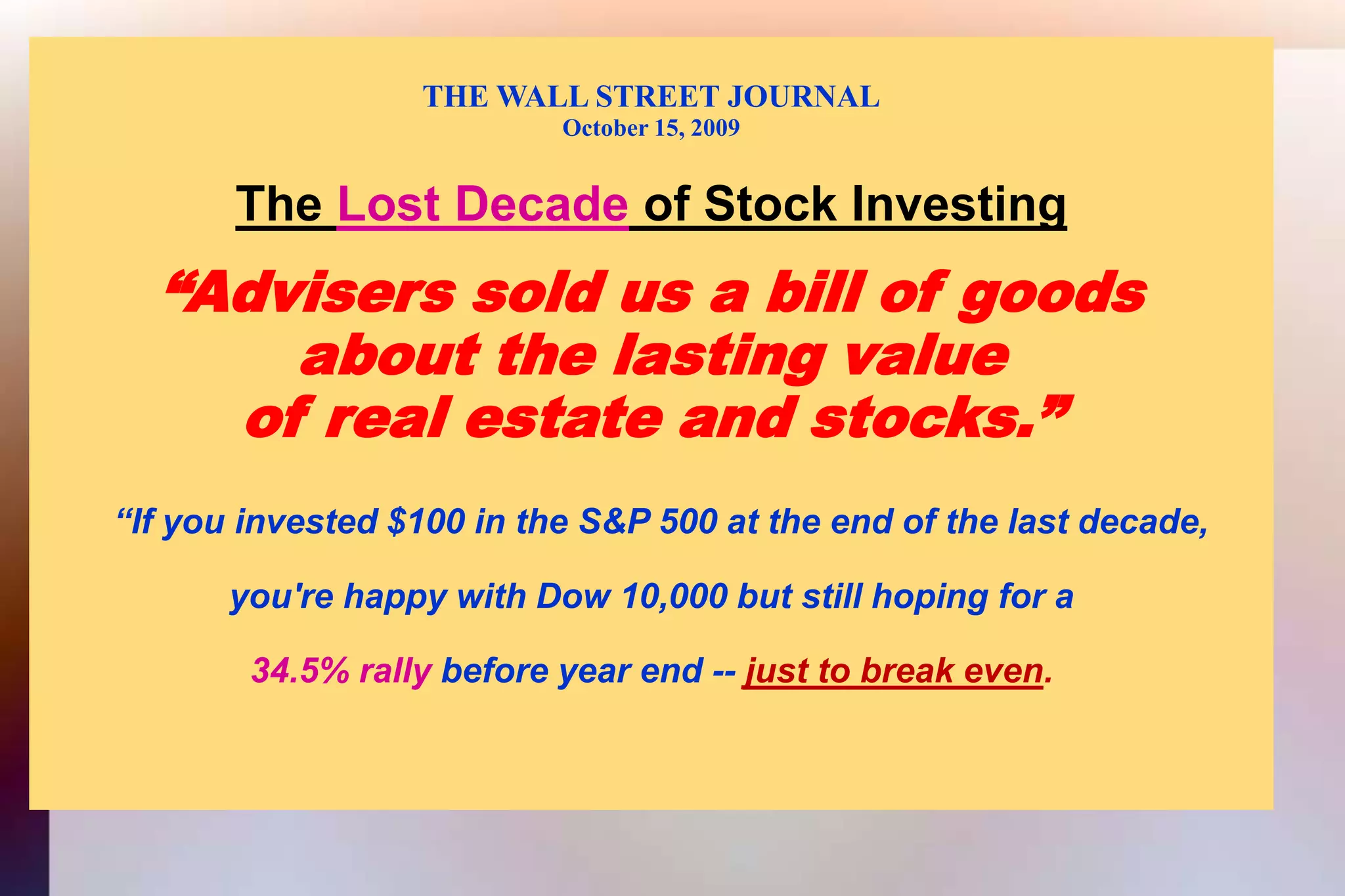

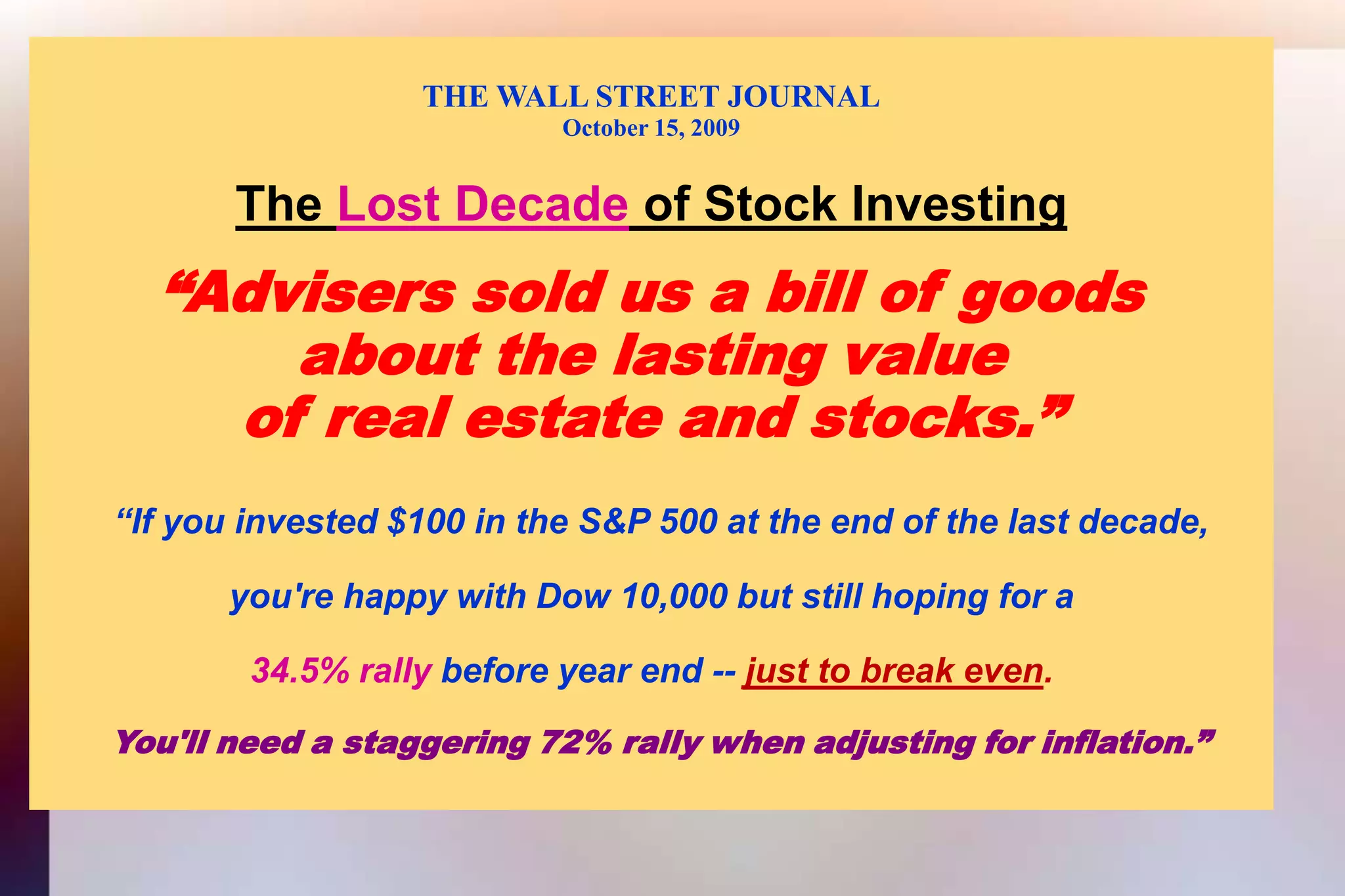

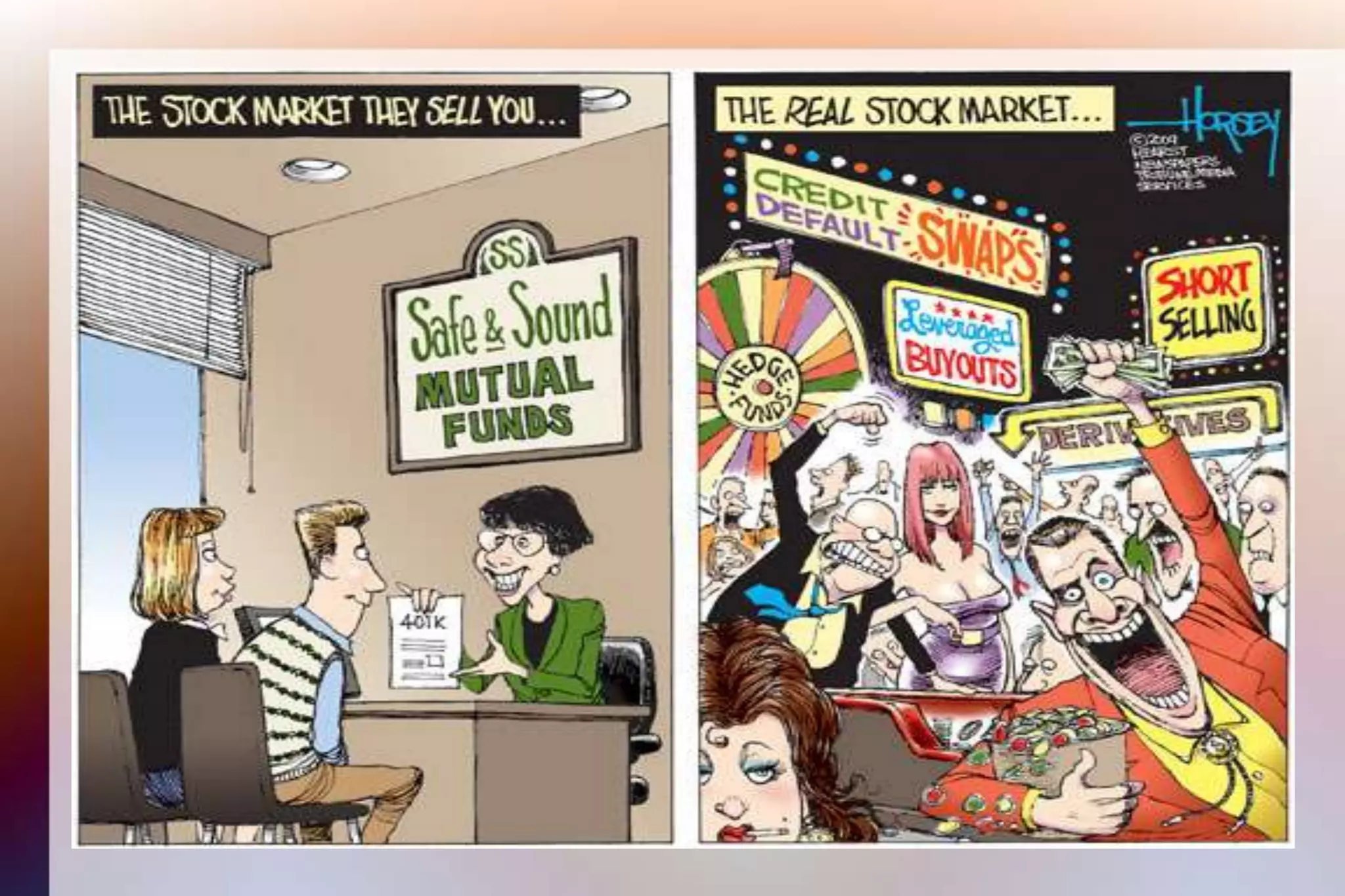

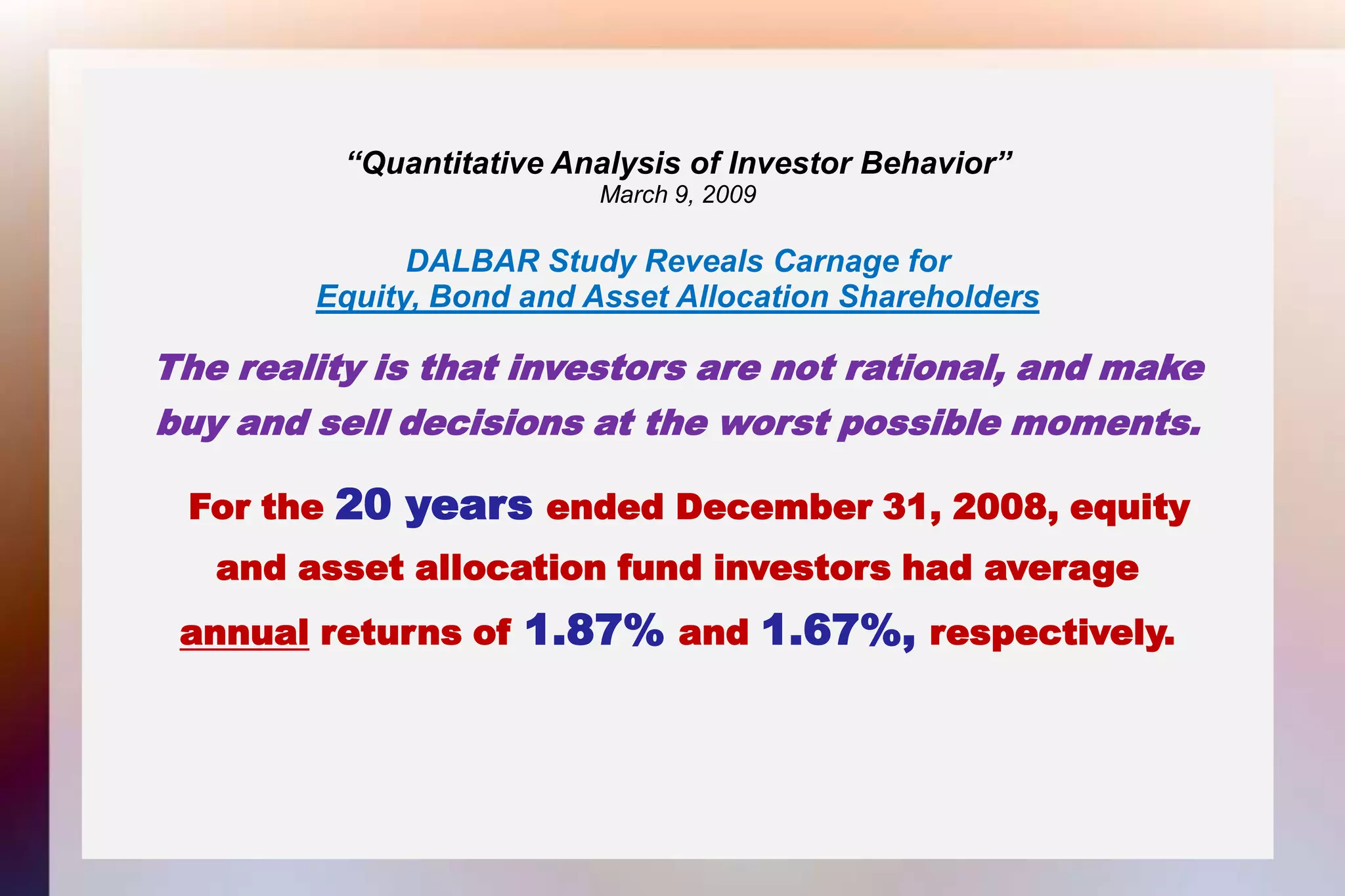

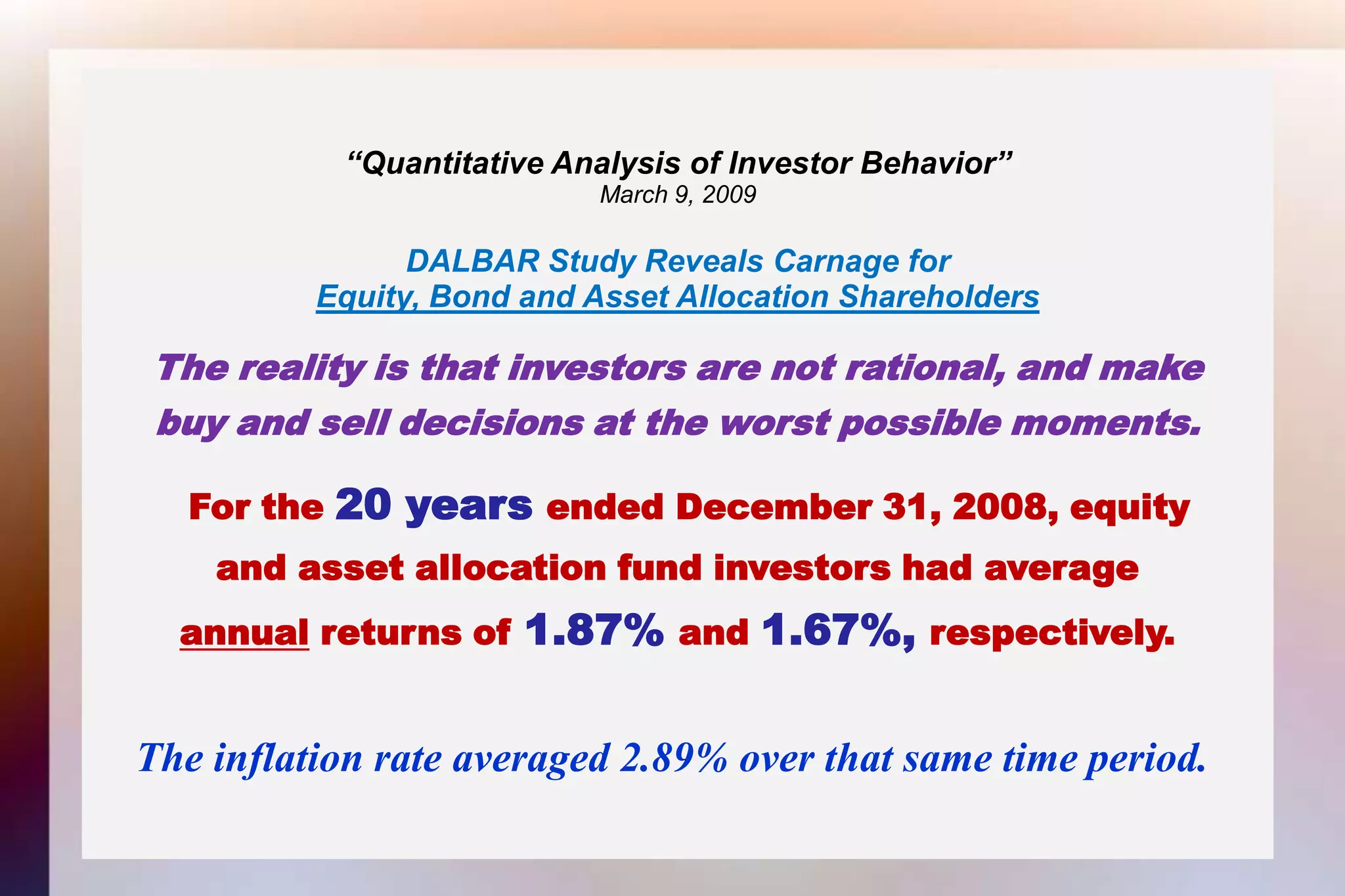

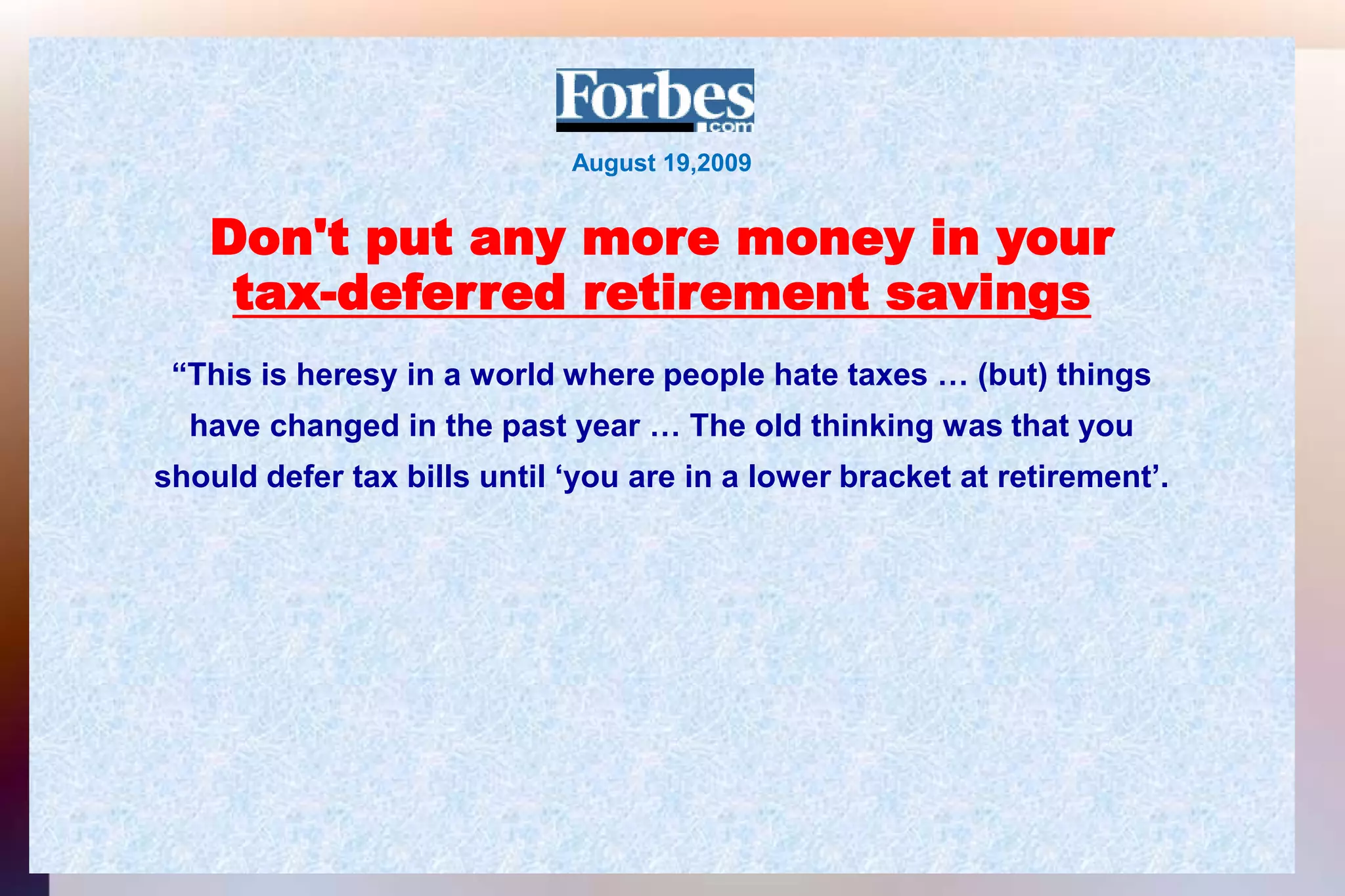

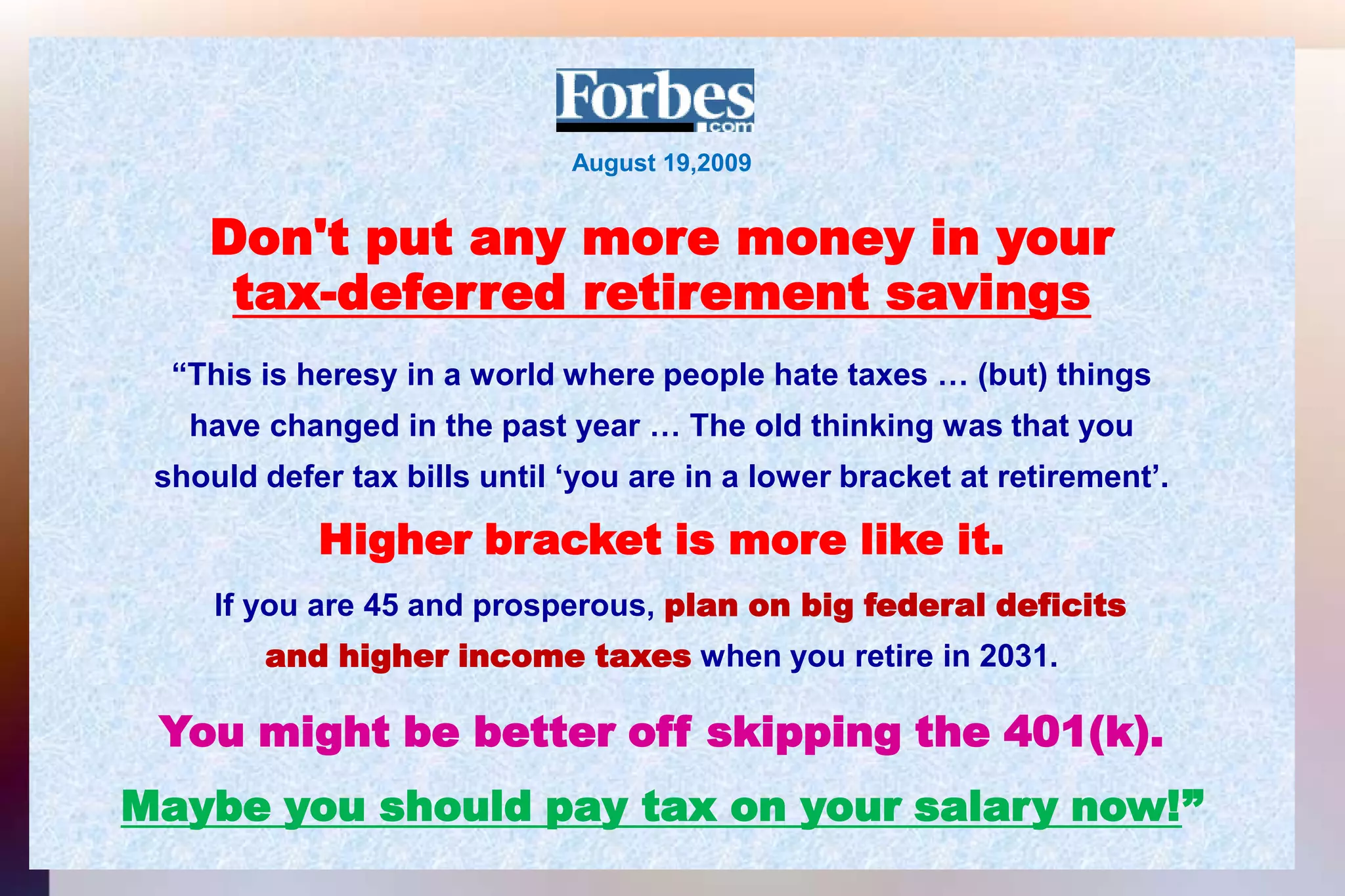

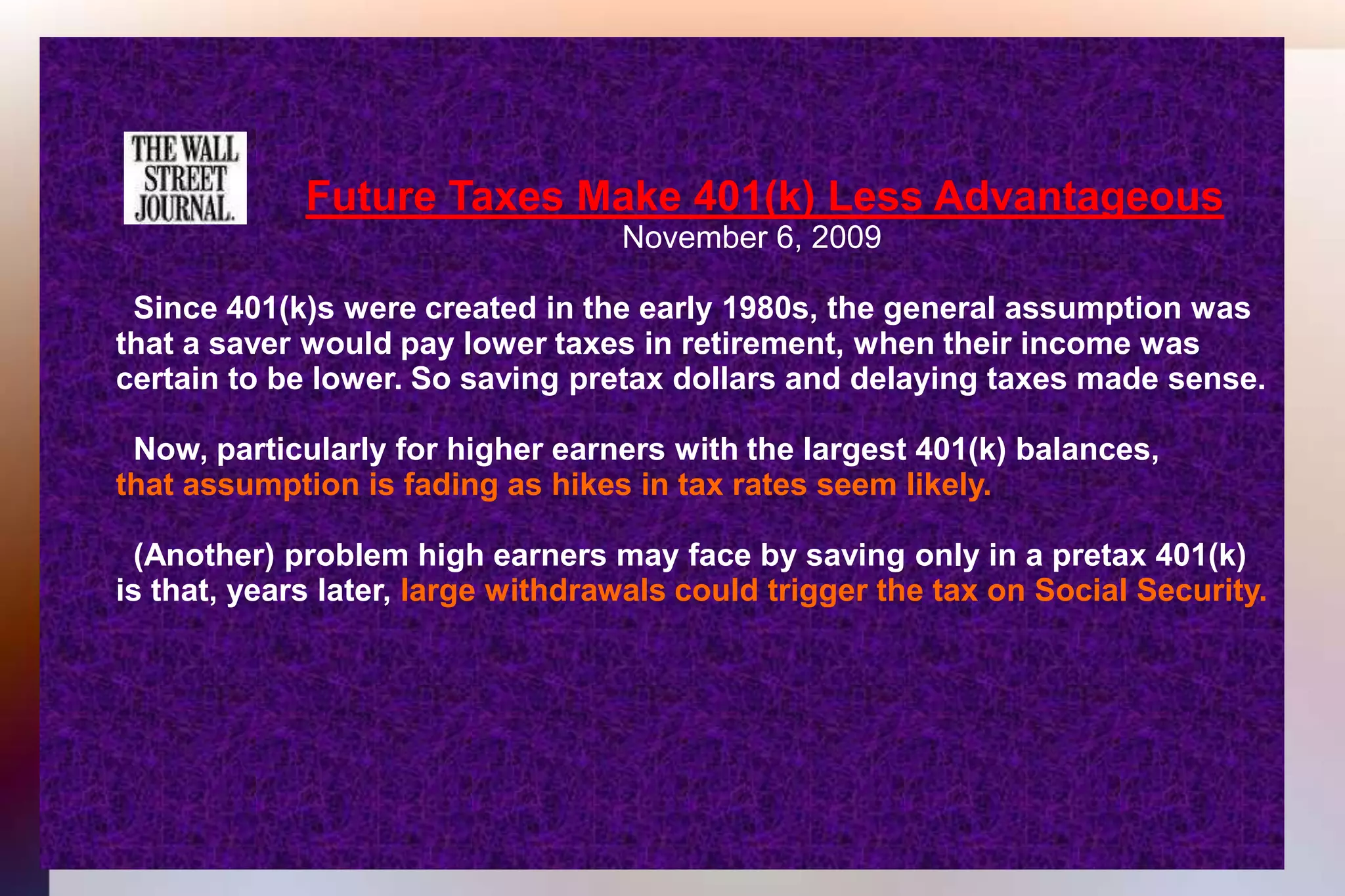

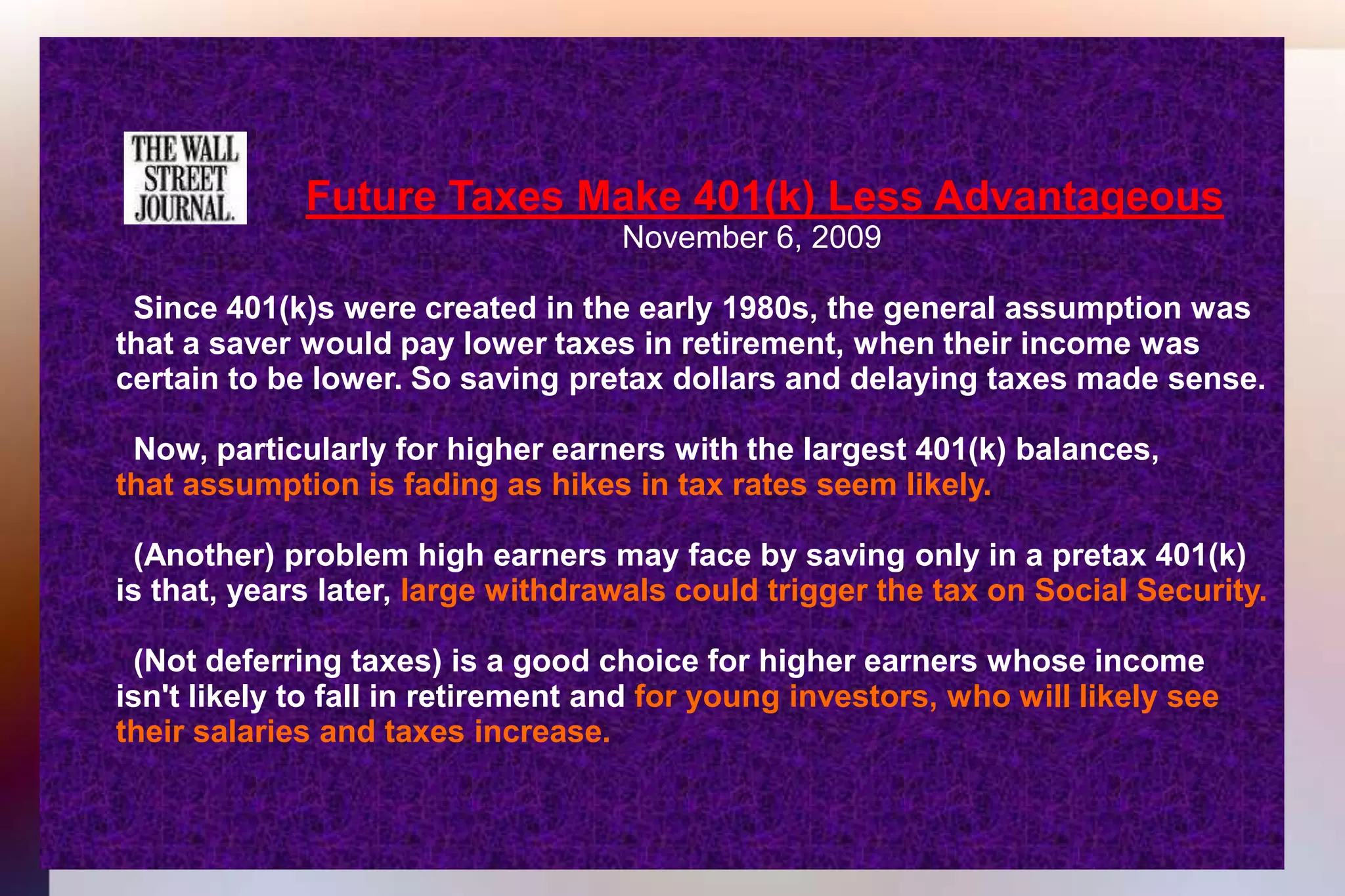

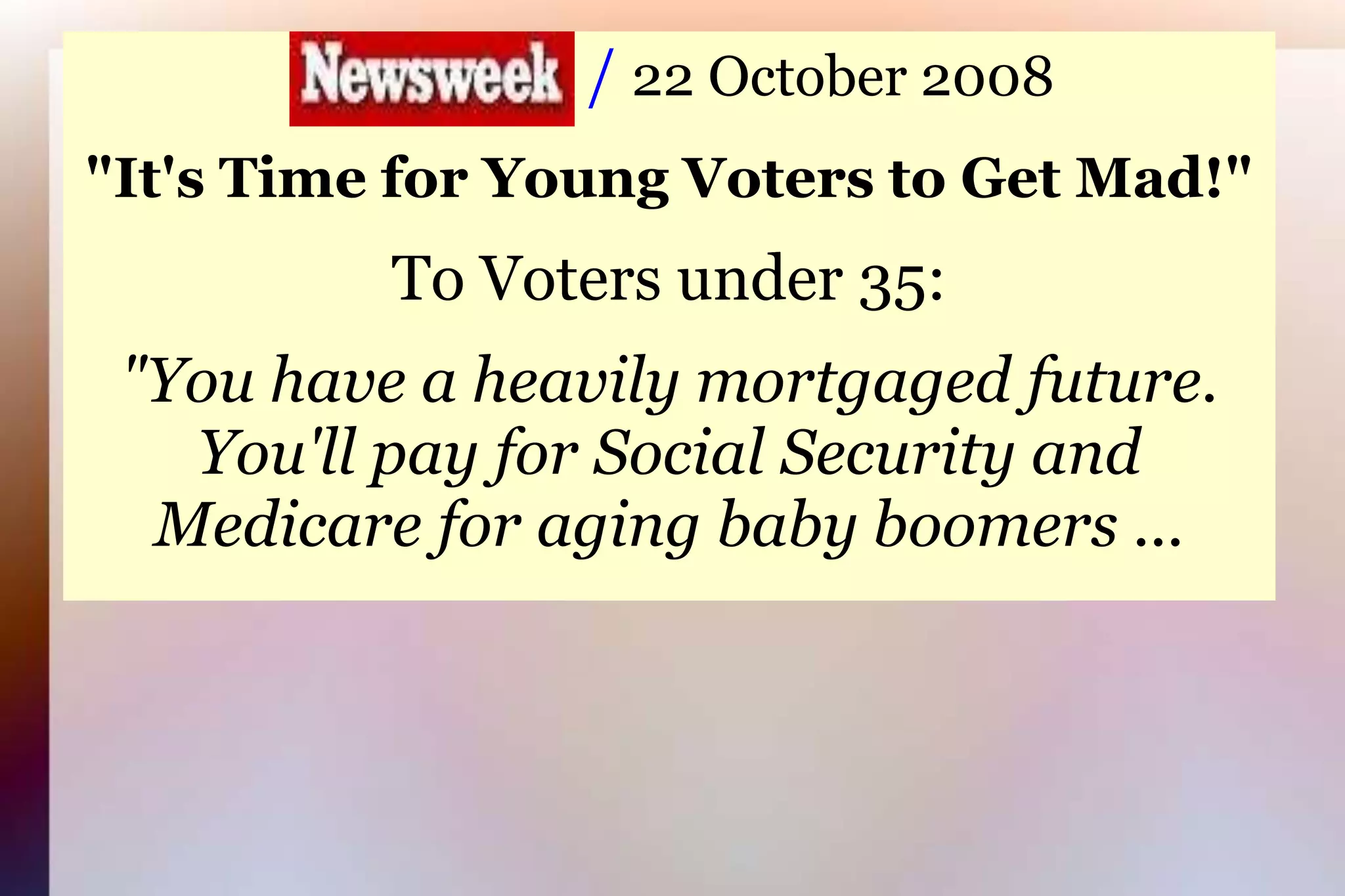

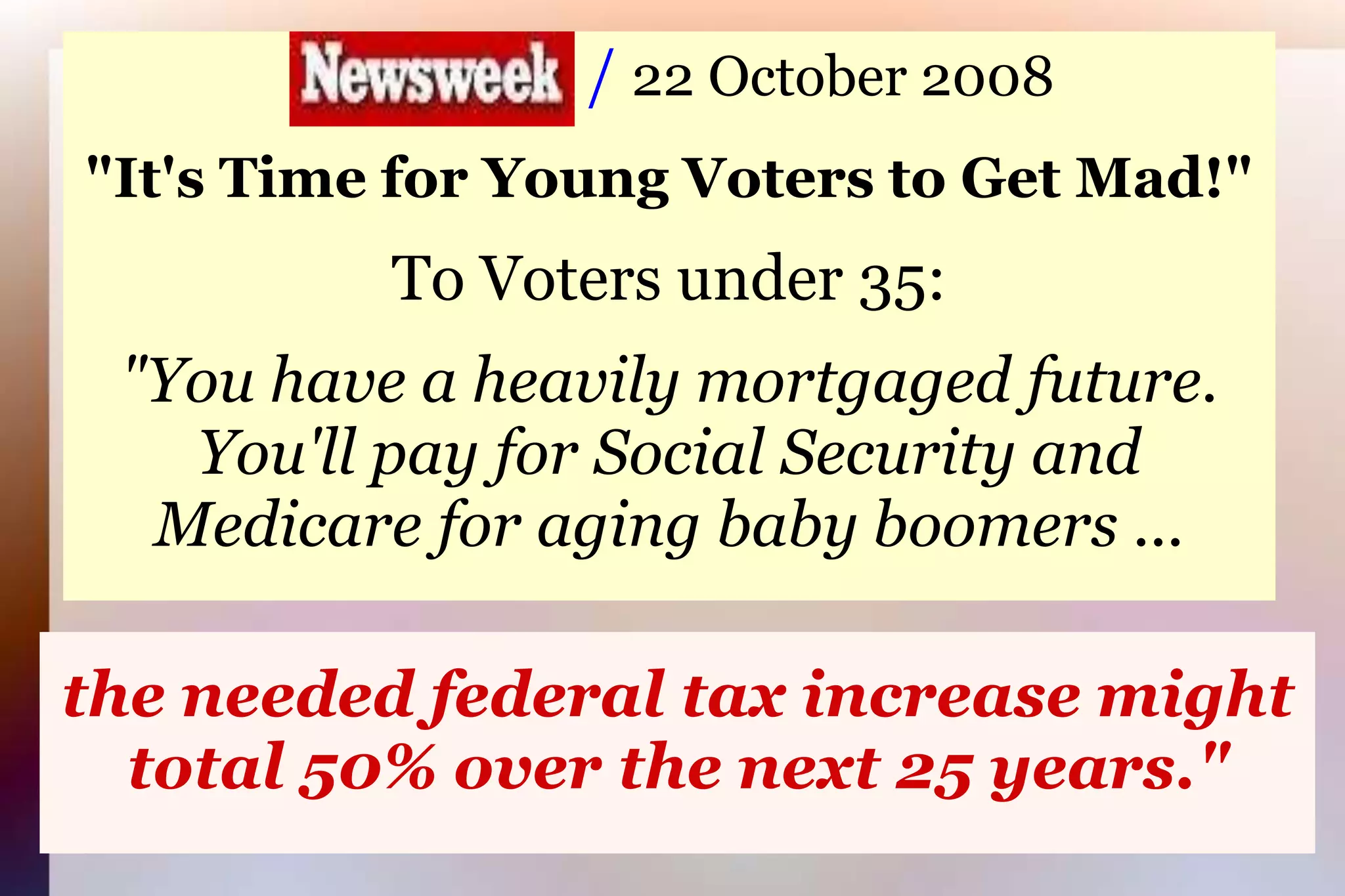

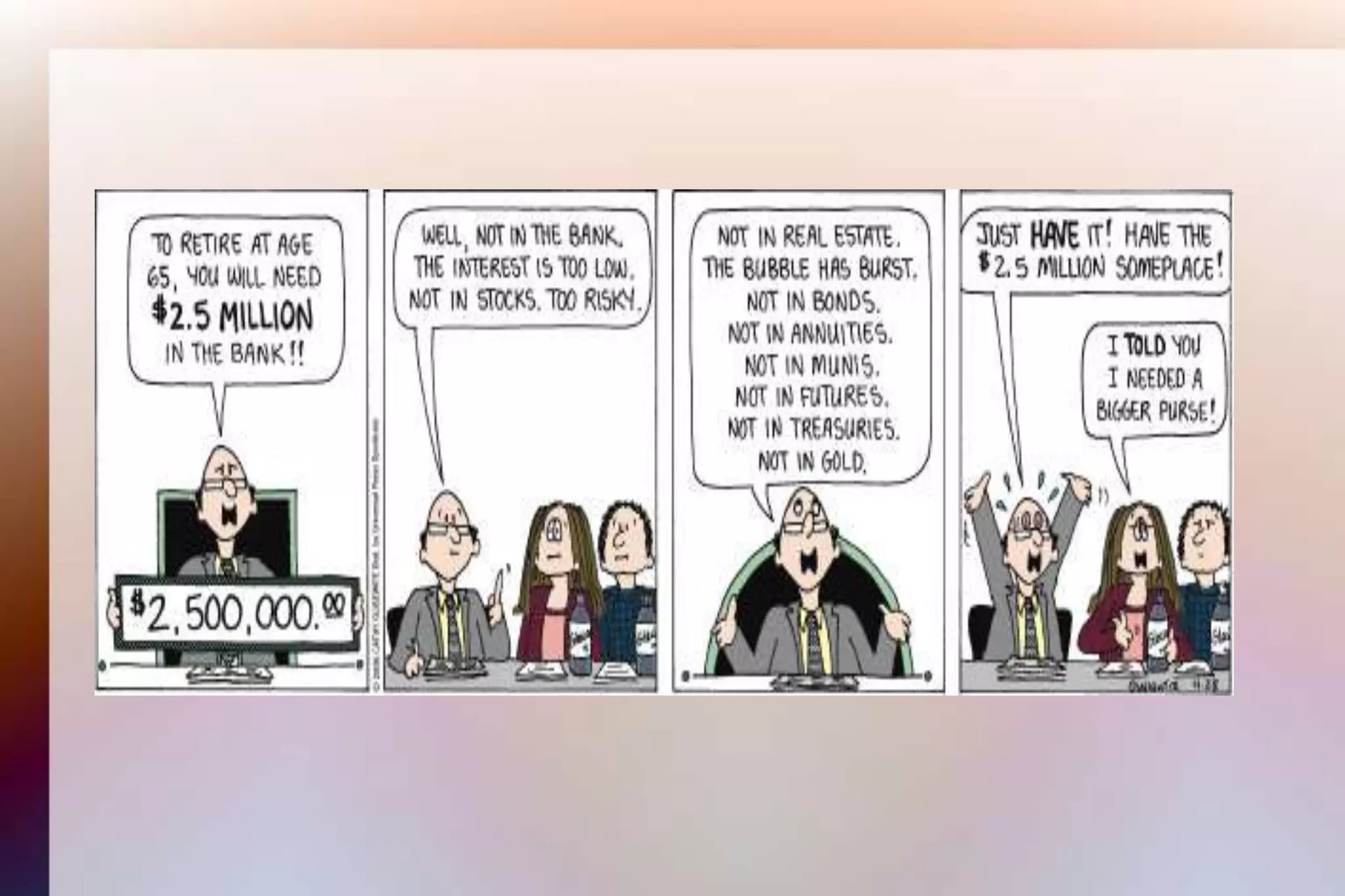

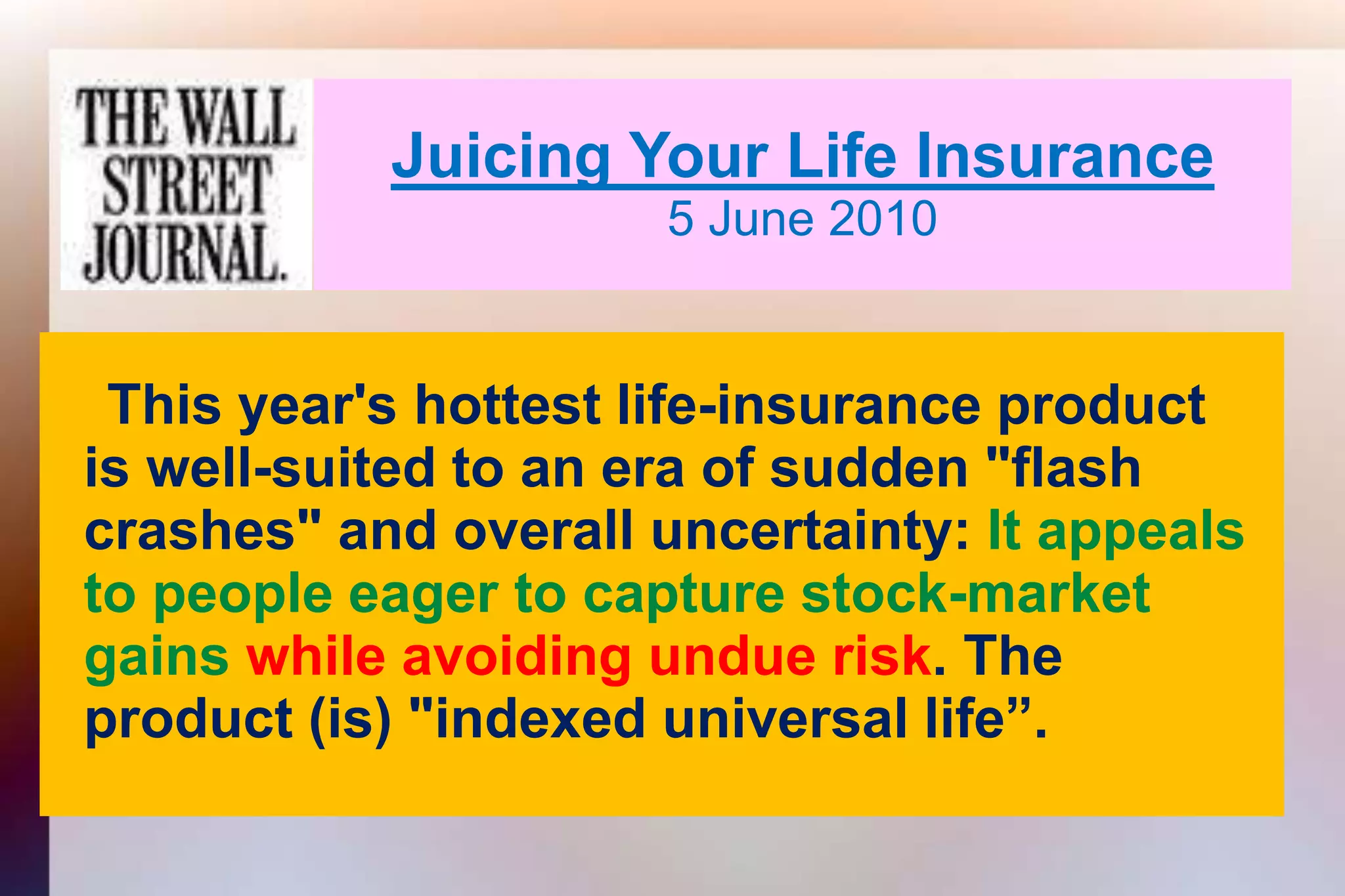

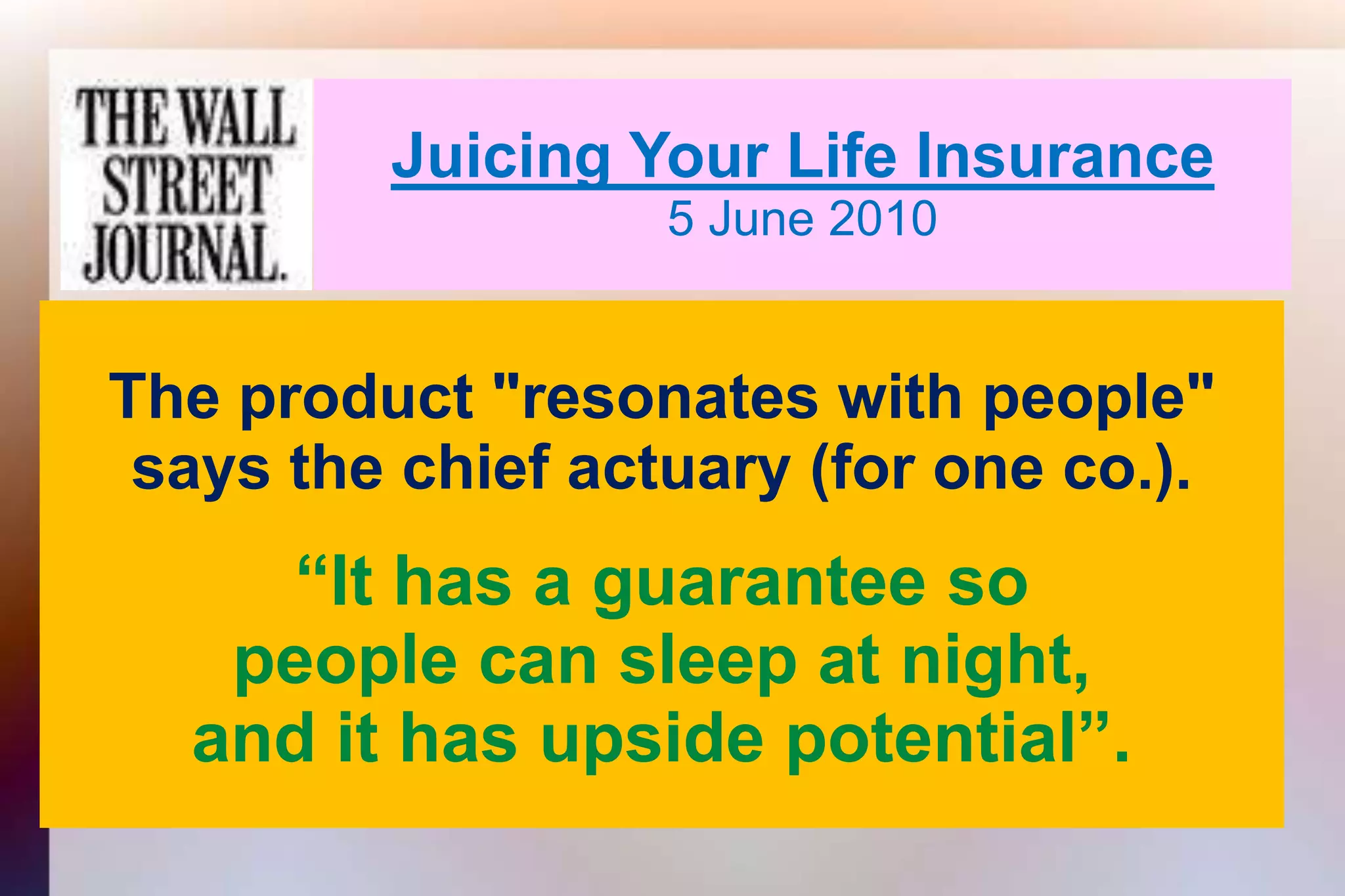

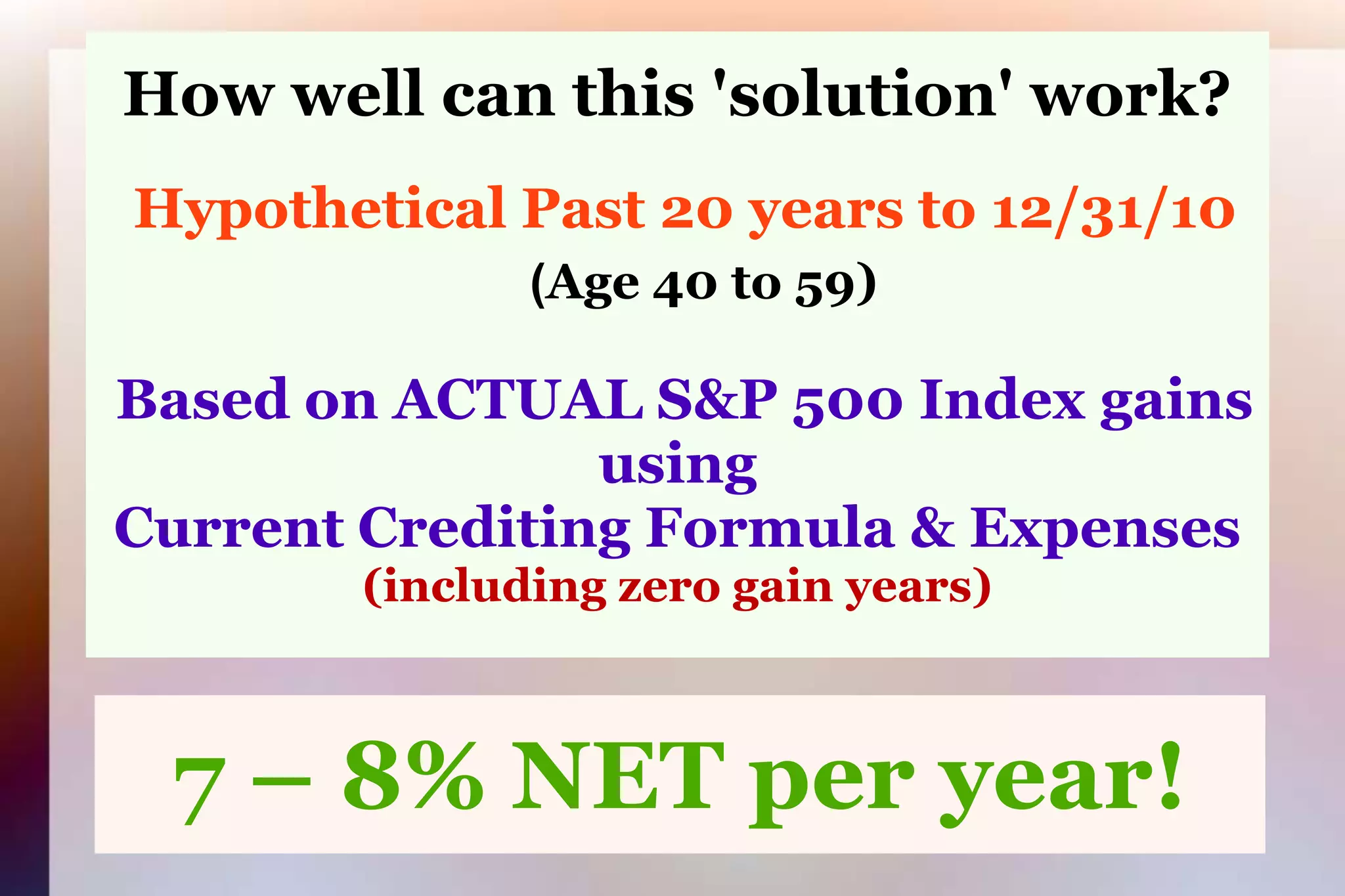

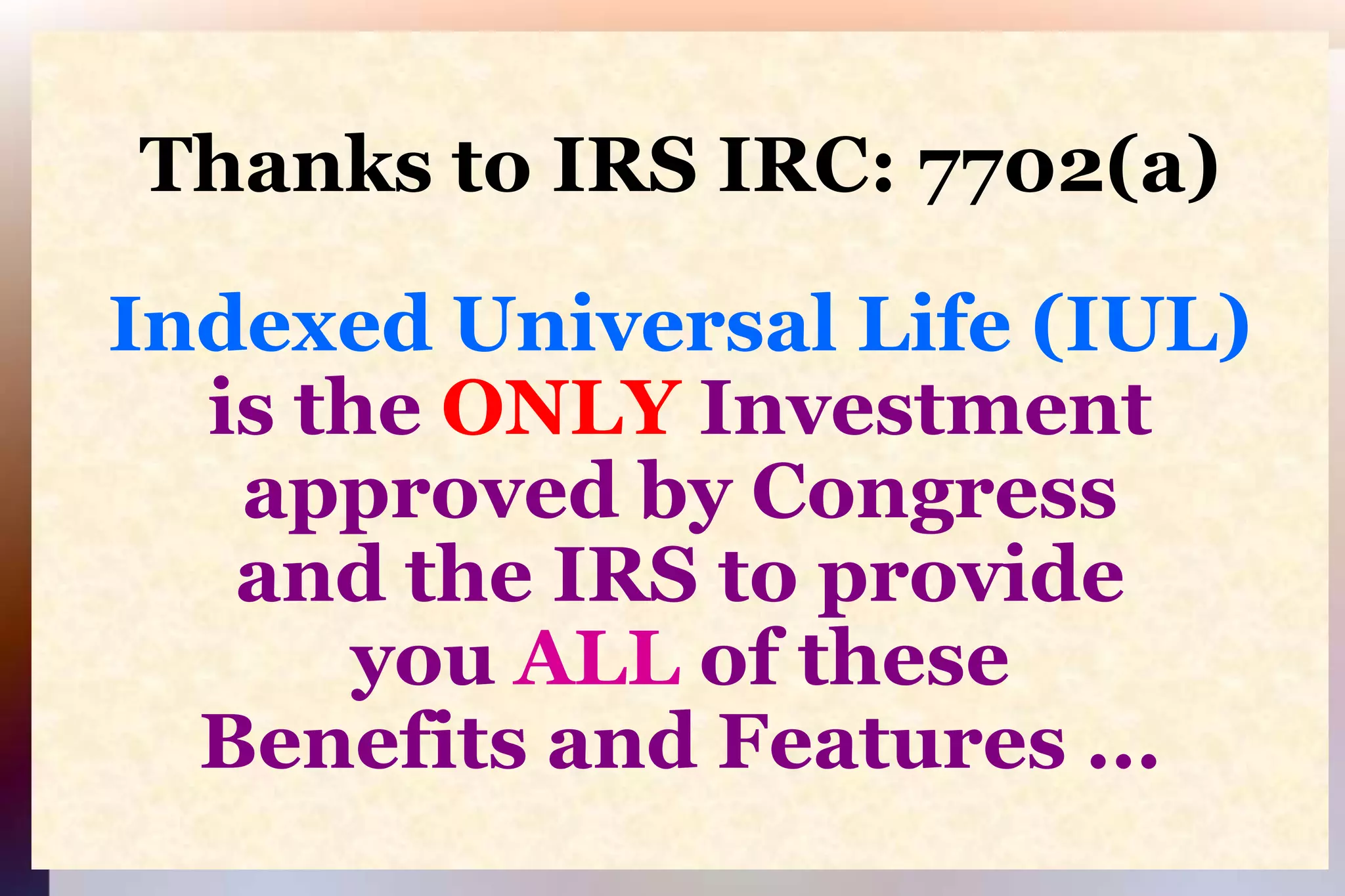

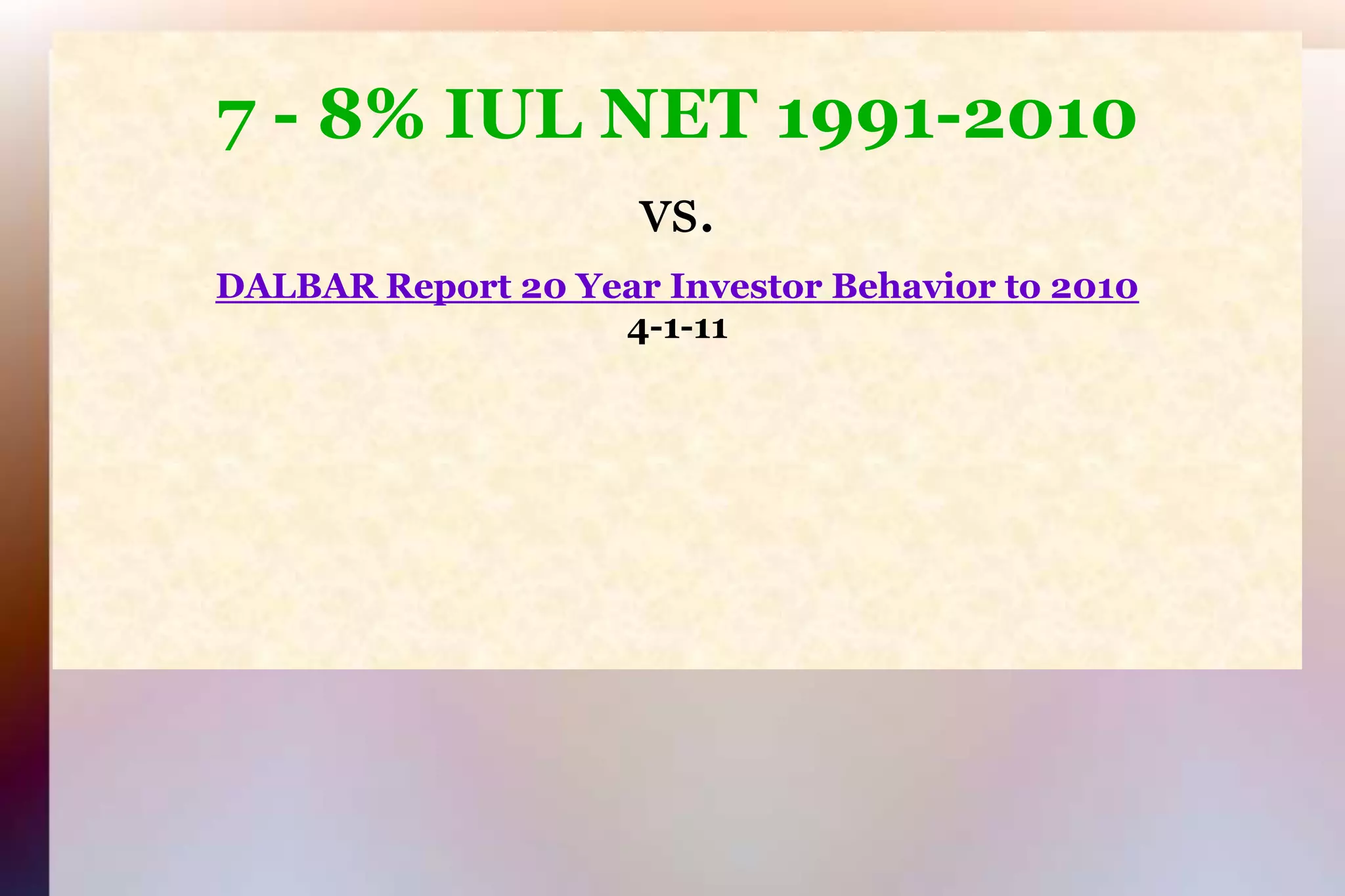

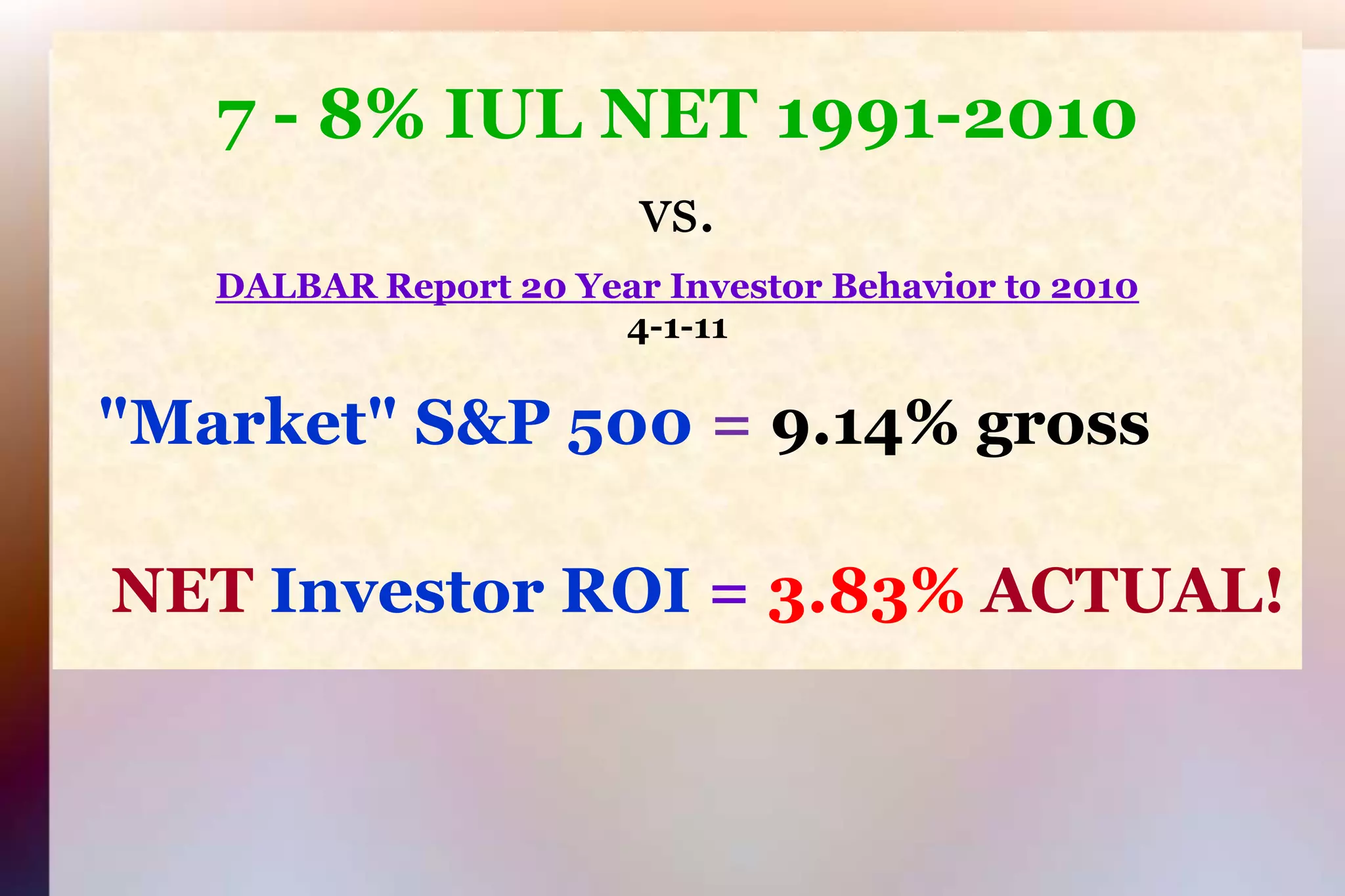

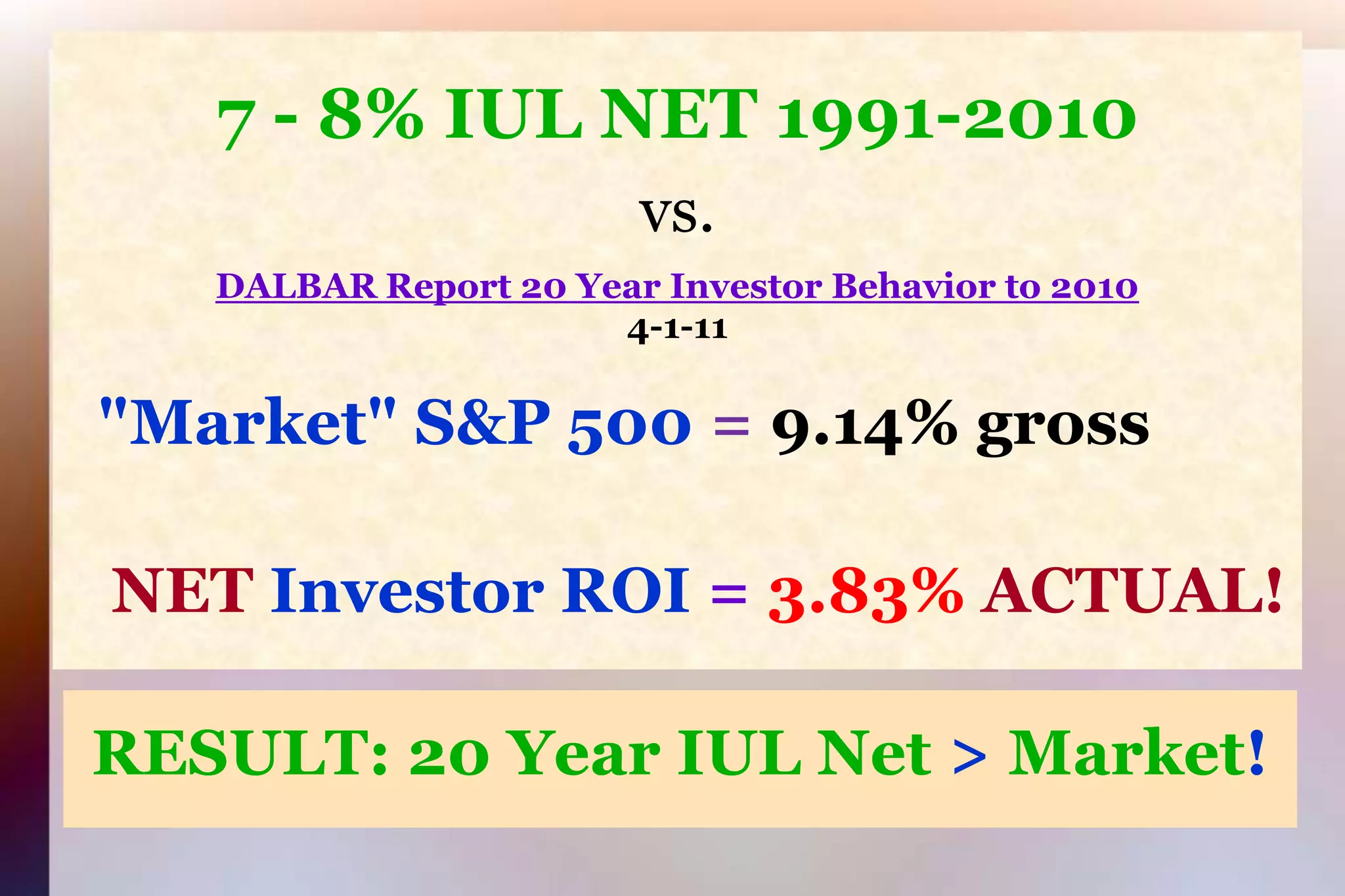

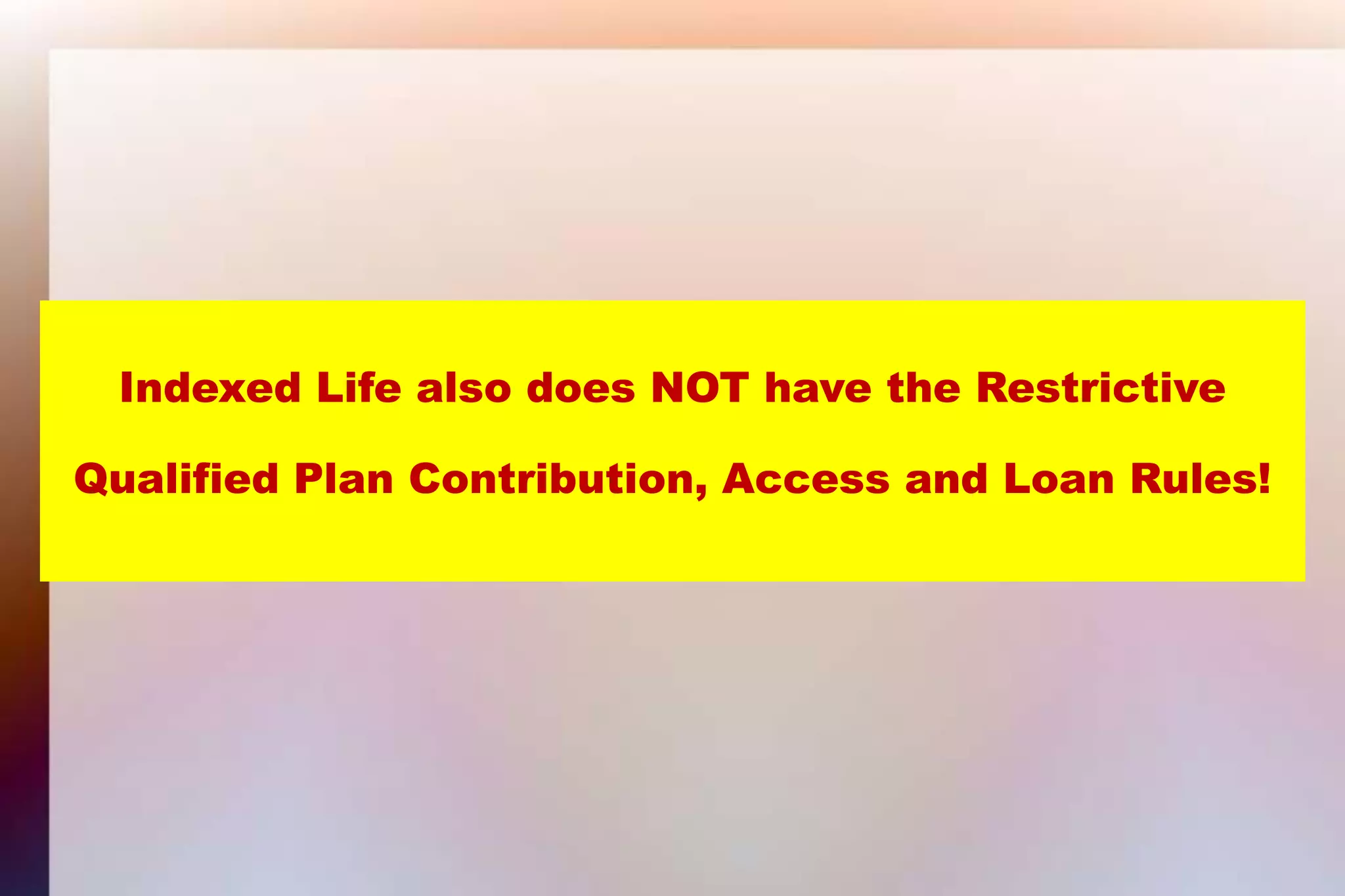

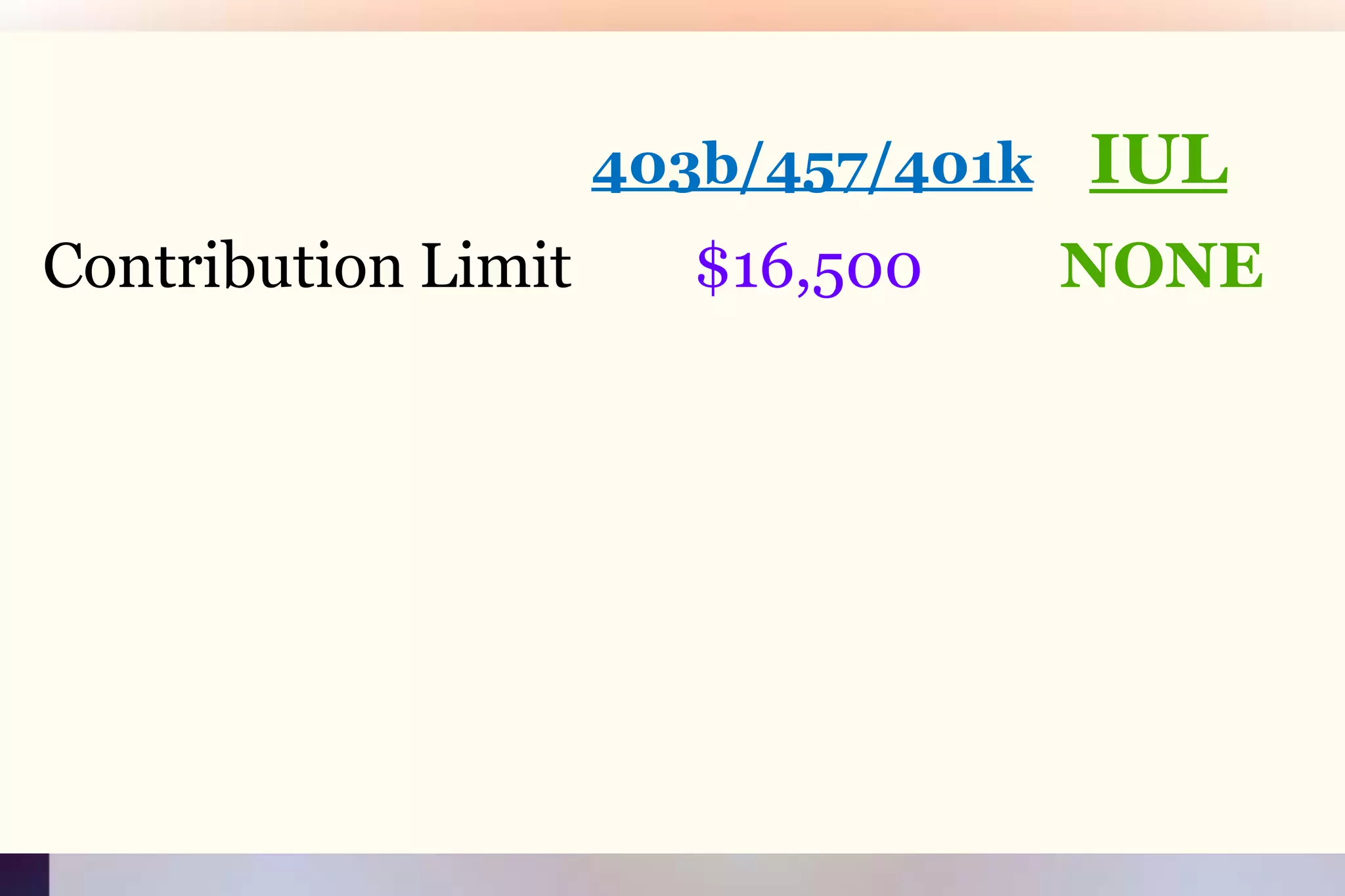

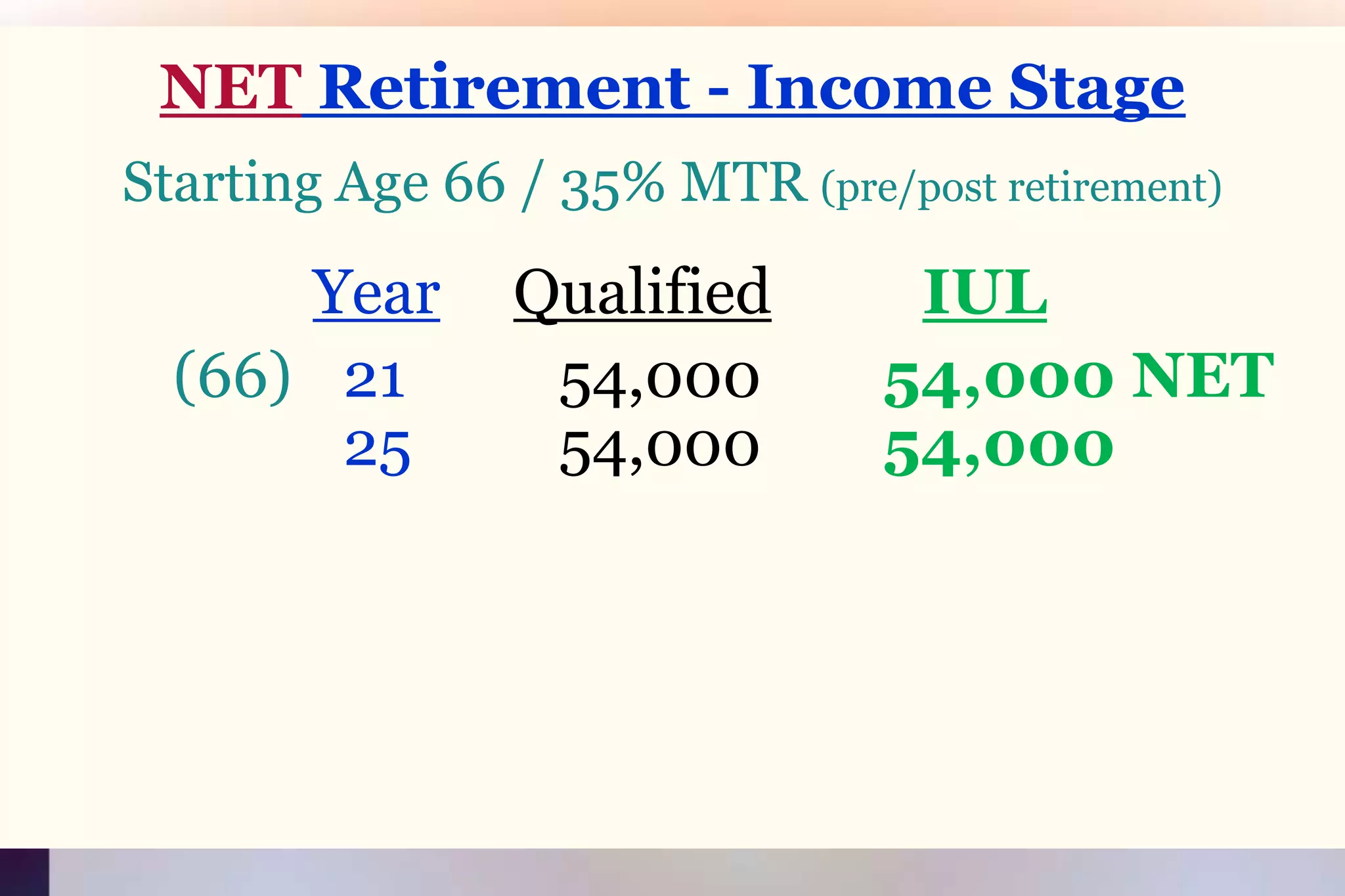

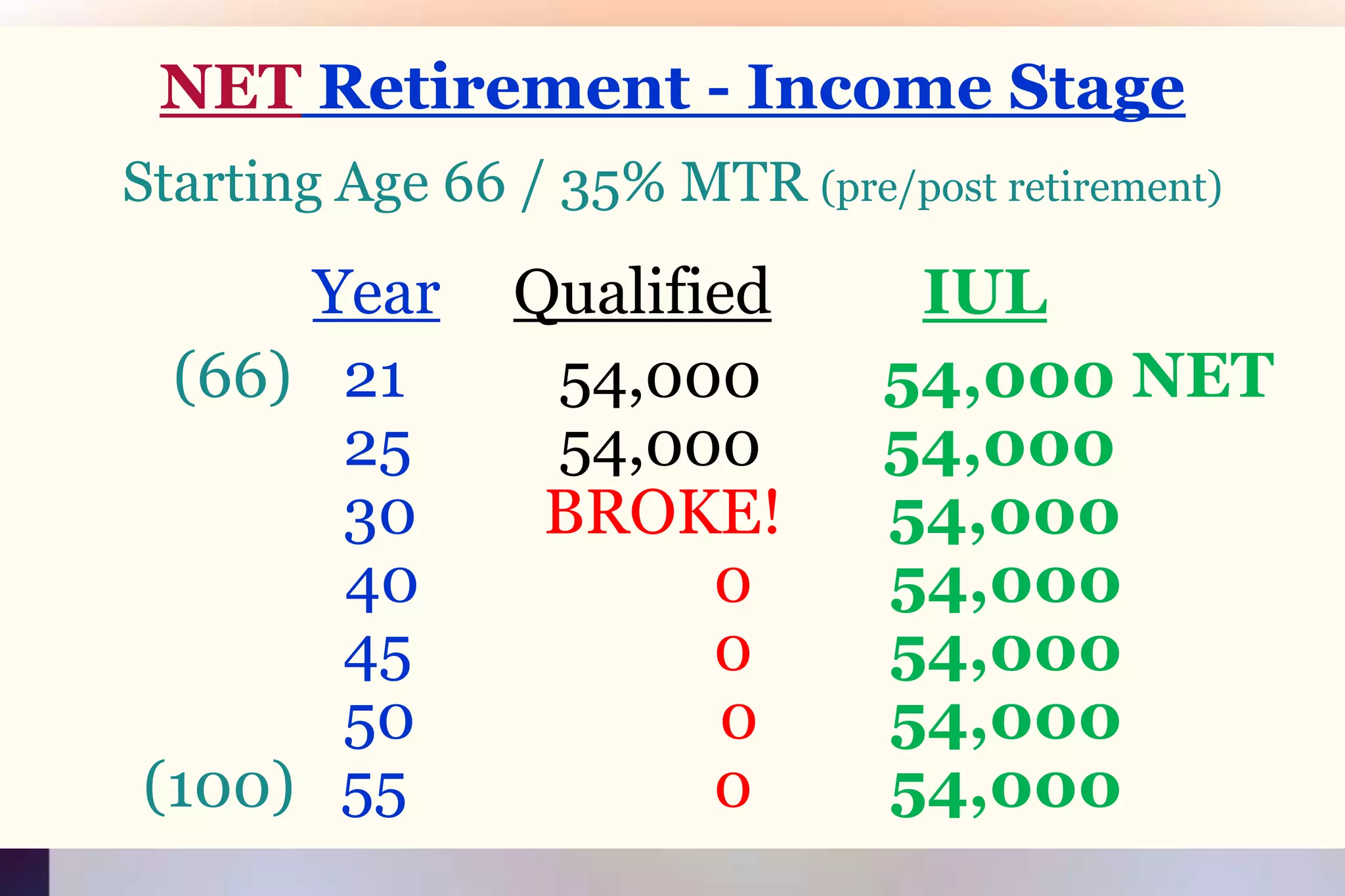

The document critiques traditional retirement savings plans like 401(k)s and IRAs, highlighting their inefficiencies and high fees, advocating for new solutions such as guaranteed retirement accounts that ensure income regardless of employment changes. It emphasizes the alarming statistic that a significant portion of Americans are at risk of being financially unprepared for retirement, necessitating a shift in retirement planning strategies. The document warns against stock investments due to historical losses and volatility, suggesting that a more stable and secure approach to retirement savings is needed.

![MorningstarManagement Fee [8-17-09]: Average domestic fee is 1.39%. International is 1.56%.](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-35-2048.jpg)

![MorningstarManagement Fee [8-17-09]: Average domestic fee is 1.39%. International is 1.56%.Transaction Fee [6-19-09]: This annual fee is 1.64%. For Small Cap Fund it’s 2.80%.](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-36-2048.jpg)

![MorningstarManagement Fee [8-17-09]: Average domestic fee is 1.39%. International is 1.56%.Transaction Fee [6-19-09]: This annual fee is 1.64%. For Small Cap Fund it’s 2.80%.“Vastly more important than expense ratios and no one’s talking about it.” These are in ADDITION to Fund fees. You don’t control a fund’s transaction costs. That’s determined in part by how often the fund manager trades the securities in the fund’s portfolio, and how costly those trades are.](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-37-2048.jpg)

![MorningstarManagement Fee [8-17-09]: Average domestic fee is 1.39%. International is 1.56%.Transaction Fee [6-19-09]: This annual fee is 1.64%. For Small Cap Fund it’s 2.80%.“Vastly more important than expense ratios and no one’s talking about it.” These are in ADDITION to Fund fees. You don’t control a fund’s transaction costs. That’s determined in part by how often the fund manager trades the securities in the fund’s portfolio, and how costly those trades are.The Minimum Average TOTAL Actual Annual Fund Fees = 3.03%!](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-38-2048.jpg)

![MorningstarManagement Fee [8-17-09]: Average domestic fee is 1.39%. International is 1.56%.Transaction Fee [6-19-09]: This annual fee is 1.64%. For Small Cap Fund it’s 2.80%.“Vastly more important than expense ratios and no one’s talking about it.” These are in ADDITION to Fund fees. You don’t control a fund’s transaction costs. That’s determined in part by how often the fund manager trades the securities in the fund’s portfolio, and how costly those trades are.The Minimum Average TOTAL Actual Annual Fund Fees = 3.03%!Investment NewsERISA Costs [10-15-09]:“It's fair to say that in many cases the total ERISA(401k) drag is close to about 1% of plan assets.”](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-39-2048.jpg)

![MorningstarManagement Fee [8-17-09]: Average domestic fee is 1.39%. International is 1.56%.Transaction Fee [6-19-09]: This annual fee is 1.64%. For Small Cap Fund it’s 2.80%.“Vastly more important than expense ratios and no one’s talking about it.” These are in ADDITION to Fund fees. You don’t control a fund’s transaction costs. That’s determined in part by how often the fund manager trades the securities in the fund’s portfolio, and how costly those trades are.The Minimum Average TOTAL Actual Annual Fund Fees = 3.03%!Investment NewsERISA Costs [10-15-09]:“It's fair to say that in many cases the total ERISA(401k) drag is close to about 1% of plan assets.”Summary: Many plans are in the range of 4% to 5% in TOTALyearly costs – the worst plans charge even more.After all the fees …](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-40-2048.jpg)

![The Life Insurance can also be used forPENSION MAXto Increase Your Pension Income $hundreds or $thousands per month!Popular for Teacher & Government Pension Plans: STRS [State Teachers Retirement System] PERS [Public Employees Retirement System]](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-157-2048.jpg)

![November 2007 BEST ALL-AROUNDRETIREMENT ACCOUNTis the Roth IRA:“There's no up-front tax break [IUL], but decades of tax-free growth [IUL], plus tax-free income in retirement [IUL].”](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-175-2048.jpg)

![November 2007 BEST ALL-AROUNDRETIREMENT ACCOUNTis the Roth IRA:“There's no up-front tax break [IUL], but decades of tax-free growth [IUL], plus tax-free income in retirement [IUL].”Why Stop There?! Even BETTER is ...](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-176-2048.jpg)

![An IUL "SUPER ROTH"!Unlikea Roth ... * NO Contribution Limits. * NO Income Restrictions. * Includes Hundreds of Thousands $'s (or more) in Life Insurance from Day 1[NOT Allowed in Roth! Use it to Pension Max!]](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-179-2048.jpg)

![An IUL "SUPER ROTH"!Unlikea Roth ... * NO Contribution Limits. * NOIncome Restrictions. * Includes Hundreds of Thousands $'s (or more) in Life Insurance from Day 1[NOT Allowed in Roth! Use it to Pension Max!]* NOIRS or State Penalties for pre 59.5 access to gains.](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-180-2048.jpg)

![In case you were wondering,many of the companies whooffer IUL are among the oldest(over 100 to 150 years old),most stable, best rated,ANDlargest financial servicescompanies in the world![Checks from Ins. Co.’s are a major reasonwhy many survived the Great Depression!]](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-189-2048.jpg)

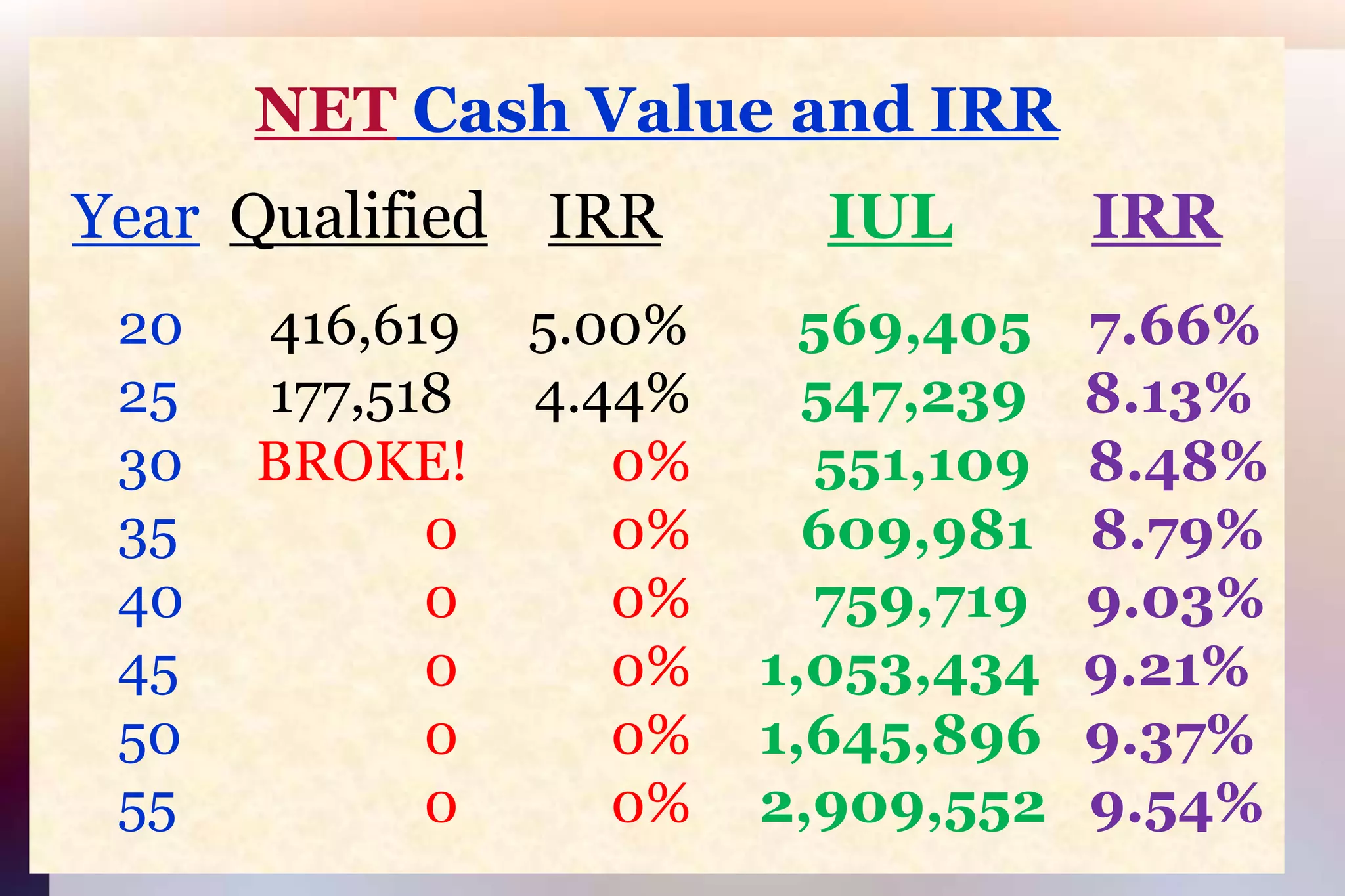

![NET CASH VALUE – Saving Stage[NET Fees, Pre 59.5 Penalties and Taxes]Age 45 PNT / Save $1,000 mo. for 20 years[Average Past 25, Thirty Year Periods (since 1953)]YearQualifiedIUL 5 60,918 57,747 6 74,989 74,913 10 138,667 164,919 15 271,882 324,799 20 416,619 569,405](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-192-2048.jpg)

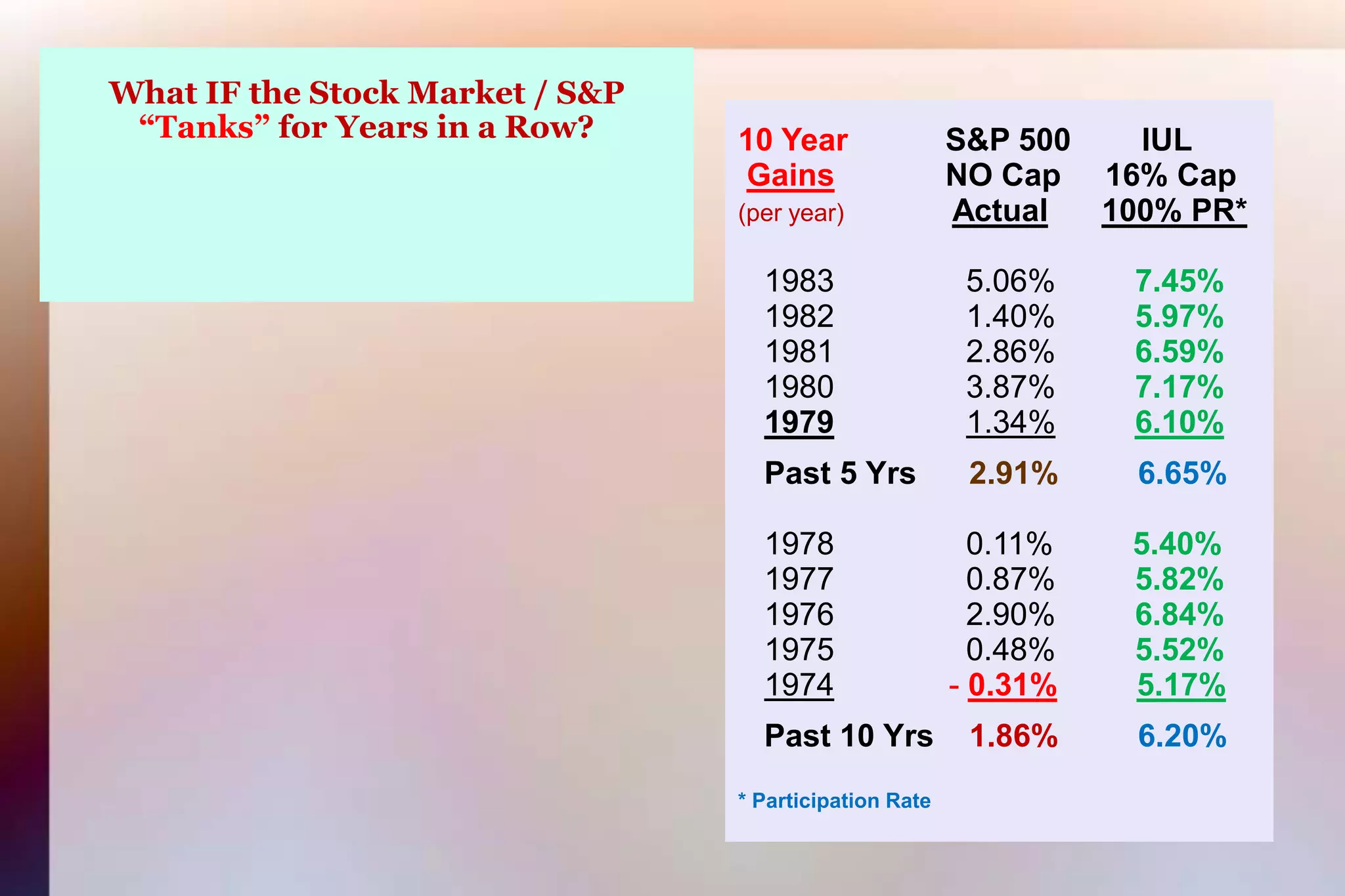

![What IF the Stock Market / S&P “Tanks” for Years in a Row?The average 10 year gain of the S&Pin an IUL the past 65 years is 9.05%.[18% historical average cap]10 Year S&P 500 IULGainsNO Cap 16% Cap (per year)Actual100% PR* 1983 5.06% 7.45% 1982 1.40% 5.97% 1981 2.86% 6.59% 1980 3.87% 7.17%19791.34%6.10% Past 5 Yrs 2.91% 6.65% 1978 0.11% 5.40% 1977 0.87% 5.82% 1976 2.90% 6.84% 1975 0.48% 5.52%1974-0.31%5.17% Past 10 Yrs 1.86% 6.20%* Participation Rate](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-197-2048.jpg)

![What IF the Stock Market / S&P “Tanks” for Years in a Row?The average 10 year gain of the S&Pin an IUL the past 65 years is 9.05%.[18% historical average cap]The worst stretch during that time was 1974 to 1983 when the S&P10 year gains averaged 1.86% per yr.10 Year S&P 500 IULGainsNO Cap 16% Cap (per year)Actual100% PR* 1983 5.06% 7.45% 1982 1.40% 5.97% 1981 2.86% 6.59% 1980 3.87% 7.17%19791.34%6.10% Past 5 Yrs 2.91% 6.65% 1978 0.11% 5.40% 1977 0.87% 5.82% 1976 2.90% 6.84% 1975 0.48% 5.52%1974-0.31%5.17% Past 10 Yrs 1.86% 6.20%* Participation Rate](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-198-2048.jpg)

![What IF the Stock Market / S&P “Tanks” for Years in a Row?The average 10 year gain of the S&Pin an IUL the past 65 years is 9.05%.[18% historical average cap]The worst stretch during that time was 1974 to 1983 when the S&P10 year gains averaged 1.86% per yr.But at an average (low) cap of 16%IUL would of averaged 6.20% per year – a gain that is 233% MORE!10 Year S&P 500 IULGainsNO Cap 16% Cap (per year)Actual100% PR* 1983 5.06% 7.45% 1982 1.40% 5.97% 1981 2.86% 6.59% 1980 3.87% 7.17%19791.34%6.10% Past 5 Yrs 2.91% 6.65% 1978 0.11% 5.40% 1977 0.87% 5.82% 1976 2.90% 6.84% 1975 0.48% 5.52%1974-0.31%5.17% Past 10 Yrs 1.86% 6.20%* Participation Rate](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-199-2048.jpg)

![What IF the Stock Market / S&P “Tanks” for Years in a Row?The average 10 year gain of the S&Pin an IUL the past 65 years is 9.05%.[18% historical average cap]The worst stretch during that time was 1974 to 1983 when the S&P10 year gains averaged 1.86% per yr.But at an average (low) cap of 16%IUL would of averaged 6.20% per year – a gain that is 233% MORE!This is because IUL KEEPSits prior annual gains so whenthe market goes up again itBUILDS on those gainsinstead of having to recover 1st!10 Year S&P 500 IULGainsNO Cap 16% Cap (per year)Actual100% PR* 1983 5.06% 7.45% 1982 1.40% 5.97% 1981 2.86% 6.59% 1980 3.87% 7.17%19791.34%6.10% Past 5 Yrs 2.91% 6.65% 1978 0.11% 5.40% 1977 0.87% 5.82% 1976 2.90% 6.84% 1975 0.48% 5.52%1974-0.31%5.17% Past 10 Yrs 1.86% 6.20%* Participation Rate](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-200-2048.jpg)

![What IF the Stock Market / S&P “Tanks” for Years in a Row?The average 10 year gain of the S&Pin an IUL the past 65 years is 9.05%.[18% historical average cap]The worst stretch during that time was 1974 to 1983 when the S&P10 year gains averaged 1.86% per yr.But at an average (low) cap of 16%IUL would of averaged 6.20% per year – a gain that is 233% MORE!This is because IUL KEEPSits prior annual gains so whenthe market goes up again itBUILDS on those gainsinstead of having to recover 1st!Indexed Life =Retirement Security! 10 Year S&P 500 IULGainsNO Cap 16% Cap (per year)Actual100% PR* 1983 5.06% 7.45% 1982 1.40% 5.97% 1981 2.86% 6.59% 1980 3.87% 7.17%19791.34%6.10% Past 5 Yrs 2.91% 6.65% 1978 0.11% 5.40% 1977 0.87% 5.82% 1976 2.90% 6.84% 1975 0.48% 5.52%1974-0.31%5.17% Past 10 Yrs 1.86% 6.20%* Participation Rate](https://image.slidesharecdn.com/lcrstonehouseqpppt6511-13160205359775-phpapp02-110914122057-phpapp02/75/Risk-free-Tax-free-Retirement-Strategy-201-2048.jpg)