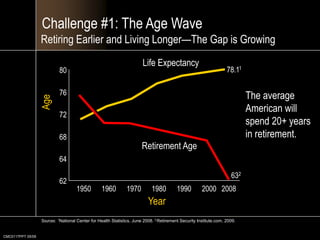

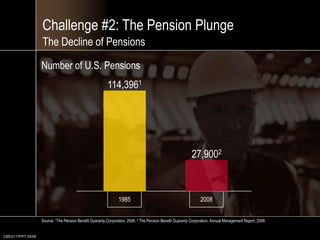

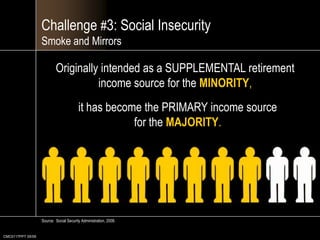

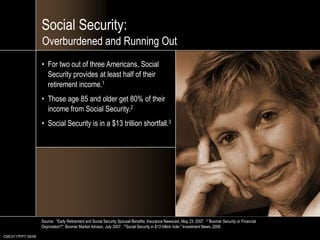

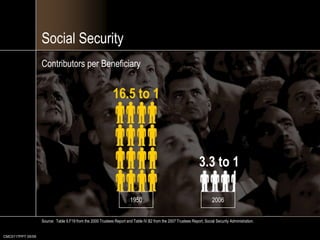

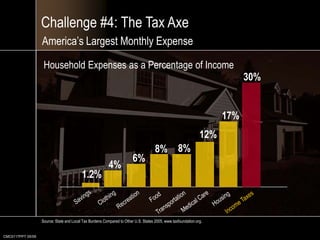

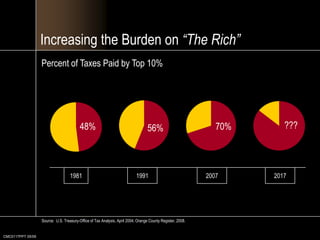

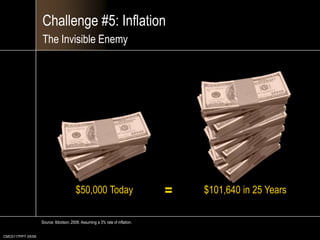

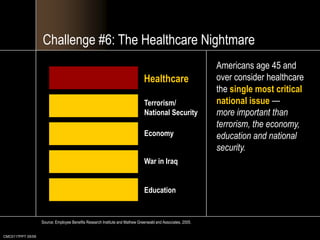

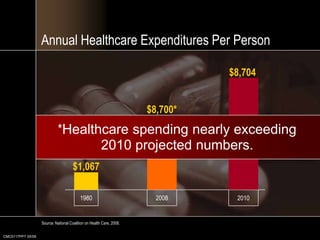

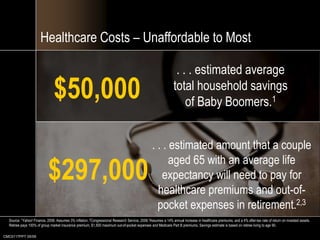

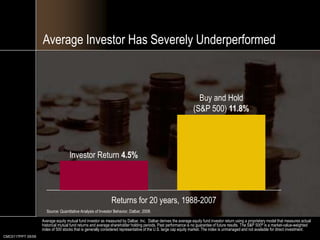

The document summarizes 7 challenges facing Americans in retirement: 1) Americans are retiring earlier and living longer, 2) the decline of pensions means fewer retirees have guaranteed retirement income, and 3) Social Security faces a shortfall as fewer workers support more retirees. Healthcare costs are rising dramatically and threaten to consume retirees' savings. Inflation erodes purchasing power over time. Many investors underperform markets by frequently buying and selling at the wrong times. Overall, Americans are underprepared for the rising costs and longer lifespans of retirement.