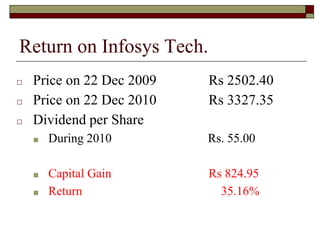

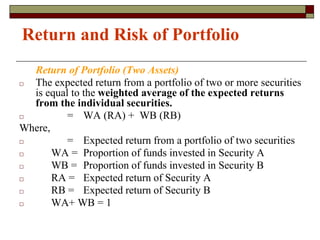

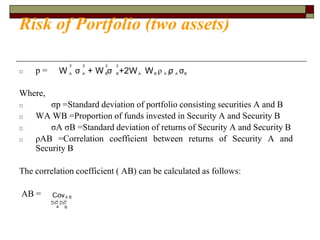

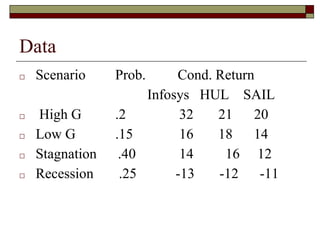

This document discusses risk and return as it relates to investments. It defines types of return including realized and expected return, and components of total return such as periodic cash receipts and capital gains or losses. It also defines risk as the probability that expected returns will not materialize. Various types of risk are described such as systematic, unsystematic, market, interest rate, purchasing power, and others. Methods of measuring risk like volatility and beta are explained. The relationship between risk and expected return is discussed, noting higher risk investments require higher expected returns. Portfolio risk and return are covered, showing how a portfolio reduces risk through diversification.