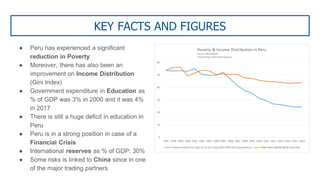

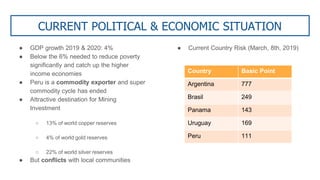

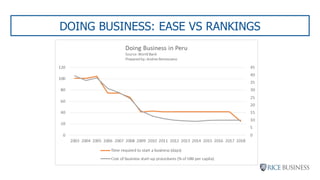

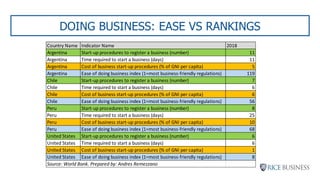

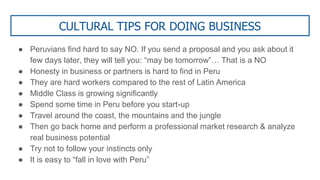

The document provides an overview of Peru's current political, economic, and business climate. It notes that while Peru has experienced steady GDP growth and low inflation over the past decade, it remains one of the poorest countries in the region. The political situation is complicated and corruption has been an issue. GDP growth is projected to be 4% for 2019-2020, below what is needed to significantly reduce poverty. Doing business in Peru faces challenges such as informality and red tape, though the country remains an attractive destination for mining investment. Cultural tips for doing business in Peru include the importance of personal relationships over professional factors.