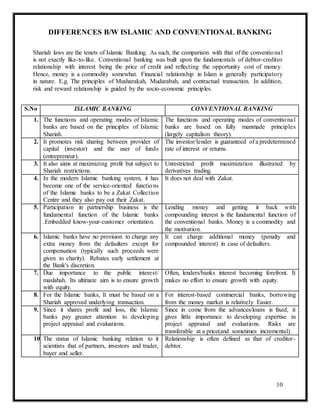

This report compares Islamic banking with conventional banking, highlighting the fundamental differences influenced by Shariah law. While conventional banking operates on an interest-based system, Islamic banking prohibits interest and focuses on profit and loss sharing through various financial products aligned with Islamic principles. The report aims to elucidate the roles, regulations, and economic implications of both banking systems.