The document provides information about the Rajiv Gandhi Equity Savings Scheme (RGESS), which was launched in 2012 by the Union Finance Minister to encourage new equity investors. Some key points:

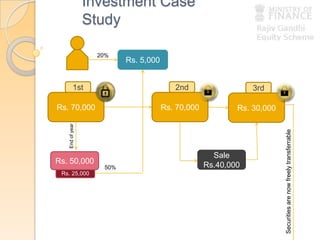

- RGESS allows new individual investors to claim a tax deduction of up to Rs. 50,000 on investments in equities.

- There is a 3-year lock-in period on investments made under RGESS. Eligible securities include stocks listed on the BSE 100 or CNX 100 indices and units of mutual funds.

- To qualify, investors must be new to equities, have a demat account, and have an annual income of less than Rs. 12 lakhs. Gains from