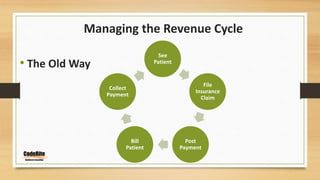

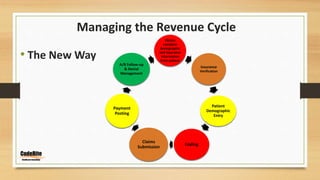

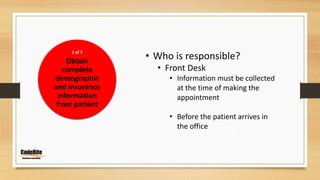

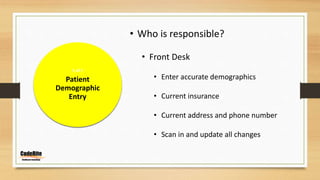

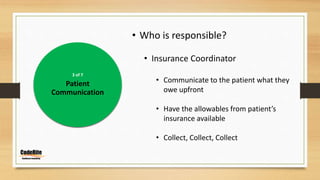

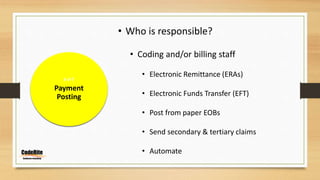

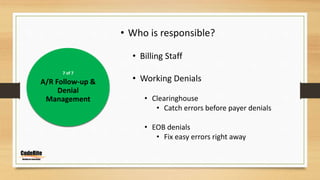

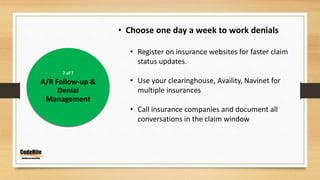

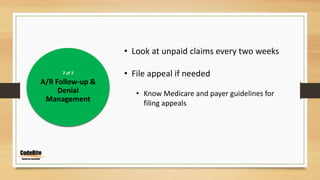

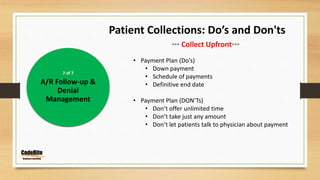

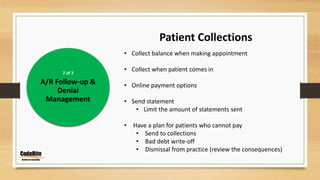

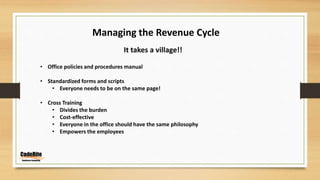

This document discusses managing the revenue cycle in a healthcare practice. It explains that revenue cycle management involves determining patient insurance eligibility, coding claims properly, and streamlining billing and collections. The "old way" of managing the revenue cycle is described as inefficient, with no insurance verification, nothing collected upfront, and relying on insurance to cover payments. The "new way" outlines specific responsibilities for the front desk, insurance coordinator, coding and billing staff to improve the process through insurance verification, patient communication, accurate coding and claims submission, payment posting, and active accounts receivable follow-up and denial management. The document emphasizes that managing the revenue cycle effectively requires involvement and standard procedures from all areas of the practice.