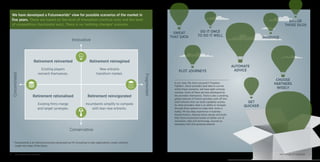

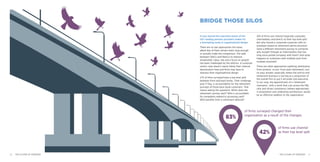

The document discusses how the retirement market is undergoing a transformation following changes in 2015 that gave people more freedom and choice in how they use their pension savings. It notes that while some providers see this as an opportunity, many still have further to go to adapt. The document then discusses possible future scenarios for the retirement market in 5 years and the capabilities that will help providers succeed, such as using data effectively to personalize customer experiences. It emphasizes that providers must improve how they view and use customer data, map out retirement journeys, deliver a consistent experience across platforms, and consider automated advice solutions.