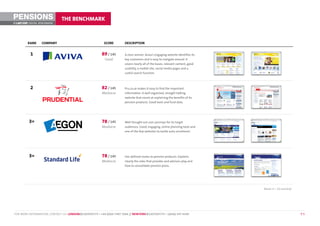

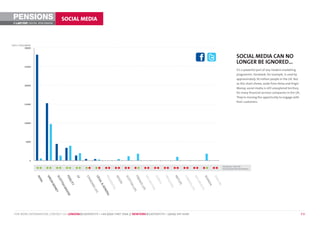

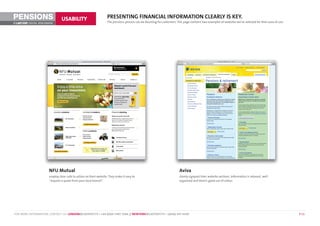

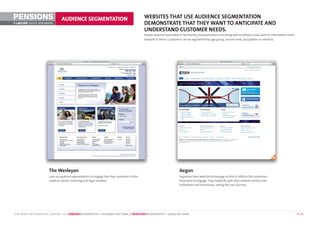

The document provides an overview of the impending changes in the UK pensions market due to the Retail Distribution Review and auto-enrolment, emphasizing the need for pension providers to adapt to digital expectations. It benchmarks the digital presence of 19 UK pension providers, finding that most are poorly prepared for online engagement, with only one website rated 'good' and the rest deemed 'mediocre' or 'weak'. The summary highlights issues with usability, information clarity, mobile optimization, and social media engagement, suggesting that companies that embrace these changes stand to gain a competitive advantage.