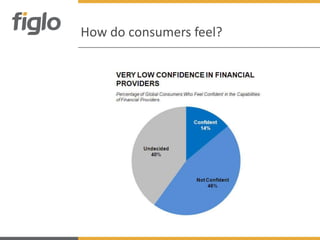

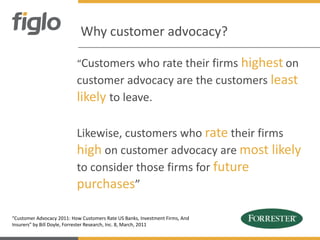

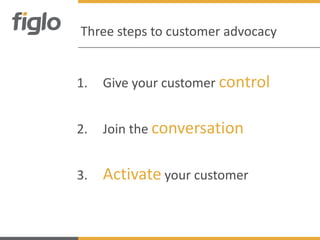

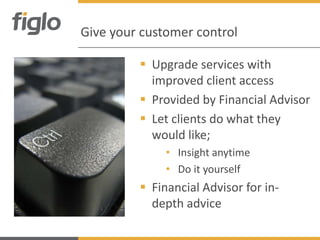

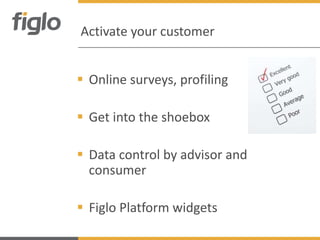

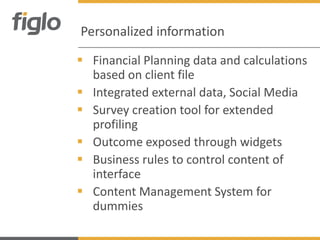

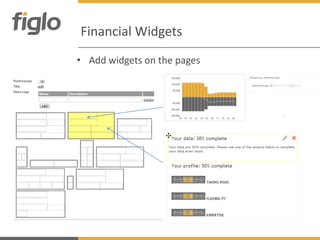

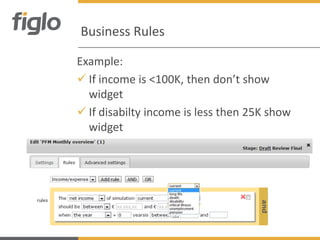

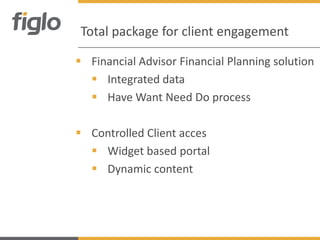

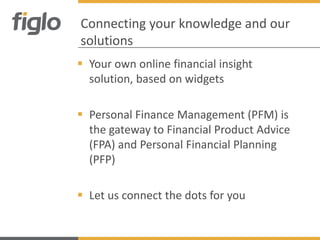

The document discusses the importance of customer engagement in the financial planning industry, emphasizing that clients should have control, be part of the conversation, and be activated to advocate for financial services. It outlines a three-step approach to enhance customer advocacy through improved access, dialogue, and interactive tools like the Figlo platform that offers personalized financial planning solutions. The aim is to simplify financial information for consumers and improve communication between advisors and clients to foster loyalty and encourage future business.