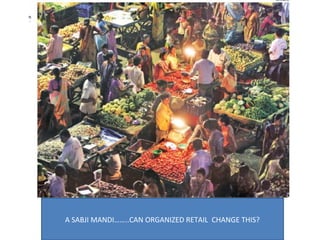

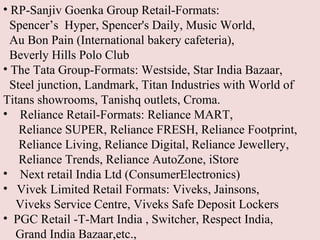

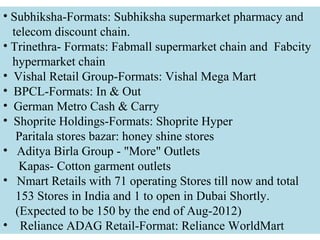

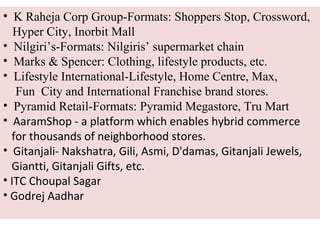

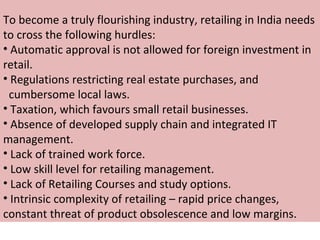

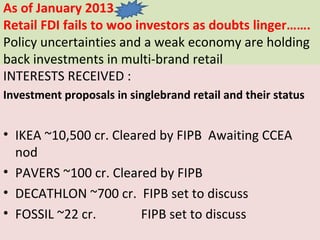

The document discusses the growth of retail sector in India from 1997-2010. It notes that traditionally, most Indian shopping took place in small, independent shops with limited product selection and pricing transparency. However, from 1997-2010, India's retail market grew significantly in size and modern organized retailers began establishing a presence in large urban areas, though they still only accounted for 4% of the market. The entry of large multinational retailers sparked debate around job losses for small shops but studies found limited impact. The document outlines many major Indian and international retailers operating in India and the formats they use. It also discusses some challenges faced by the emerging organized retail sector in India.