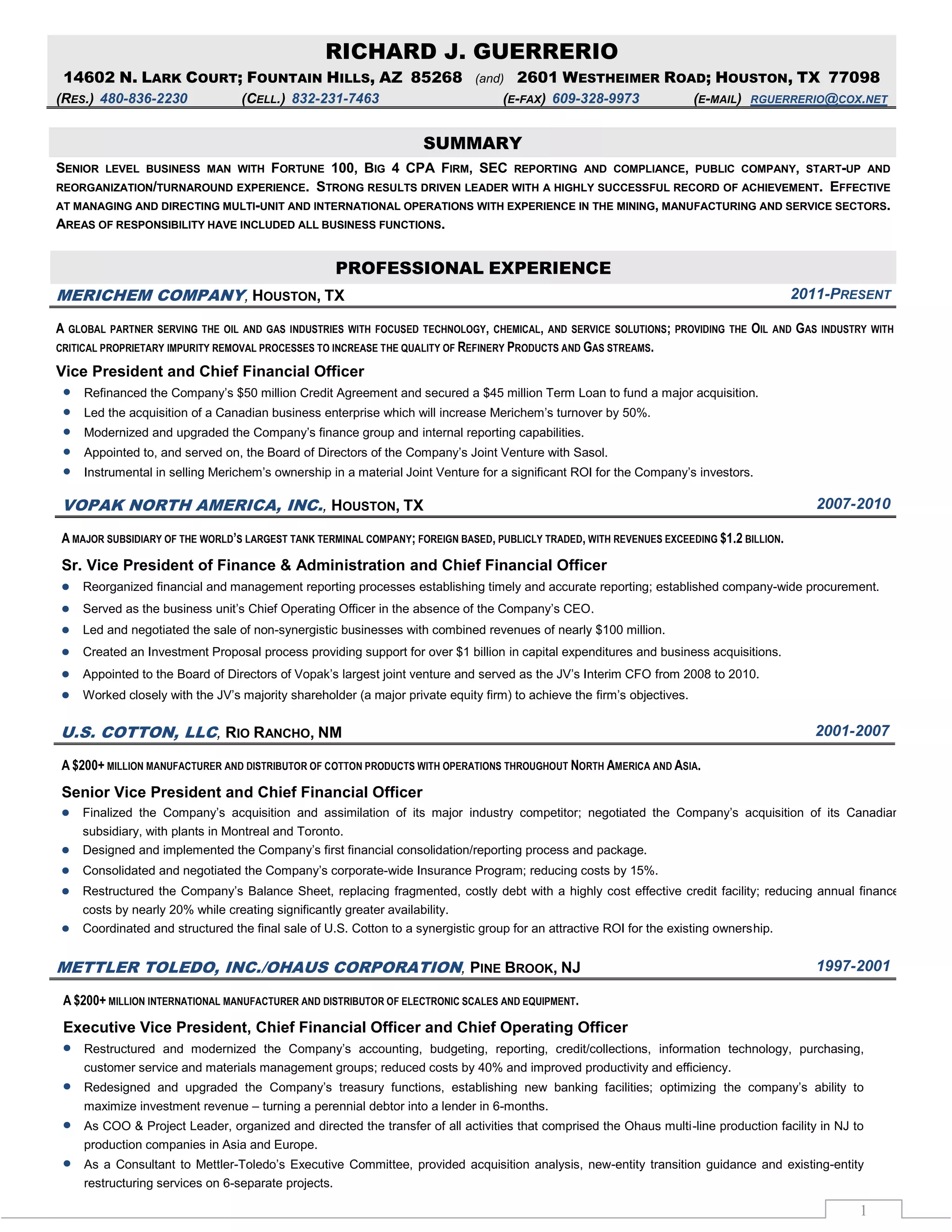

This document provides a summary of Richard J. Guerrerio's professional experience and qualifications. He has over 40 years of senior level experience in finance, accounting, and general management roles, including as CFO for multiple public and private companies across various industries. He has a proven track record of improving business performance through restructurings, acquisitions, and financial management.