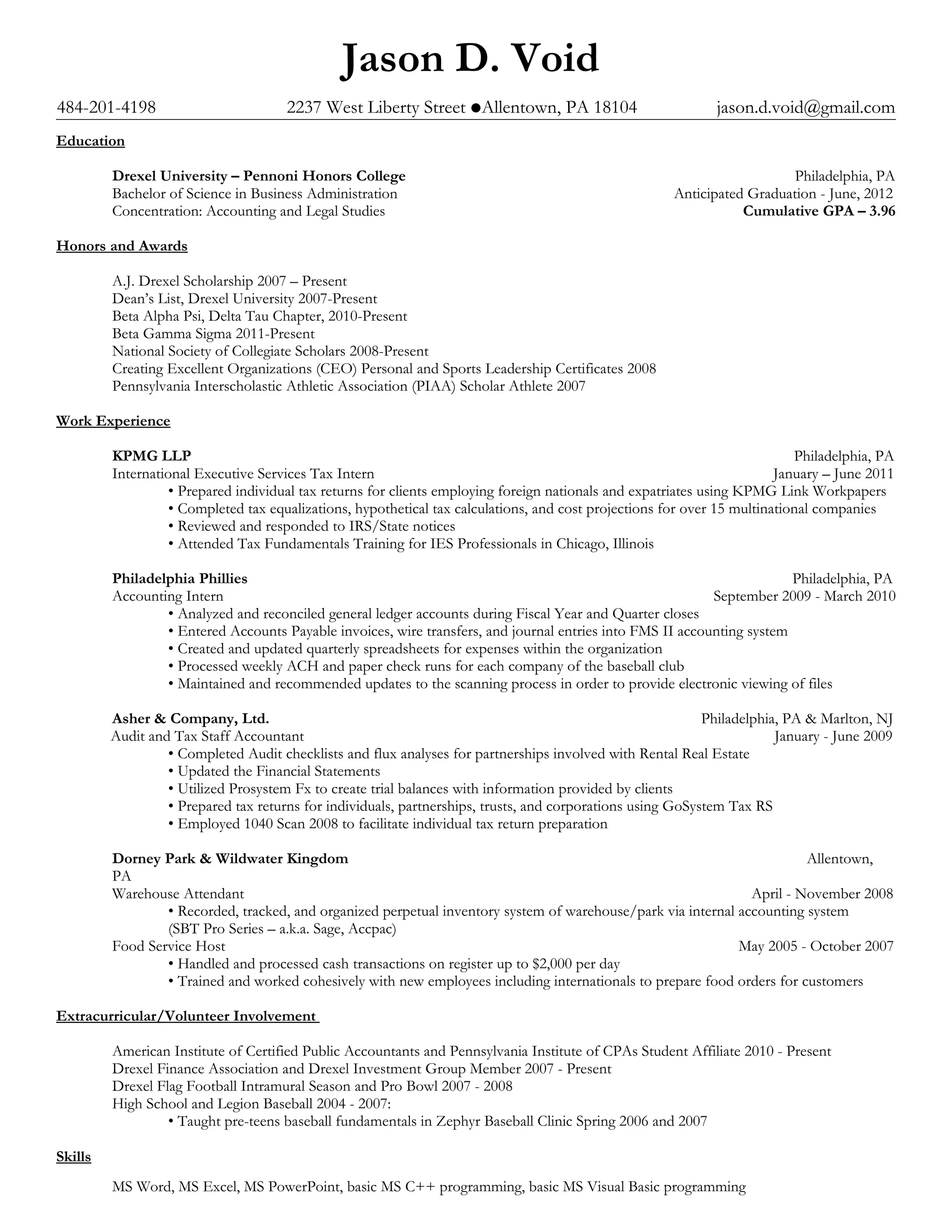

Jason D. Void is a senior at Drexel University majoring in Business Administration with a concentration in Accounting and Legal Studies. He has maintained a 3.96 GPA and received numerous honors and scholarships. His work experience includes tax and audit internships at KPMG and Asher & Company as well as accounting roles with the Philadelphia Phillies and Dorney Park. He is involved with the American Institute of CPAs and several Drexel organizations.