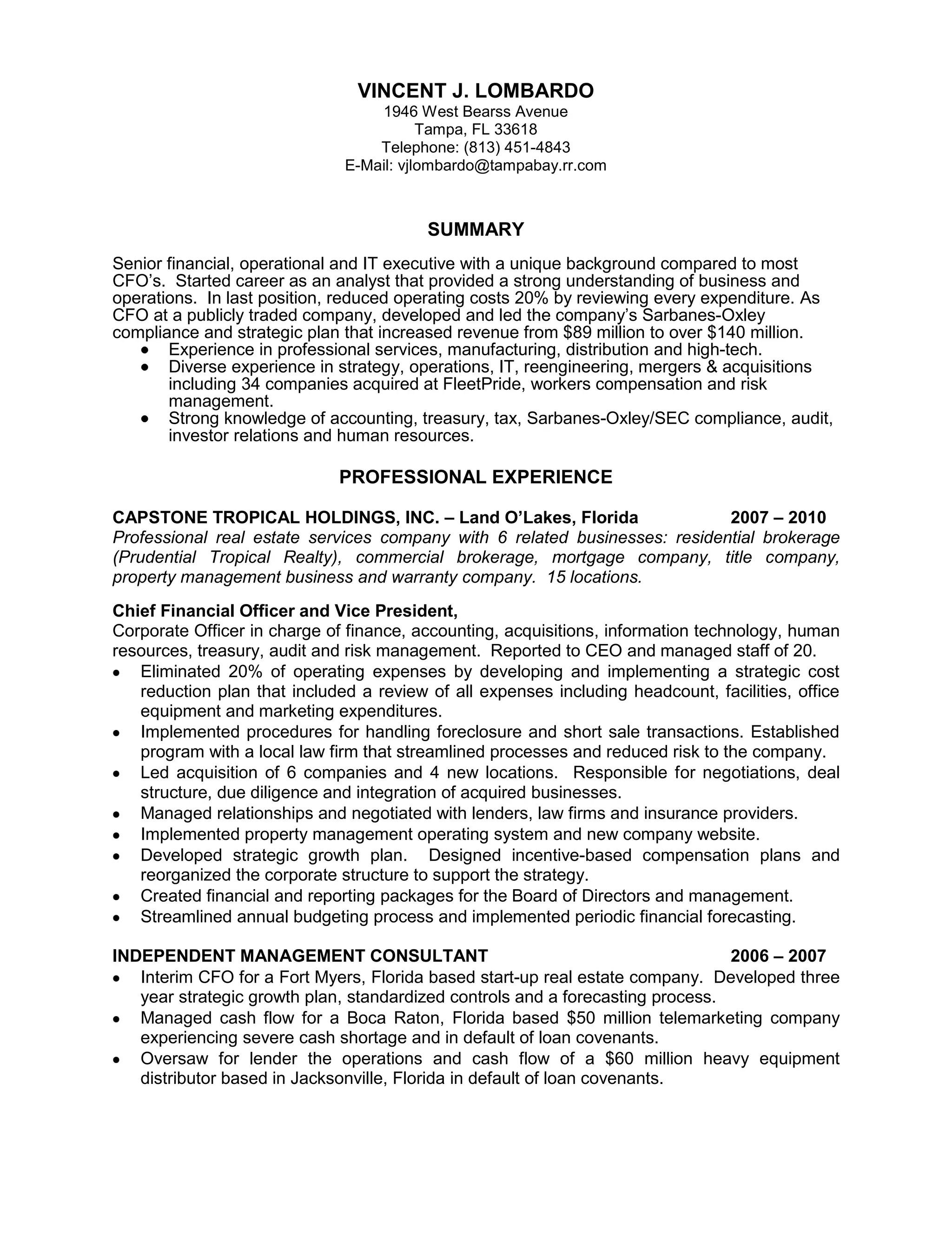

Vincent J. Lombardo has over 30 years of experience in senior financial roles. He has worked in a variety of industries including professional services, manufacturing, distribution, and high-tech. His background includes experience in strategy, operations, IT, reengineering, mergers and acquisitions. He has a proven track record of reducing costs and improving profitability through strategic planning and process improvement initiatives.