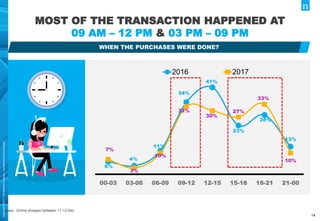

This document summarizes Nielsen's 2017 National Online Shopping Survey in Indonesia. It finds that 89% of internet users were aware of annual nationwide online shopping festival HarBolNas, up slightly from 2016. Online shopping websites and social media were the main sources of awareness. The survey also found more female and youth shoppers this year versus 2016, with smartphone now the most popular device for online purchases.