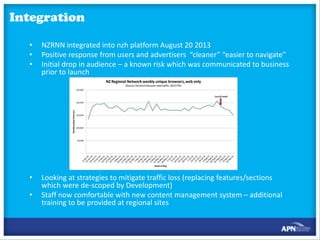

The document provides an overview of a training program for digital certification. It covers:

1. An introduction and rules of the program.

2. The goals of the training which are to gain certification and understand what it means.

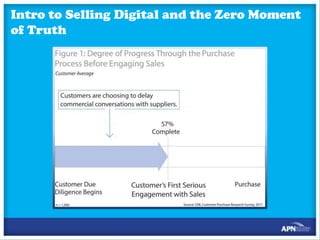

3. An overview of the agenda which includes topics like the state of the internet, social media, online advertising, and product development.