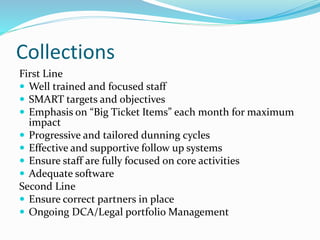

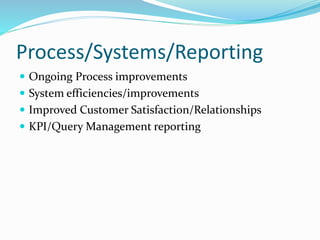

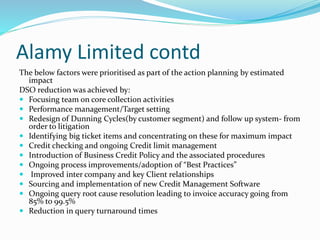

This document discusses factors that influence credit and collections processes. It provides examples of case studies where companies implemented action plans to improve their days sales outstanding (DSO). For Alamy Limited, focusing on core collection activities, credit management, and ongoing improvements helped reduce DSO from 60 to 41 days as turnover increased 400%. For Unit4 Business Software, enhanced reporting, collection targets, automated processes, and improved relationships helped reduce DSO from 77 to 51 days despite a 25% rise in turnover.