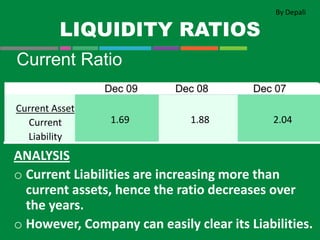

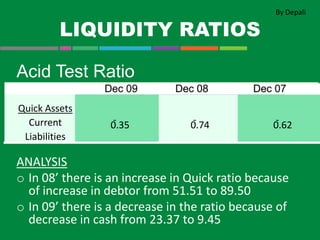

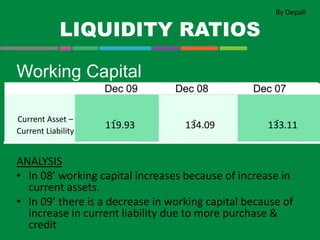

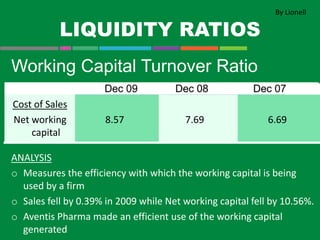

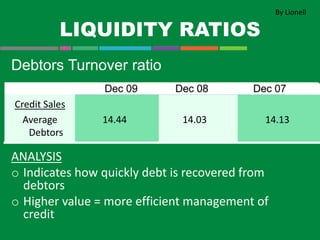

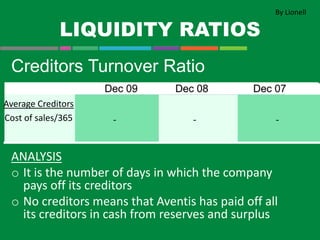

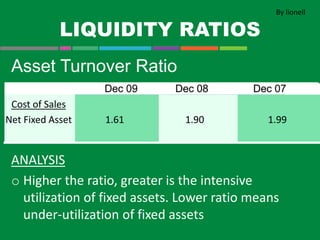

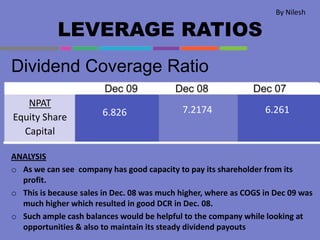

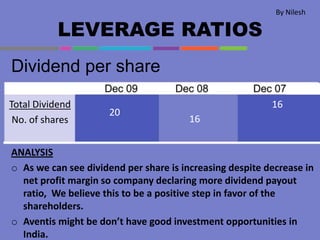

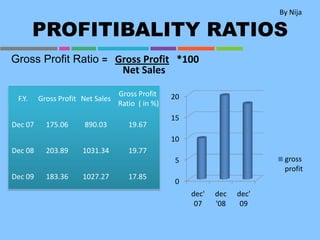

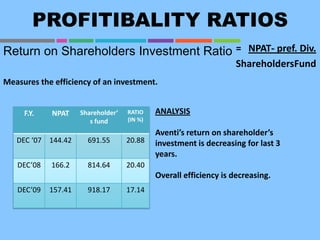

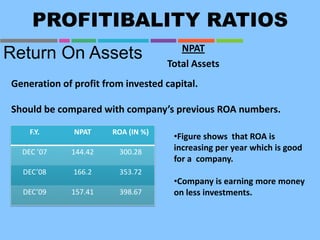

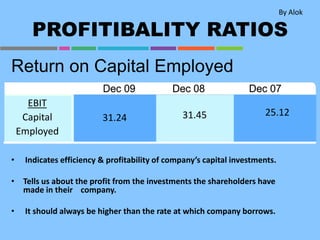

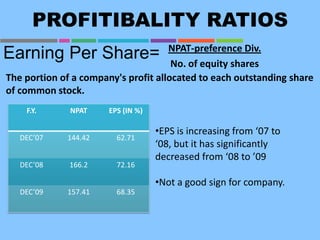

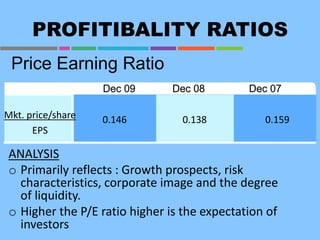

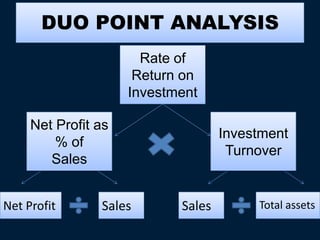

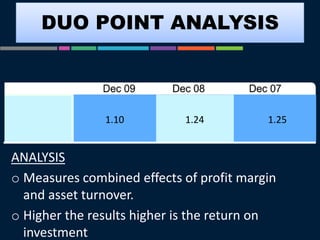

This document contains a ratio analysis of Sanofi-Aventis, a large French pharmaceutical company, for the fiscal years 2007-2009. Several liquidity, leverage, activity, and profitability ratios are calculated and analyzed. Overall, the analysis found that Sanofi-Aventis maintained strong liquidity and no debt over this period. Some profitability ratios like return on assets increased year-over-year, though others like net profit ratio and return on equity declined from 2008-2009 likely due to higher expenses. The analysis provides insights into the company's financial performance and condition during these years based on calculations of key financial ratios.