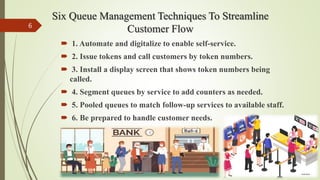

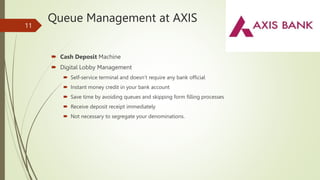

Queue management is the process of improving customer experience, employee productivity, and service delivery by managing customer wait times. It involves tracking both the actual and perceived wait times. Software tools can help banks implement queue management techniques like issuing tokens, displaying wait times, segmenting queues by service, and preparing staff for upcoming customer needs to streamline customer flow. Major banks in India like SBI, ICICI, and Axis are utilizing technologies like mobile apps, self-service machines, and digital displays to manage queues and provide a better customer experience.