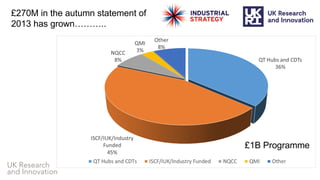

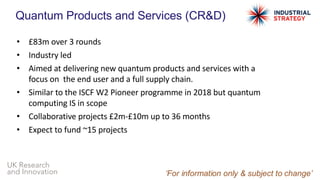

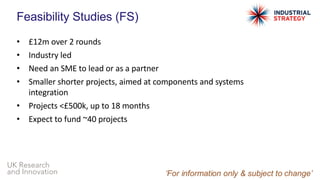

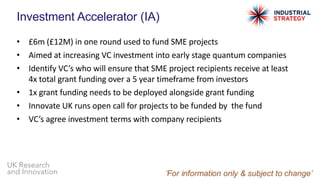

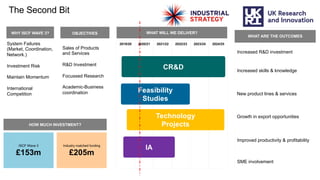

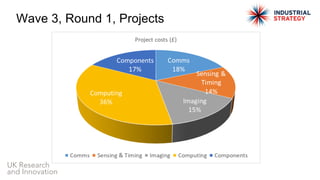

The document discusses the UK's initiatives and strategies for promoting quantum technologies through various funding and collaboration programs. It outlines key projects, investment amounts, and partnerships with international bodies, including a focus on the US market and the need for UK companies to grow and scale. The mission findings highlight opportunities for collaboration in quantum applications while emphasizing the importance of securing investments and fostering international partnerships.