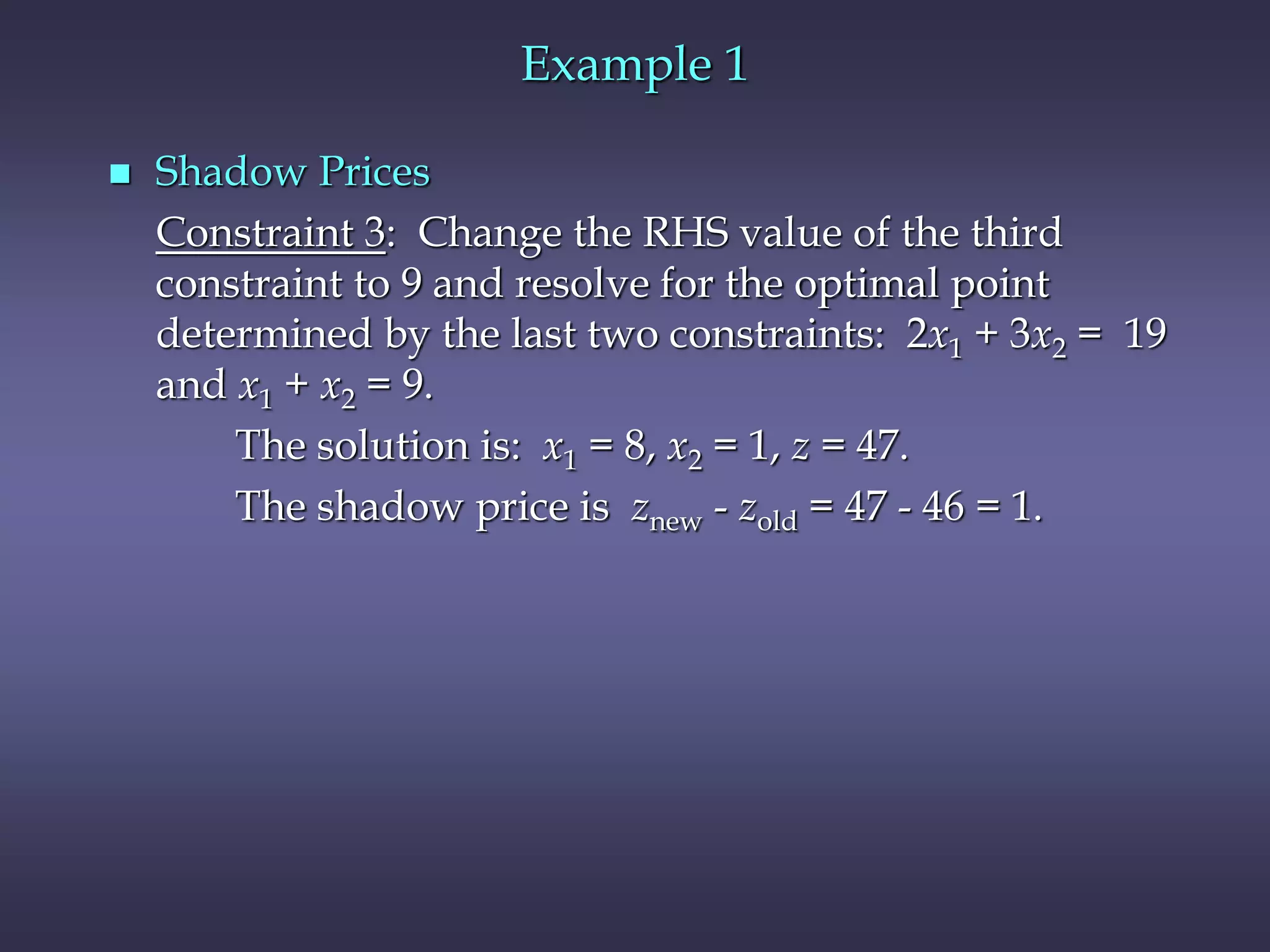

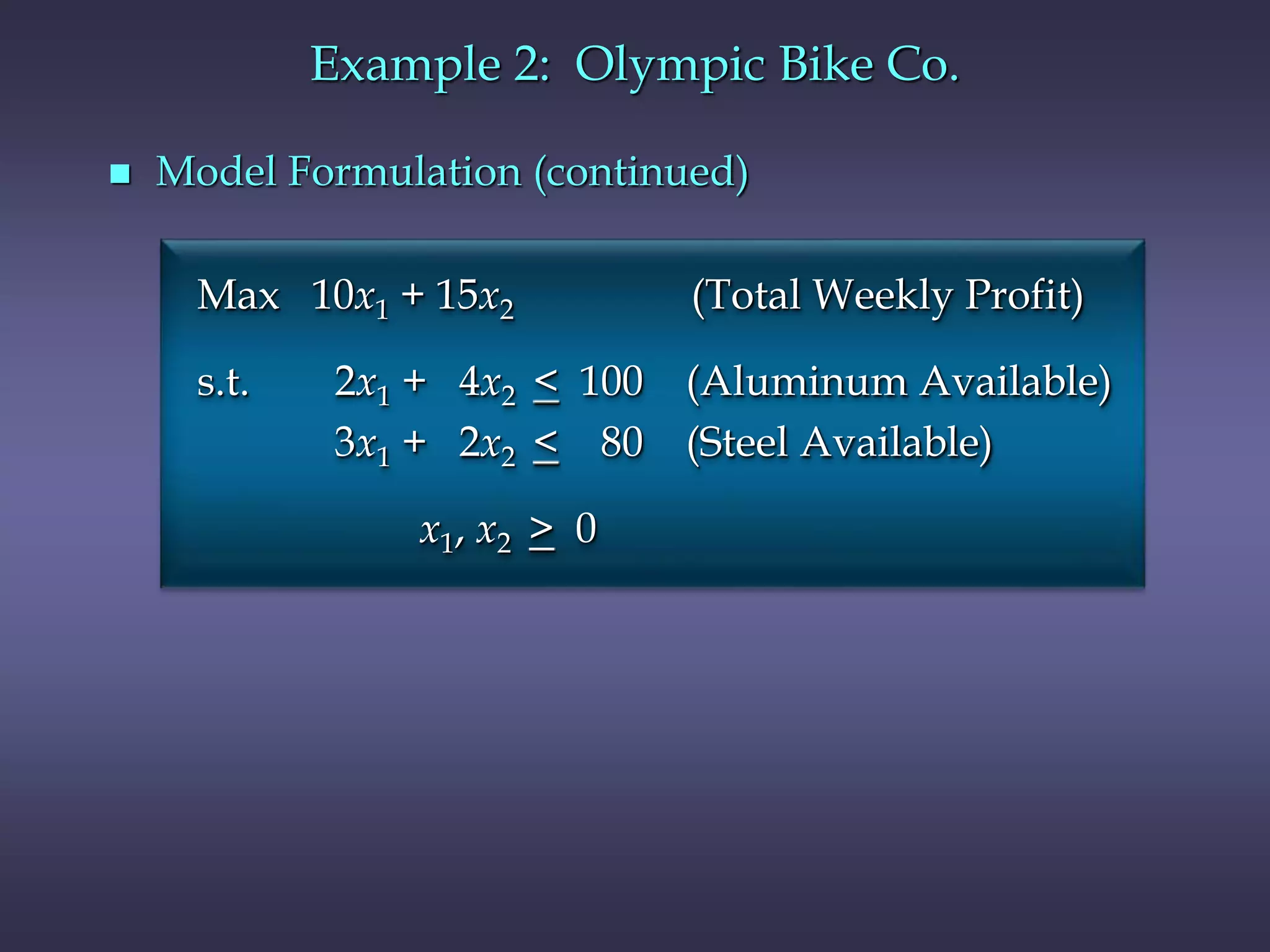

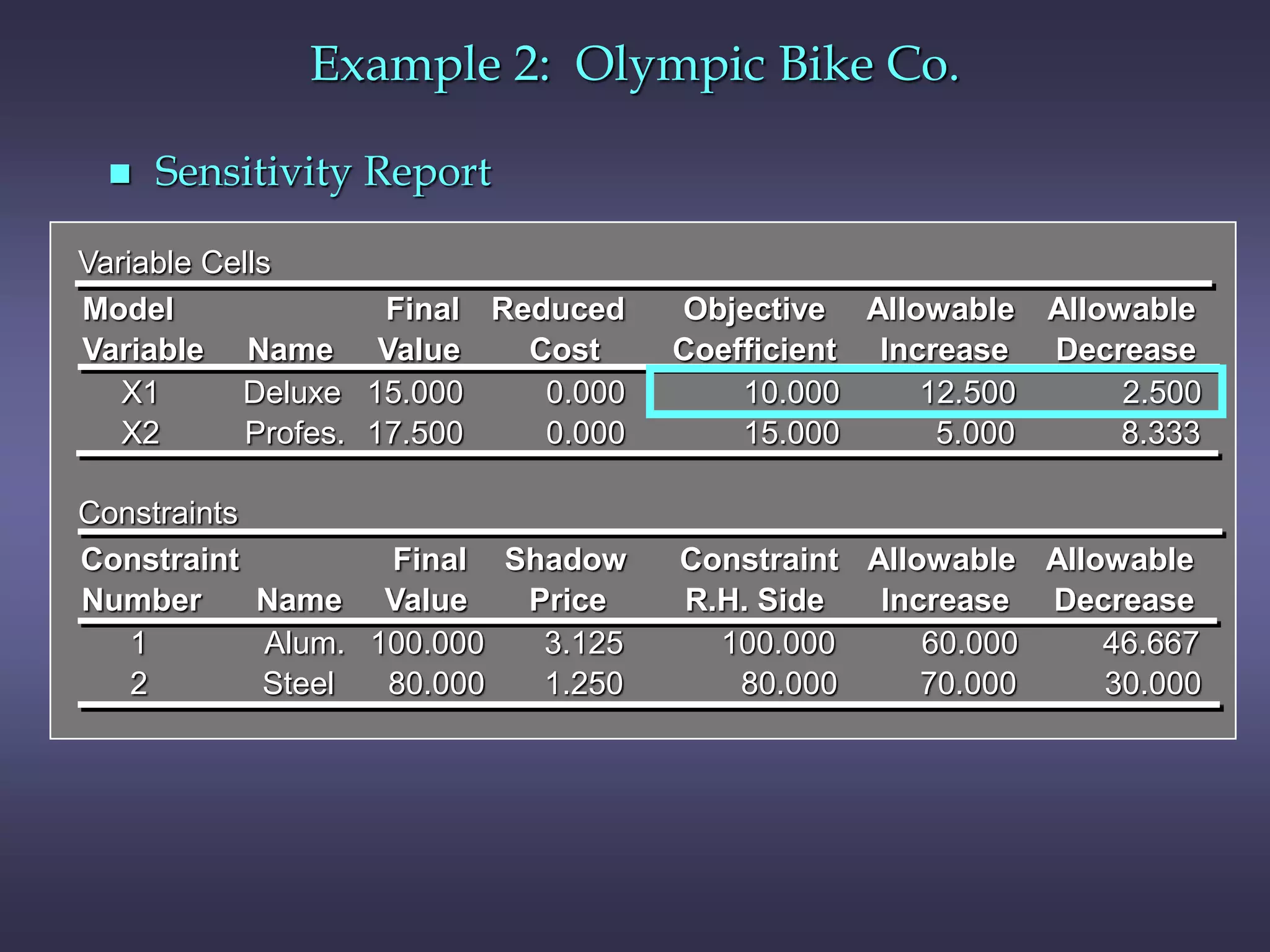

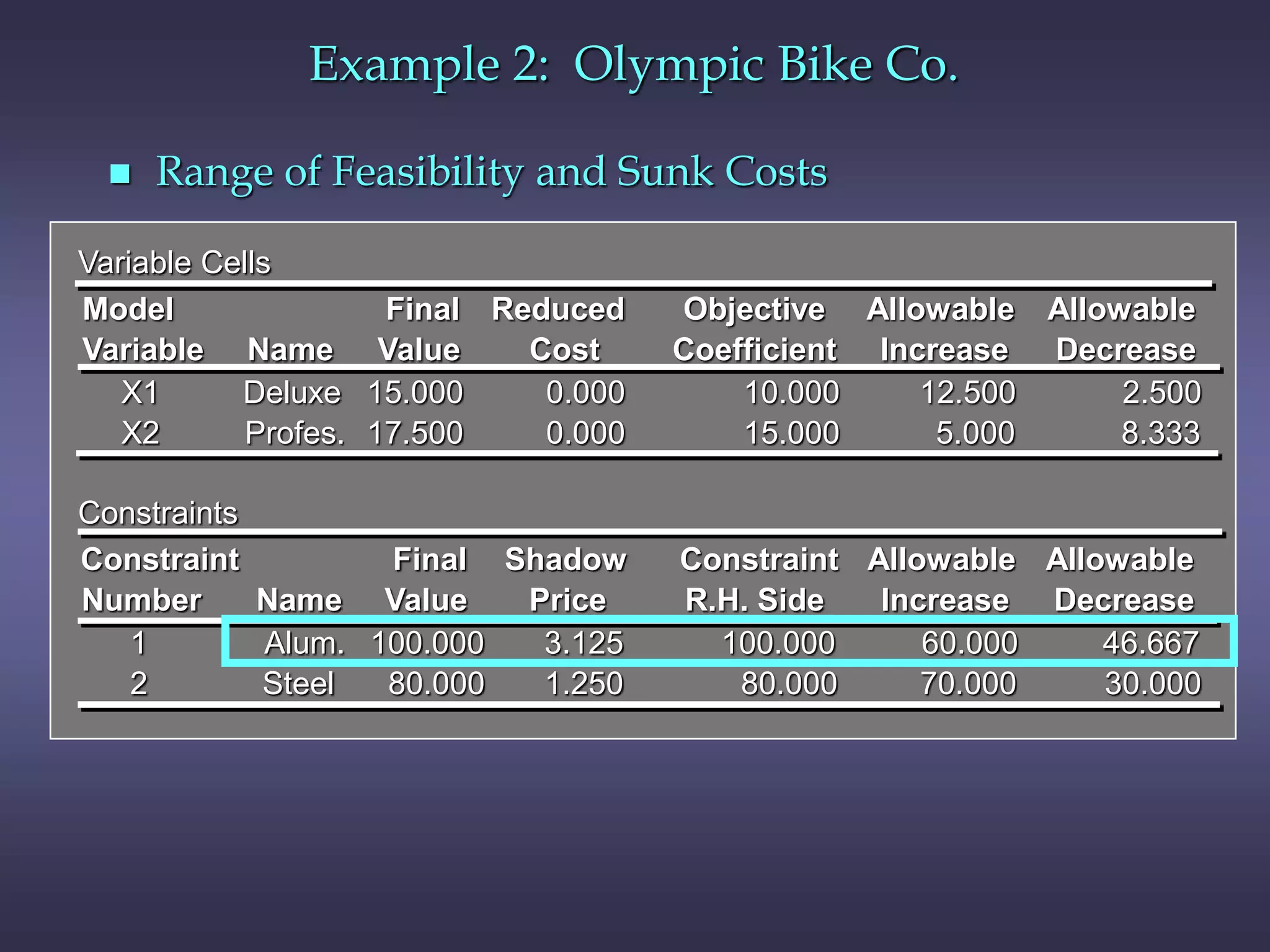

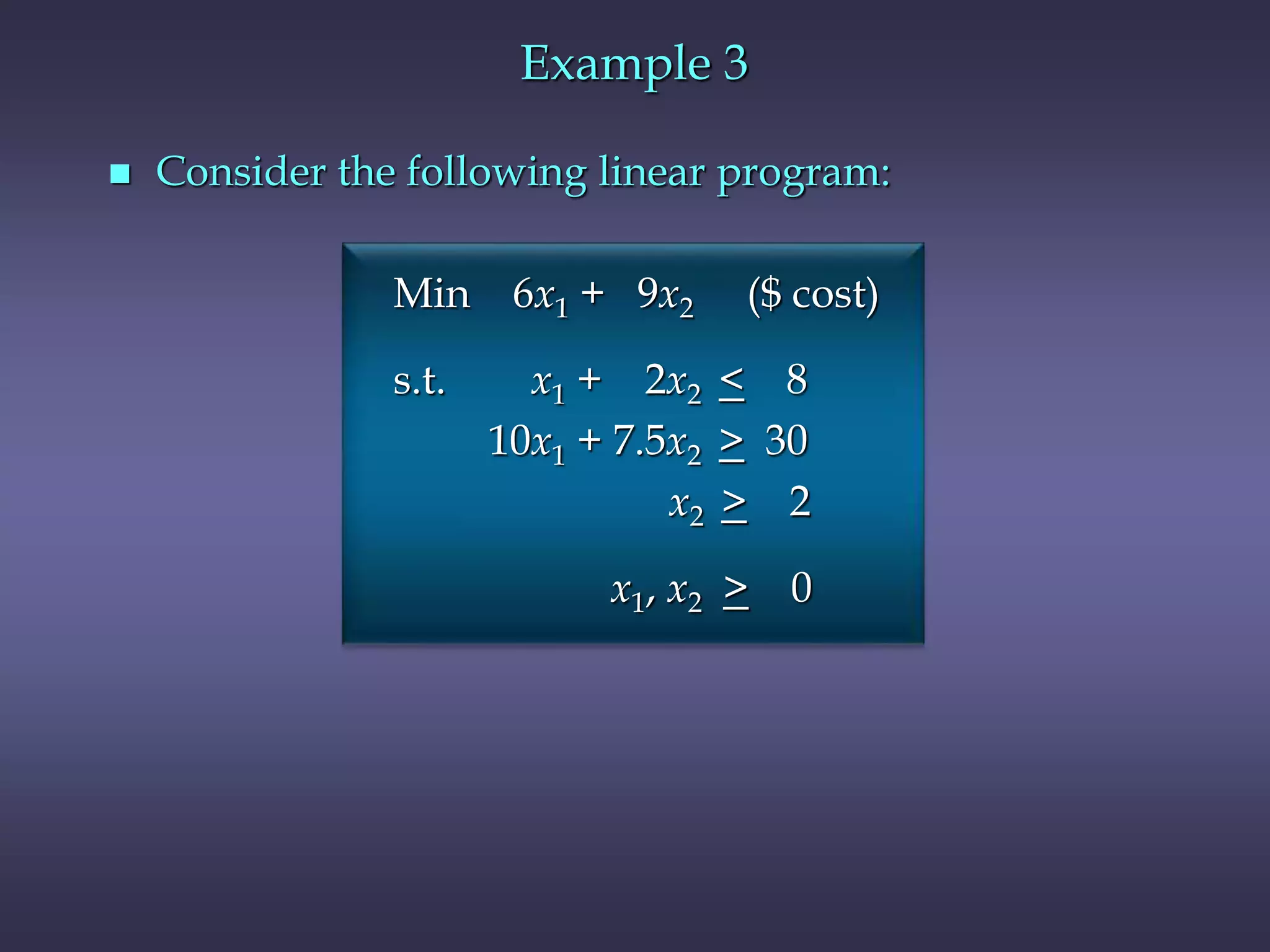

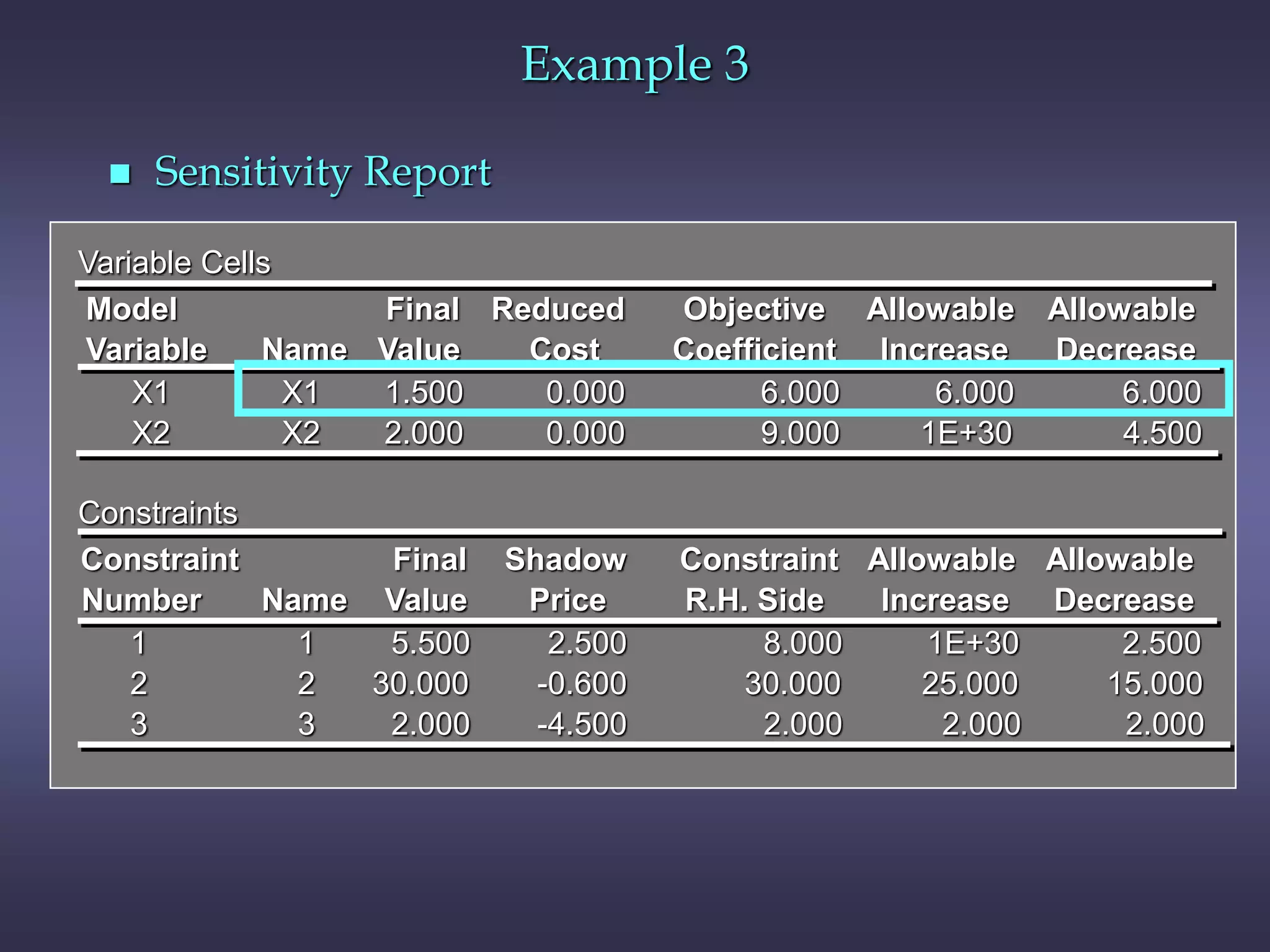

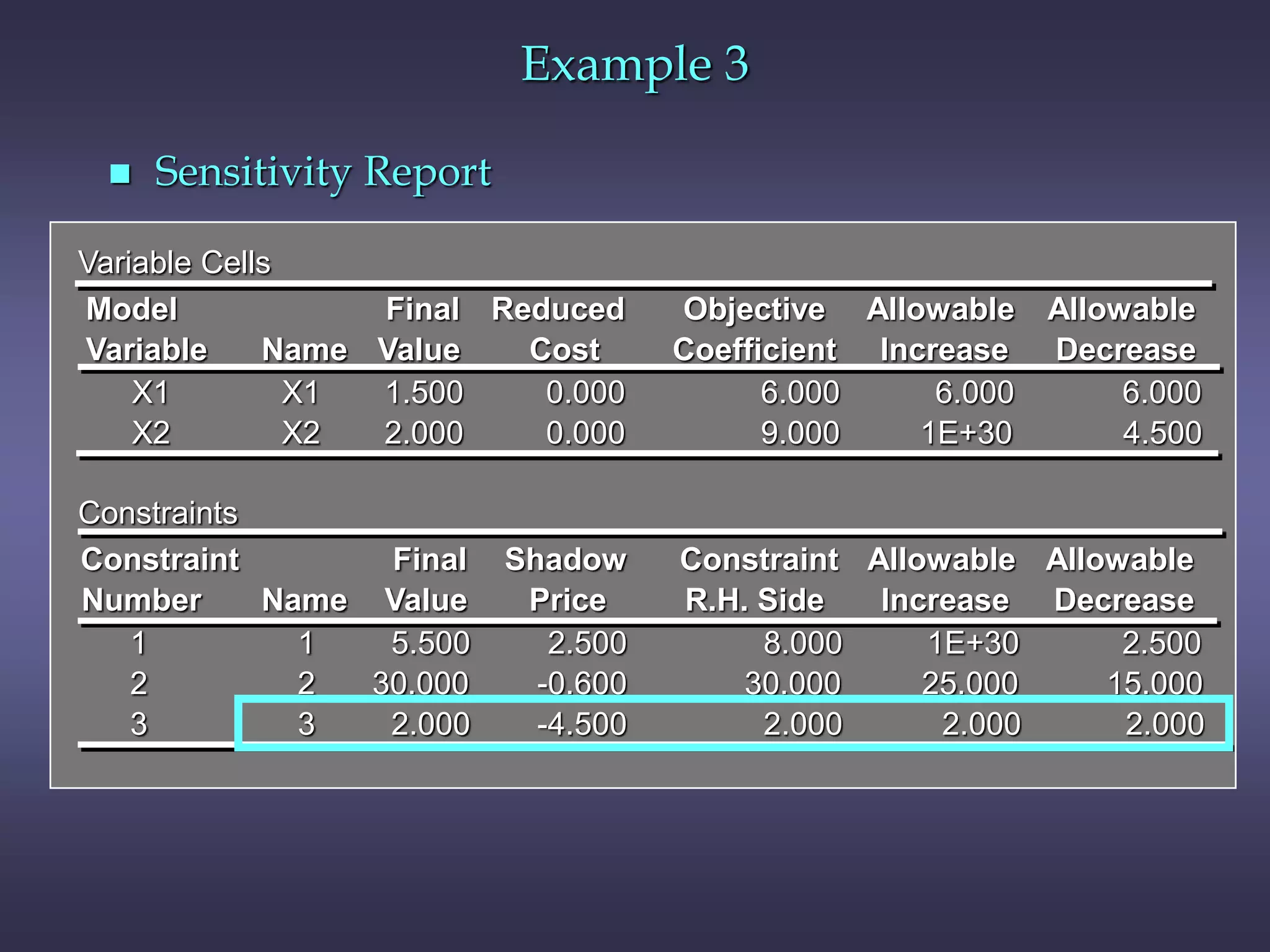

This chapter discusses sensitivity analysis in linear programming, which examines how changes to the objective function coefficients or right-hand side values affect the optimal solution. It introduces the concepts of ranges of optimality and feasibility, which define the ranges of coefficient or right-hand side values where the optimal solution remains the same. The chapter also discusses shadow prices, which measure the impact of changing a right-hand side value, and provides an example to illustrate these concepts.