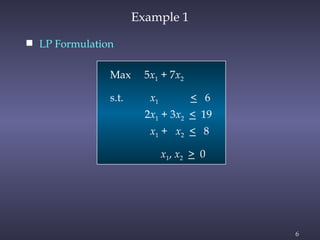

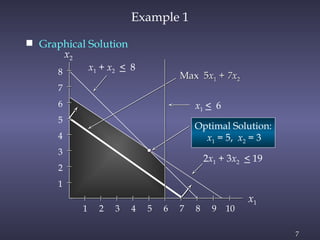

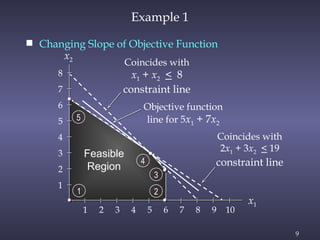

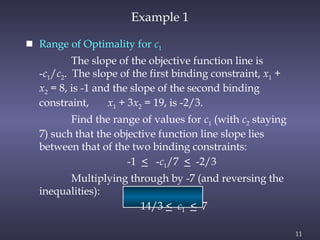

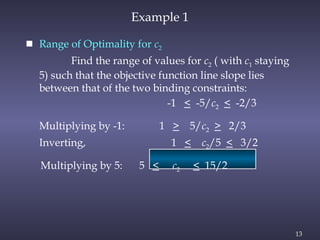

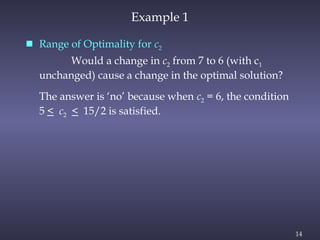

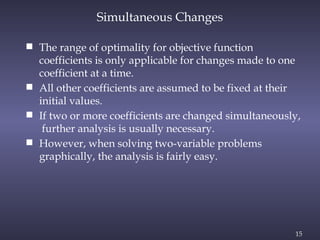

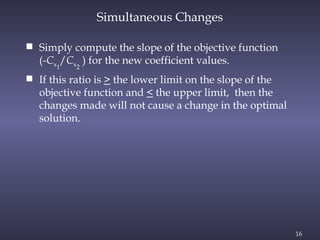

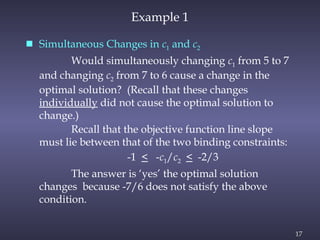

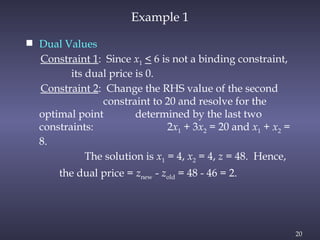

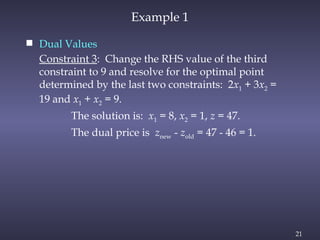

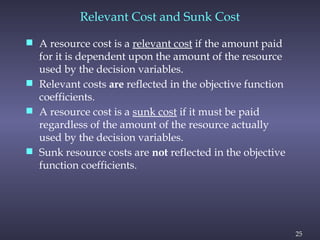

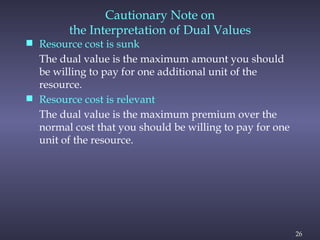

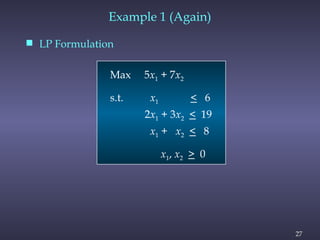

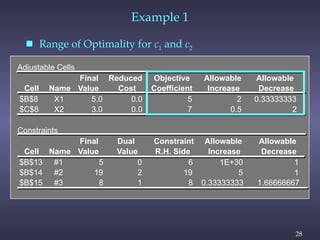

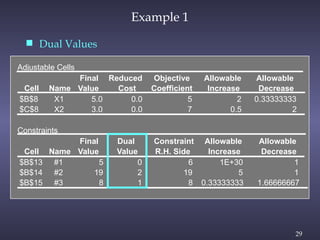

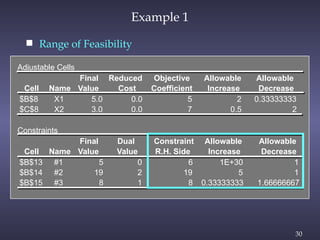

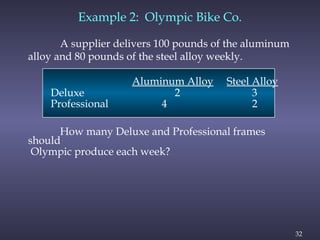

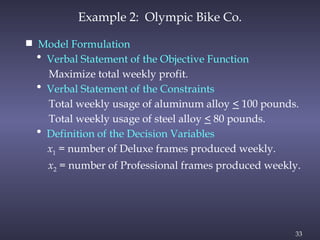

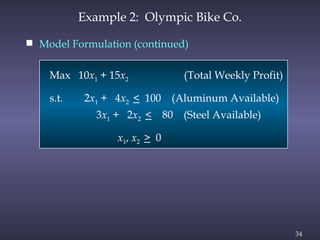

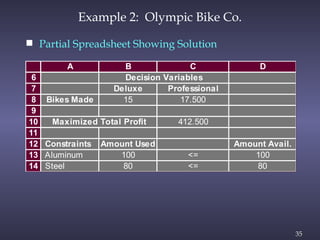

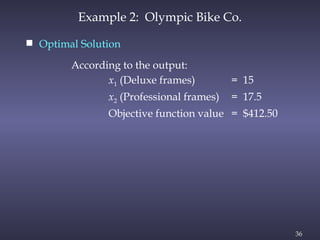

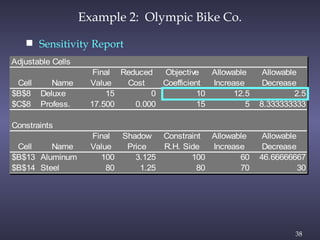

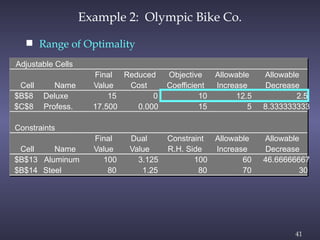

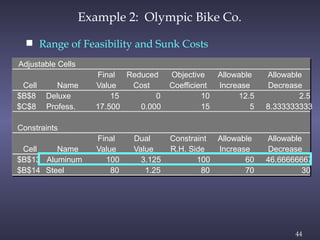

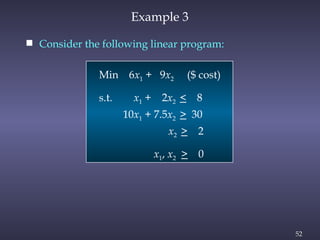

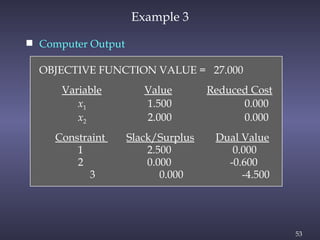

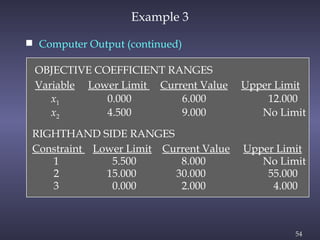

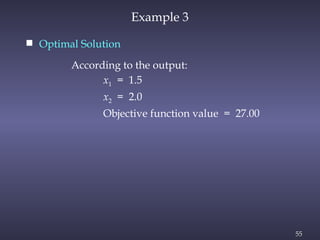

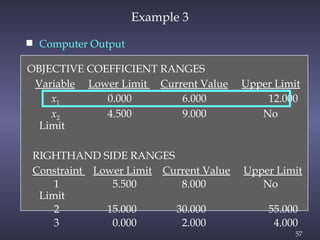

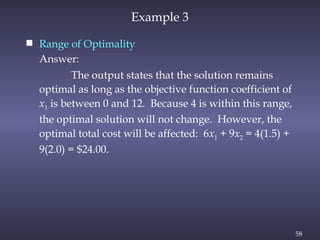

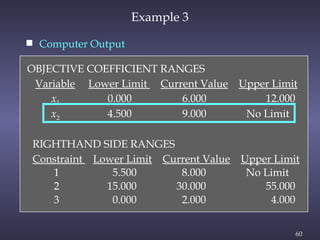

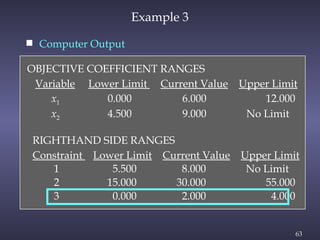

The document discusses sensitivity analysis in linear programming, focusing on how changes in objective function coefficients and constraint values impact the optimal solution. It covers graphical solutions, ranges of optimality for adjusting coefficients, and the implications of changes in right-hand side values on feasibility and dual values. Additionally, it exemplifies the concepts through practical applications like the case of Olympic Bike Co., demonstrating how profit values and resource constraints affect decision-making.