Q4 2019 | Houston Industrial | Research & Forecast Report

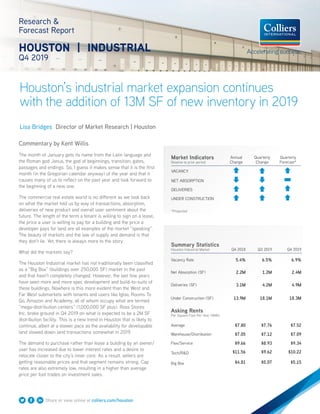

- 1. Share or view online at colliers.com/houston Houston’s industrial market expansion continues with the addition of 13M SF of new inventory in 2019 Research & Forecast Report HOUSTON | INDUSTRIAL Q4 2019 Lisa Bridges Director of Market Research | Houston Commentary by Kent Willis The month of January gets its name from the Latin language and the Roman god Janus, the god of beginnings, transition, gates, passages and endings. So, I guess it makes sense that it is the first month (in the Gregorian calendar anyway) of the year and that it causes many of us to reflect on the past year and look forward to the beginning of a new one. The commercial real estate world is no different as we look back on what the market told us by way of transactions, absorption, deliveries of new product and overall user sentiment about the future. The length of the term a tenant is willing to sign on a lease, the price a user is willing to pay for a building and the price a developer pays for land are all examples of the market “speaking”. The beauty of markets and the law of supply and demand is that they don’t lie. Yet, there is always more to the story. What did the markets say? The Houston Industrial market has not traditionally been classified as a “Big Box” (buildings over 250,000 SF) market in the past and that hasn’t completely changed. However, the last few years have seen more and more spec development and build-to-suits of these buildings. Nowhere is this more evident than the West and Far West submarkets with tenants and users like Igloo, Rooms To Go, Amazon and Academy, all of whom occupy what are termed “mega-distribution centers” (1,000,000 SF plus). Ross Stores Inc. broke ground in Q4 2019 on what is expected to be a 2M SF distribution facility. This is a new trend in Houston that is likely to continue, albeit at a slower pace as the availability for developable land slowed down land transactions somewhat in 2019. The demand to purchase rather than lease a building by an owner/ user has increased due to lower interest rates and a desire to relocate closer to the city’s inner core. As a result, sellers are getting reasonable prices and that segment remains strong. Cap rates are also extremely low, resulting in a higher than average price per foot trades on investment sales. Summary Statistics Houston Industrial Market Q4 2018 Q3 2019 Q4 2019 Vacancy Rate 5.4% 6.5% 6.9% Net Absorption (SF) 2.2M 1.2M 2.4M Deliveries (SF) 3.1M 4.2M 4.9M Under Construction (SF) 13.9M 18.1M 18.3M Asking Rents Per Square Foot Per Year (NNN) Average $7.80 $7.76 $7.52 Warehouse/Distribution $7.05 $7.12 $7.09 Flex/Service $9.66 $8.93 $9.34 Tech/R&D $11.56 $9.62 $10.22 Big Box $4.81 $5.07 $5.15 Market Indicators Relative to prior period Annual Change Quarterly Change Quarterly Forecast* VACANCY NET ABSORPTION DELIVERIES UNDER CONSTRUCTION *Projected

- 2. Change in Sales (Year over Year) Average Price Per SF $40 $50 $60 $70 $80 $90 $100 United States Houston Average CAP Rate 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% United States Houston -100.0% -50.0% 0.0% 50.0% 100.0% 150.0% 200.0% 250.0% 300.0% Houston United States 2 Houston Research & Forecast Report | Q4 2019 | Industrial | Colliers International Sales Activity Source: Real Capital Analytics Q4 2019 NO. OF PROPERTIES: 31 SALES VOLUME: $244.4M AVERAGE $/SF: $79 AVERAGE CAP RATE: 6.8% Job Growth & Unemployment (not seasonally adjusted) UNEMPLOYMENT 11/18 11/19 HOUSTON 3.8% 3.6% TEXAS 3.5% 3.3% U.S. 3.5% 3.3% Oilfield pain…. As everyone knows, oil is king in Texas and Houston is known around the globe as the Energy Capital of the World. And nowhere in the world has more oilfield service companies than Houston. 2019 will be known as a year of consolidation in the industry. The price of oil in 2019 rose from $45.15 per barrel (12/2018) to $61.66 per barrel (12/2019). In November of 2019, the US became a net exporter of all oil products, including both refined petroleum products and crude oil and the resulting effect has been a stable oil price hovering around $60 per barrel. Capital expenditures in the oilfield have tightened, meaning layoffs. Consolidations that occurred resulted in companies eliminating redundancies in their operations, which for the industrial real estate market meant downsizing and merging of facilities. Overbuilt? The main thing you will hear almost unanimously across town is that spec development of bulk distribution space has outpaced demand and that is cause for some worry among real estate professionals. As of January 2020, there is about 21M SF under construction in Houston. While many brokers noticed a slowdown in deal volume over the summer and the early fall of 2019, most agree that Q4 2019 saw an increase in tenants actively searching for space, which is thankfully carrying over into 2020. The Far East and Baytown submarkets (and other submarkets where large spec developments have occurred) will force Landlords to “get creative”, which means readjusting their proformas or getting very aggressive on lease rates and incentives- essentially becoming a Tenants market as they say. In Summary… Here is a quick way to “put the pieces together” and summarize the state of the Houston Industrial market: According to NAIOP, 60% of the total U.S. demand for industrial space is coming from just five industries: logistics and distribution, food and beverage, e-commerce distribution, third party logistics (or 3PL’s), and traditional retailers.* Hence, the emergence of Katy/Brookshire area as a Big Box market, as discussed above. Now couple that with the continued low cost of feedstocks for the petrochemical industry that has driven demand on the Port of Houston and East side markets and the need for plastics and packaging materials. Once products are produced and packaged, they need to be shipped. But the 3PL’s cannot do all the work, which has led to an “explosive 84% year-over-year growth” of “in-house and distribution demand” according to the NAIOP report. *This bodes well for Houston’s Industrial market in the coming months, albeit with some caution. The good news is that recent history tells us that Houston seems to have been less affected by the past recessions than the rest of the country and likely could do so in the face of another one. The mythical god Janus was often depicted in statues and drawings as having two faces, looking to the past, but also to the future. The general sentiment from other brokers around Houston is that 2019 was a “healthy” and overall solid year with a decent amount of active requirements in the market today. JOB GROWTH Annual Change # of Jobs Added HOUSTON 2.7% 85.5K TEXAS 2.7% 343.0K U.S. 1.5% 2.2M

- 3. Change in Sales (Year over Year) Average Price Per SF $40 $50 $60 $70 $80 $90 $100 United States Houston Average CAP Rate 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% United States Houston -100.0% -50.0% 0.0% 50.0% 100.0% 150.0% 200.0% 250.0% 300.0% Houston United States 3 Houston Research & Forecast Report | Q4 2019 | Industrial | Colliers International Sales Activity Source: Real Capital Analytics Q4 2019 NO. OF PROPERTIES: 31 SALES VOLUME: $244.4M AVERAGE $/SF: $79 AVERAGE CAP RATE: 6.8% Job Growth & Unemployment (not seasonally adjusted) UNEMPLOYMENT 11/18 11/19 HOUSTON 3.8% 3.6% TEXAS 3.5% 3.3% U.S. 3.5% 3.3% Vacancy & Availability On an annual basis, Houston’s average industrial vacancy rate increased 150 basis points from 5.4% in Q4 2018 to 6.9% in Q4 2019 and by 40 basis points quarterly from 6.5% in Q3 2019. At the end of the fourth quarter, Houston had 38.8M SF of vacant industrial space for direct lease and an additional 2.2.M SF of vacant space for sublease. Among the major industrial corridors, the Inner Loop Corridor had the lowest vacancy rate at 4.5%, followed by the South Corridor at 5.3%. The submarket with the largest percentage of vacant space is the North Corridor, which had a 8.4% vacancy rate. Absorption & Demand Houston’s industrial market posted 2.4M SF of positive net absorption in the fourth quarter, pushing the year-end total absorption to 8.7M SF. Some of the tenants that relocated or expanded in Q4 2019 include COE Distributing, moving into 238,000 SF in the Northwest Corridor, Daxwell Distribution moving into 171,700 SF in the Northwest Corridor and Exclusive Furniture moving into 156,000 SF in the Southwest Corridor. The majority of fourth-quarter positive net absorption occurred in the Northwest Corridor, recording 2.2M SF. The North, Northeast and South Corridors also reported positive net absorption in the fourth quarter of 2019. The Inner Loop, Southeast and Southwest Corridors recorded negative net absorption. 4.9M SF of new inventory delivered during the quarter. The North Corridor had the most significant amount of new inventory, 1.7M SF, delivered during the fourth quarter. Rental Rates According to our data service provider (CoStar Property), Houston’s citywide average quoted industrial rental rate for all product types decreased from $7.76 per SF NNN to $7.52 per SF NNN over the quarter. According to Colliers’ internal data, actual lease transactions are in the $4.68 – $5.28 per SF NNN range for newer bulk industrial spaces, while flex rates range from $7.20 to $10.80 per SF NNN depending on the existing improvements or the allowance provided for tenant improvements and the age and location of the property. Based on data from our data service provider, the average quoted NNN rental rates by property type are as follows: $7.09 per SF for Warehouse Distribution space, $9.34 per SF for Flex/Service space, Tech/R&D space averaging $10.22 per SF and $5.15 per SF for Big Box. JOB GROWTH Annual Change # of Jobs Added HOUSTON 2.7% 85.5K TEXAS 2.7% 343.0K U.S. 1.5% 2.2M

- 4. 4 Houston Research & Forecast Report | Q4 2019 | Industrial | Colliers International44 Q4 2019 Industrial Lease Transactions over 100,000 SF BUILDING NAME/ADDRESS SUBMARKET SF TENANT LEASE DATE Victory Commerce Center East-Southeast Outlier 349,050 Wholesome Sweetners1,2 Dec-19 West Ten Business Park - Bldg 3 Northwest Outlier 238,000 Amazon.com Services1 Oct-19 300 S Sheldon East I-10 Outer Loop 180,000 Gerber Plumbing Fixtures1 Oct-19 1403 Gillingham Ln - Bldg 1 Sugar Land 148,921 Scope Imports1 Nov-19 Claymoore Distribution Center Northwest Inner Loop 124,050 Owens & Minor3 Oct-19 Pinto Business Park North Fwy/Tomball Pky 123,330 BGI1 Dec-19 Allied Power Building Northwest Hwy 6 113,000 Allied Power Group3 Oct-19 5901 Griggs Rd South Inner Loop 101,707 Supply Chain Warehouse LLC1 Oct-19 Leasing Activity According to our data service provider (CoStar Property), Houston’s industrial leasing activity decreased over the quarter from 7.2M SF in Q3 2019 to 5.7M SF in Q4 2019. The decrease in leasing activity can be attributed to more owner/users in the market. Most of the Q4 2019 transactions consisted of leases for 50,000 SF or less; however, there were several larger deals that occurred. The table below highlights some of the larger transactions that closed in Q4 2019. 1 Direct/New Under Construction Currently, 18.3M SF of industrial space is under construction in Houston with 38.9% of this space pre-leased. The largest project under construction is a 1,300,000-SF distribution warehouse for Medline Industries which is being developed by Clay Development & Construction. The majority of projects under construction are located in the Southeast, Southwest and North Corridor submarkets and are between 25,000-150,000 SF. Below is a partial list of the largest buildings currently under construction. 2 Colliers International Transaction 3 Expansion/Renewal Q4 2019 Industrial Under Construction - 300,000 SF or greater BUSINESS PARK/ADDRESS SUBMARKET RBA % LEASED/ OWNED DEVELOPER/CONTRACTOR DELIVERY DATE BUILDING DESCRIPTION 31207 Kingsland Blvd Sugar Land/Brookshire 2,165,000 100% Ross Stores Inc Feb-21 Ross Distribution Center Pederson Distribution Park Northwest Outlier 1,300,000 100% Clay Development & Construction Dec-20 Medline Industries Pinto Business Park North Fwy/Tomball Pky 1,000,000 100% Hines Feb-20 BTS Coca-Cola Southwest Beverages Conroe Park North Industrial Park The Woodlands/Conroe 860,000 100% Ryan Companies US, Inc. Dec-20 BTS Five Below Bay Area Business Park East-Southeast Far 784,000 0.0% Stream Realty Jun-20 Spec Warehouse Grand National Business Park - Fallbrook Dr Hwy 290/Tomball Pky 770,640 100% Hines Apr-20 BTS Home Depot Distribution Center Generation Park Northeast Hwy 90 648,720 0% Lincoln Property Company Sep-20 Spec Distribution Cedar Port Logistics East-Southeast Far 644,000 0.0% Avera Companies May-20 Spec Warehouse Bayport South Business Park - 10591 Red Bluff Rd East-Southeast Far 642,994 0.0% Panattoni Development Company Mar-20 Spec Warehouse 1919 S Fm 565 Rd East-Southeast Far 604,800 100% DVO Jun-20 BTS Katoen Natie Kennedy Greens Distribution Center I North Outer Loop 524,160 0.0% Clay Development & Construction Feb-20 Spec Distribution Warehouse I-10 & Pin Oak Rd Northwest Outlier 498,700 100.0% American Furniture Warehouse Mar-20 American Furniture Warehouse Park 249 - Bldg 1 Hwy 290/Tomball Pky 443,520 0.0% Panattoni Apr-20 Spec Distribution Warehouse Clay 99 - Bldg 5 Northwest Outlier 433,200 0.0% Duke Realty Corporation Feb-20 Spec Distribution Ella Logistics Center North Fwy/Tomball Pky 358,567 0.0% Hines Jan-20 Spec Distribution Warehouse Deerwood Glen Business Park East-Southeast Far 308,225 100% Clay Development & Construction Mar-20 BTS CAP Barbell

- 5. 5 Houston Research & Forecast Report | Q4 2019 | Industrial | Colliers International Q4 2019 Houston Industrial Market Statistical Summary MARKET RENTABLE AREA DIRECT VACANT SF DIRECT VACANCY RATE SUBLET VACANT SF SUBLET VACANCY RATE TOTAL VACANT SF TOTAL VACANCY RATE 4Q19 NET ABSORP- TION 3Q19 NET ABSORP- TION 4Q19 COMPLE- TIONS SF UNDER CONSTRUC- TION Houston Total 596,082,620 38,785,759 6.5% 2,227,998 0.4% 41,013,757 6.9% 2,362,462 1,201,053 4,876,462 18,291,261 CBD-NW Inner Loop 11,439,576 799,035 7.0% 0 0.0% 799,035 7.0% 16,969 (154,843) - - Downtown 30,241,375 1,187,883 3.9% 16,297 0.1% 1,204,180 4.0% (149,533) (10,918) - - North Inner Loop 5,076,305 138,768 2.7% - 0.0% 138,768 2.7% 15,000 165,343 - - Southwest Inner Loop 5,969,037 222,095 3.7% - 0.0% 222,095 3.7% 34,049 (40,472) - - INNER LOOP CORRIDOR TOTAL 52,726,293 2,347,781 4.5% 16,297 0.0% 2,364,078 4.5% (83,515) (40,890) - - North Fwy/Tomball Pky 27,995,354 2,961,306 10.6% 264,470 0.9% 3,225,776 11.5% 170,010 (57,626) 242,760 2,399,833 North Hardy Toll Rd 37,705,661 2,997,033 7.9% 68,411 0.2% 3,065,444 8.1% 251,428 30,747 1,044,297 747,435 North Outer Loop 22,809,470 1,289,195 5.7% 196,837 0.9% 1,486,032 6.5% (172,793) 28,012 351,400 524,160 The Woodlands/ Conroe 18,707,268 1,163,863 6.2% 36,800 0.2% 1,200,663 6.4% 126,501 (98,940) 56,215 1,089,732 NORTH CORRIDOR TOTAL 107,217,753 8,411,397 7.8% 566,518 0.5% 8,977,915 8.4% 375,146 (97,807) 1,694,672 4,761,160 Liberty County 1,211,541 86,440 7.1% - 0.0% 86,440 7.1% - (21,190) - - LIBERTY COUNTY TOTAL 1,211,541 86,440 7.1% - 0.0% 86,440 7.1% - (21,190) - - Northeast Hwy 321 1,549,806 23,700 1.5% - 0.0% 23,700 1.5% - (18,750) - - Northeast Hwy 90 20,333,823 1,596,260 7.9% 38520 0.2% 1,634,780 8.0% (17,925) 115,248 239,300 856,920 Northeast I-10 4,103,199 233,294 5.7% - 0.0% 233,294 5.7% 598 3,935 10,800 - Northeast Inner Loop 12,174,180 488,096 4.0% 5,000 0.0% 493,096 4.1% 110,879 149,315 - - NORTHEAST CORRIDOR TOTAL 38,161,008 2,341,350 6.1% 43,520 0.1% 2,384,870 6.2% 93,552 249,748 250,100 856,920 Hwy 290/Tomball Pky 24,753,539 2,292,001 9.3% 233,258 0.9% 2,525,259 10.2% 94,700 176,093 - 2,129,910 Northwest Hwy 6 12,244,621 1,173,397 9.6% - 0.0% 1,173,397 9.6% 11,702 51,125 14,000 69,526 Northwest Inner Loop 60,053,294 3,845,792 6.4% 252,628 0.4% 4,098,420 6.8% 344,339 (84,595) 40,967 180,053 Northwest Near 18,291,913 738,981 4.0% 124,882 0.7% 863,863 4.7% 80,308 172,840 21,000 - Northwest Outliers 27,847,193 1,616,504 5.8% 63,204 0.2% 1,679,708 6.0% 1,511,832 202,647 886,044 3,545,315 West Outer Loop 26,765,537 1,084,689 4.1% 29,850 0.1% 1,114,539 4.2% 114,839 159,665 - - NORTHWEST CORRIDOR TOTAL 169,956,097 10,751,364 6.3% 703,822 0.4% 11,455,186 6.7% 2,157,720 677,775 962,011 5,924,804 South Highway 35 35,719,197 1,801,893 5.0% 216,736 0.6% 2,018,629 5.7% (12,020) (146,755) 65,400 262,488 South Inner Loop 12,388,688 485,332 3.9% 67,325 0.5% 552,657 4.5% 101,980 27,214 - - SOUTH CORRIDOR TOTAL 48,107,885 2,287,225 4.8% 284,061 0.6% 2,571,286 5.3% 89,960 (119,541) 65,400 262,488 East I-10 Outer Loop 13,607,283 535,162 3.9% - 0.0% 535,162 3.9% 21,862 (90,437) - - East-Southeast Far 73,506,174 6,238,783 8.5% 393,845 0.5% 6,632,628 9.0% (271,971) 306,375 810,630 4,340,079 Southeast Outer Loop 17,095,778 831,914 4.9% 144,796 0.8% 976,710 5.7% (7,084) (7,476) 526,094 176,201 SOUTHEAST CORRIDOR TOTAL 104,209,235 7,605,859 7.3% 538,641 0.5% 8,144,500 7.8% (257,193) 208,462 1,336,724 4,516,280 Highway 59/Highway 90 23,919,089 1,392,023 5.8% 51,469 0.2% 1,443,492 6.0% (54,705) (143,023) 361,419 874,678 Southwest Far 15,158,944 1,792,534 11.8% - 0.0% 1,792,534 11.8% 217,520 113,577 77,586 684,543 Southwest Outer Loop 13,170,837 897,752 6.8% 17,670 0.1% 915,422 7.0% (138,808) 64,507 - - Sugar Land/Ft Bend Co 22,243,938 872,034 3.9% 6,000 0.0% 878,034 3.9% (37,215) 309,435 128,550 410,388 SOUTHWEST CORRIDOR TOTAL 74,492,808 4,954,343 6.7% 75,139 0.1% 5,029,482 6.8% (13,208) 344,496 567,555 1,969,609 Market Summary

- 6. TOTAL INDUSTRIAL INVENTORY 596.1M SF OTHER: 5% SERVICE/FLEX 2% R&D: 1% DISTRIBUTION: 15% WAREHOUSE: 61% MANUFACTURING: 16% 8.1M SF 5.9M SF 6.5M SF 7.2M SF Q4 2018 Q1 2019 Q2 2019 Q3 2019 -29.6% ANNUAL DECREASE LEASING ACTIVITY 58% ANNUAL INCREASE NEW CONSTRUCTION (DELIVERIES) Q4 2019 4.9M SF Q4 2018 3.1M SF Q1 2019 3.2M SF Q2 2019 6.1 SF 5.7M SFQ4 2019 Q3 2019 4.2 SF 6.9% $7.52/SF VACANCY AVG. RENTAL RATE Q42019 UNDER CONSTRUCTION 18.3M SF 6 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | Market 000 Address, Suite # 000 Address, Suite # +1 000 000 0000 colliers.com/<<market>> 6 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2019 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | Houston 1233 West Loop South, Suite 900 Houston, Texas 77027 +1 713 222 2111 colliers.com/houston FOR MORE INFORMATION Lisa Bridges Director of Market Research | Houston +1 713 830 2125 lisa.bridges@colliers.com Q4 Houston Industrial 2019 Highlights Kent Willis Vice President | Houston +1 713 830 2154 kent.willis@colliers.com

- 7. 7 Houston Research & Forecast Report | Q4 2019 | Industrial | Colliers International7 Our philosophy revolves around the fact that the best possible results come from linking our global enterprise with local advisors who understand your business, your market, and how to integrate real estate into a successful business strategy. C O L L I E R S I N T E R N A T I O N A L G L O B A L L O C A T I O N S COMMERCIAL REAL ESTATE SECTORS REPRESENTED OFFICE INDUSTRIAL LAND RETAIL HEALTHCARE MULTIFAMILY HOTEL $127BTRANSACTION VALUE 2BSF UNDER MANAGEMENT $3.3BIN REVENUE 438OFFICES 17,300PROFESSIONALS 340ACCREDITED MEMBERS 68COUNTRIES SIOR ADVANTAGE Colliers International (NASDAQ, TSX: CIGI) is a leading global real estate services and investment management company. With operations in 68 countries, our 14,000 enterprising people work collaboratively to provide expert advice and services to maximize the value of property for real estate occupiers, owners and investors. For more than 20 years, our experienced leadership team, owning more than 40% of our equity, have delivered industry-leading investment returns for shareholders. In 2018, corporate revenues were $2.8 billion ($3.3 billion including affiliates), with more than $26 billion of assets under management. Colliers professionals think differently, share great ideas and offer thoughtful and innovative advice to accelerate the success of its clients. Colliers has been ranked among the top 100 global outsourcing firms by the International Association of Outsourcing Professionals for 13 consecutive years, more than any other real estate services firm. Colliers is ranked the number one property manager in the world by Commercial Property Executive for two years in a row. PROPERTY POSITIONING & MARKETING REAL ESTATEINVESTMENT VALUATION& ADVISORY CORPORATE SOLUTIONS MANAGEMENT REALESTATE REPRESENTATION LANDLORD REPRESENTATION TENANT LOCA TION INTELLIGENCE M A RKET RESEARCH& MARKETS PROJECT MANAGEMENT COLLIERS SPECIALIZATIONS and REAL ESTATE SERVICE REPRESENTATION DATACENTERS HE ALTHCARE HOTELS & HOSPITALITY SERVICES IN DUSTRIAL LAND HOUSING&MULTIFAMILY SER VICES MARINA, LEISURE & GOLF COURSE OFFICE RETAIL SPECIALPURPOSE