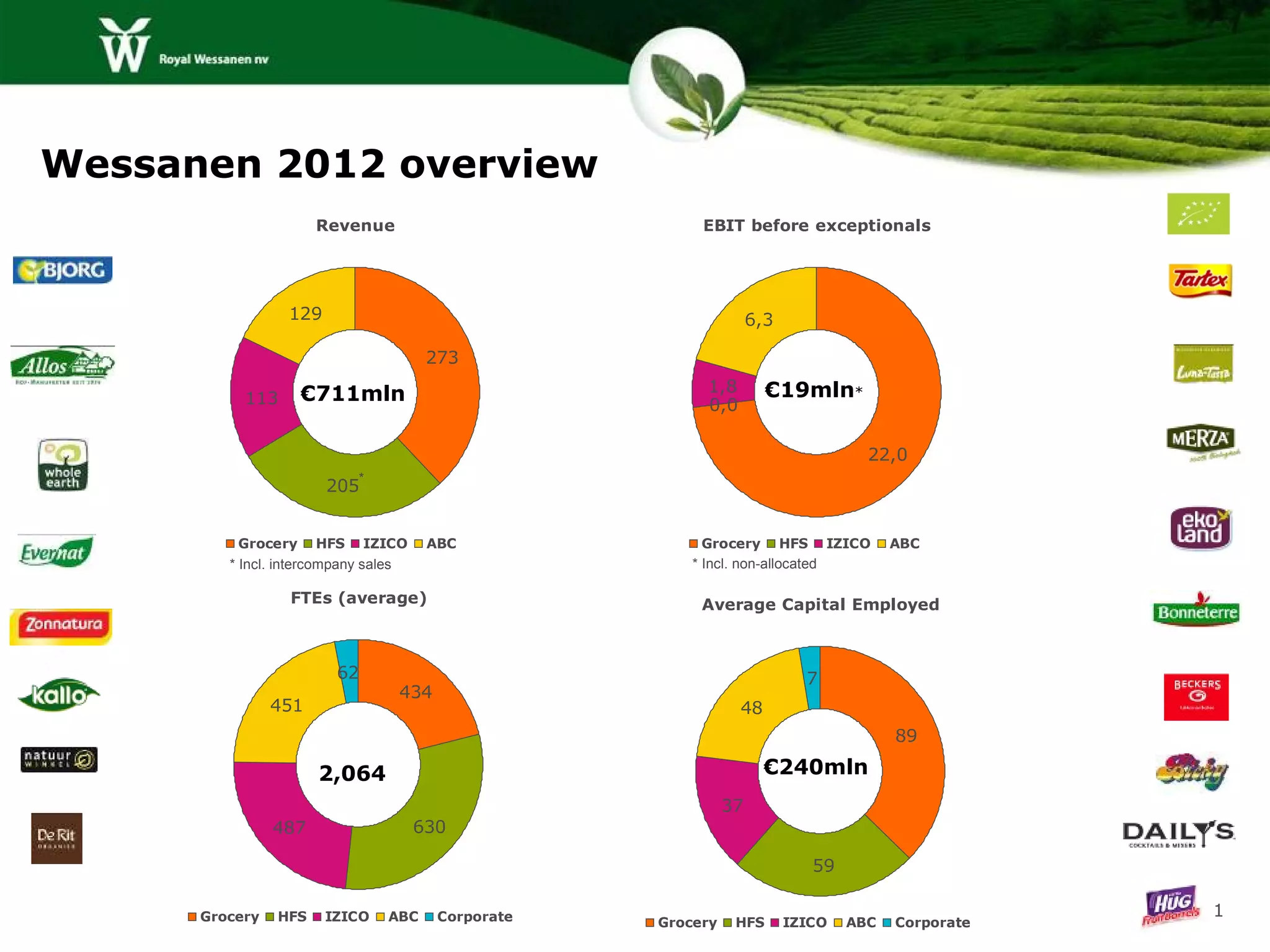

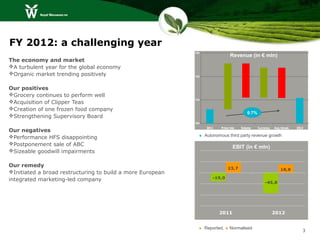

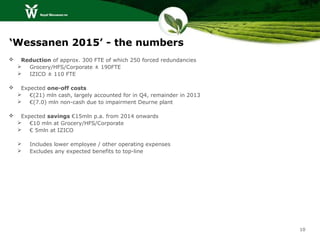

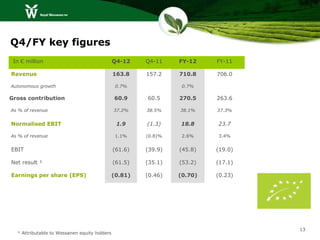

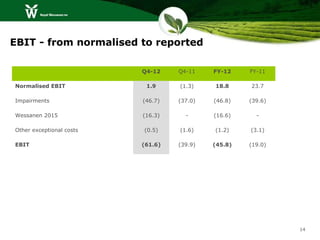

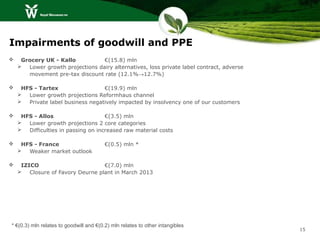

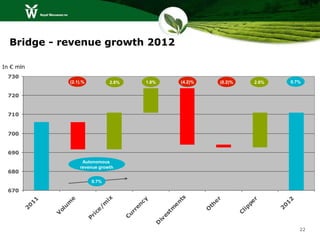

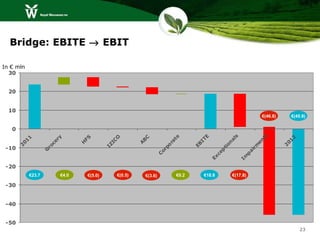

Wessanen reported revenue of €711 million in 2012, a 0.7% increase over 2011. EBIT before exceptionals was €19 million, down from €23.7 million in 2011. The Grocery segment continued to perform well with 4.6% autonomous growth in 2012. However, performance in the Health Food Stores and IZICO segments was disappointing. A broad restructuring was initiated to build a more integrated European company.