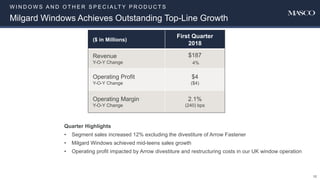

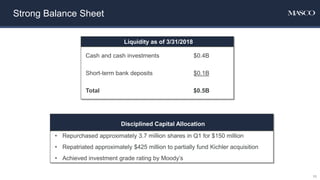

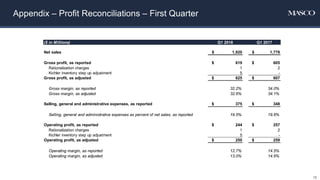

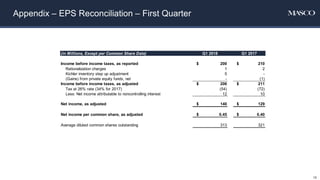

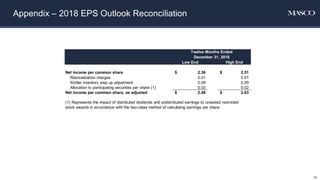

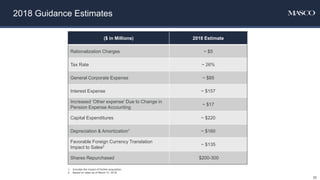

Masco Corporation reported first quarter 2018 results. Revenue increased 8% to $1.92 billion due to growth in the Plumbing and Decorative Architectural segments and the North American Windows business. Operating profit decreased to $250 million due to $30 million in strategic growth investments and a lag in passing along price increases. Management affirmed its annual earnings guidance range of $2.48 to $2.63 per share.