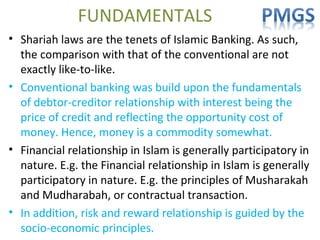

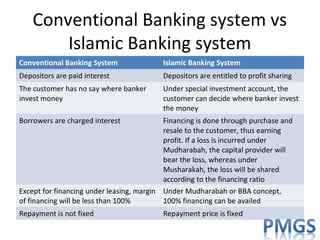

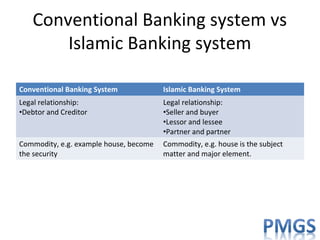

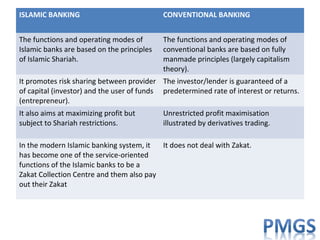

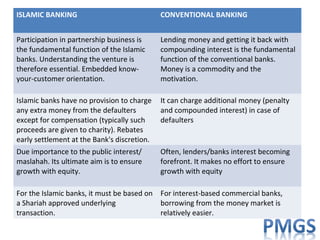

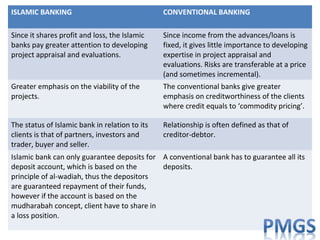

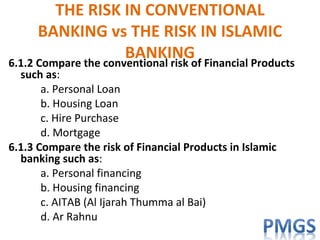

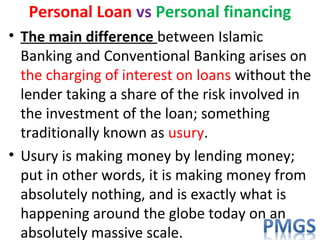

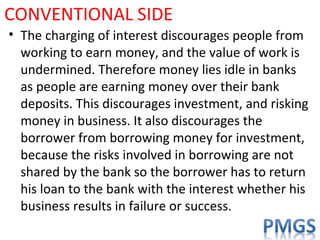

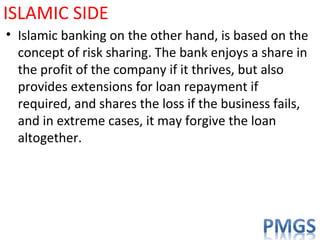

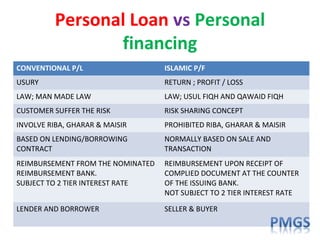

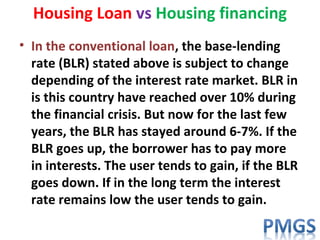

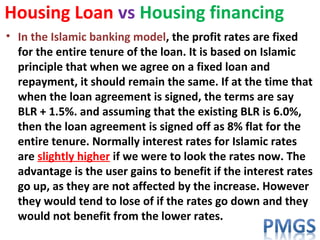

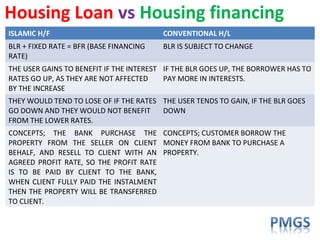

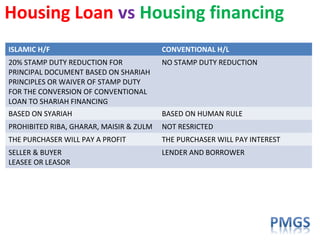

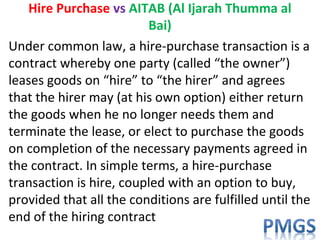

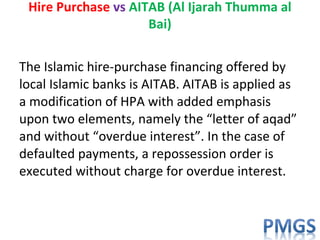

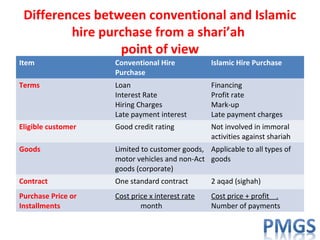

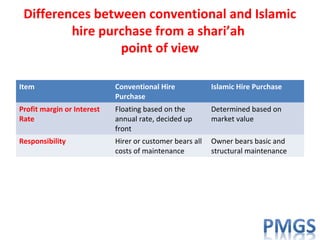

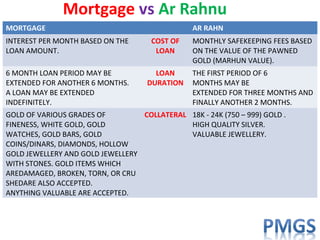

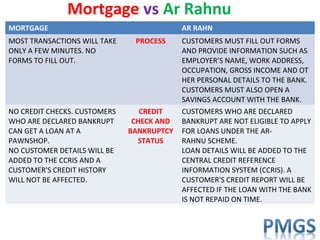

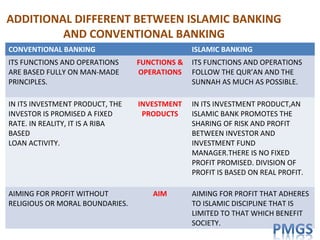

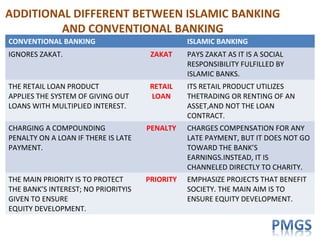

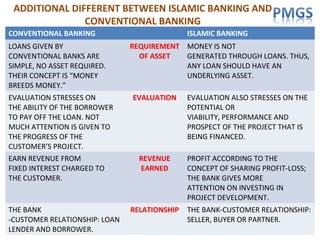

This document compares the risks in conventional banking and Islamic banking. It discusses the differences in how risk is managed in each system. In conventional banking, risks are eliminated and the lender is guaranteed returns, while in Islamic banking risks are shared between parties. Several financial products are also compared, including personal loans/financing, housing loans/financing, and others. For each product, the document outlines how risks are treated differently under Islamic principles versus conventional interest-based systems.