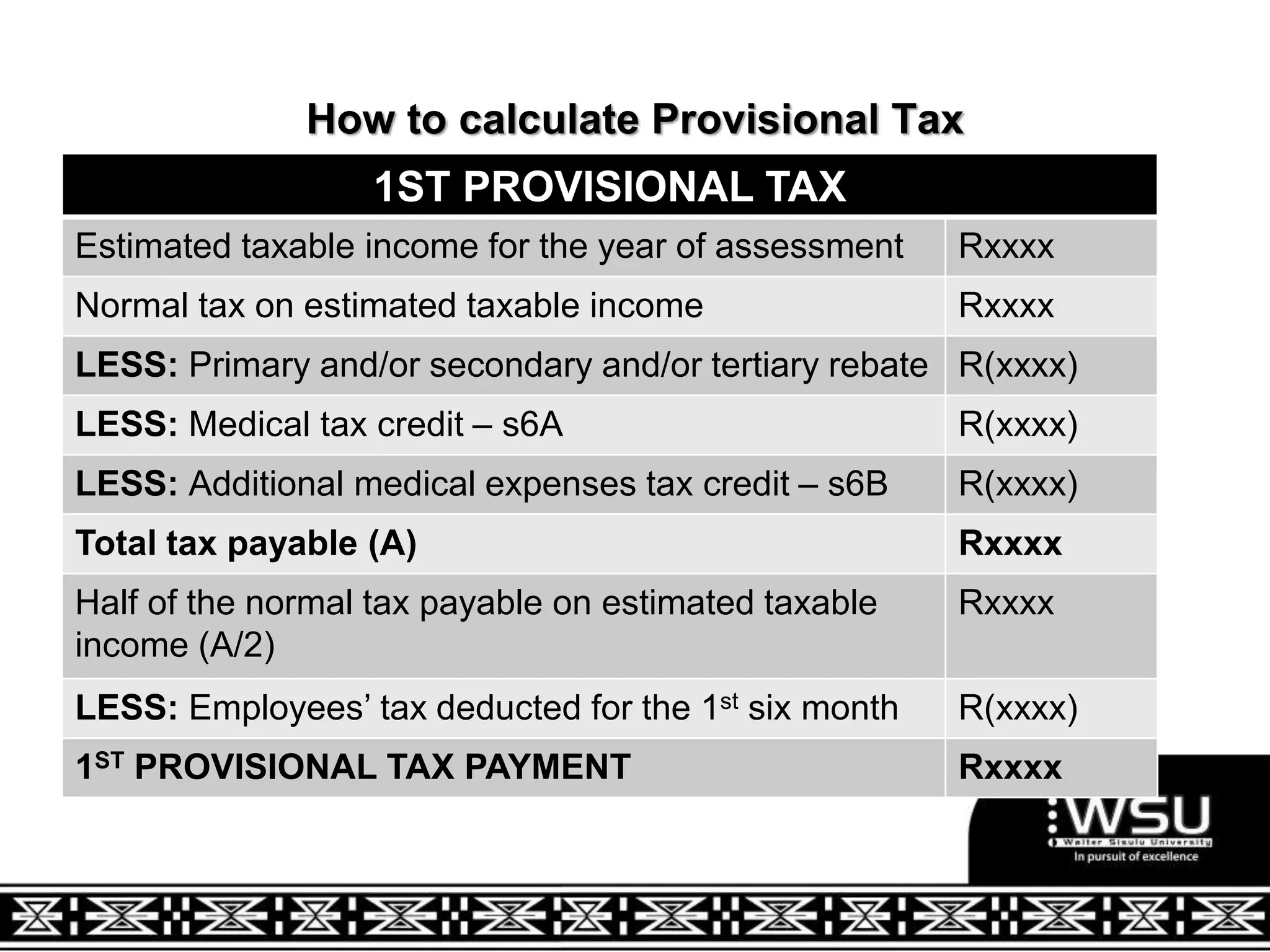

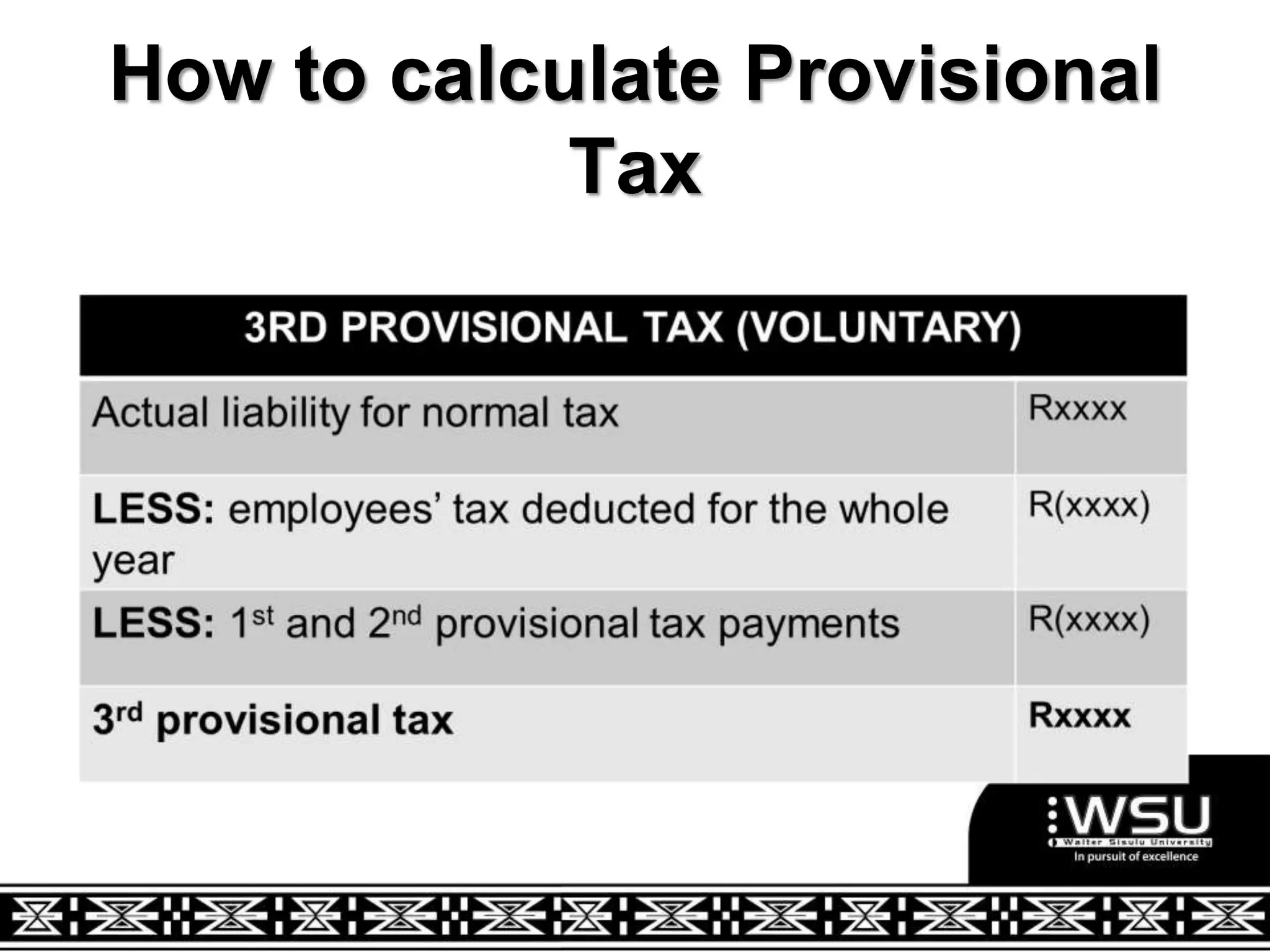

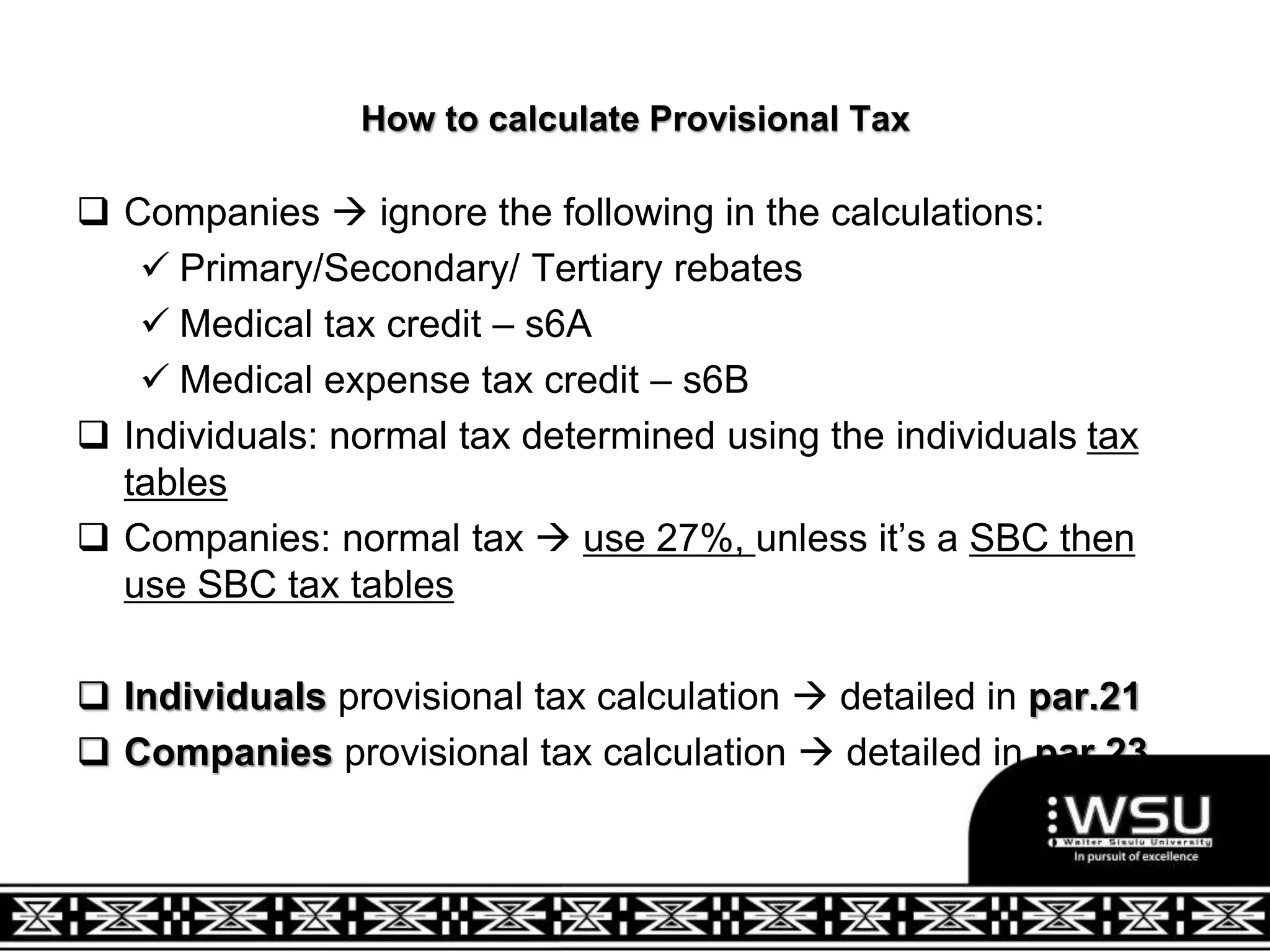

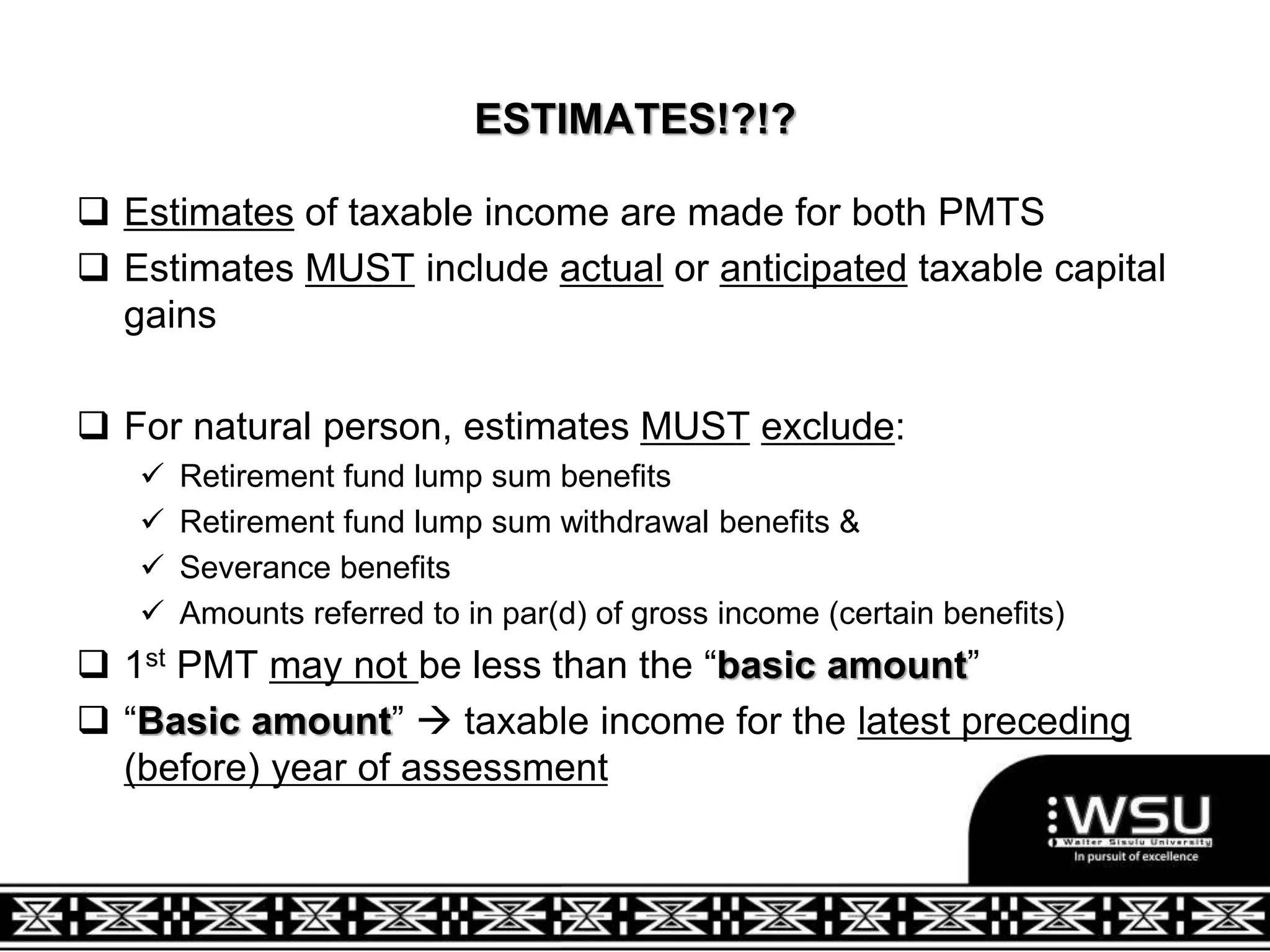

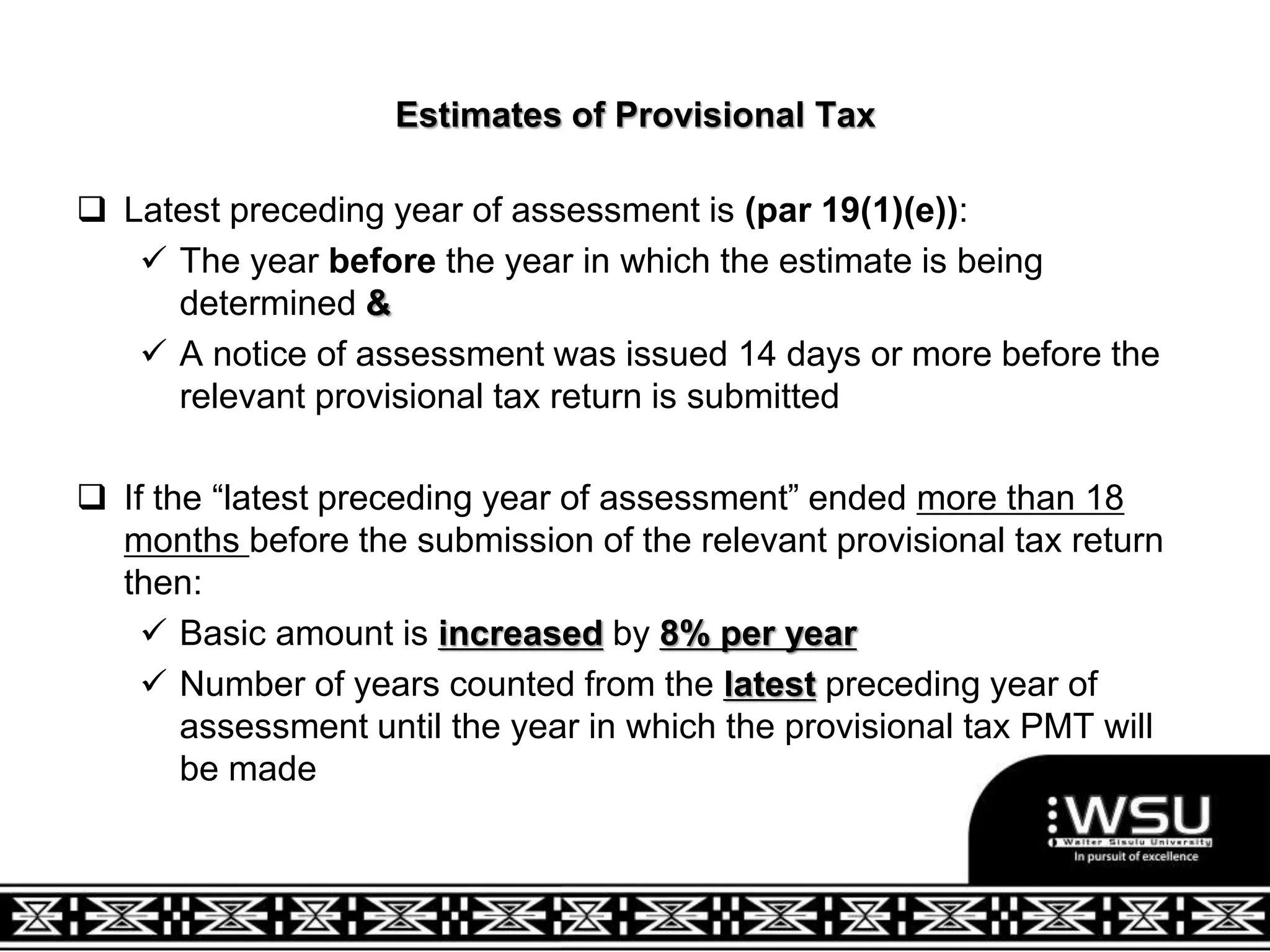

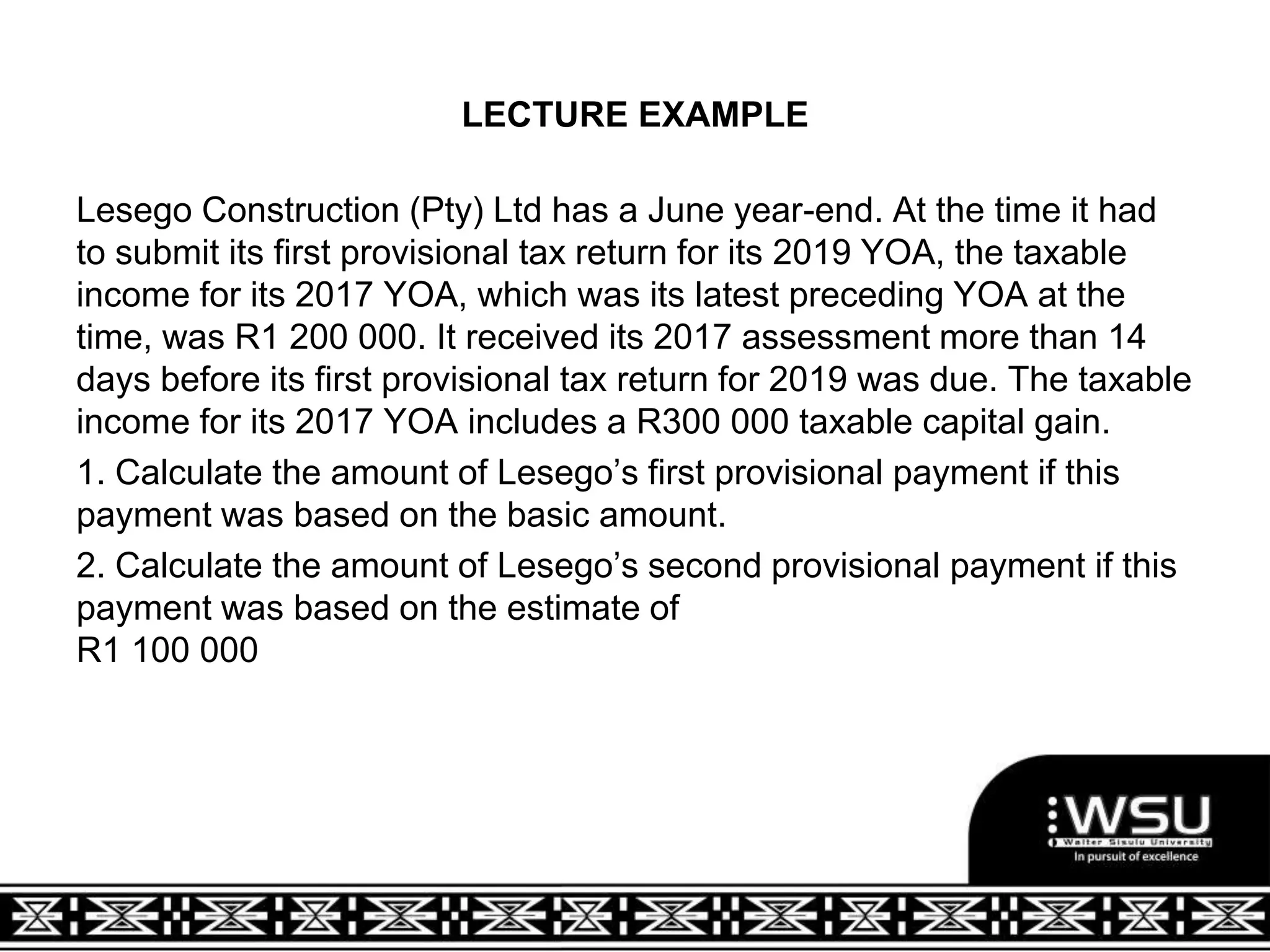

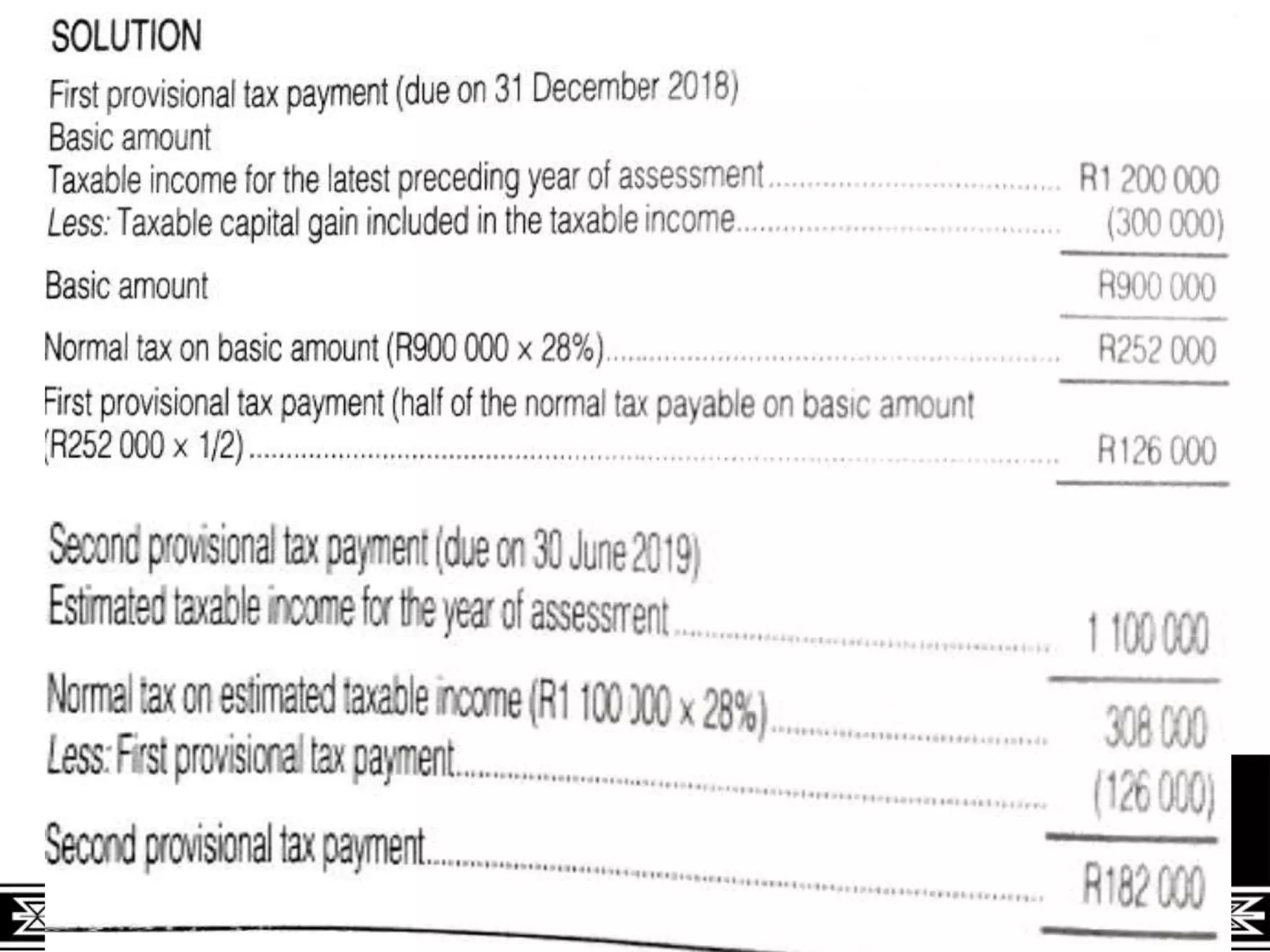

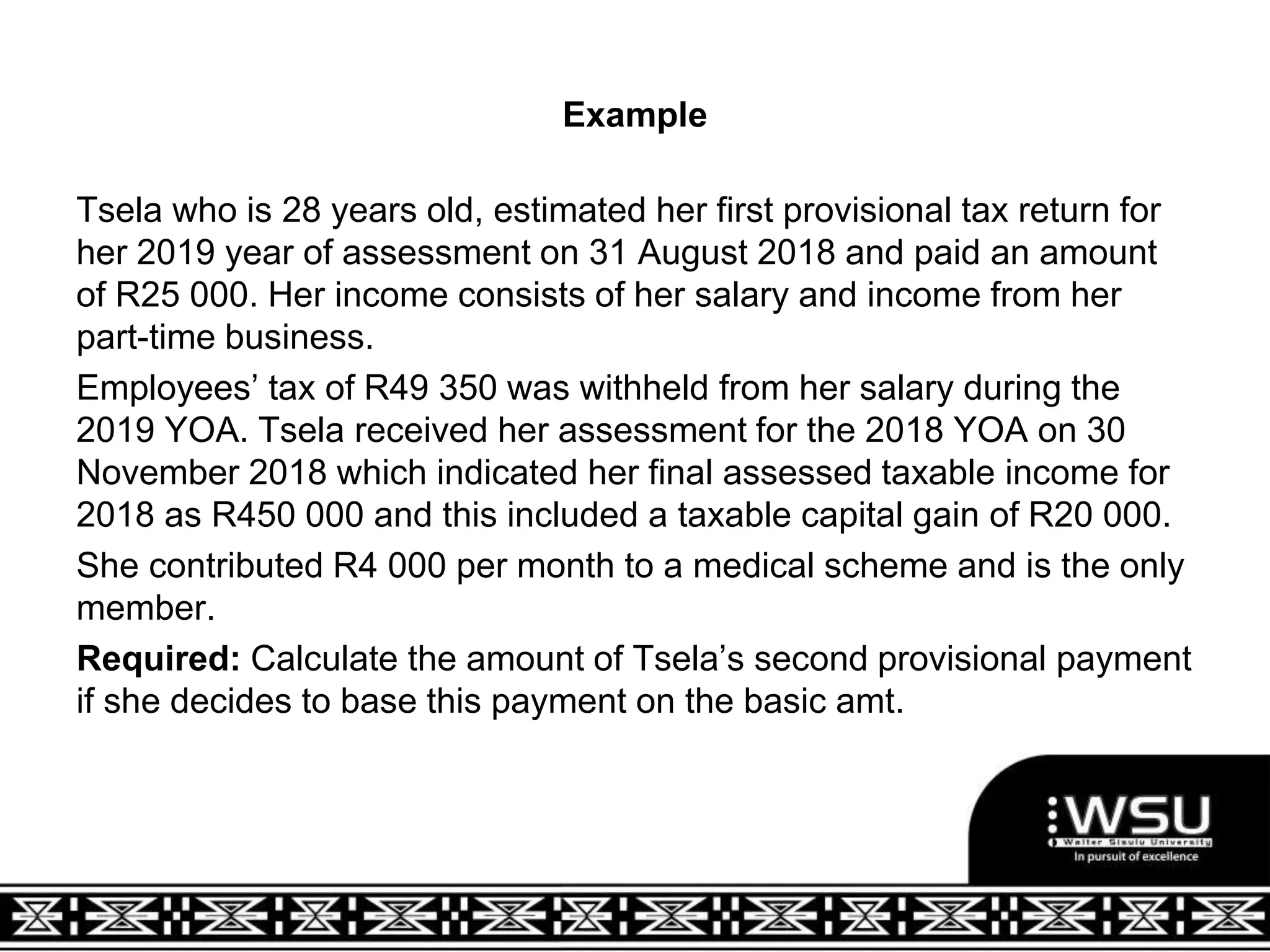

1. The document covers topics related to provisional tax in South Africa, including definitions, payment requirements, estimates, penalties, and calculations for individuals and companies.

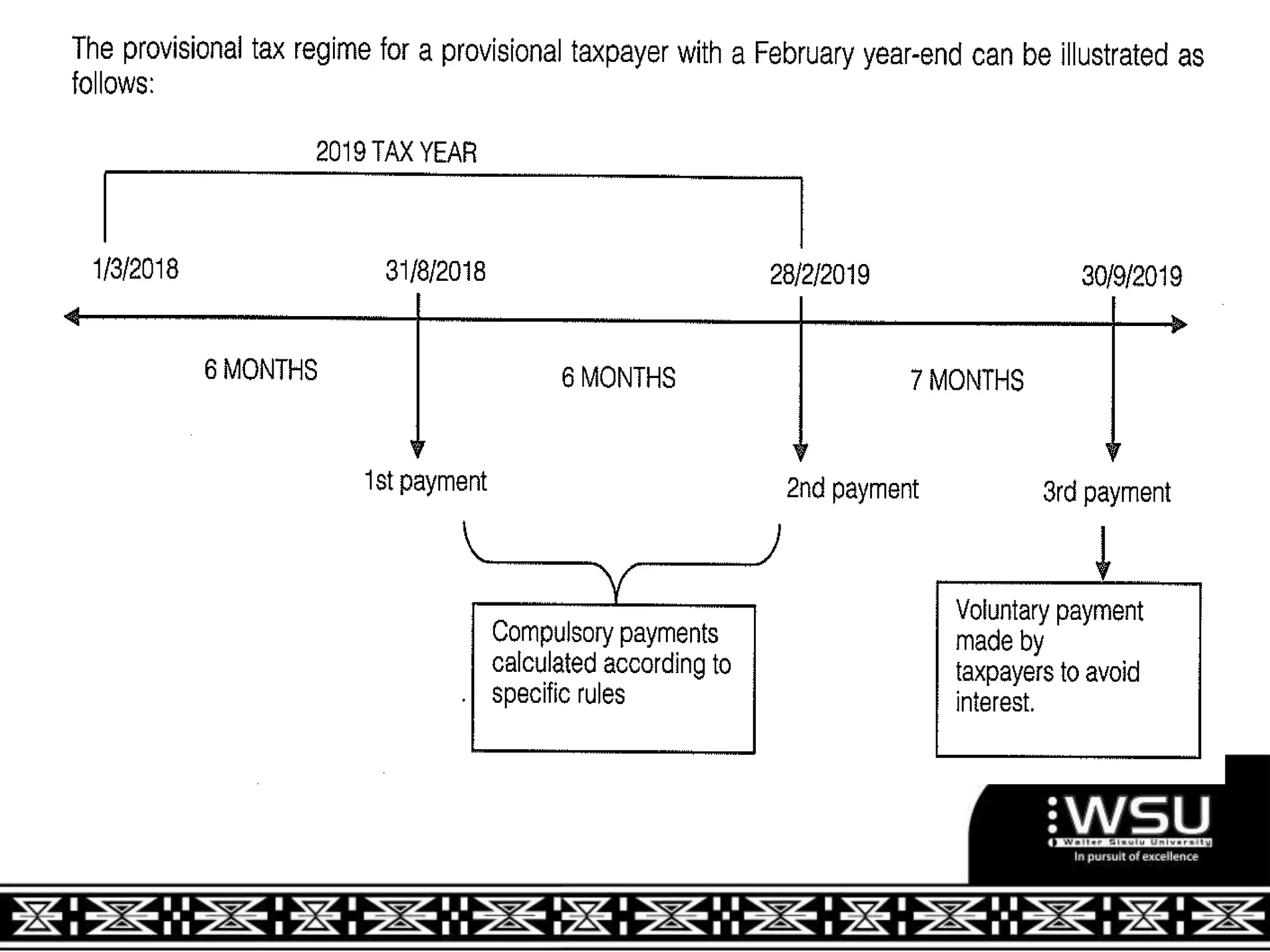

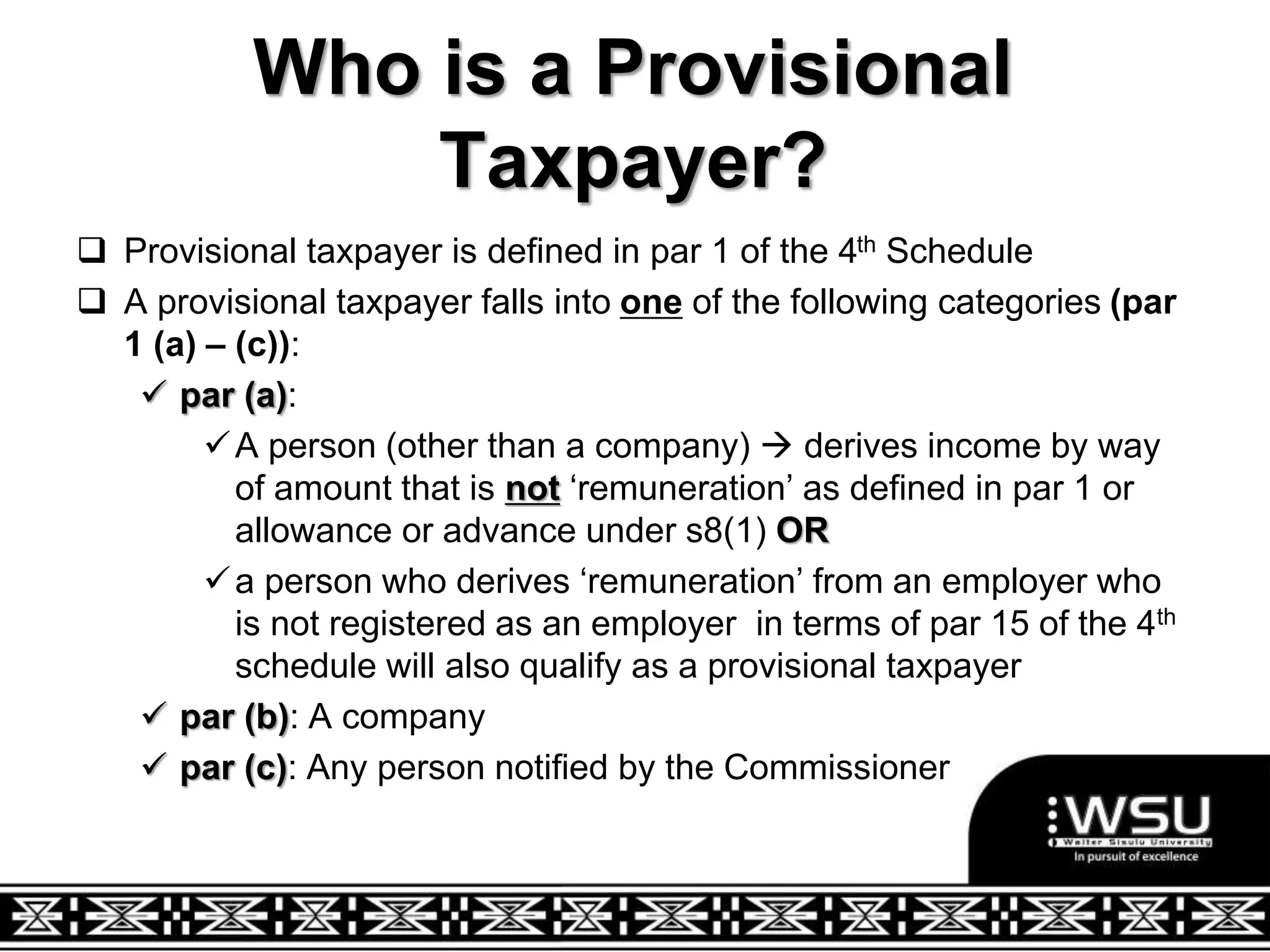

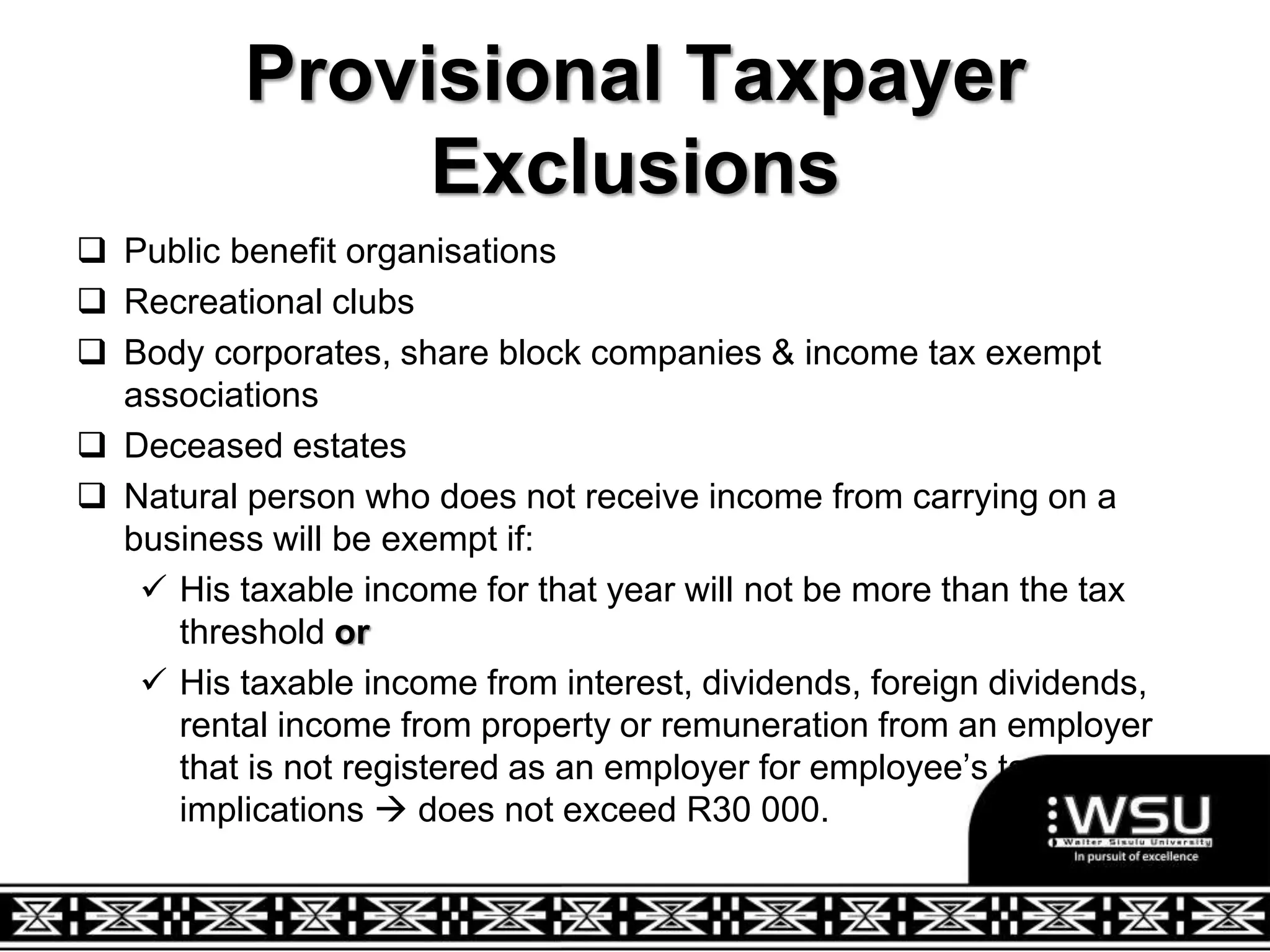

2. A provisional taxpayer is defined as an individual deriving income other than remuneration or a company, and they must make one or two provisional tax payments per year depending on circumstances.

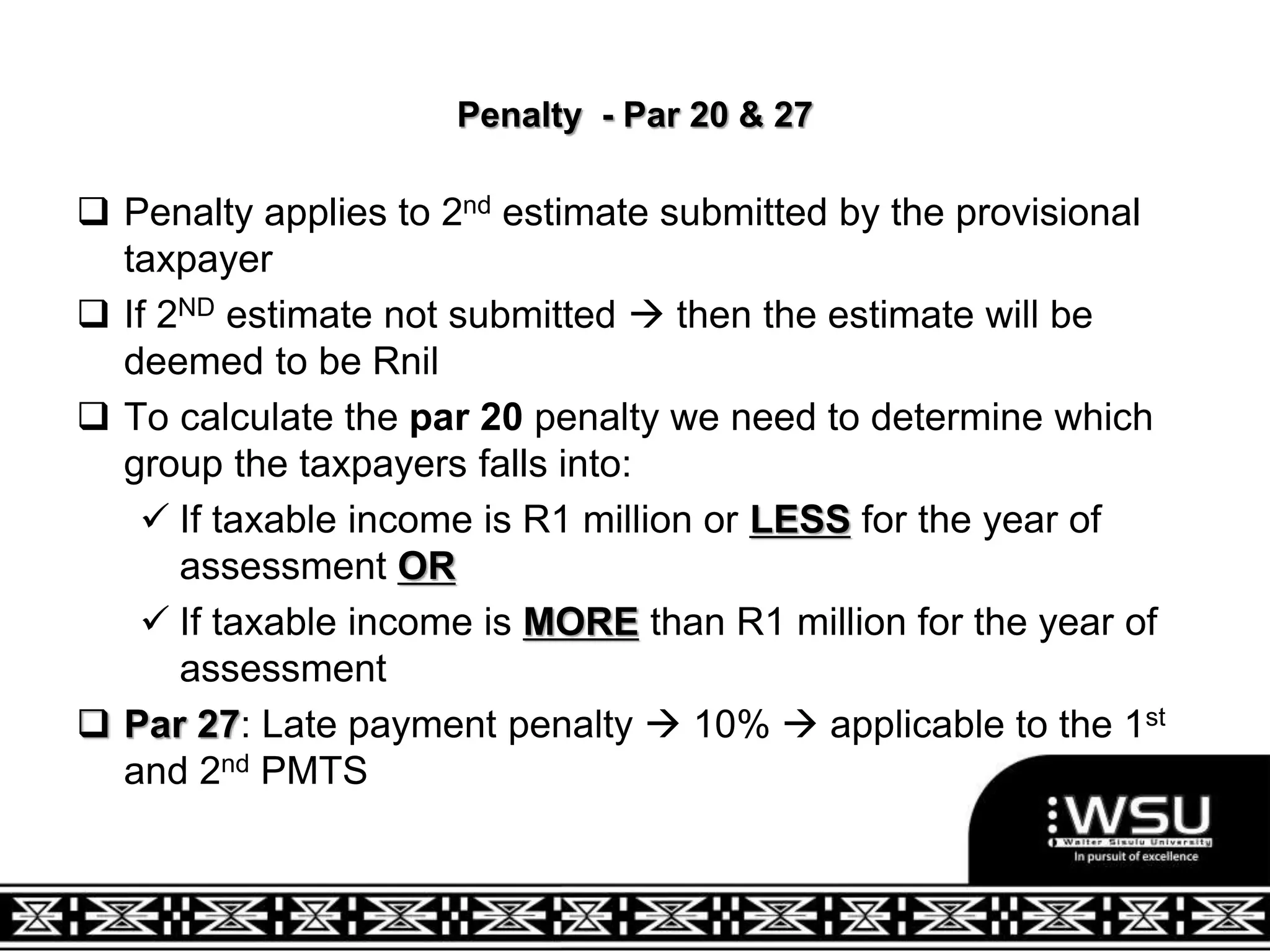

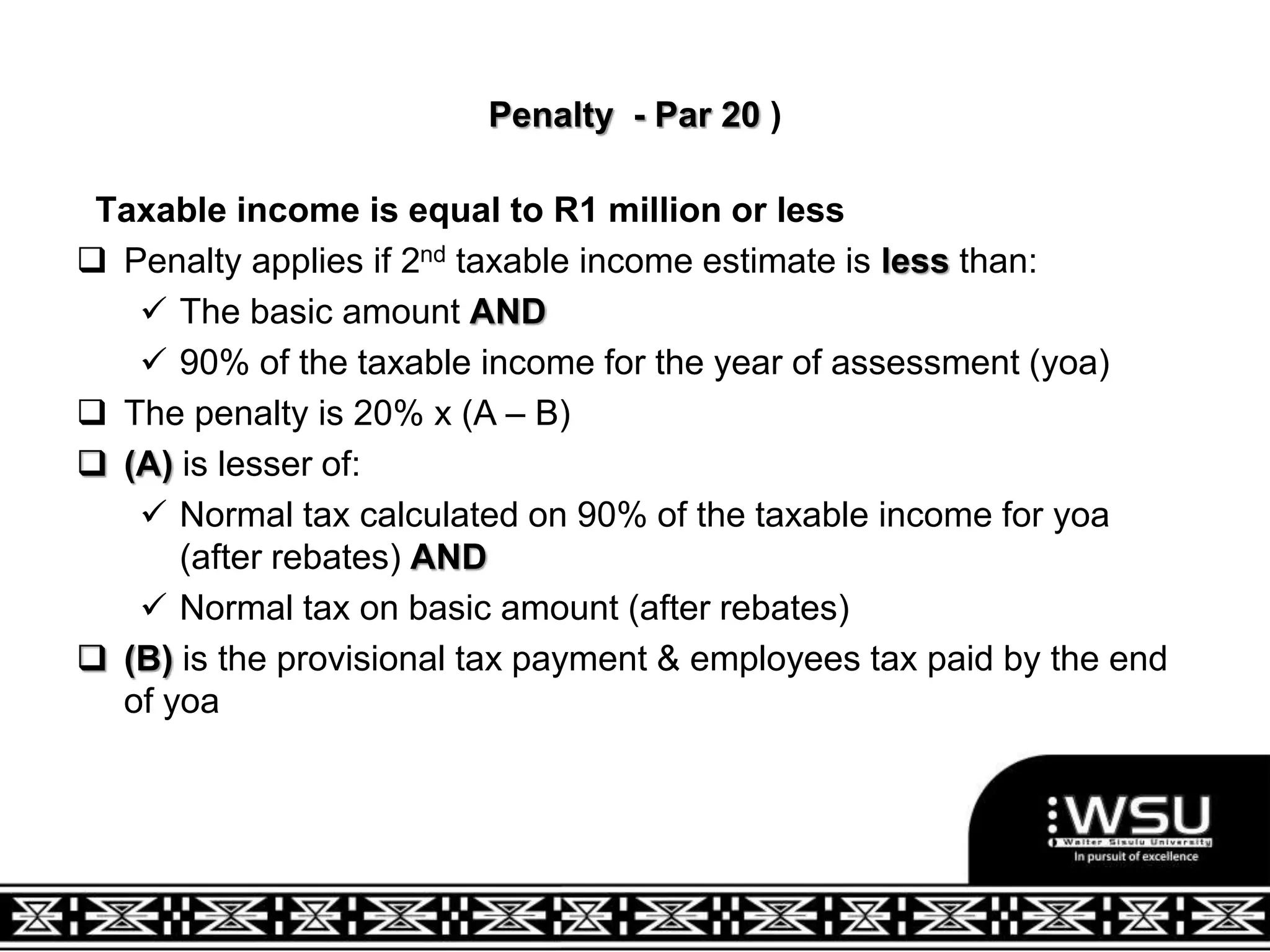

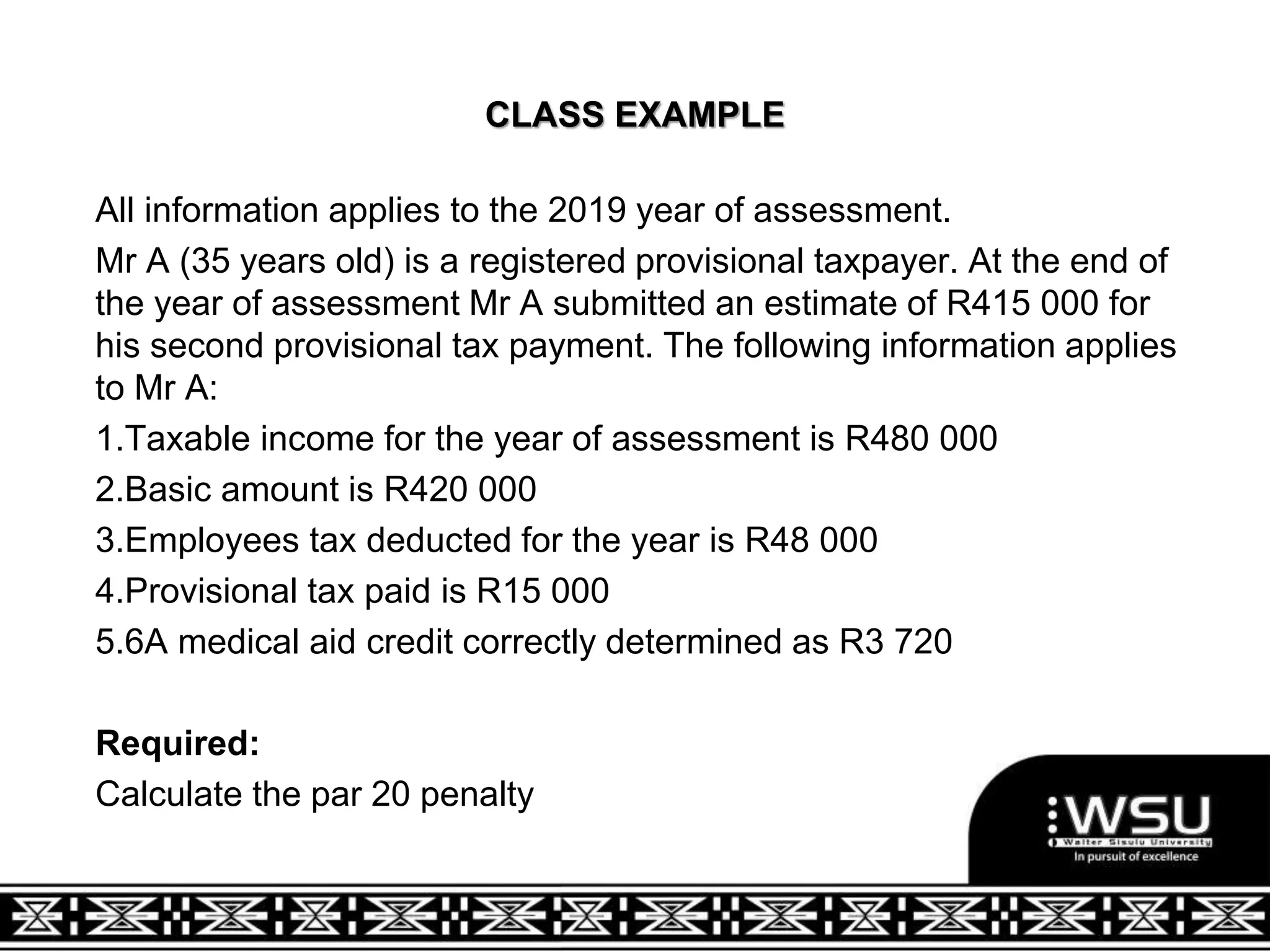

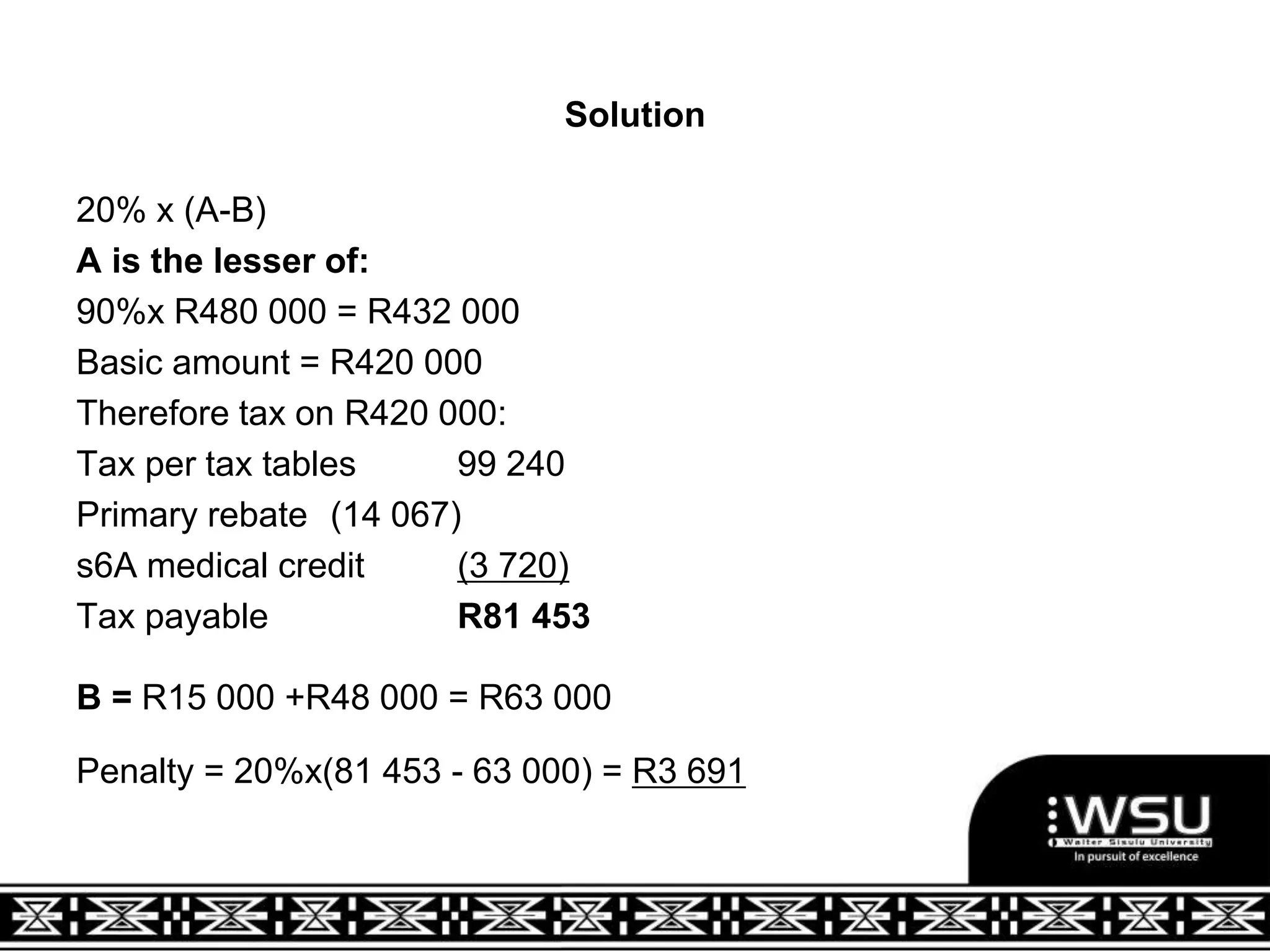

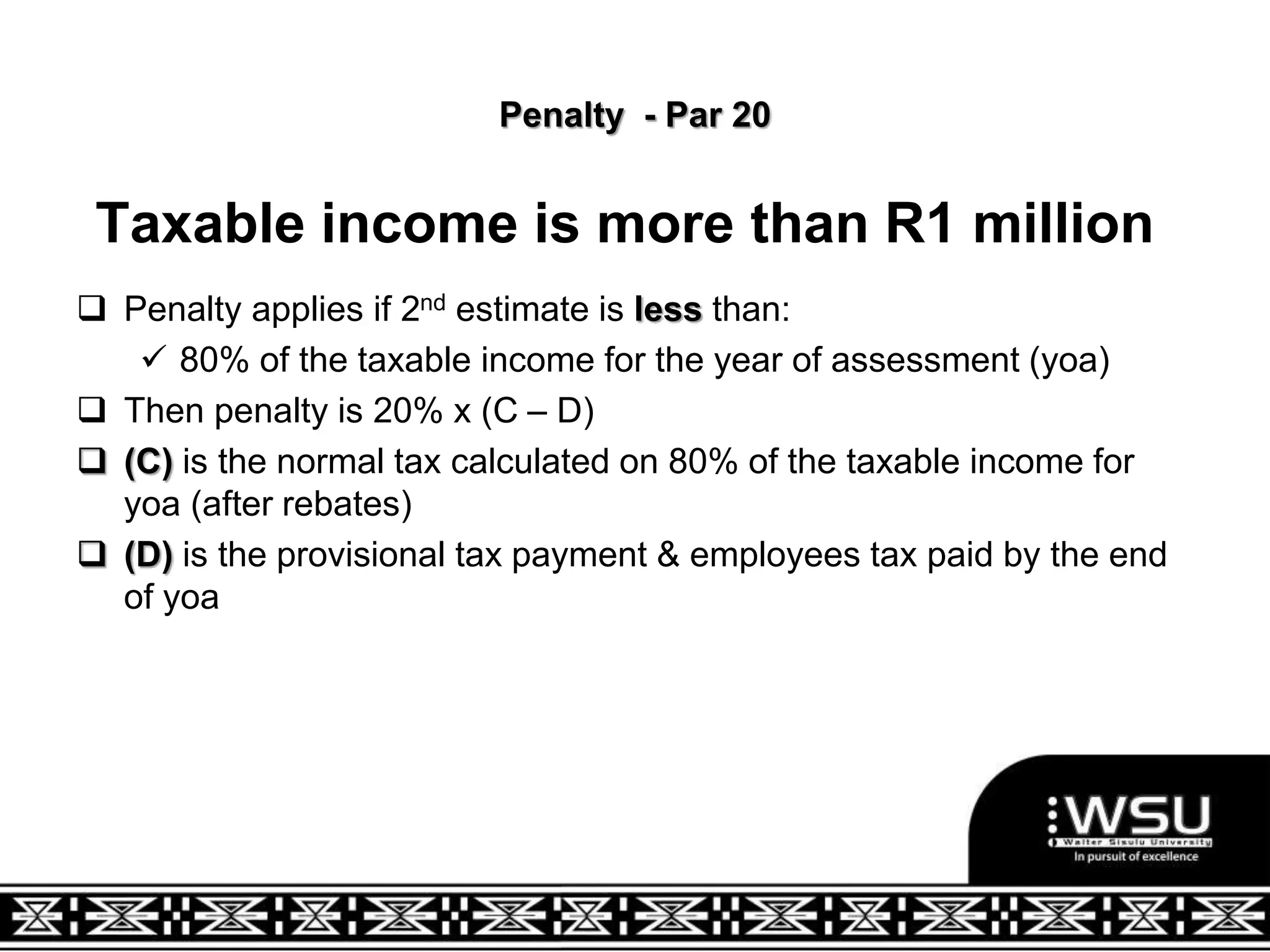

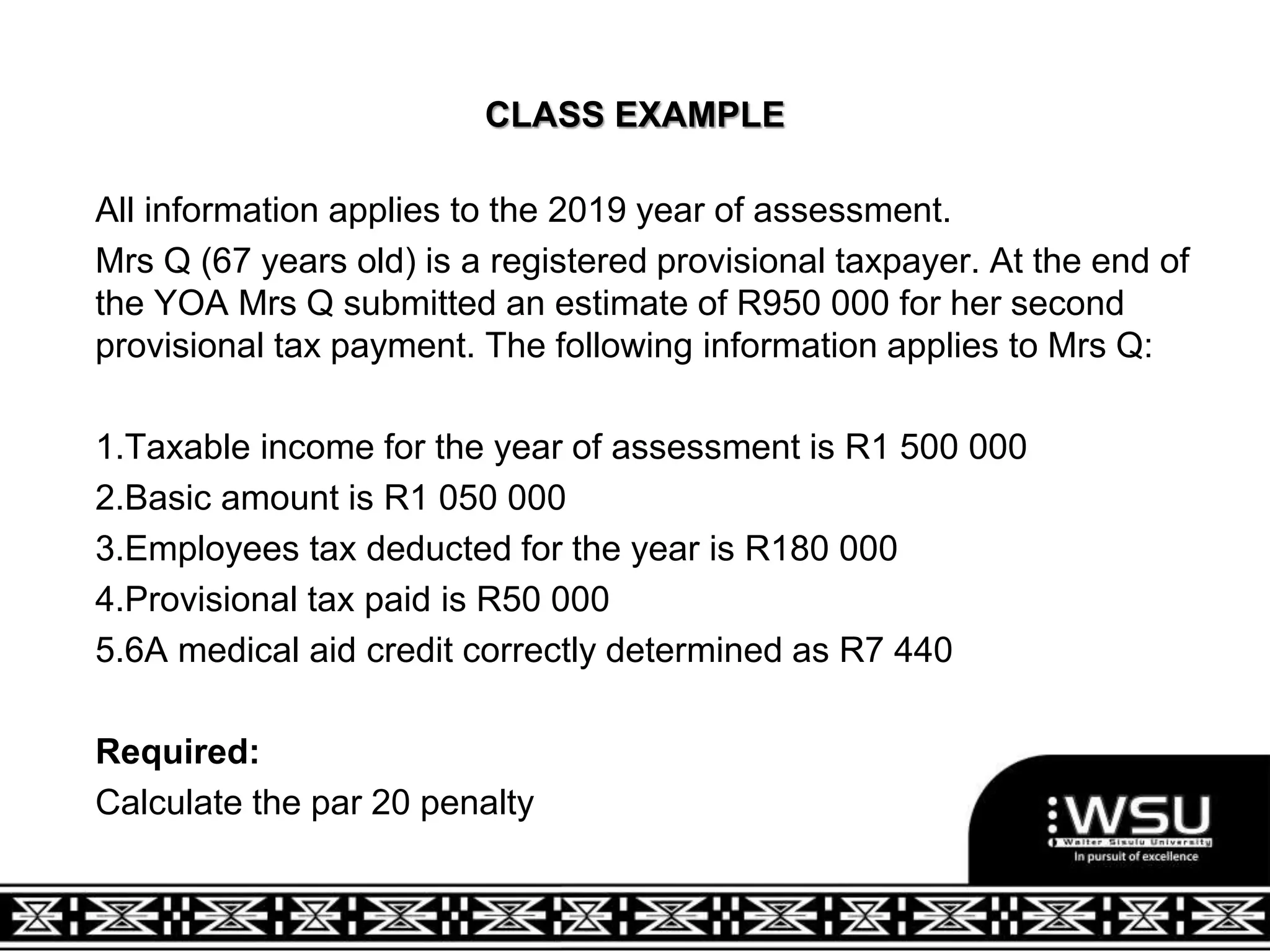

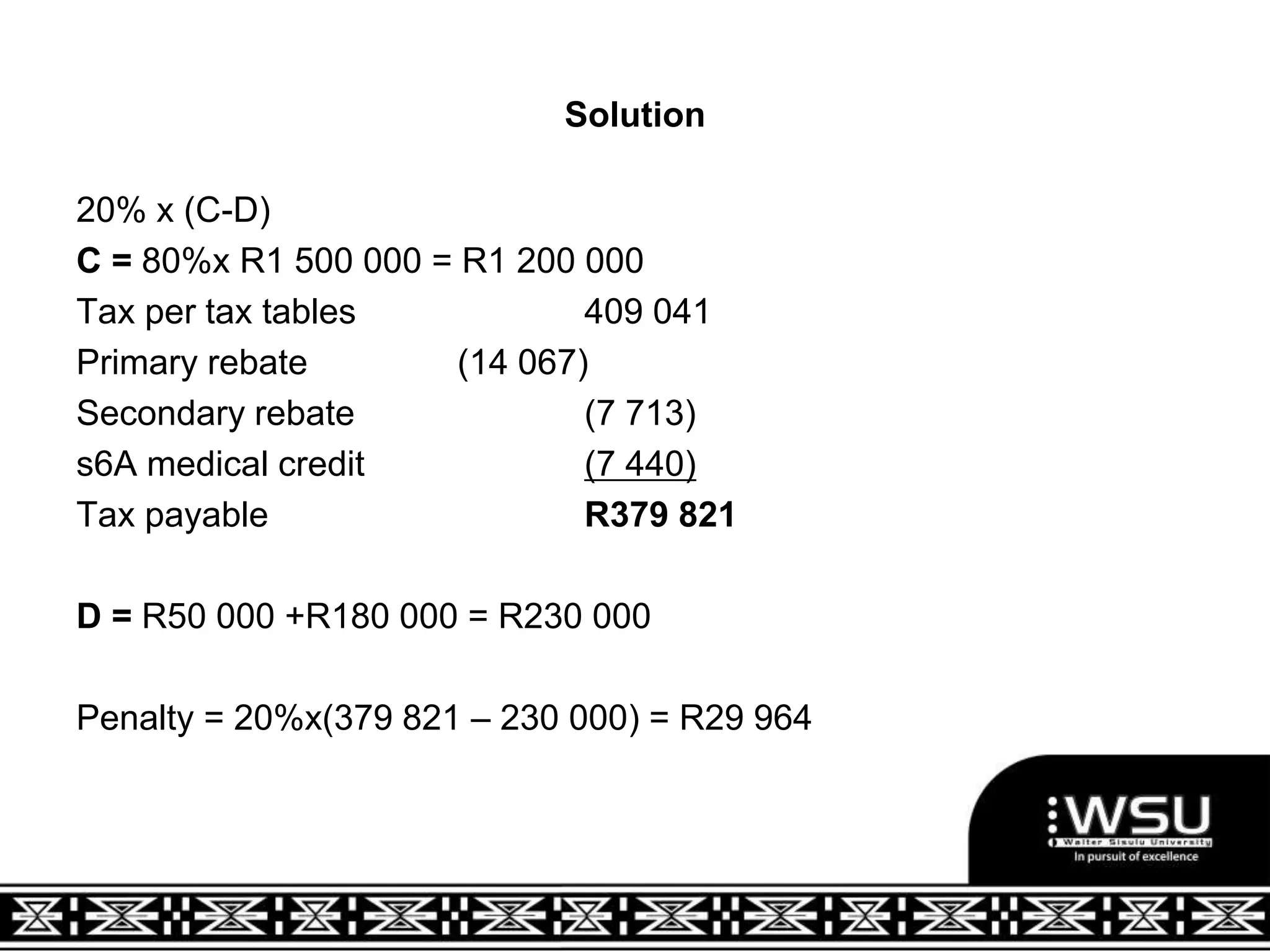

3. Penalties may be applied if provisional tax payments are underestimated compared to the taxpayer's actual taxable income for the year, with different penalty calculations depending on whether taxable income is above or below R1 million.