The document consists of various accounting problems requiring the completion of worksheets, balance sheets, income statements, and cash flow statements for different companies and scenarios. It covers topics such as the effects of different business structures, stock transactions, and dividend effects on financial statements. Additionally, it includes comparisons of partnerships and corporations in terms of taxation and liability.

![8.

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be reproduced or

transmitted without publisher's prior permission.

Violators will be prosecuted.

314 ACC201

LOS

• connect](https://image.slidesharecdn.com/problem8-18a-221129132119-ad840f45/75/PROBLEM-8-18a-Fill-in-the-worksheet-with-the-appropriate-value-docx-51-2048.jpg)

![to receive 60 percent of the profits and M. Calloway to get the

remaining 40 percent. With

regard to the 53,000 distribution, A. Calloway withdrew SI,200

from the business and

M. Calloway withdrew 51,800.

c, Ca1JO"Qyis a corporation. It issued 5,000 shares of 55 par

common stock for $40,000 cash

to start the business.

Problem 1-18 Recording lUId reporting stock transactions tUJd

ClISh di"';dends

across moo IU:cormtUtg cydes

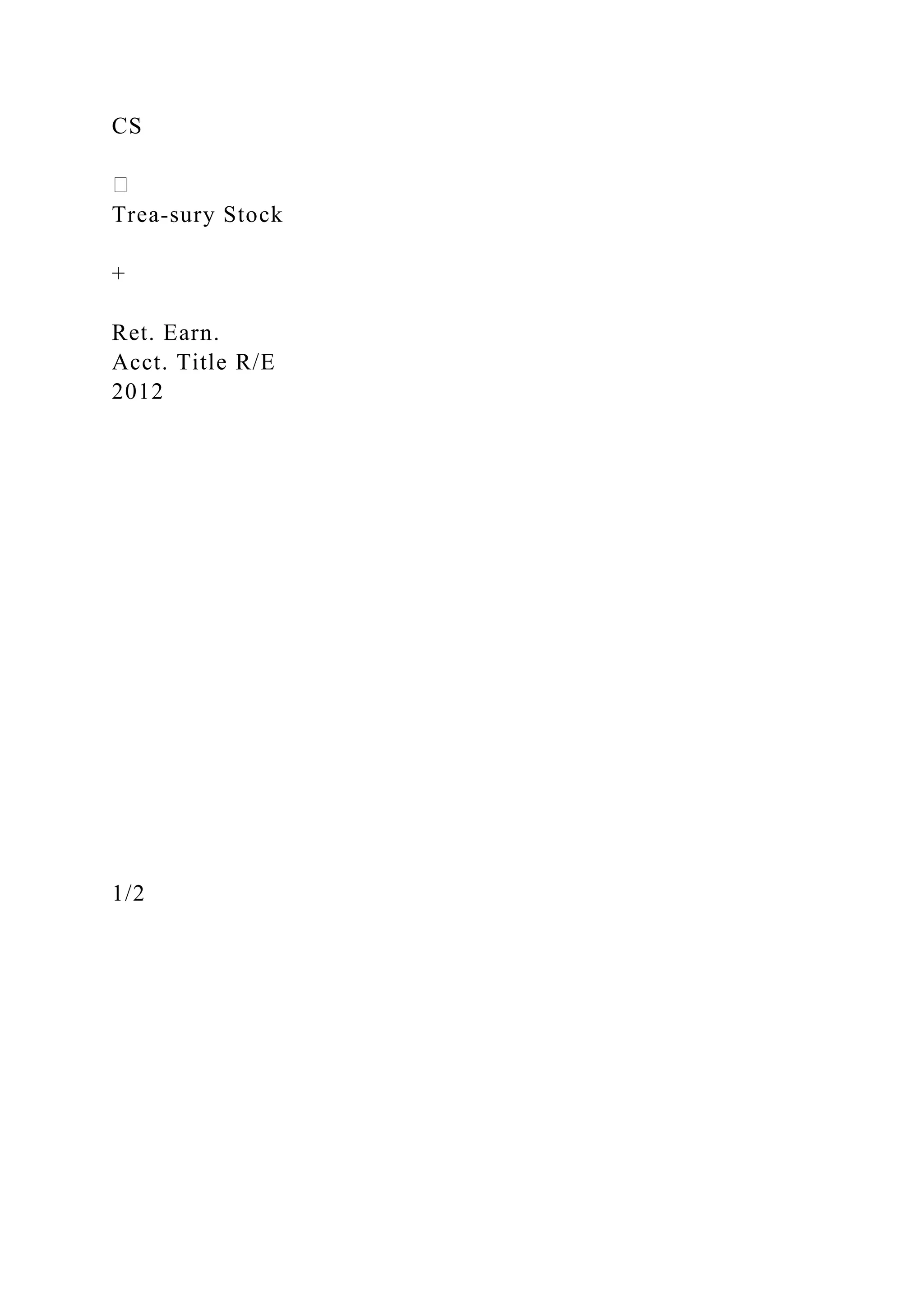

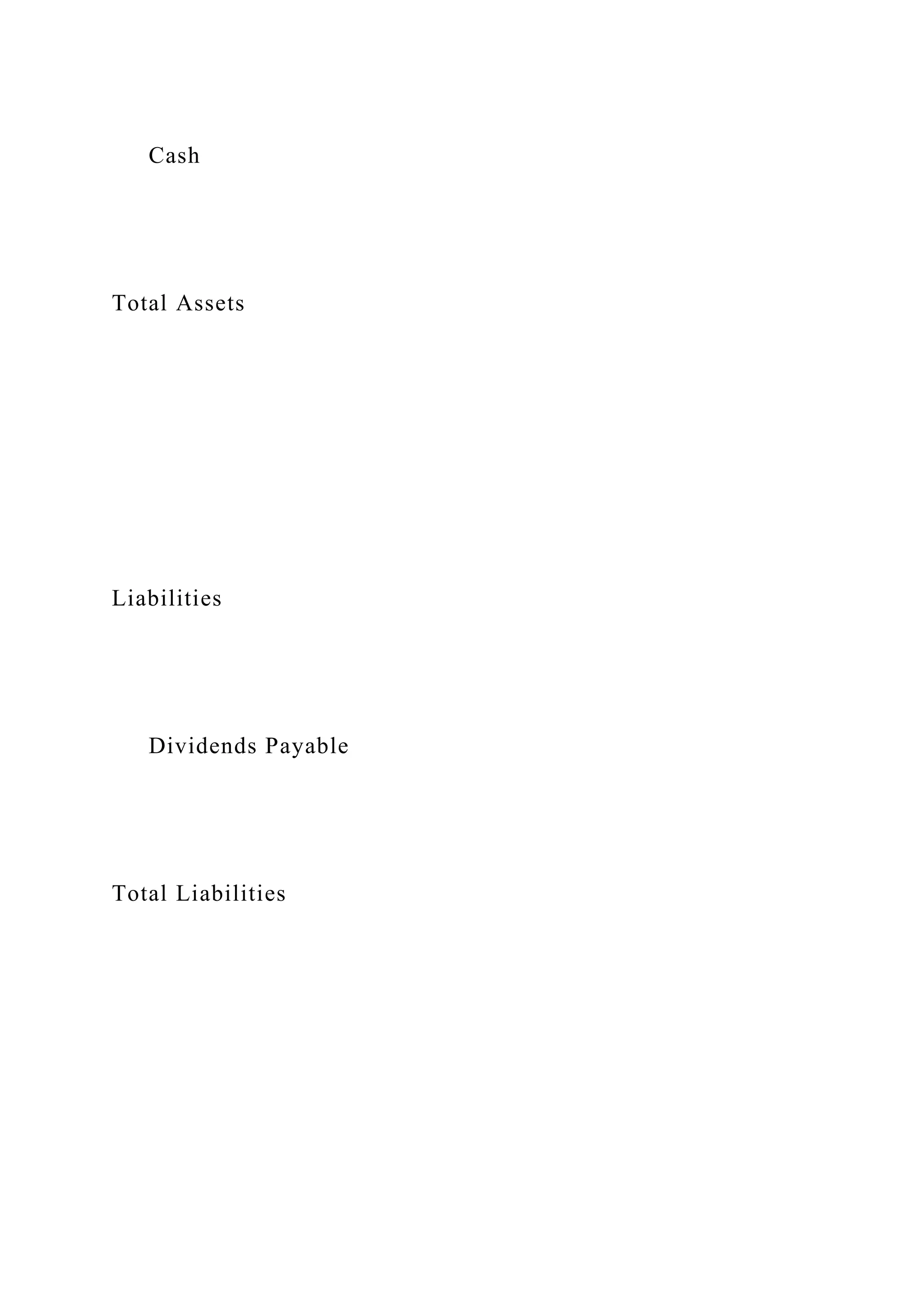

Davis Corporation was authorized to issue 100,000 shares of

$10 par common stock and 50,000

shares of SSOpar, 6 percent, cumulative preferred stock. Davis

Corporation completed the fol-

lowing transactions during its first twO years of operation.

21112

Jan. 2 Issued 5,000 shares of Sto par common stock for 528 per

share.

15 Issued 1,000 shares of S50 par preferred stock for S70 per

share.

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be reproduced or

transmitted without publishers prior permission.

Violators will be prosecuted.

Survey of Accounting. Third Edition 31](https://image.slidesharecdn.com/problem8-18a-221129132119-ad840f45/75/PROBLEM-8-18a-Fill-in-the-worksheet-with-the-appropriate-value-docx-54-2048.jpg)

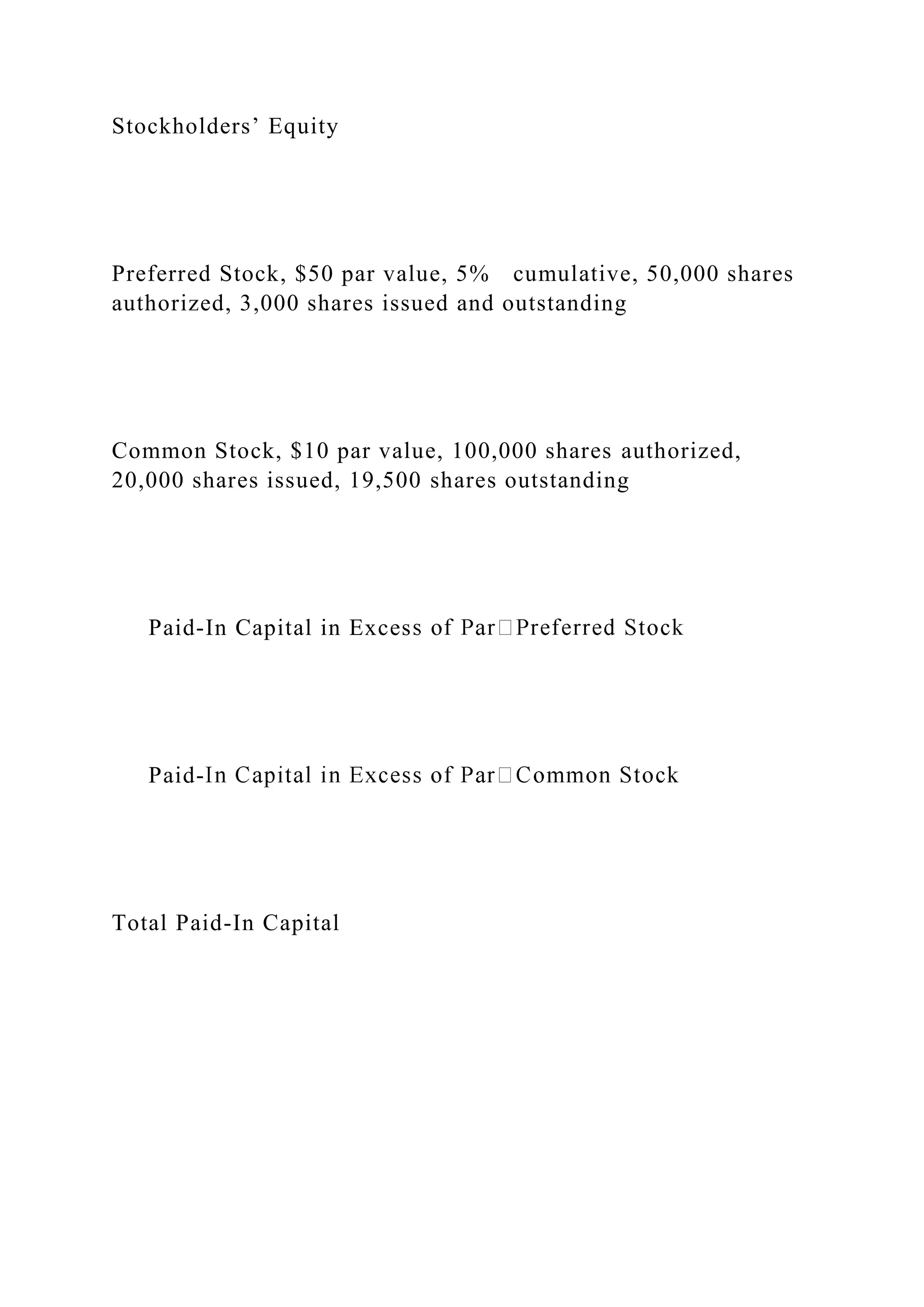

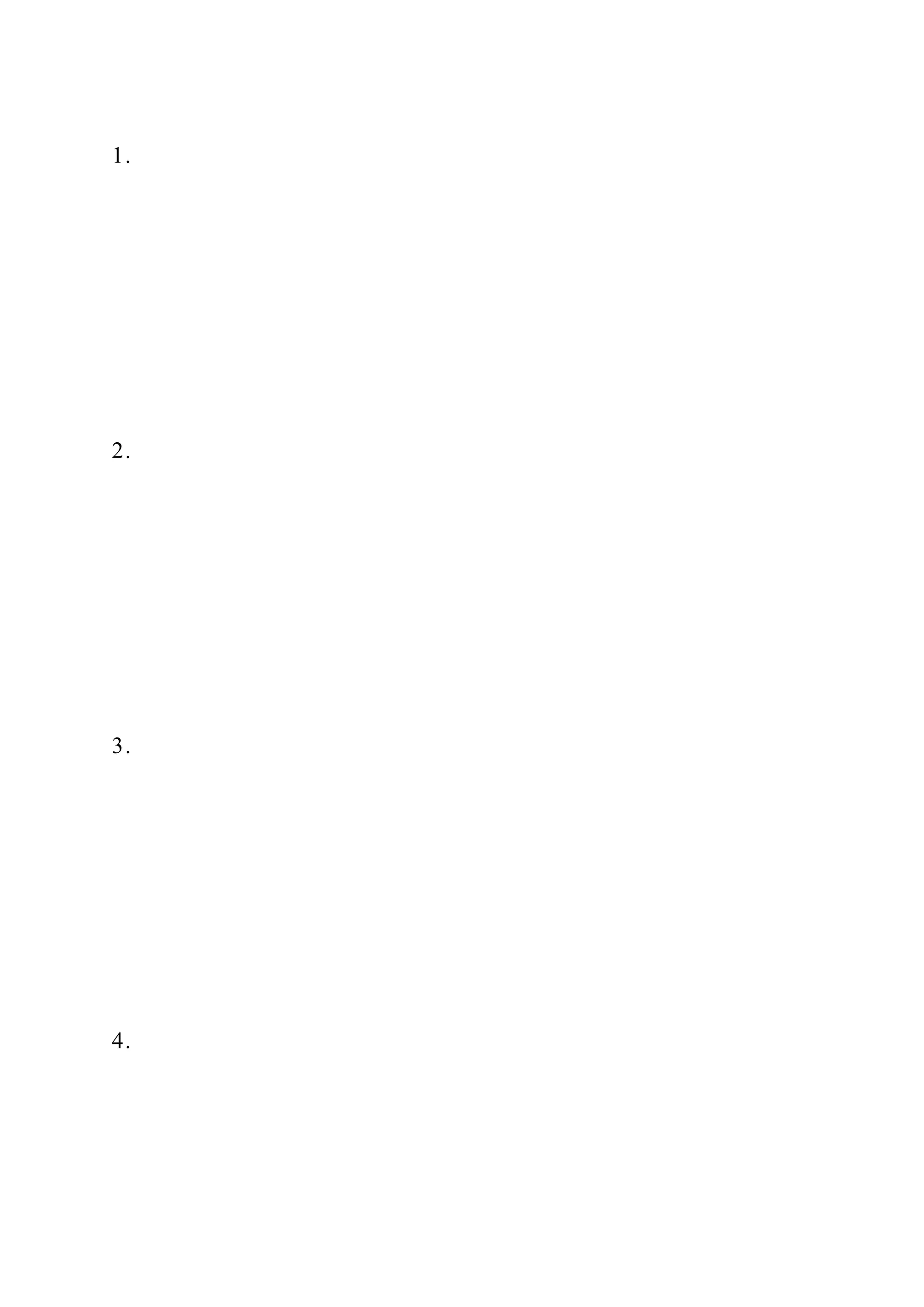

![CHECKAG~RES

Total Paid·ln Capital: 5451.200

Total Stock·hofders'equity:

SSlO,OOO

PRINTED BY: [email protected] Printing is for personal.

private use only. No part of this book may be reproduced or

transmitted without publisher's prior permission.

Violators will be prosecuted.

Survey of Accounting. Third Edition 31

Problem 8-23 Diffenm fomu of ~~ O'KtUrizIztitm

Shawn Bates was worki.ng to establish a business enterprise

••••ith four of his wealthy friends, Each

of the five individuals would reoei",: a W peta:Dt ownership

interest in the company. A primary

goal of establishing the enterprise ",-as to miniI::!.i.zethe

amount of income taxes paid. Assume

that thefive investors an: taaed at the rate of Isy. on cfuidend

income and 30% on all other in-

come and that the corporate taX me is 30 percent. Also assume

that the new company is ex-

pected to earn S40Q,OOOof cash incooe before taxes during its

ru-st year of operation. All

earnings are expected to be ;mmerliarely Cisuibu~ to the

owners.

LD1

Prop:ietorsh~s. Partnerships. and CoI'OOl'C"t'.o/lS 315

available to each investor if the business is estab-](https://image.slidesharecdn.com/problem8-18a-221129132119-ad840f45/75/PROBLEM-8-18a-Fill-in-the-worksheet-with-the-appropriate-value-docx-58-2048.jpg)

![NA NA + FA

ANALVZE, THINK, COMMUNICATE

Use the 1 's annual report in Appendix B 10 answer tbe

following questions, --Required

., What is the par value per share of Target's srock?

II. How many shares of Target's common stock were

outstanding as of January 31, 2010?

c. Target's annual report provides some details about the

company's executive officers. How

many are identified? What is their minimum, maximum, and

average age? How many are

females?

d. Target's balance sheet does not show a balance for treasury

stock. Does this mean the com-

pany has not repurchased any of its o.•••.n stock? Explain.

l

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be reproduced or

transmitted without publisher's prior permission.

Violators will be prosecuted.

---_ .._-----------------------------_. Survey of Accounting. Third

Edition

Exercise 1-23 Effecti~ interest amortization of Q bond discount

On January 1,2012, Sea V_ Condo Association issued bonds

with 8: face value of S2OO,OOO,a

stated rate of interest of 8 percent, and a l()..year tetm to](https://image.slidesharecdn.com/problem8-18a-221129132119-ad840f45/75/PROBLEM-8-18a-Fill-in-the-worksheet-with-the-appropriate-value-docx-60-2048.jpg)

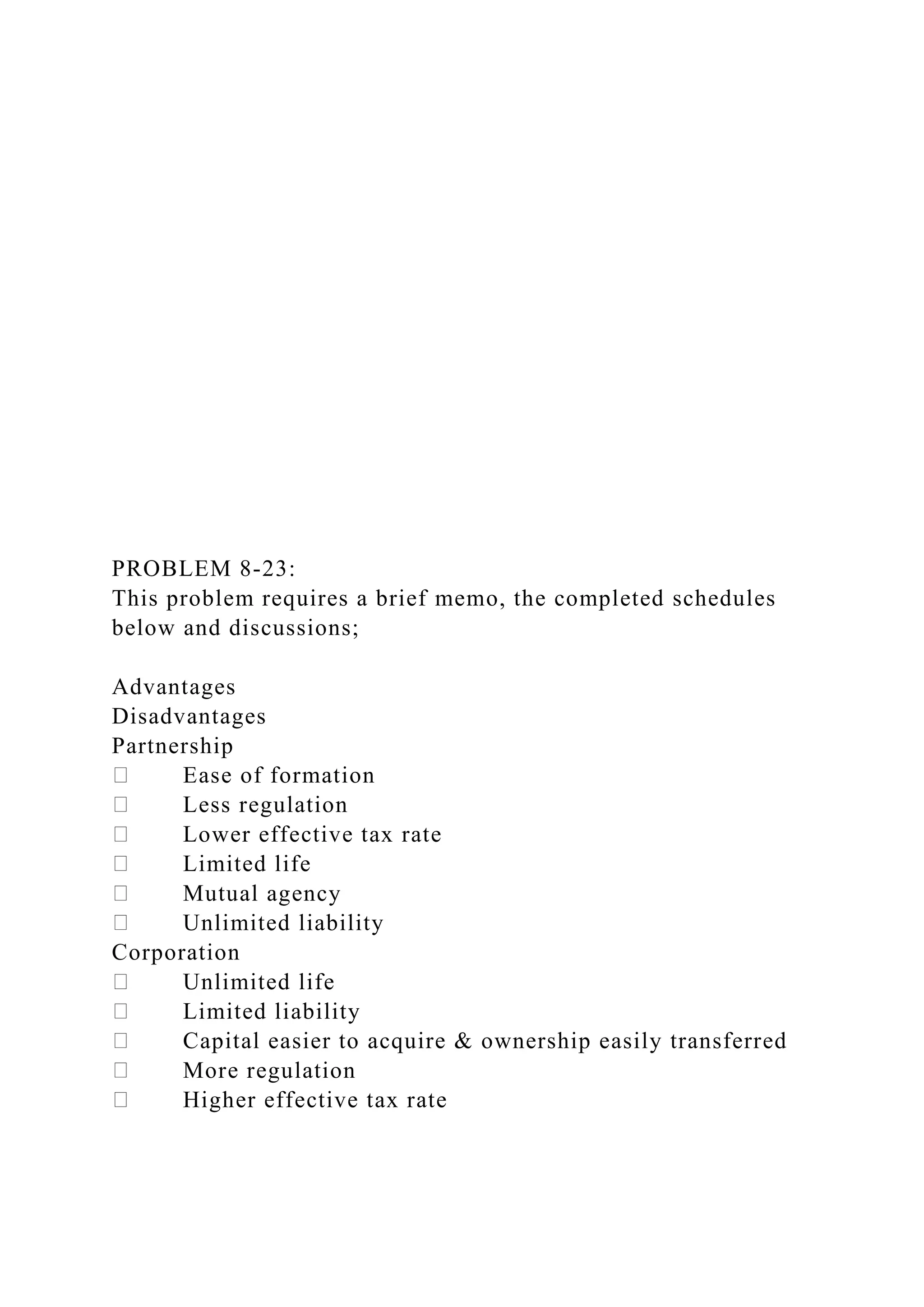

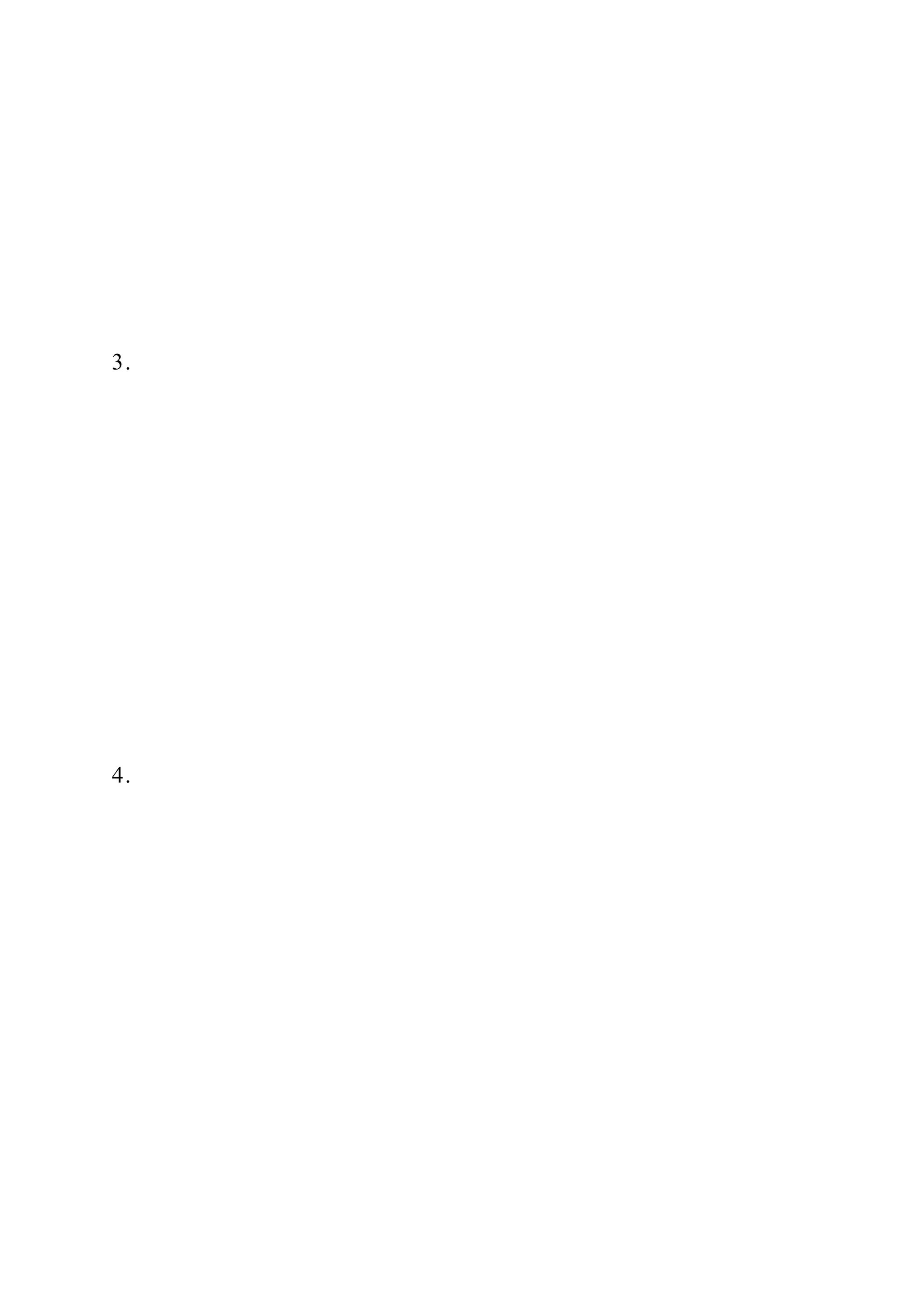

![1. Received $4(),000 cash from the issue of a short-term note

with a 5 percent interest rate and

a one-year maturity. The Dote was issued on April I; 2012.

ACCO<lnt1ngfor liabilitieS 277

LO'I1

L011

t.O 11

LO'I~2. 3. 4

CHECK RGlJRf

Ne Income 2012: $46,500

PRINTED BY: [email protected] Printing is for personal,

private use only. No part of this book may be reproduced or

transmitted without publishers prior permission.

Violators will be prosecuted.

ACC201

LO 1. 2, 4

CHfCKAGURE

TOIaI Current liabilities!S44.1l5D

Z. Received $120,000 cash plus applicable sales tax from

performing- services The services are

subject to a sales tax rate of 6 percent.](https://image.slidesharecdn.com/problem8-18a-221129132119-ad840f45/75/PROBLEM-8-18a-Fill-in-the-worksheet-with-the-appropriate-value-docx-63-2048.jpg)

![flow statement?

lWbatamount of assets would be reported on the December

31,2013, balance sheefI-

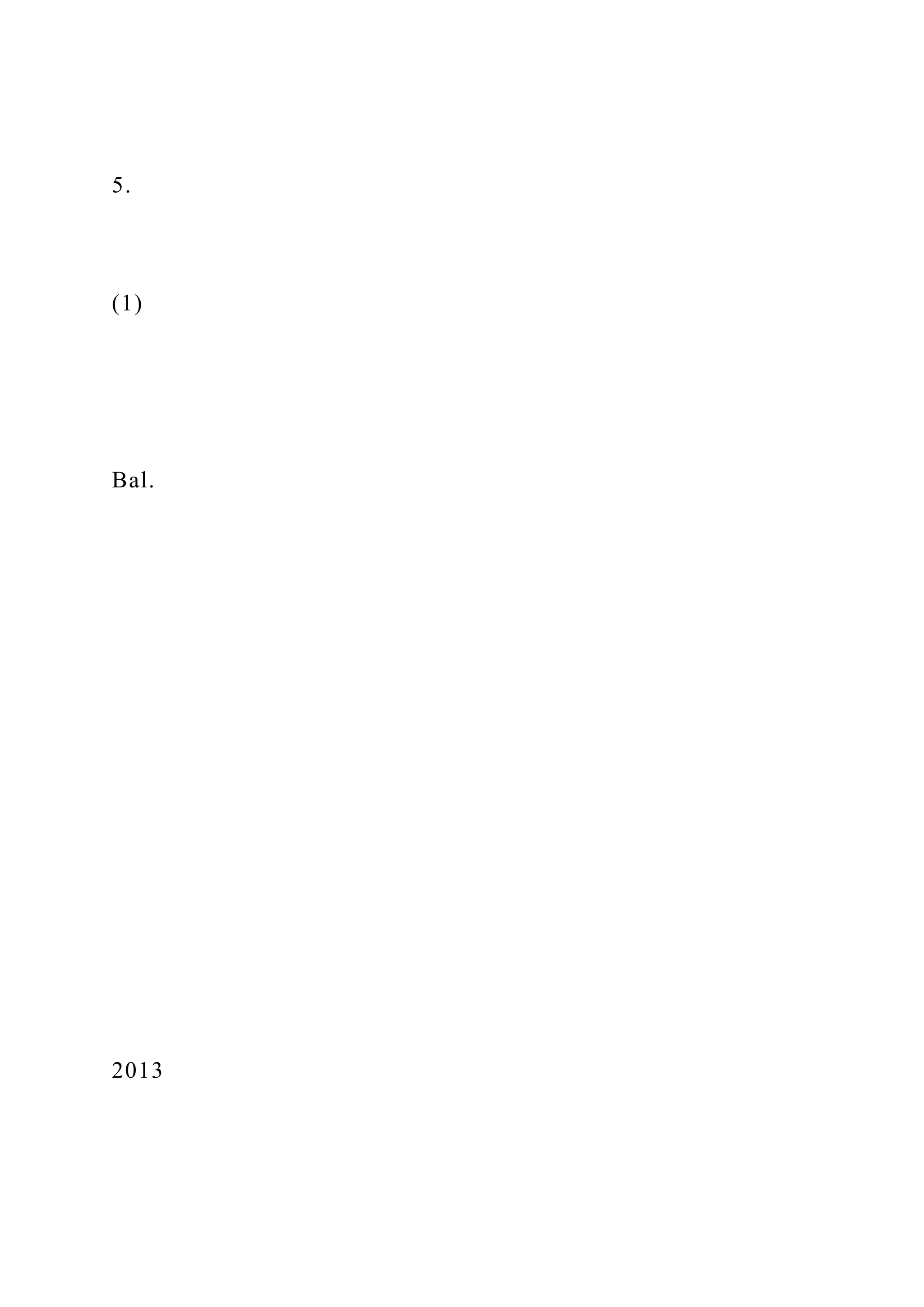

Problem 7·28 CrD'fent li4bilities

The folJowfug selected transactions were taken from the boon

of Caledonia Company for 2012.

1. On Maroh 1,2012, borrowed S50,OOOcash from thelocal

bank. The note had a 6 percent

interest rate and was due on September 1.2012.

2. cash sales for the year amounted (05125,000 plus sales tax at

the rate of 1 percent.

3. Caledonia provides a 9O-day warranty on the merchandise

sold. The warranty expense ~

estimated to be 2 percent of sales.

4. Paid the sales tax to the state sales tax agency on

SI90,OOOof the sales.

5. Paid the note due on September 1 and 'the related interest.

PRINTED BY, [email protected] Printing is for personal,

private use only. No part of this book may be reproduced or

transmitted without publisher's prior permission.

Violators will be prosecuted.

Survey of Accounting. ThIrd Edition--------------------------------

--------------------------------------------------

ACcountingforUabiitles 279

6_ On October 1, 2012, borrowed S40,OOOcash from the local

bank, The note had a 7 percent](https://image.slidesharecdn.com/problem8-18a-221129132119-ad840f45/75/PROBLEM-8-18a-Fill-in-the-worksheet-with-the-appropriate-value-docx-66-2048.jpg)