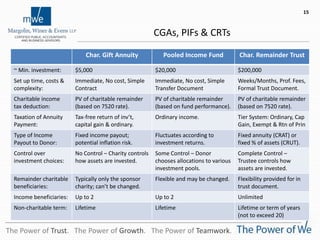

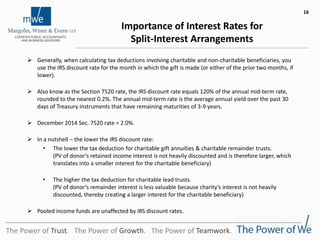

This document provides an overview of different charitable giving techniques ranging from simple to complex. It begins with outright gifts such as donations during life or at death. It then discusses more complex options like donor advised funds, charitable gift annuities, pooled income funds, private foundations, charitable remainder trusts, and charitable lead trusts. For each option, it provides a brief description of how they work and their tax implications. It concludes by comparing some of the options side by side and discussing how interest rates impact tax deductions for split-interest arrangements.