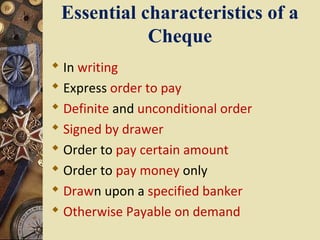

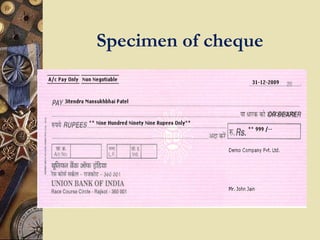

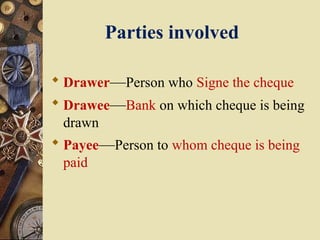

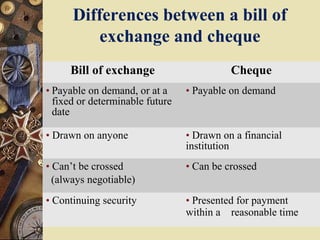

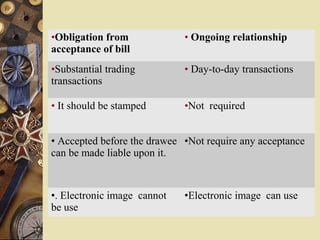

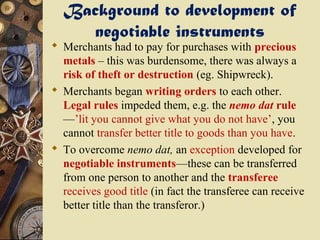

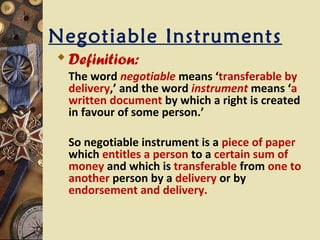

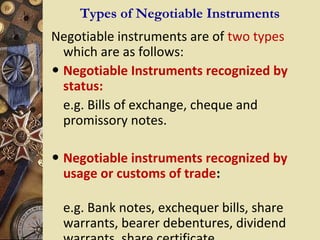

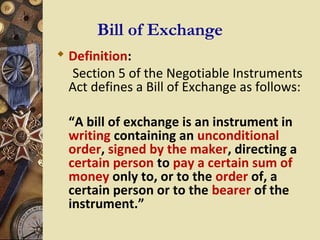

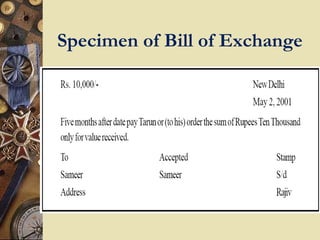

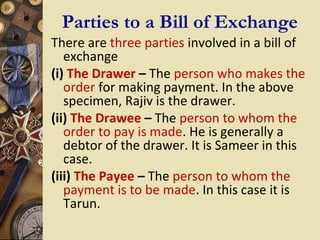

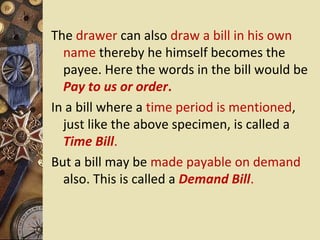

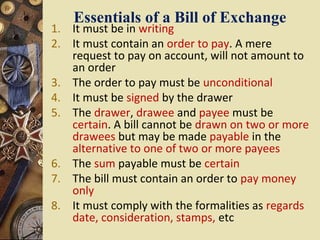

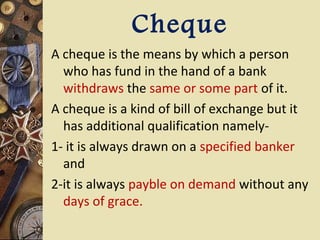

The document provides information on negotiable instruments under Indian law, specifically comparing bills of exchange and cheques. It defines bills of exchange and cheques, outlines the key parties involved for each (drawer, drawee, payee), and describes some of the distinguishing characteristics between the two types of negotiable instruments such as bills of exchange can be drawn on anyone while cheques must be drawn on a specified banker, and cheques are always payable on demand.

![Definition

A “cheque” is a bill of exchange drawn on

a specified banker and not expressed to be

payable otherwise than on demand.

‘Cheque’ includes electronic image of a

truncated cheque and a cheque in

electronic form. [section 6].](https://image.slidesharecdn.com/billandcheque-130130051232-phpapp01/85/Bill-and-cheque-12-320.jpg)