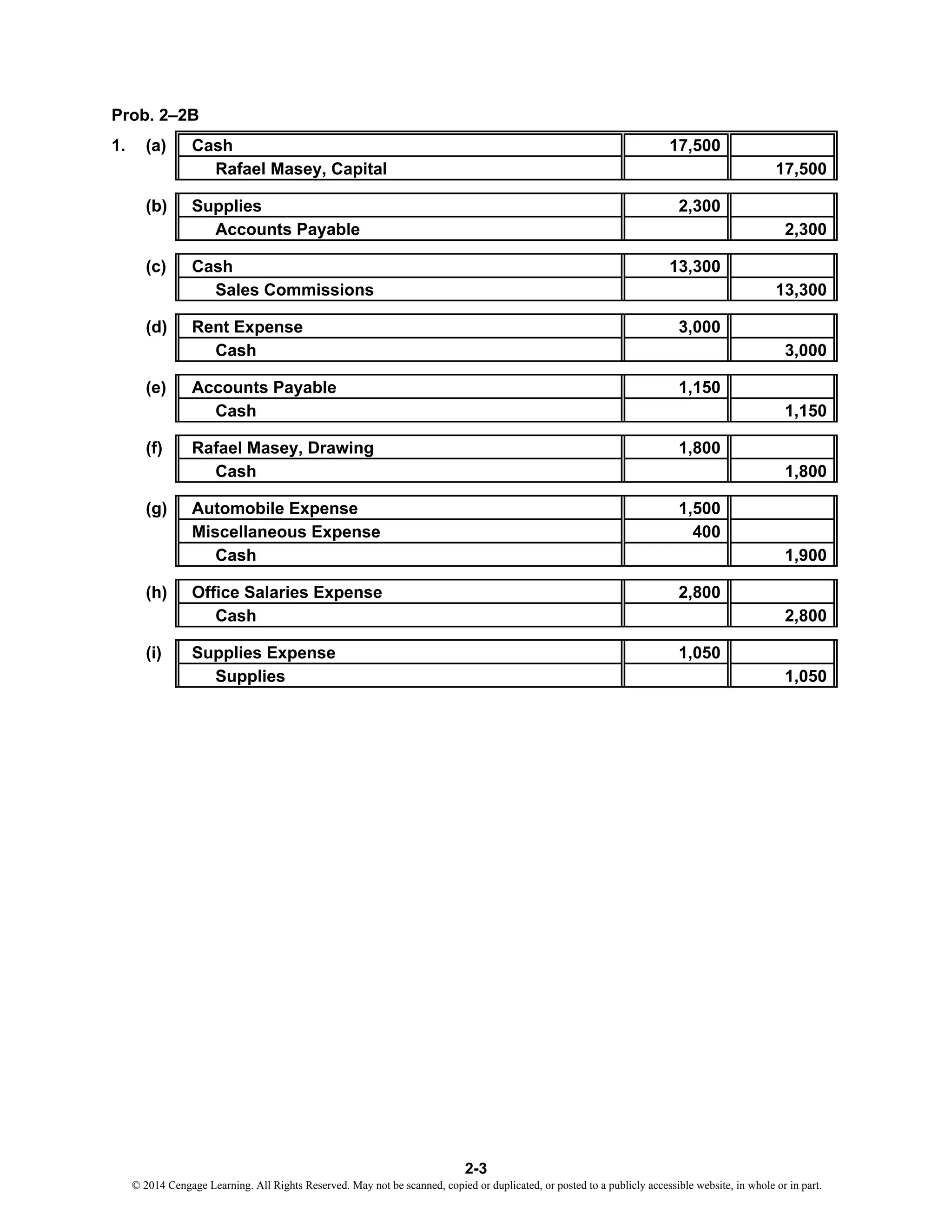

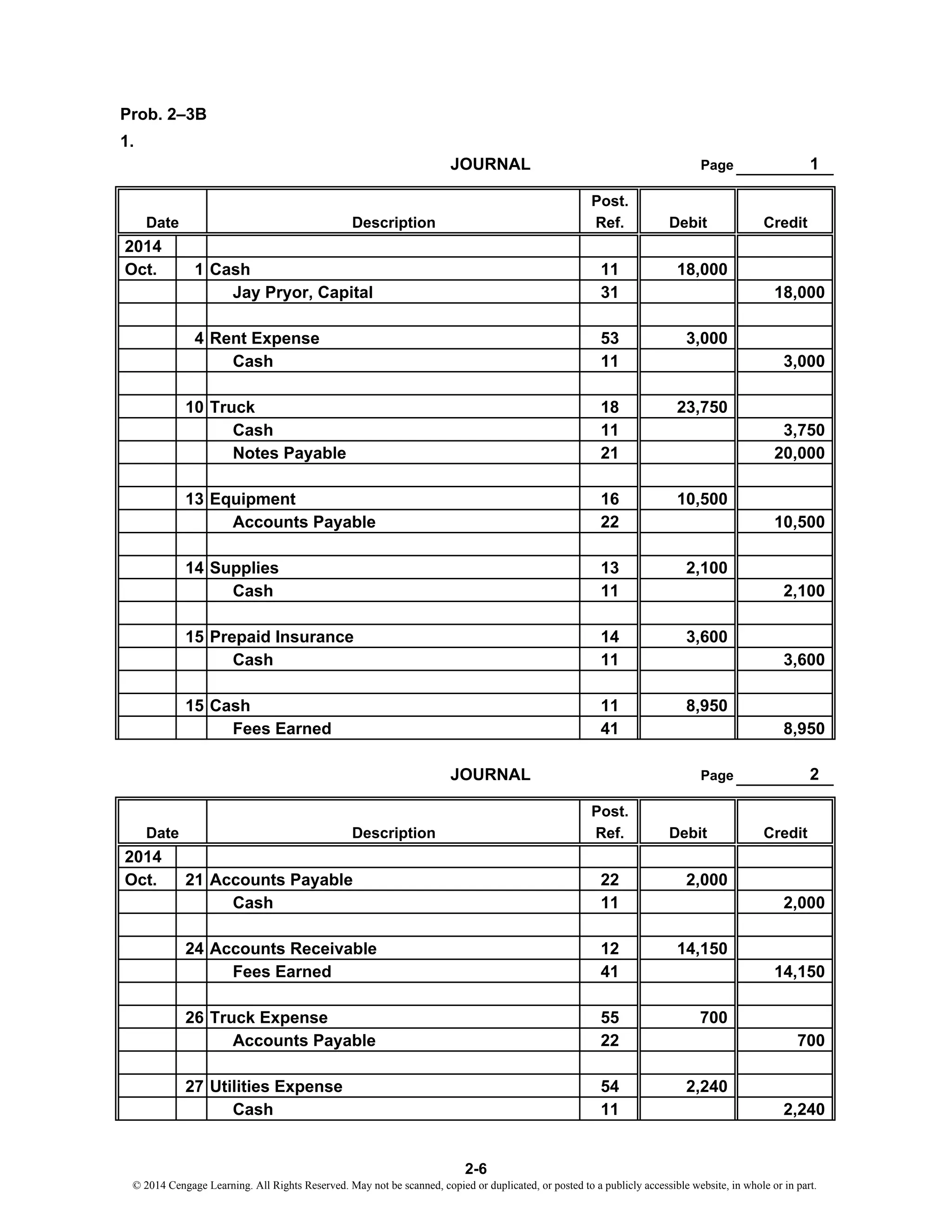

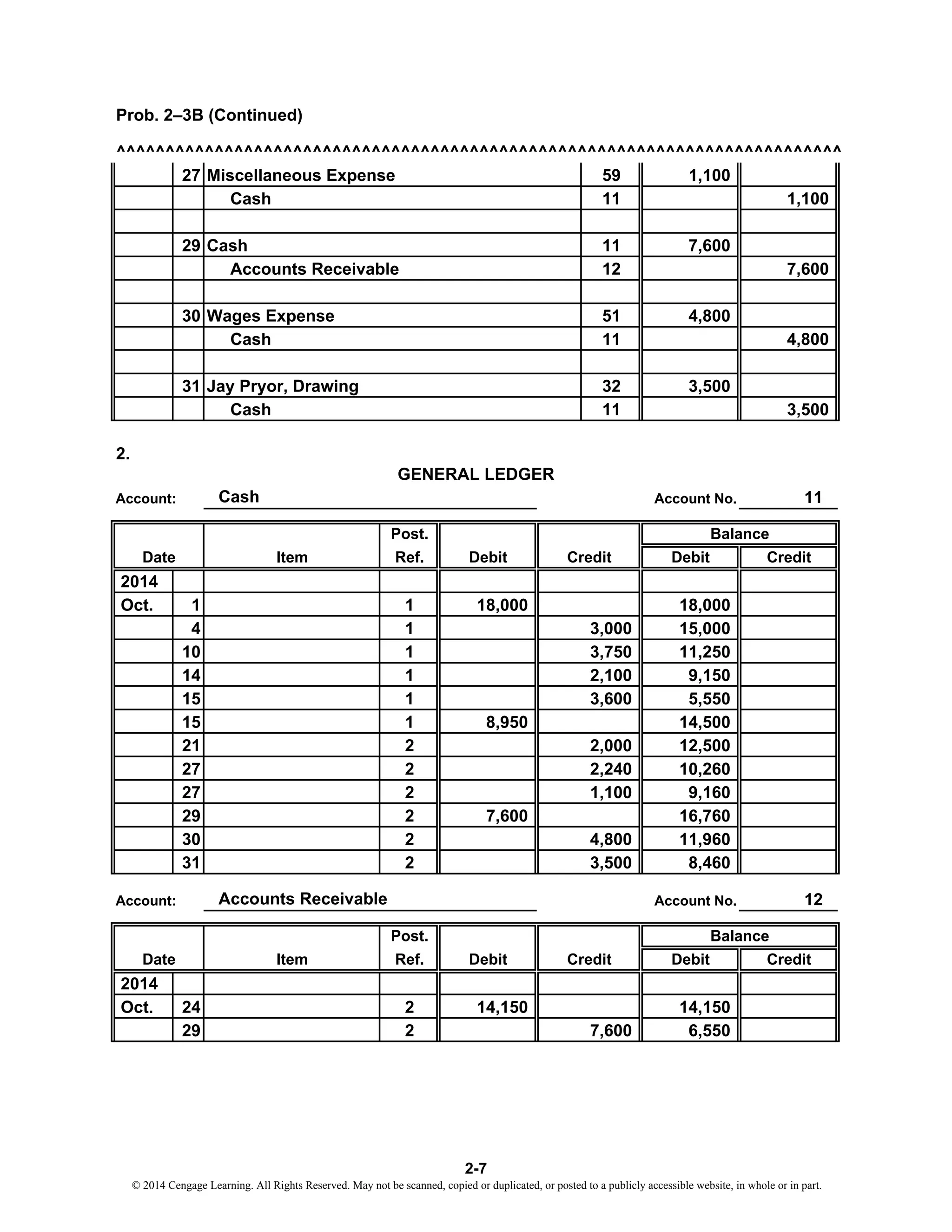

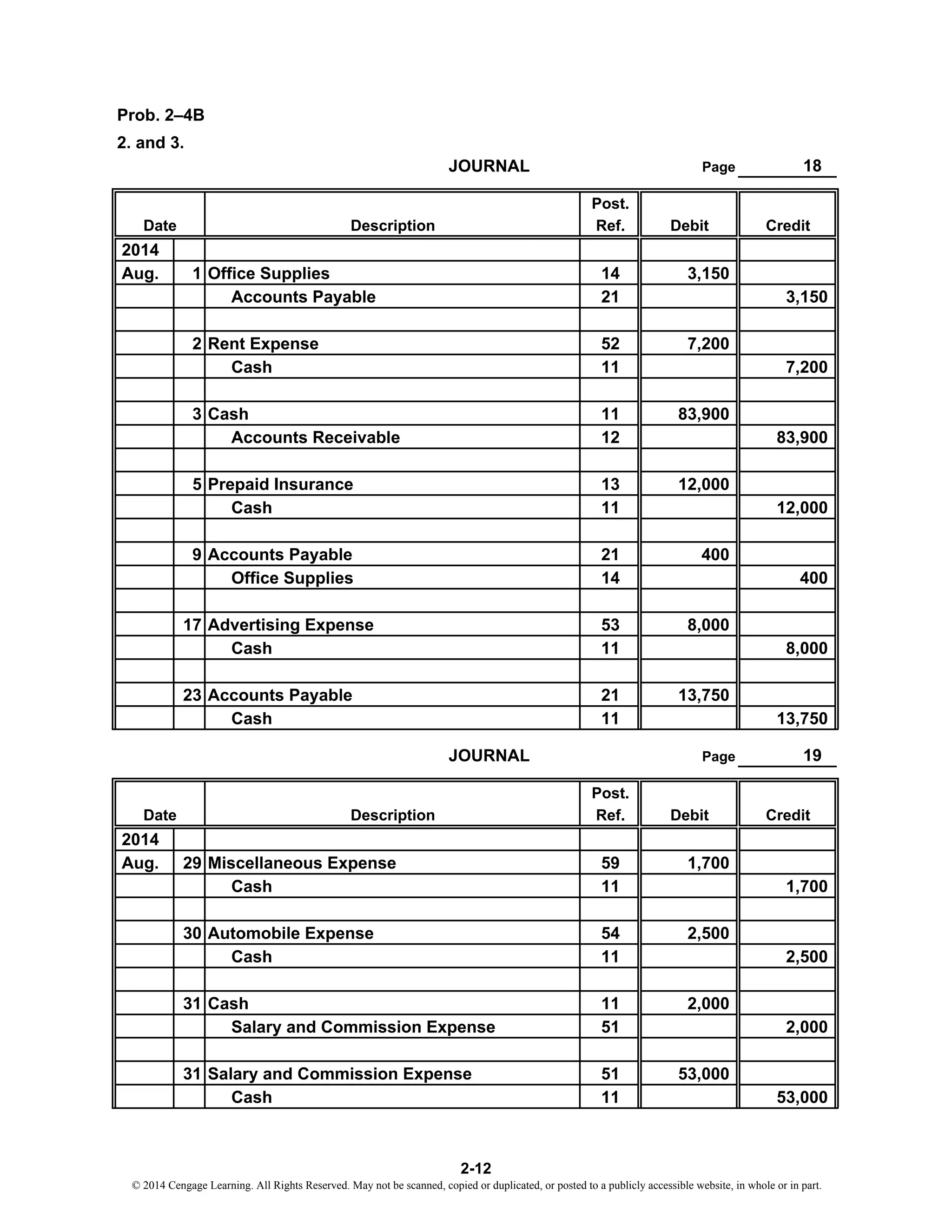

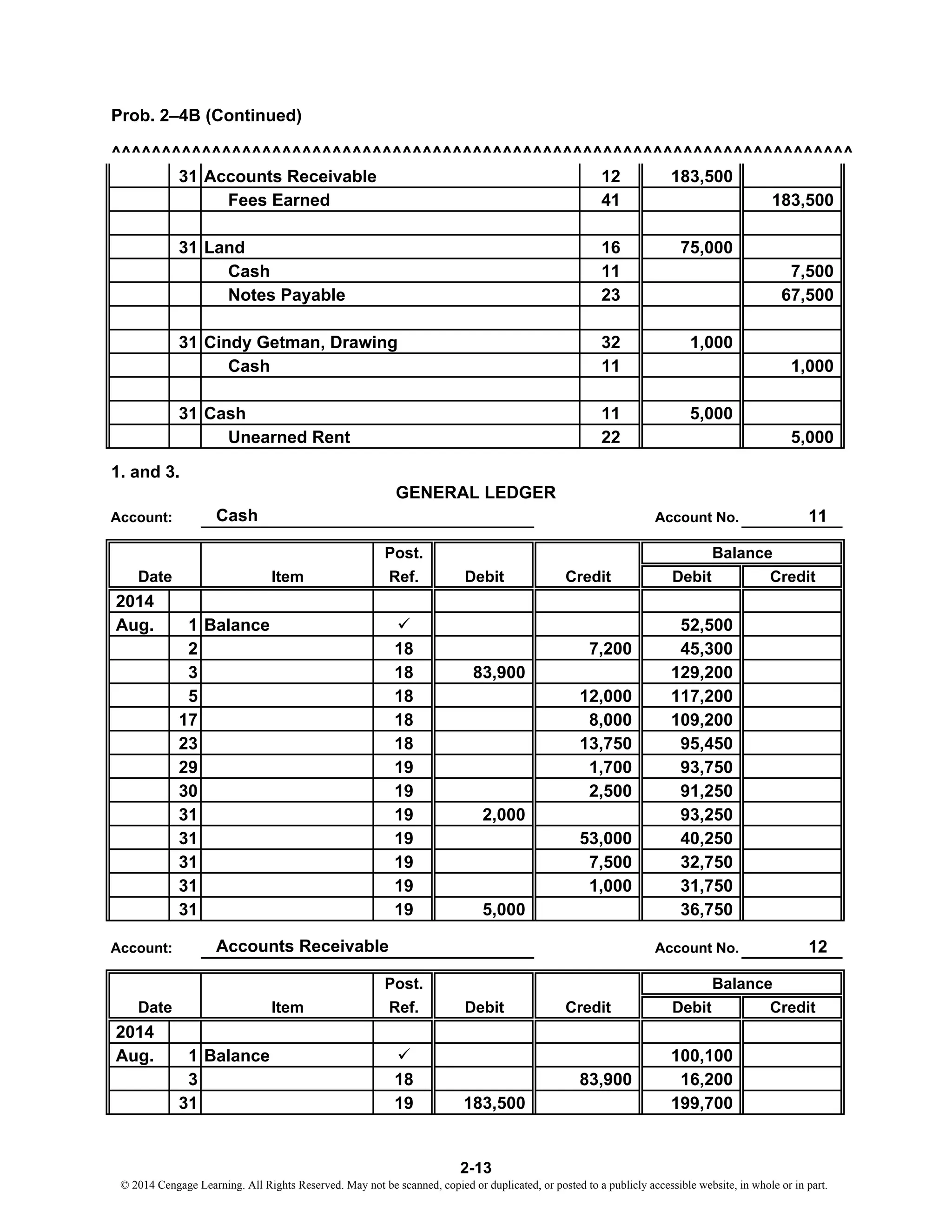

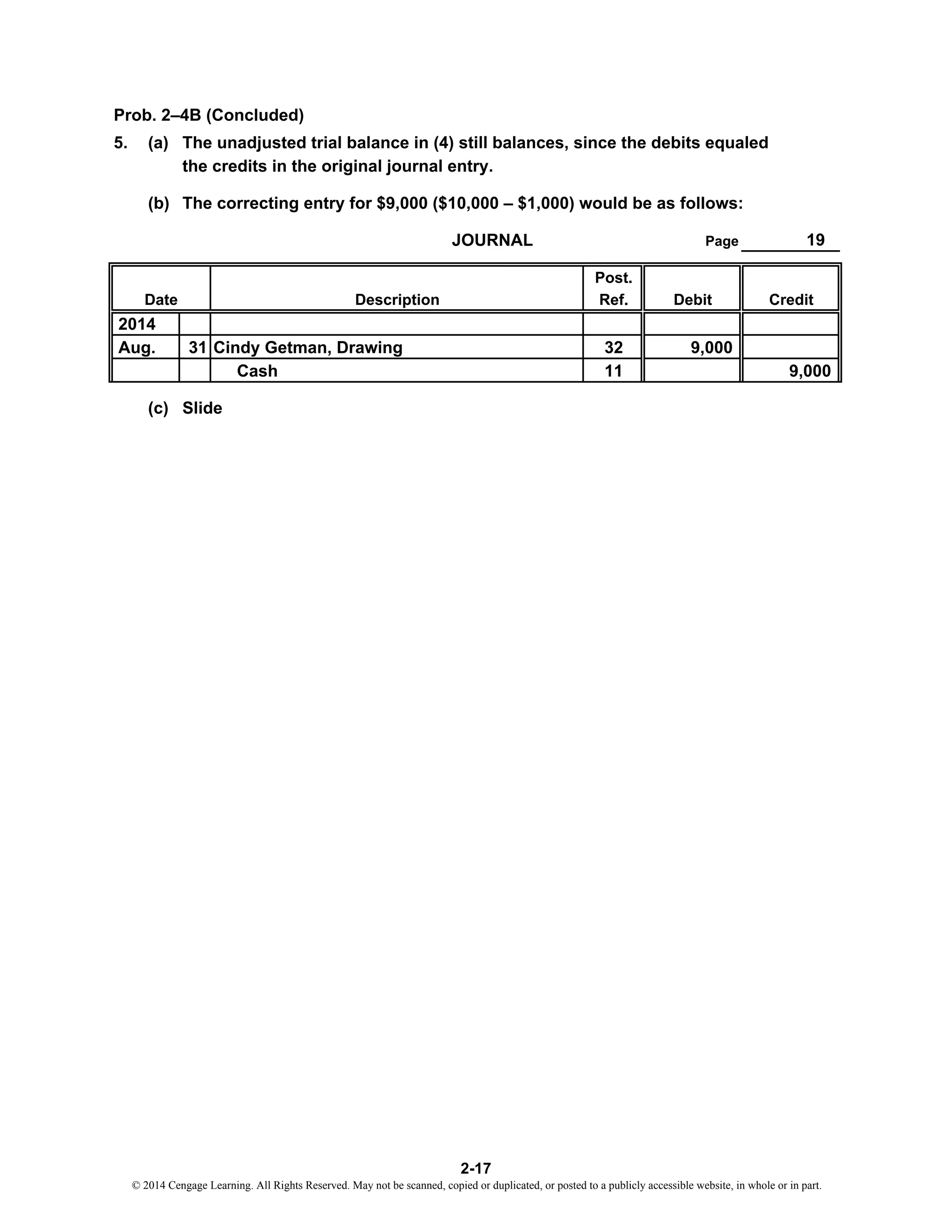

- The document appears to be a journal for a company with various transactions in August 2014, including the purchase of office supplies, payment of rent, collection of fees, and payment of expenses like advertising and salaries.

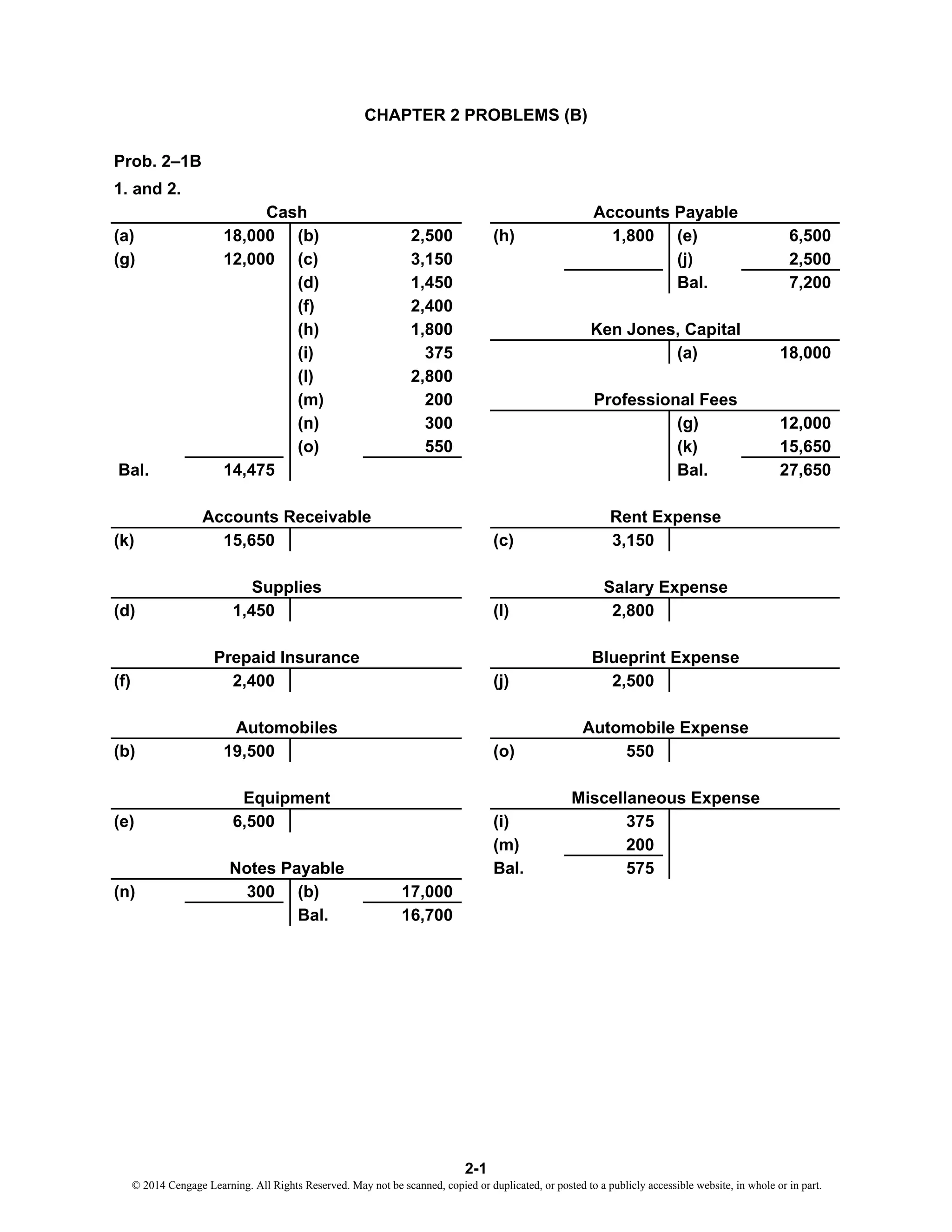

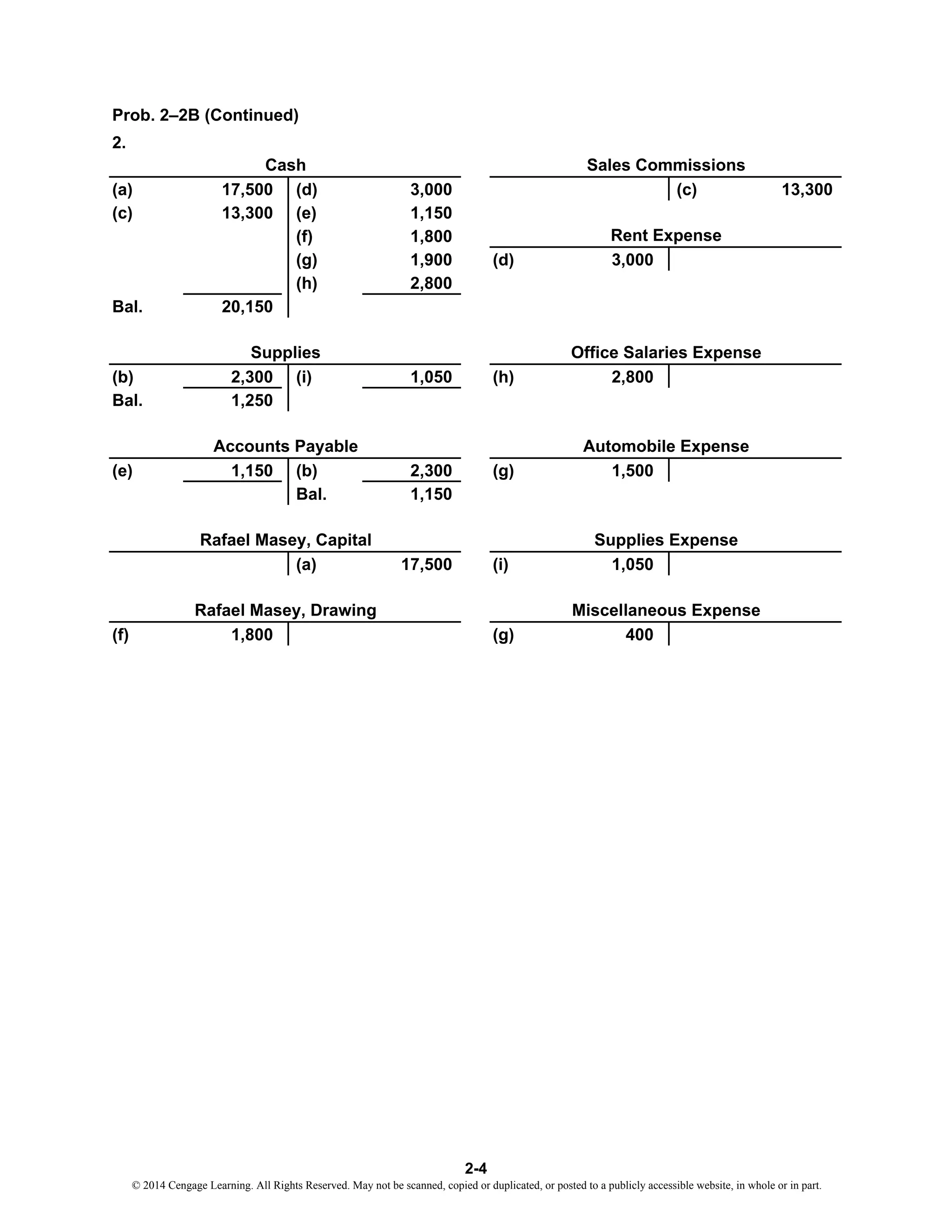

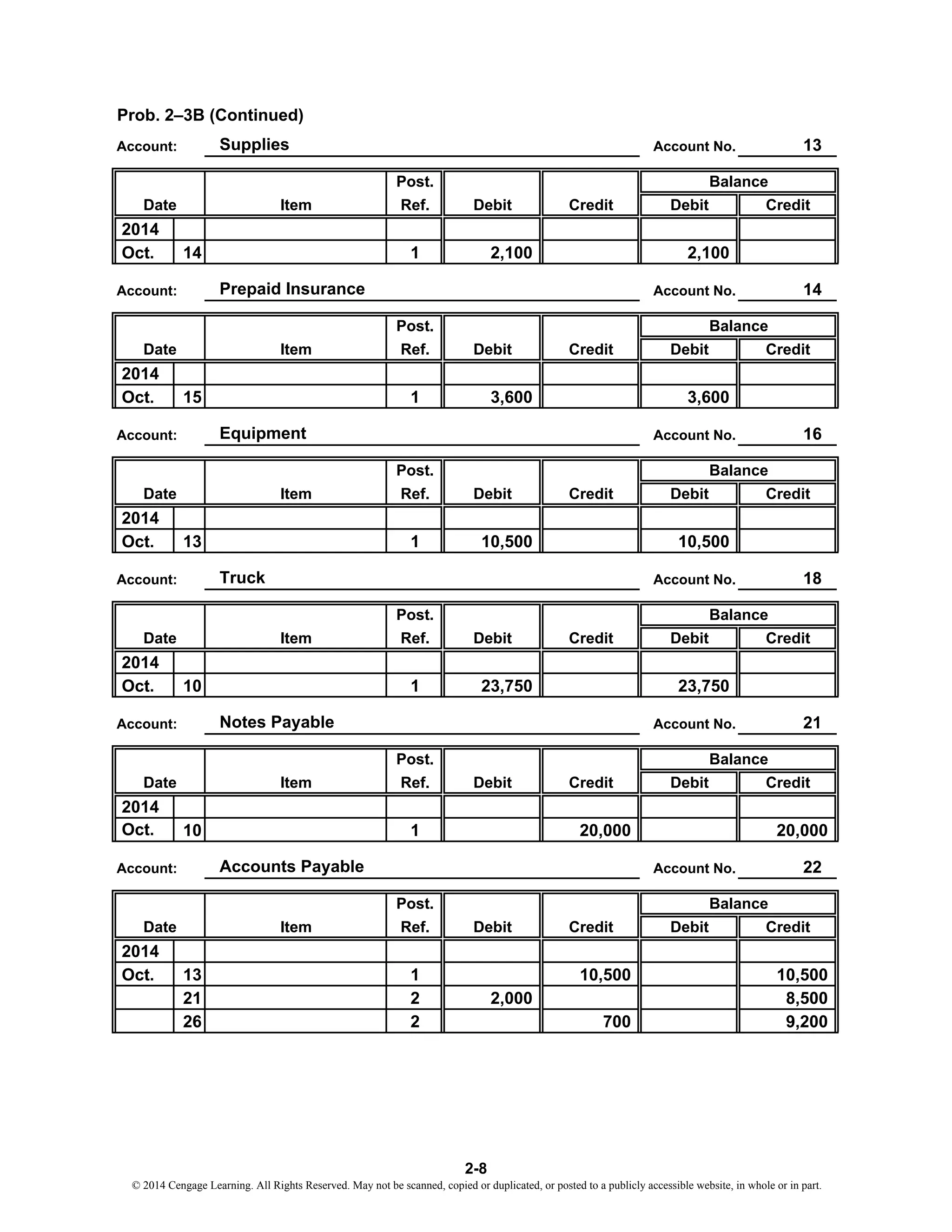

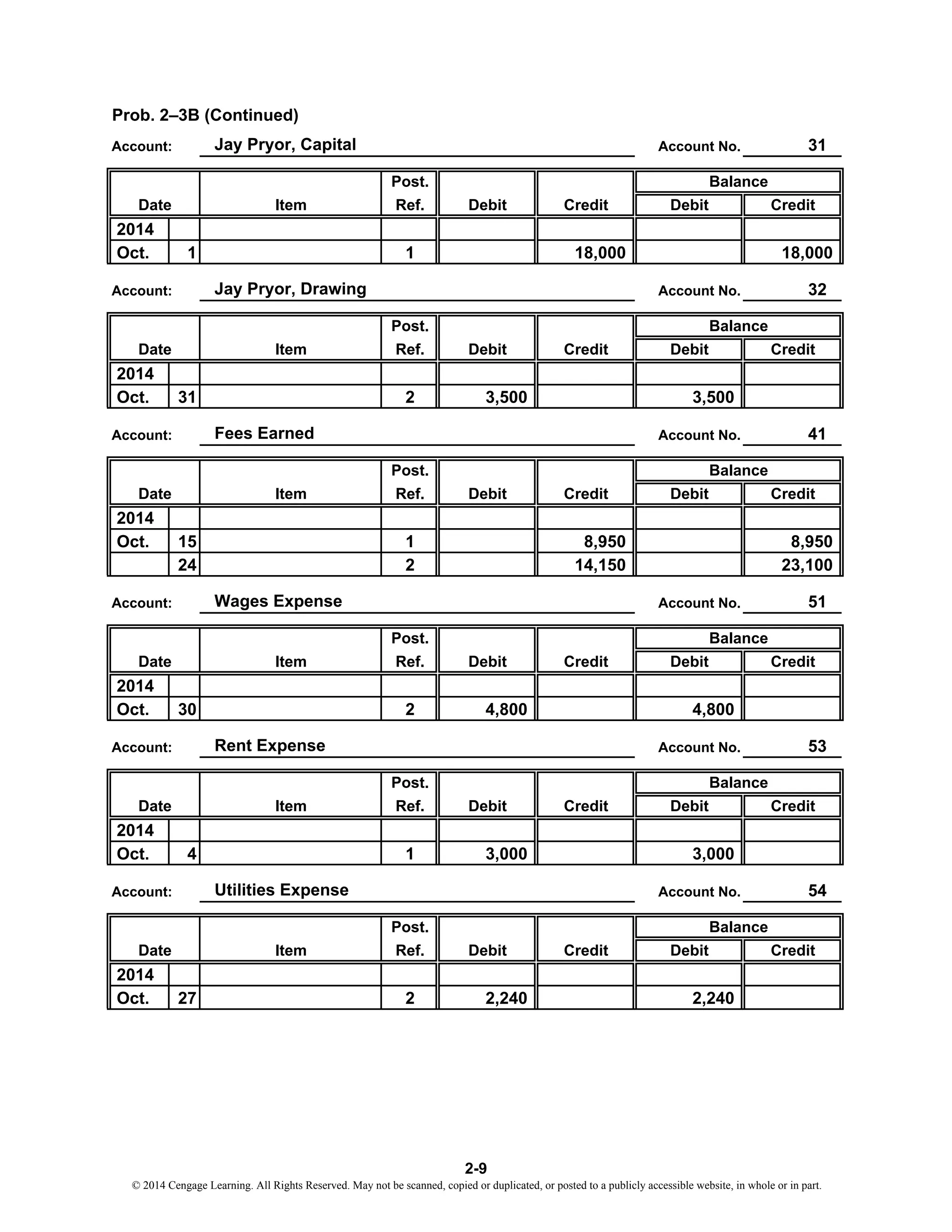

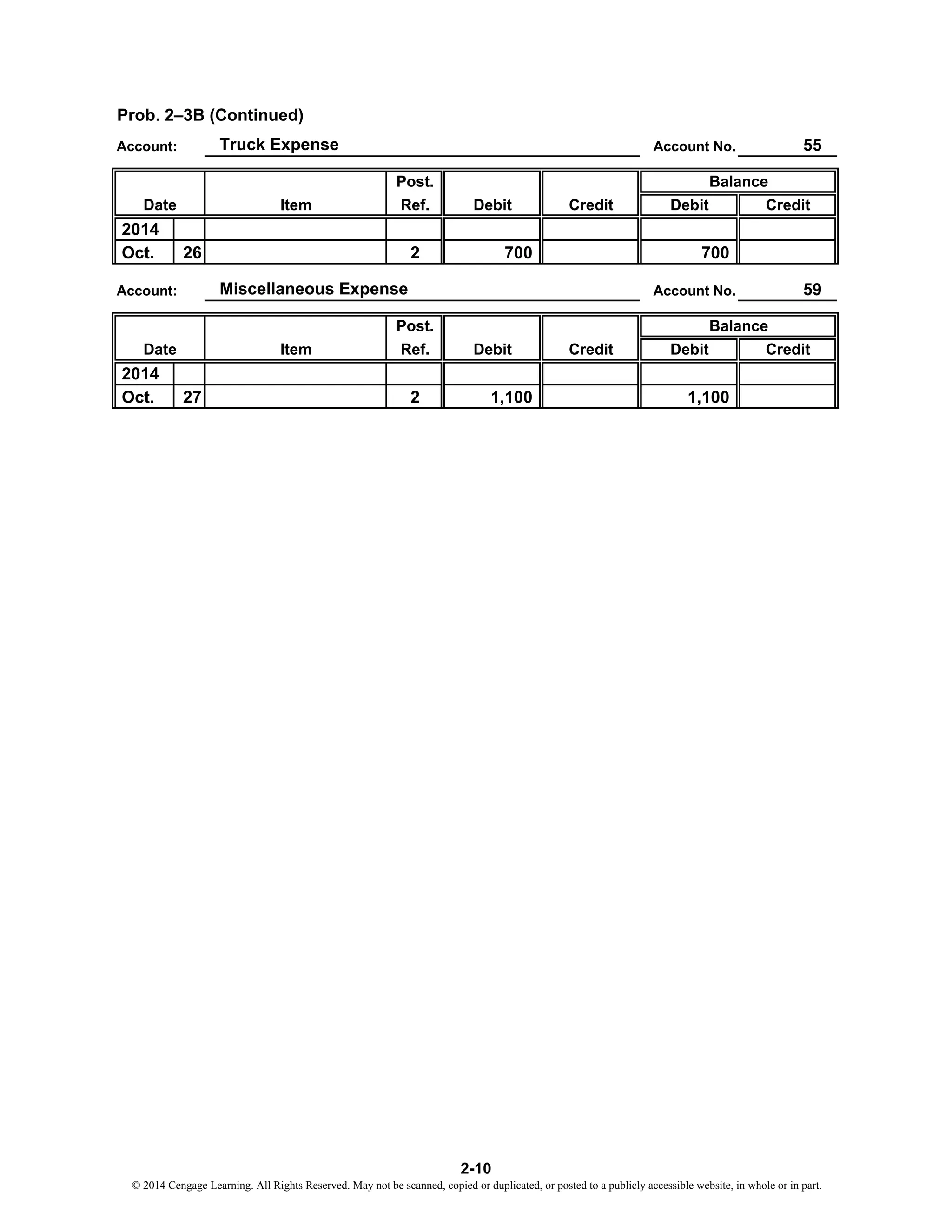

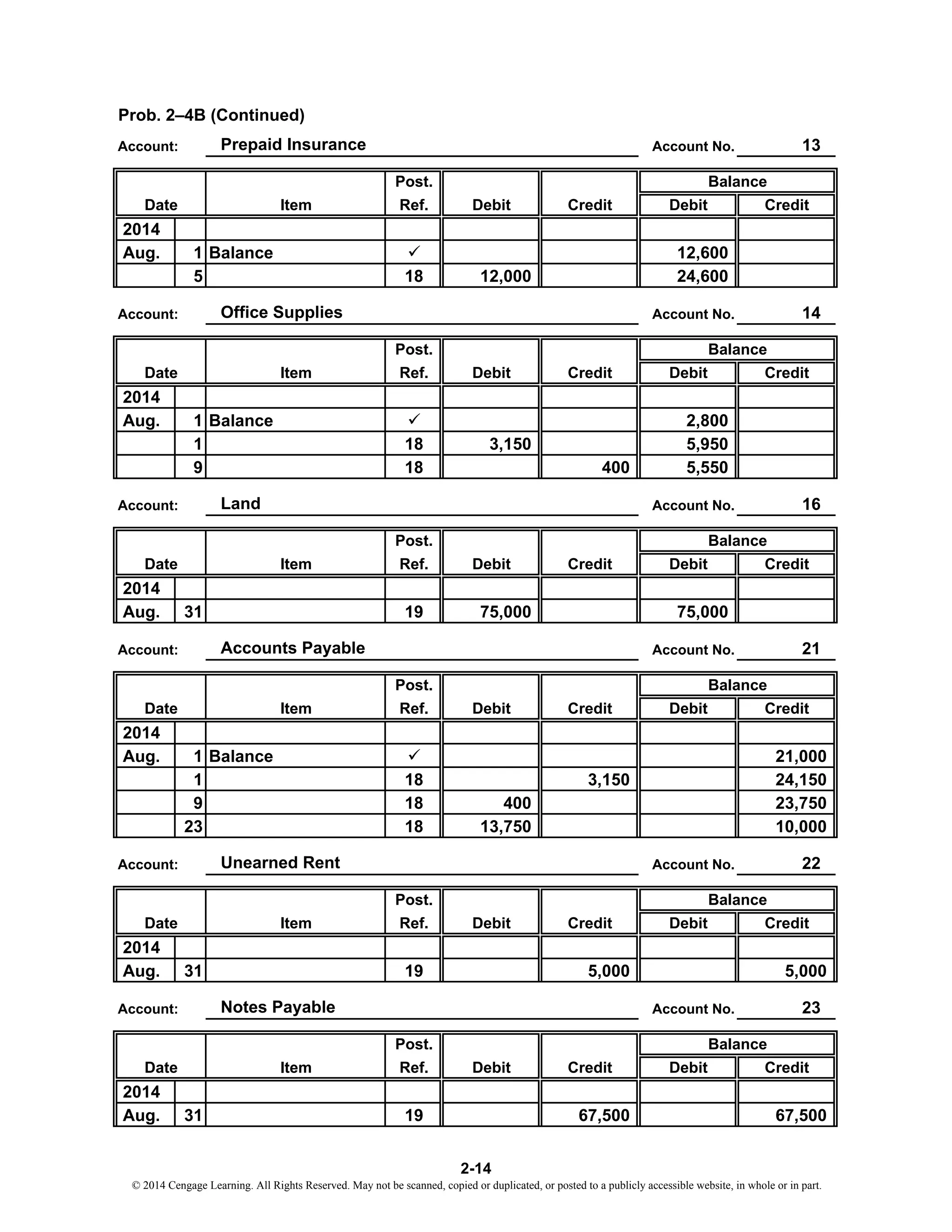

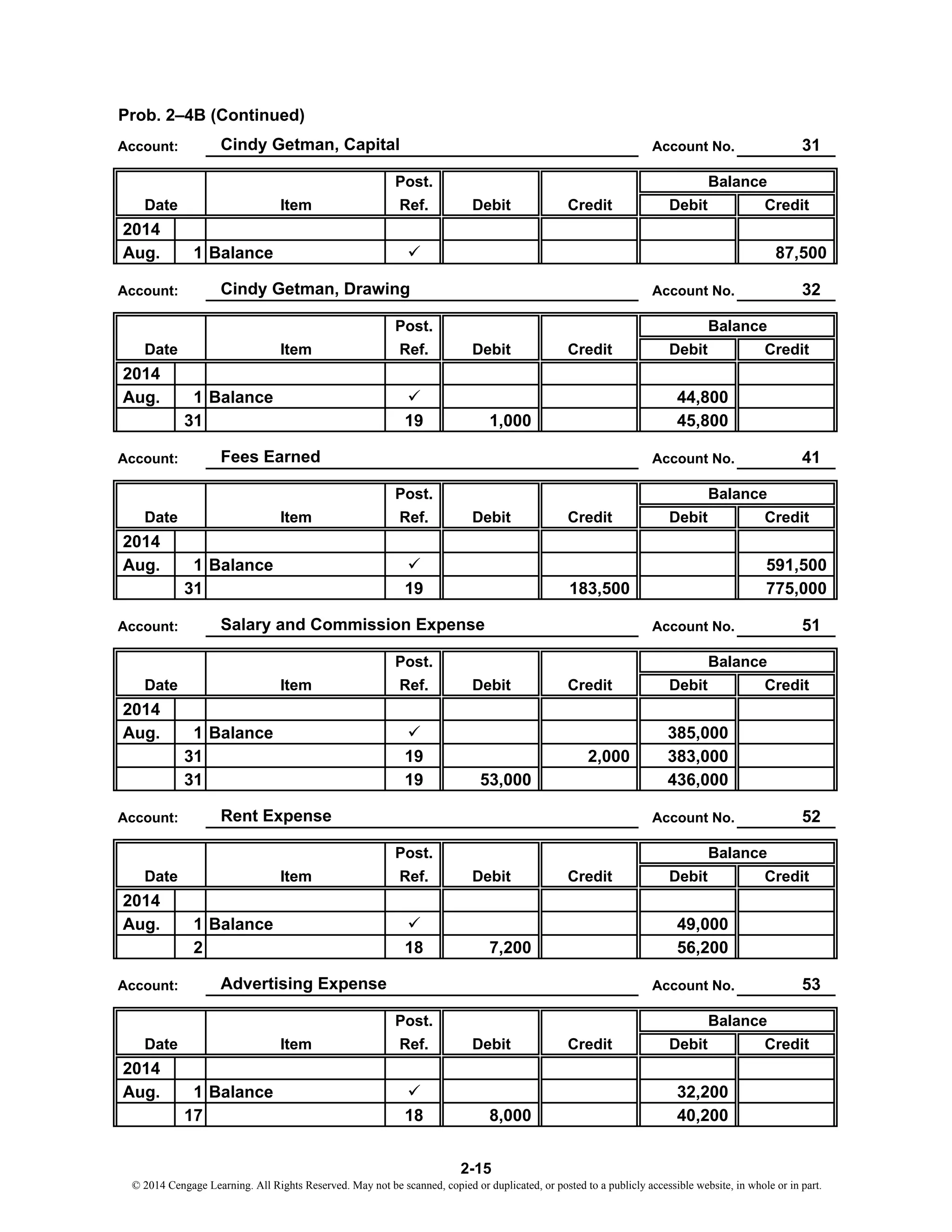

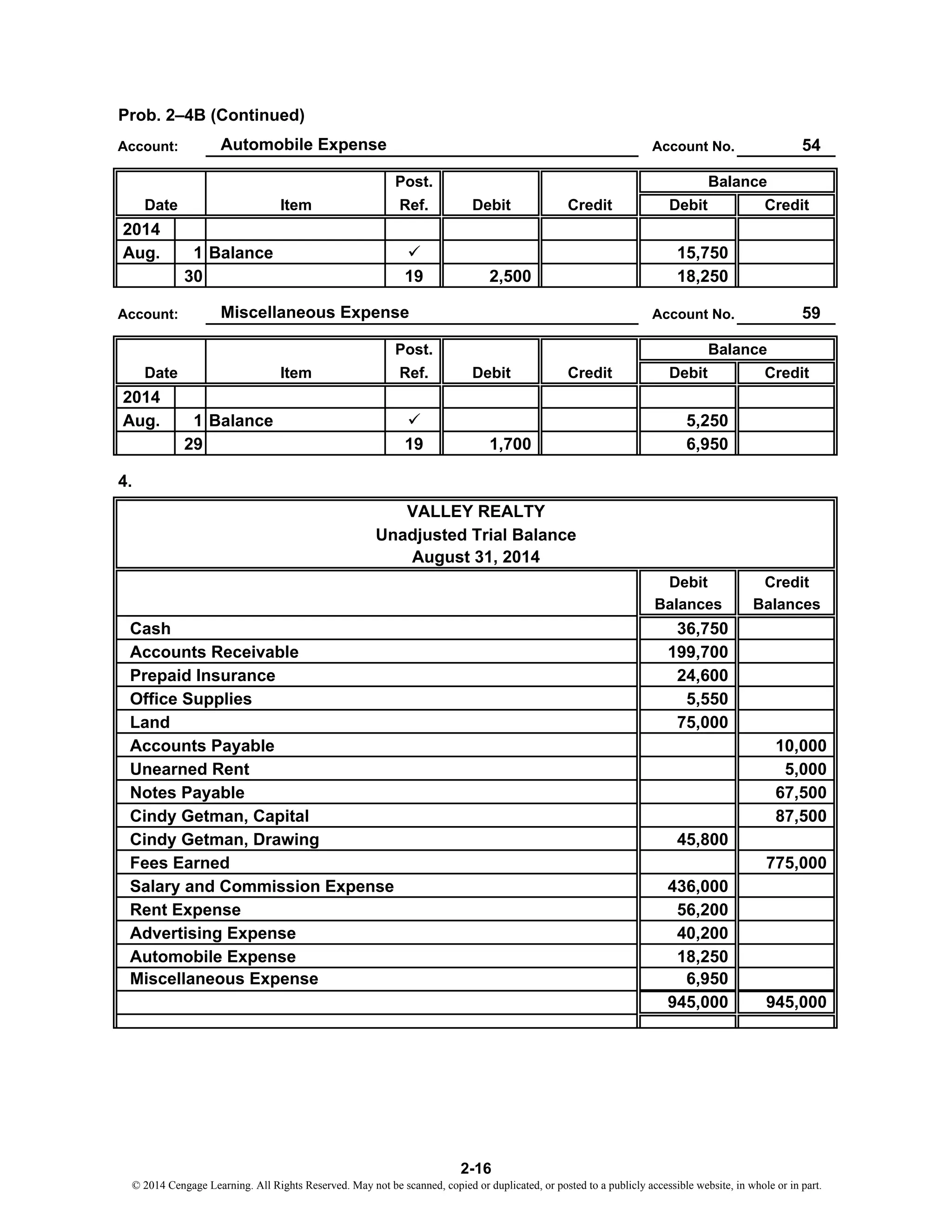

- The general ledger accounts show debits and credits for cash, accounts receivable, prepaid insurance, accounts payable, and other expense and revenue accounts.

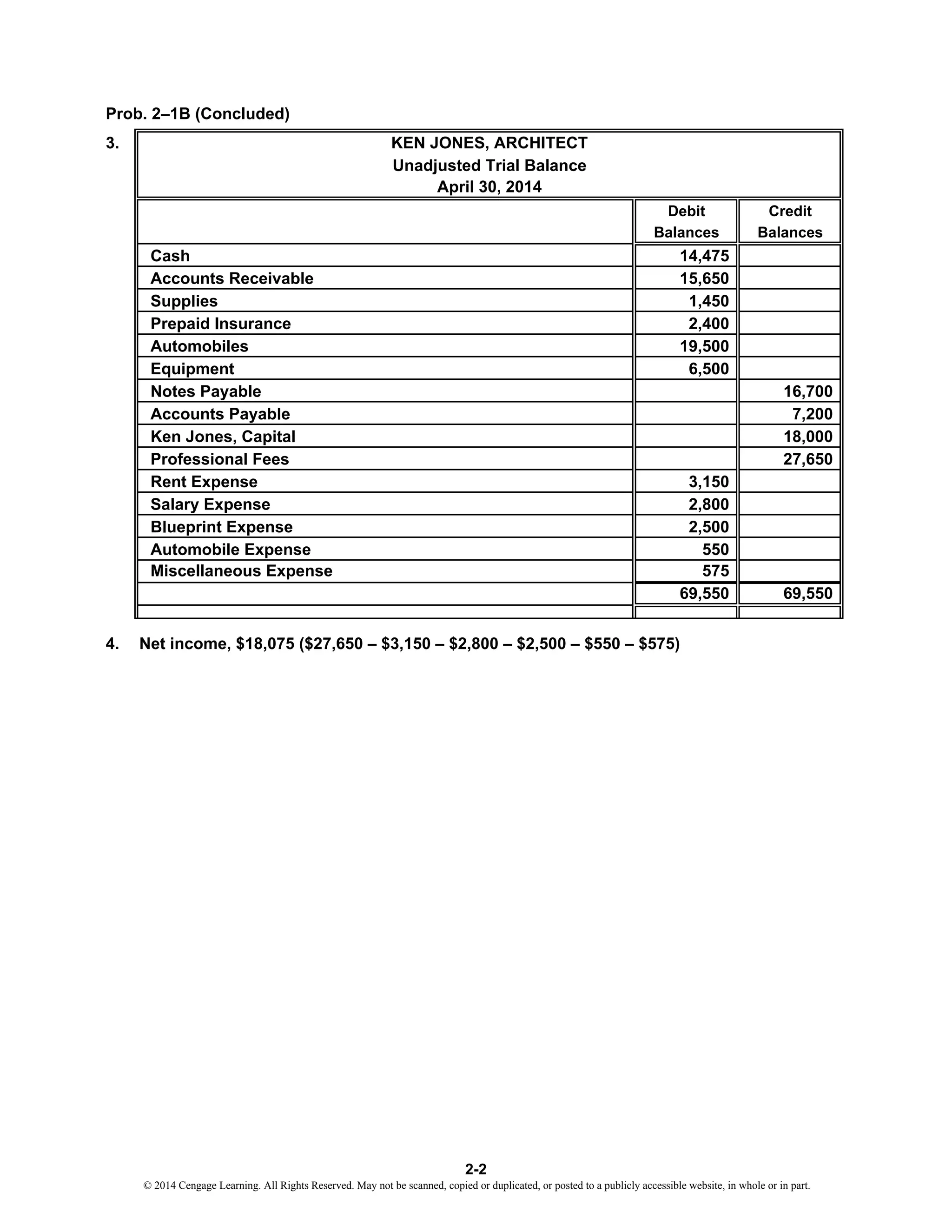

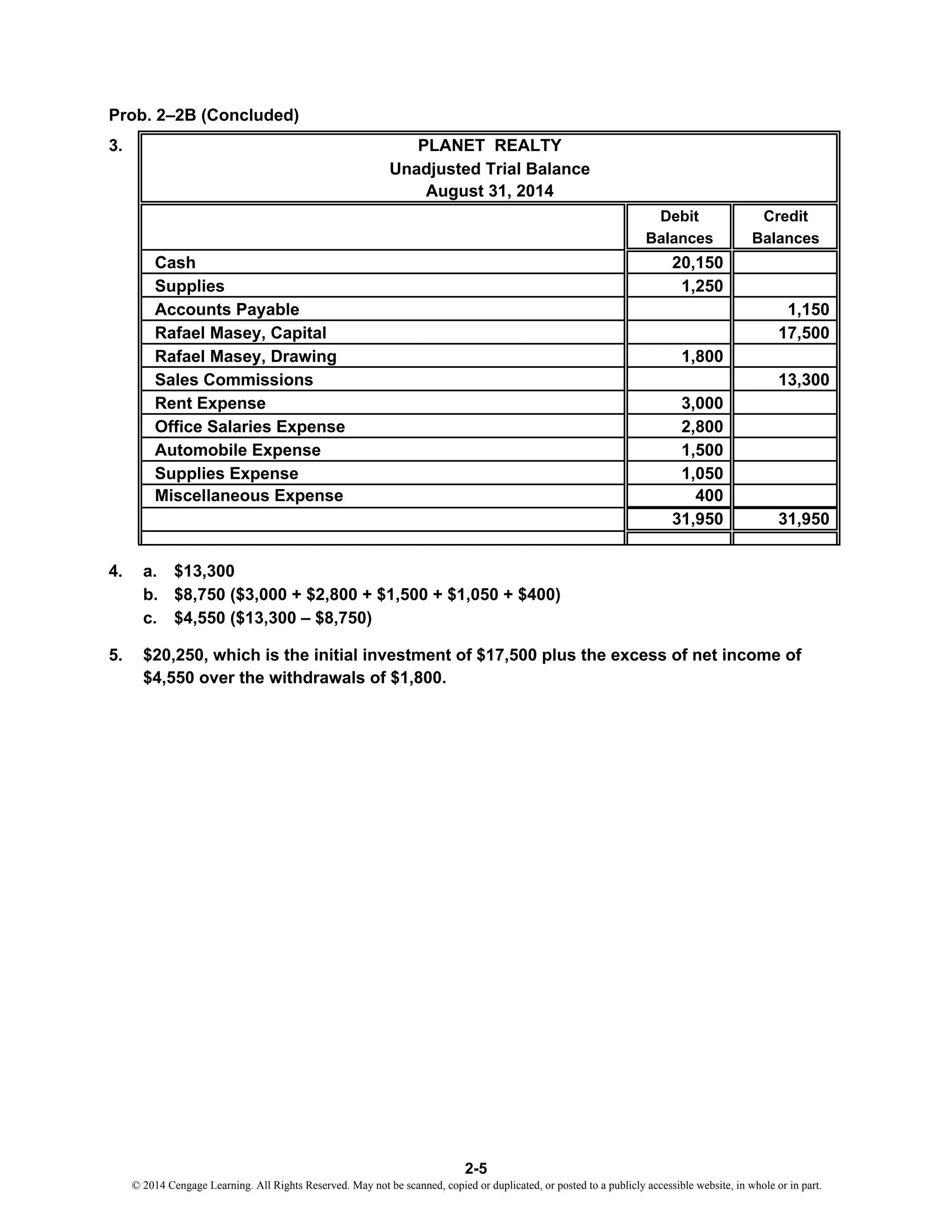

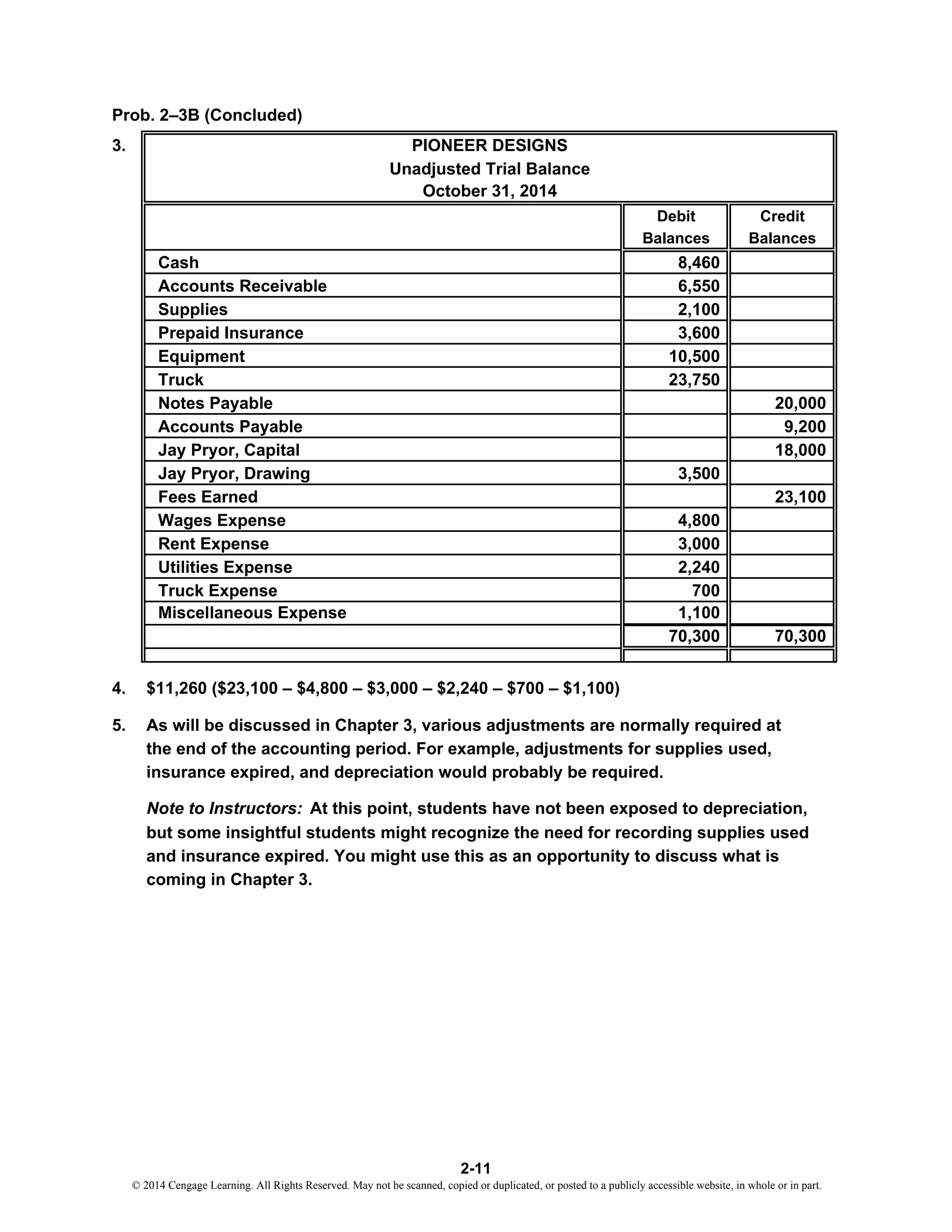

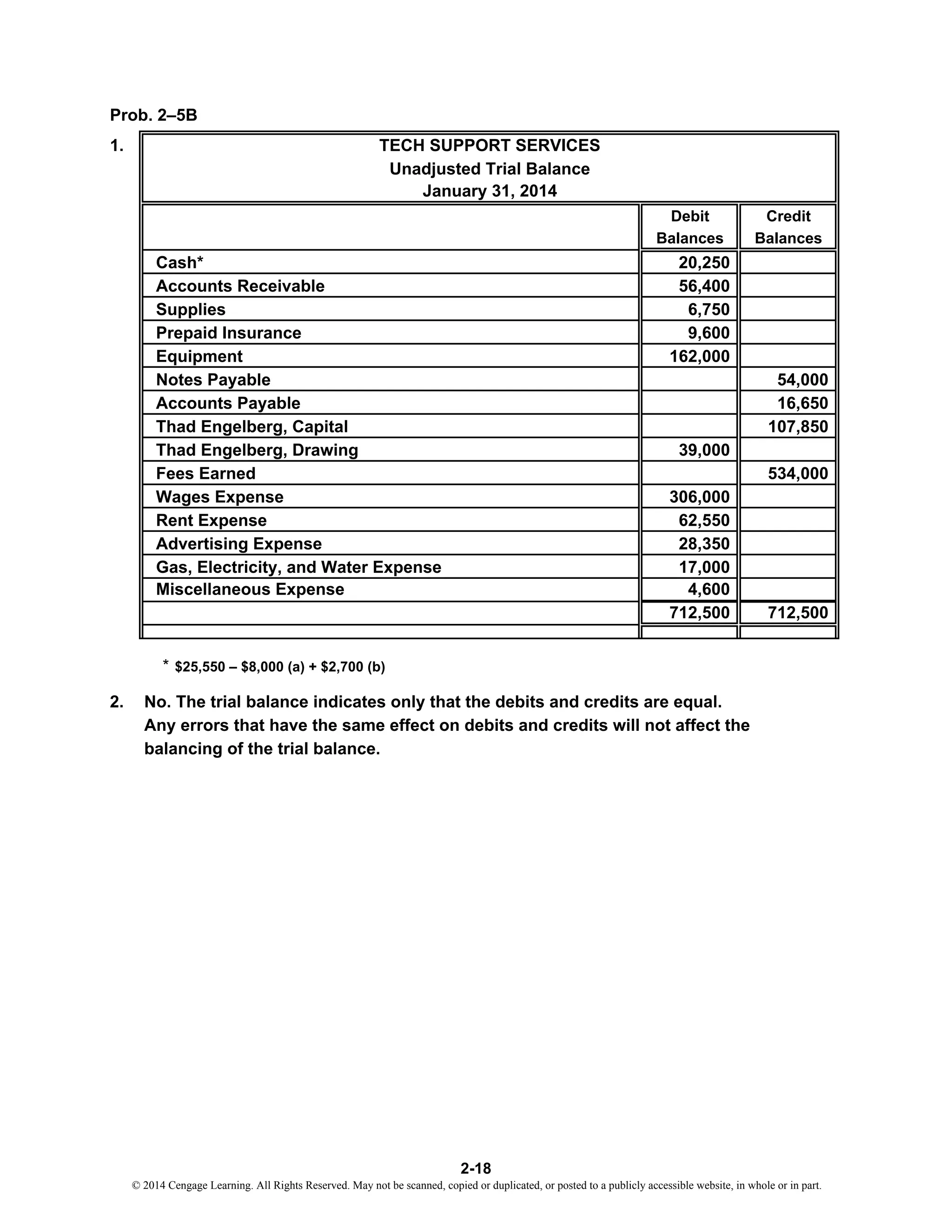

- The trial balance at the end of the period lists account balances and totals debits and credits.